The Spanish economy is beginning to feel the effects of the war in Ukraine

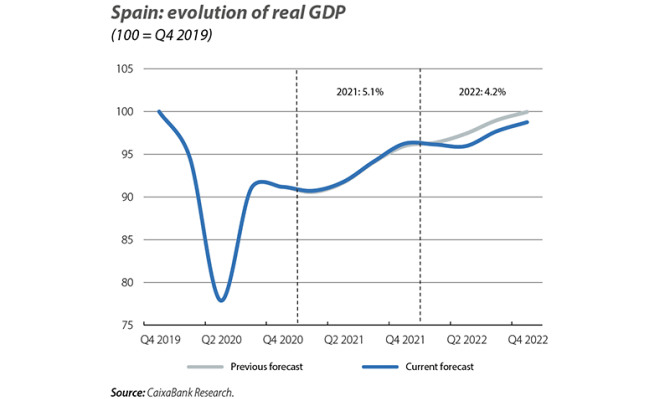

Our current outlook foresees growth of 4.2% for the Spanish economy in 2022. While a significant growth rate, this is 1.3 pps lower than we anticipated before the war in Ukraine (see the Focus «The war between Russia and Ukraine will slow the recovery of the Spanish economy» in this same Monthly Report for more details). At the close of this report, few post-invasion economic indicators had been published. Nevertheless, with the limited data available we can already draw some signals. On the negative side of the balance, in March there has been a sharp deterioration in consumer confidence and a substantial rise in inflation. This confirms that high uncertainty and rising prices are two of the main channels through which the war in Ukraine is impacting the Spanish economy. Other indicators, in contrast, have shown greater resilience than might have been expected; in particular, the PMIs have registered a slowdown but have nevertheless been higher than expected and remain in expansionary territory (>50 points), while the labour market has held its ground and continued to create jobs, albeit at a more moderate rate.

In particular, the manufacturing PMI, which reflects business sentiment, remained comfortably within expansionary territory in March (54.2 points), but suffered a 2.7-point decline compared to February, affected by rising production costs, supply problems and carrier strikes. This is the lowest level since March 2021. The services PMI, on the other hand, also fell by 3.2 points, placing it at 53.4 points. Confidence indicators also registered a significant setback in March. On the one hand, the European Commission’s industry confidence index fell by 4.7 points compared to February, while its consumer confidence index fell even more sharply (–17.9 points versus February).

Job creation moderated in March, but less than would be expected given the high uncertainty triggered by the war and the unemployment figures in various sectors. Specifically, in seasonally adjusted terms, Social Security affiliation grew by 23,998 people in March (37,726 in February), placing quarter-on-quarter growth in employment for Q1 at 1.07% (2.1% in Q4 2021). There has also been a slight increase in the number of non-COVID ERTE furlough schemes, albeit less than expected (going from 13,575 at the end of February to 17,162), and in seasonally adjusted terms unemployment increased by 25,682 people (the first increase since April 2021). On the positive side, there has been a significant improvement in permanent hiring: the percentage of Social Security affiliates with a permanent contract has risen to 75%, 5 points above the usual level before the pandemic.

