Portugal: the strong start to the year pushes annual growth towards 6%

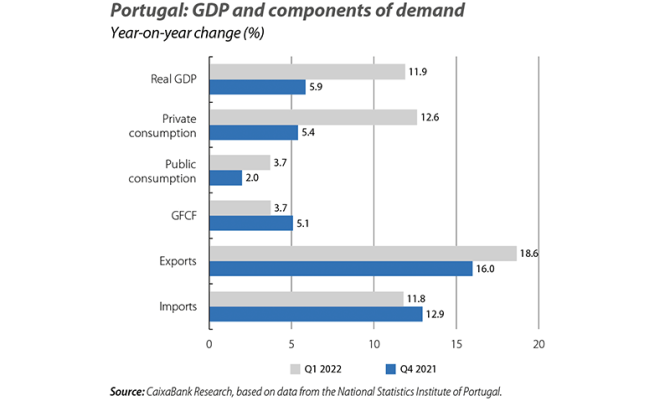

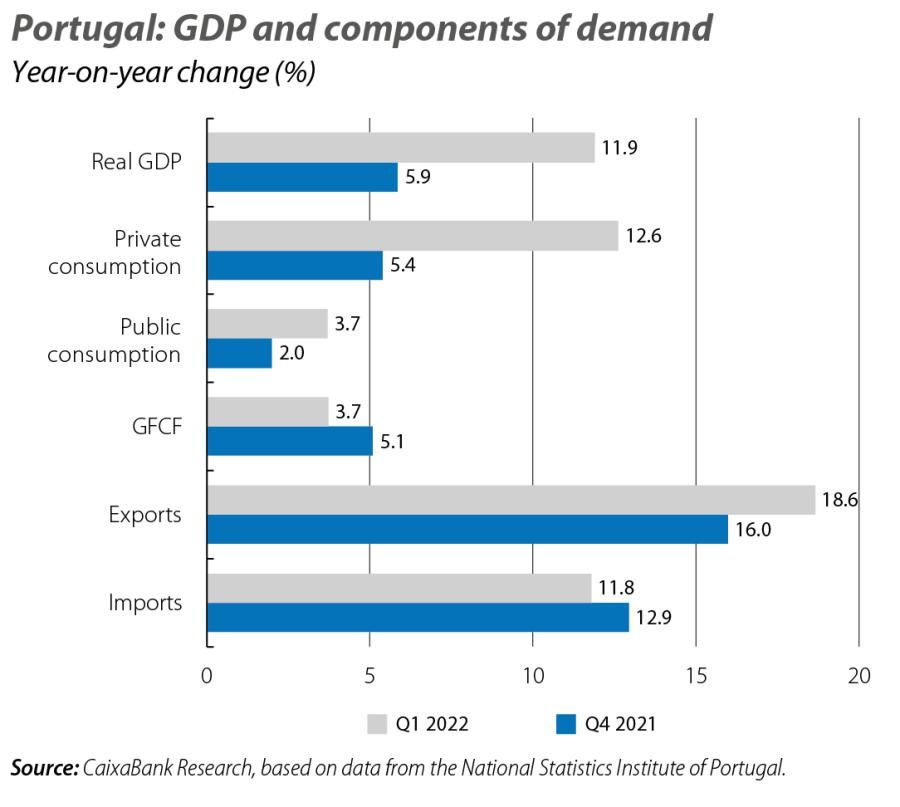

The National Statistics Institute confirmed that the economy grew by 2.6% quarter-on-quarter and 11.9% year-on-year in Q1, driven by consumption and the recovery of tourism. Thus, even if the economy were to stagnate during the rest of the year, GDP would still grow by 6.3% in 2022 as a whole. However, some indicators suggest that economic activity will continue to expand, albeit at a more moderate rate than in Q1, so we have revised our forecast for real GDP growth in 2022 to 6.6%, up from the previous 4.2%. The economic activity indicators for Q2 indicate that the economy is continuing to expand, albeit in a less buoyant phase. The daily economic activity indicator shows that activity grew at over 7% year-on-year in April and May, with a slowdown during the period (2.8% in the first 22 days of May); although these figures should be read taking into account the varying degrees of lockdown that were in place in the months with which the comparison is made. The slowdown is also confirmed in the sentiment indicators, which moderated in virtually all sectors in May. The biggest concerns relate to the progress of demand and the rising prices, in all sectors with the exception of services, where confidence remains virtually stable despite the marked improvement in the accommodation and catering sector.

