The outlook for Spain improves slightly, but remains highly challenging

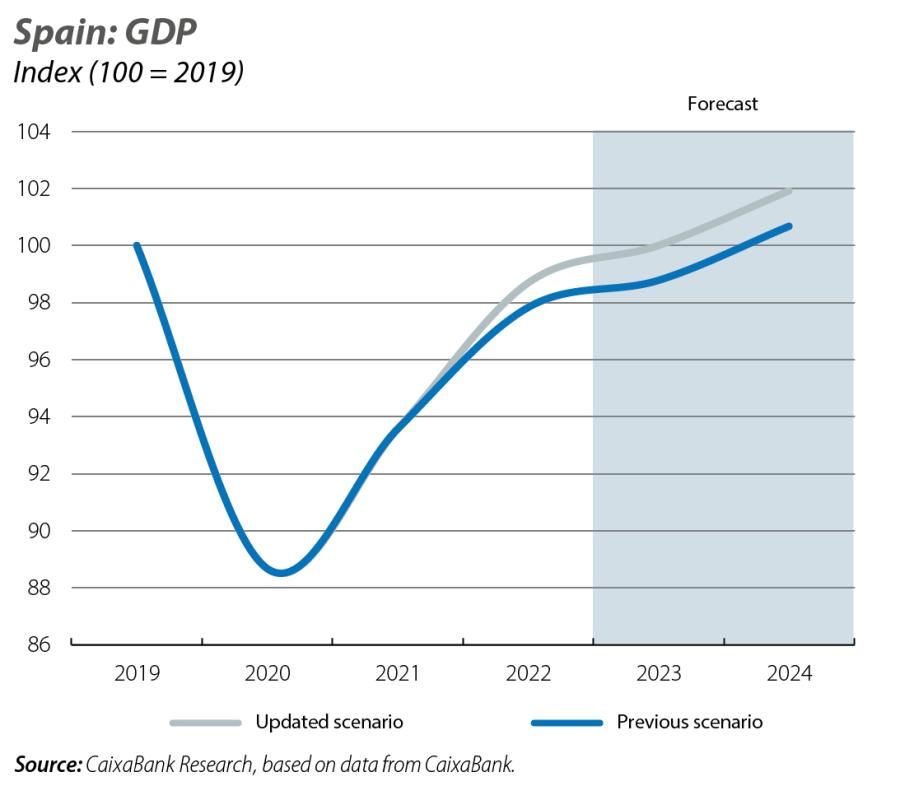

Whereas in December 2021 our GDP growth forecast for 2022 was 5.9%, in March, after the outbreak of the war between Russia and Ukraine, we lowered this forecast to 4.2%. In the end, the economy has managed to grow by a significant 5.5%, in spite of the geopolitical conflict, rising inflation and tightening macroeconomic conditions. In the coming quarters, the Spanish economy will continue to face an adverse context, marked by geopolitical uncertainty and rising interest rates. However, there are also some elements that will support economic growth, such as the acceleration of the disbursement of the NGEU funds and the recovery of the sectors hardest hit by the pandemic, such as tourism. Inflation, while remaining high, is likely to moderate somewhat faster than expected thanks to the fall in energy prices. All this, together with the better-than-expected performance of the economy in the final stages of 2022, has led us to revise our forecast for GDP growth in 2023 slightly upwards, from 1.0% to 1.3%.

Following the sharp rise in energy prices in August, the forecasts according to the consensus of analysts in September suggested that GDP would register a decline in Q4 2022. This has not been the case, and GDP grew by 0.2% quarter-on-quarter (2.7% year-on-year). However, the composition of growth, according to preliminary data from the National Statistics Institute, shows a weakening of domestic demand. It fell by 0.9% quarter-on-quarter, as a result of the contraction of private consumption (–1.8% quarter-on-quarter) and investment (–3.8% quarter-on-quarter). Thus, GDP growth came from the contribution of external demand due to the fall in imports (–4.2% quarter-on-quarter), which were dragged down by weak domestic demand and far exceeded the decline in exports (–1.1%).

Employment according to the labour force survey (LFS) remained flat, in seasonally adjusted terms, in the closing stages of 2022. In non-seasonally adjusted terms, employment fell by 81,900 people, marking the first decline in a Q4 since 2017. On the upside, the temporary employment rate fell to 17.9%, which is the lowest in the historical series and 7.5 pps less than the figure recorded in Q4 2021. Finally, the unemployment rate crept up to 12.9% from 12.7% in Q3, 0.4 percentage points below the level at the end of 2021. The annual average for the unemployment rate in 2022 stood at 12.9%, compared to 14.8% in 2021.

In January, the PMI for the manufacturing sector rose 2 points to 48.4 points. While still below the threshold that denotes growth (50), this nevertheless suggests that the deterioration in industrial activity is moderating. Also, the counterpart indicator for the services sector climbed by 1.1 points to 52.7 points, placing it firmly in expansionary territory. The Social Security affiliation data, meanwhile, indicates that the year began better than expected. Although the number of registered workers fell, as is usual in the month of January, in seasonally adjusted terms employment grew by 57,726 people, representing an increase of 0.4% compared to the Q4 2022 average. Furthermore, on the consumer side, the CaixaBank Research consumption tracker reveals that the usage of Spanish bank cards in January continued the recovery begun in December, registering 10% year-on-year growth in January, up from 8% in December and 5% in November.

Headline inflation cut short its recent trend of moderation and stood at 5.8% in January, 1 percentage point above the figure for December. In contrast, core inflation (which excludes energy and unprocessed foods) jumped by 5 percentage points up to 7.5%, despite the VAT cut on some foods. As advanced by the National Statistics Institute, the slight rebound in headline inflation in January is explained by the rise in fuel prices, after the end of the 20-cent-per-litre discount on fuel for all users, as well as a smaller reduction in clothing and footwear prices than in the sales of January last year. However, these dynamics were practically offset by the significant fall in electricity prices. In fact, according to data from Spain’s electricity grid operator Red Eléctrica Española, the regulated tariff stood at €129/MWh on average in January, which represents a sharp year-on-year drop of 55%. The National Statistics Institute also announced that, beginning this January, the electricity and natural gas components of the CPI will include free market data in their computation. With the inclusion of this data, energy price dynamics are likely to be somewhat more stable, as free market prices tend to fluctuate less.

In November, the foreign trade deficit stood at 3,313 million euros, a figure below that of the same month of the previous year (4,207 million), thus truncating the deterioration seen in recent months. This improvement came from the balance of non-energy goods, which registered a surplus of 990 million euros compared to a deficit of 1,199 million in November 2021, driven by an increase in exports (4.5% year-on-year in terms of volume) and a fall in imports (–3.5% by volume). The energy deficit, meanwhile, continued to grow and reached 4,303 million, 1.4 times higher than a year ago, due to the sharp increase in imports (+38.7%) as a result of the rise in prices (+31.7%).