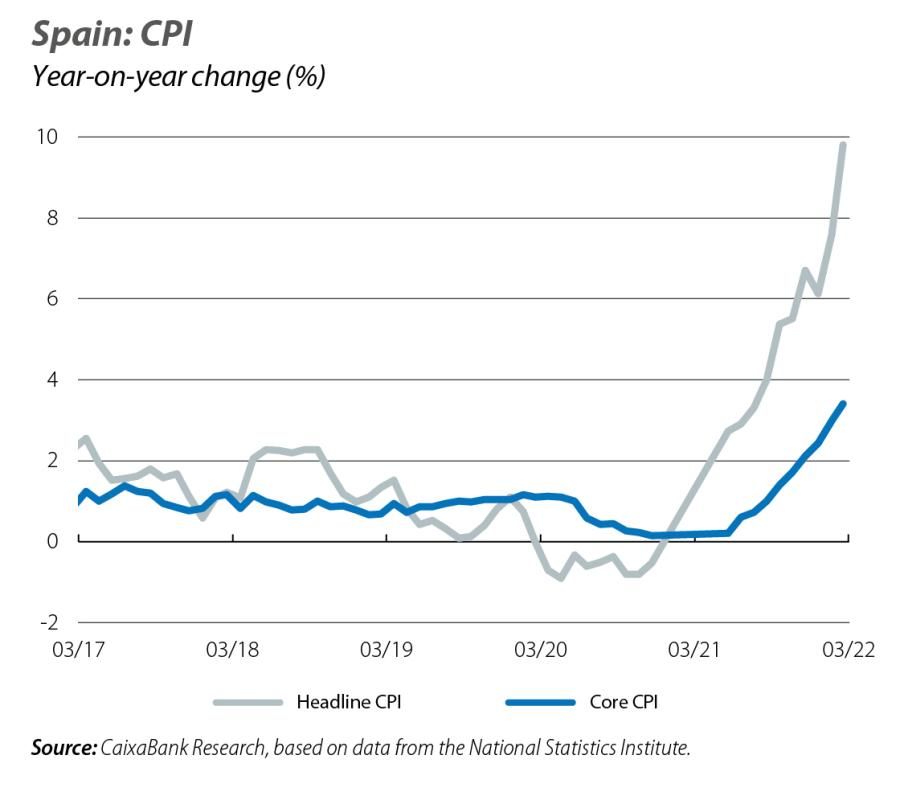

In the first month that captures the impact of the war on consumer prices, headline inflation rose to 9.8% (7.6% in February), according to the figure advanced by the National Statistics Institute. If confirmed, this would be its highest level since May 1985. The rise in inflation in March has been driven by a widespread increase in the prices of most components. In this regard, core inflation has risen to 3.4% (3.0% in February). It should be noted that the main channels of direct impact of the conflict in Ukraine (increases in gas prices, which have a knock-on effect on electricity prices, and oil and food prices) are already reflected in the March inflation figure. The high energy prices have continued to seep into the other components of the consumer price index basket by driving up transportation and production costs. This trend will continue to push up core inflation.

The general government deficit stood at 82,819 million euros in 2021, representing 6.9% of GDP compared to the 10.3% deficit in 2020. This improvement shows that the economic recovery contributed to reducing the deficit: revenues increased by 13.2% compared to 2020 and expenditure, by 5.2%. Excluding the impact of Sareb (some 1.3 billion euros), the deficit was 6.8% of GDP. Although high, this deficit figure is below the government’s forecast (an estimated 8.4% of GDP). Public debt in 2021, meanwhile, was revised down by 3 decimal points of GDP (from 118.7% to 118.4%), placing it 1.6 pps lower than at the 2020 year end but 22.9 pps higher than 2019. On the other hand, the government has presented an action plan to cushion the impact of the war in Ukraine (see the Focus «Key points of the Action Plan: what measures will be taken in Spain to alleviate the impact of the war in Ukraine?» in this same report), with a budget of 6 billion euros (0.5% of GDP).

In particular, the trade balance in January showed a deficit of 6,123 million euros, more than triple the level of the previous year and the worst figure in any January since 2008. Both the non-energy and energy deficits increased: the non-energy balance showed a deficit of 2,901 million euros (deficit of 253 million in January 2021) due to greater buoyancy in imports (32.5%) than in exports (19.3%), while the energy deficit rose to 3,222 million euros (deficit of 1,516 million in January 2021), driven by the sharp rise in energy import prices of 46.4% year-on-year. This is an early sign that the current account balance will fall significantly in 2022, largely due to the deterioration of the energy balance in the face of higher energy prices, a trend that will be accentuated by the war in Ukraine.