It was in this context that last month at CaixaBank Research we revised our annual average inflation forecast for 2022 up from 5.4% to 6%. High inflation (above 5%) now extends to almost half the components of the CPI basket. In fact, in April we saw that 37 of the categories in the basket had rates above 5% (32 in March), almost double that of January (19). Core inflation, meanwhile, reached 5.6% in May, highlighting the risk of the current bout of inflation becoming more persistent. The context remains dominated by a high degree of uncertainty: on the one hand, the announcement of the new package of sanctions, with an almost total embargo on Russian oil, is pushing up the price of crude oil; on the other hand, as of the date of writing this text, negotiations on the opening of a maritime corridor for the export of cereals from Ukraine’s ports via the Black Sea are ongoing and, if successful, this could help to stabilise the prices of these commodities.

Employment continues to enjoy a strong recovery (0.4% quarter-on-quarter and 4.7% year-on-year in Q1), far exceeding the pre-pandemic figures (2.4%; +115,000 jobs compared to Q4 2019). The recovery of employment is explained by the increase in both the private sector (1.8%, +73,000 jobs) and the public sector (+6.1%, +42,000). More specifically, public-sector employment reached 741,288 people, the highest level since late 2011 (when regular records for public employment began), representing 15.1% of the total population in work. With a better than expected performance in Q1 (the unemployment rate fell to 5.9%, compared to our expected rate of 6.4%), we have revised our unemployment rate forecast for the year as a whole down to 5.9% (previously 6.7%).

The budget deficit for the first four months of the year stood at 1.0% of GDP, well below that registered a year earlier (–7.2%) or the figure for 2019 (–1.8%). The improvement over 2021 corresponds to a significant increase in revenues (+15% year-on-year), especially tax revenues (most notably VAT), as well as a decline in spending of 1.8% year-on-year. This is due to the reduction in interest charges and current transfers, in this case as a result of the reduced impact of the COVID-related support measures for businesses and households. After the surprising result of the budget deficit in 2021 (2.8% of GDP versus a forecast of 4.3%), and taking into consideration the 2022 Government Budget presented in April, we have revised down our forecast for the budget balance to –1.7% of GDP in 2022 (previously –2.1% in national accounting terms). Similarly, the public debt ratio could fall to 119.5% of GDP (127.4% in 2021) and reach the pre-pandemic value next year (116.6%).

The number of guests and overnight stays was 1.6% and 1.1% higher, respectively, than the numbers recorded before the pandemic for the first time since the arrival of COVID-19. Q1 2022 closed with figures 19% below the number of guests and overnight stays recorded in the same quarter of 2019, but these latest figures offer a very encouraging outlook for the coming months, which mark the peak season for the Portuguese tourism sector. In parallel, the latest data from the European Travel Commission (gathered after the outbreak of the war in Ukraine) indicate that over 80% of the citizens of Portugal’s major source markets (such as Spain, Germany and the United Kingdom) plan to go on holiday abroad in 2022. Inflationary pressures, the price of jet fuel and the lack of staff reported by some hotel chains remain the main risks on the horizon.

Although the National Statistics Institute’s home price index for Q1 2022 has not yet been revealed as of the date of writing, we have revised our 2022 price forecast upwards (from 7.1% to 7.7%). The available data point in this direction: Confidencial Imobiliário’s home price index rose 17% year-on-year in Q1, and followed the same path in April (17.5%), while valuations for home loans also accelerated to 13% year-on-year in April. Although the sector’s confidence indicator is above pre-pandemic levels, we believe the second half of the year will be more moderate due to the effect of inflationary pressures on household budgets and the context of rising reference interest rates.