Spanish economy, downside risks

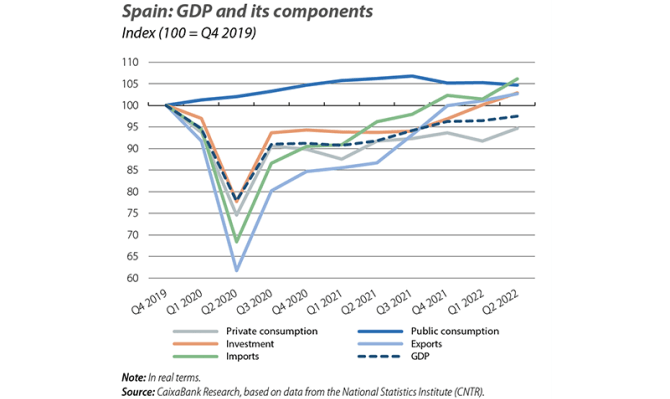

However, the buoyancy registered in Q2, with quarter-on-quarter GDP growth of 1.1%, driven by the lifting of restrictions related to the pandemic and job creation, could help GDP growth for 2022 as a whole to exceed 4% despite the deteriorating outlook for the second half of the year.

The balance of risks is clearly skewed to the downside, with growing doubts about how much gas Russia will supply, which will likely keep the price even higher than we expected. In this regard, Member States agreed to take measures to reduce the demand for natural gas by 15% between 1 August 2022 and 31 March 2023; for Spain, the target for reducing the demand for gas is 7%.

The Purchasing Managers’ Indices (PMIs) have deteriorated, and in the case of the manufacturing sector it has been below the 50-point threshold which separates contraction from expansion since July; on the other hand, the index for the services sector (50.6) is still in expansive territory, thanks to the revival of international tourism. Also, in light of the ECB’s Consumer Expectations Survey, households are anticipating a less favourable trend in their incomes, their wealth and their economic situation in general, and this is causing a deterioration in their outlook and greater caution in their spending habits. Similarly, the consumer confidence indicator has deteriorated significantly in July-August, reaching its lowest level since 2012 (–33.4 points), while retail purchases – in real terms – recorded their first decline in four months in July (–0.5% year-on-year).

After a month of weak job creation in July, with only 9,100 new registered workers in seasonally adjusted terms, August saw an improvement, with a monthly increase of 62,135 people. For the average of Q3 to date, job creation is slightly down, at a quarterly rate of 0.5% compared to 0.6% in the previous quarter. With regard to permanent hiring, the positive pattern continues, with permanent contracts accounting for 39.5% of all new contracts signed and the temporary employment rate dropping to 18.6% from the 27.2% at the end of last year.

According to the flash indicator, although headline inflation moderated slightly in August (10.4% vs. 10.8% in July), core inflation (excluding energy and unprocessed food) continues to climb and now stands at 6.4% (6.1% in July). The moderation of the headline rate was mainly due to the reduction in fuel prices, in line with the price of a barrel of Brent which registered a monthly decline of 5.6% in August, bringing it to 97 euros. On the contrary, electricity continues to apply upward pressure on inflation as a result of the sharp rise in gas prices, which reached record highs, and the higher compensation being paid to combined-cycle plants. In this regard, the rise in gas price futures over the past month poses a significant risk for our 2022 and 2023 inflation forecasts, which in turn casts a shadow over the outlook for household spending capacity.

In the first semester of the year, the current account balance showed a deficit of 1,229 million euros, a figure which stands in contrast with the 2,087-million-euro surplus for the same period of 2021. This deterioration is mainly explained by the widening of the trade deficit in goods, which rose to 31,963 million euros, six times greater than in the same period of 2021 (–5,397 million). By component, the deterioration is widespread: on the one hand, the energy deficit stands at 27,675 million (–11,032 million in 2021), driven by higher import prices; on the other hand, the balance of non-energy goods shows a deficit of 4,288 million (compared to the 5,635-million surplus in 2021), driven by the greater strength of imports (27.8% vs. 20% in the case of exports).

In contrast, the tourism sector is registering excellent figures, with a surplus of 22,165 million euros between January and June, a record high in that period. The July data suggest a very positive summer campaign: more than 9 million foreign tourists arrived, spending nearly 12,000 million euros, reducing the gap versus the same period of 2019 to 8.1% and 0.6%, respectively (–15.5% and –7.2% in June). Hotel overnight stays by foreign tourists also show a marked improvement, standing 5.7% below the level of July 2019, a gap that is 4.2 pps smaller than that observed in the previous month.

Housing demand continues to register significant growth (18.8% year-on-year in June), although there is a slight moderation compared to the rates of previous months (it was growing at 30% at the beginning of the year). In cumulative terms, 628,805 sales have been recorded in the last 12 months, a level not seen since July 2008 and well above the pre-pandemic figures (around 505,000 in 2019). In any case, the rise in interest rates on the part of the ECB and a slower rise in real household incomes in the face of rising inflation are factors that point towards a gradual cooling of demand.