The international economy, waiting for rate cuts

Cautiously optimistic outlook for the international economy, but with a demanding risk map. The US stands out among advanced economies, while the euro area has not yet left behind its sluggish economic activity. Among emerging markets, India’s growth tops the BRICS, with China giving way to the new leader.

Cautiously optimistic outlook...

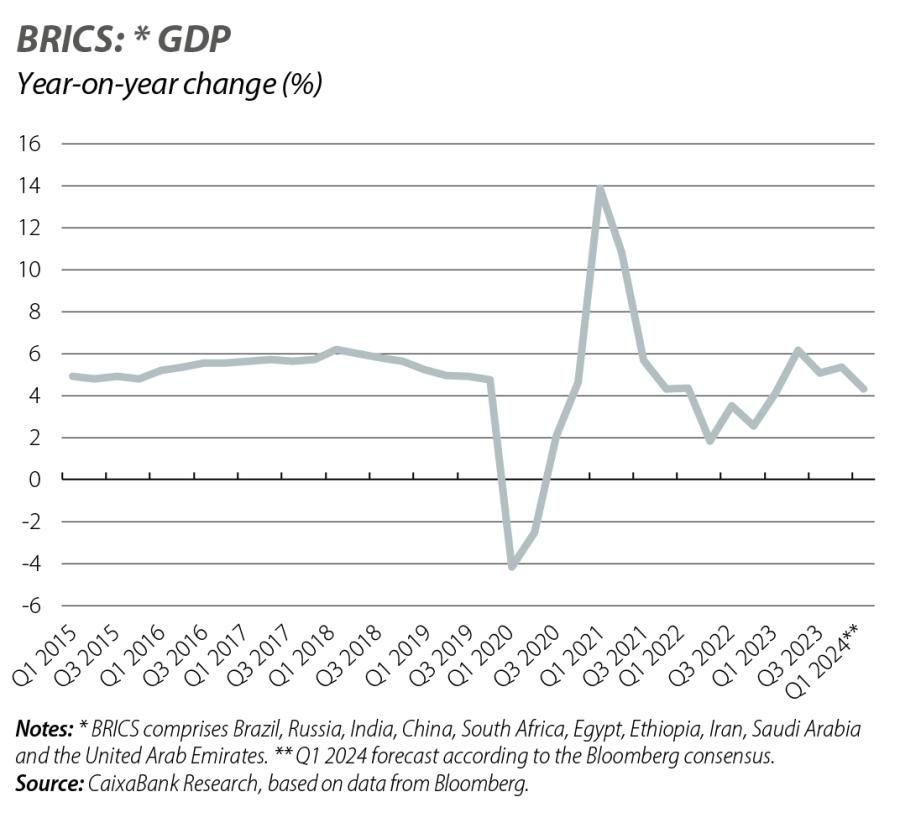

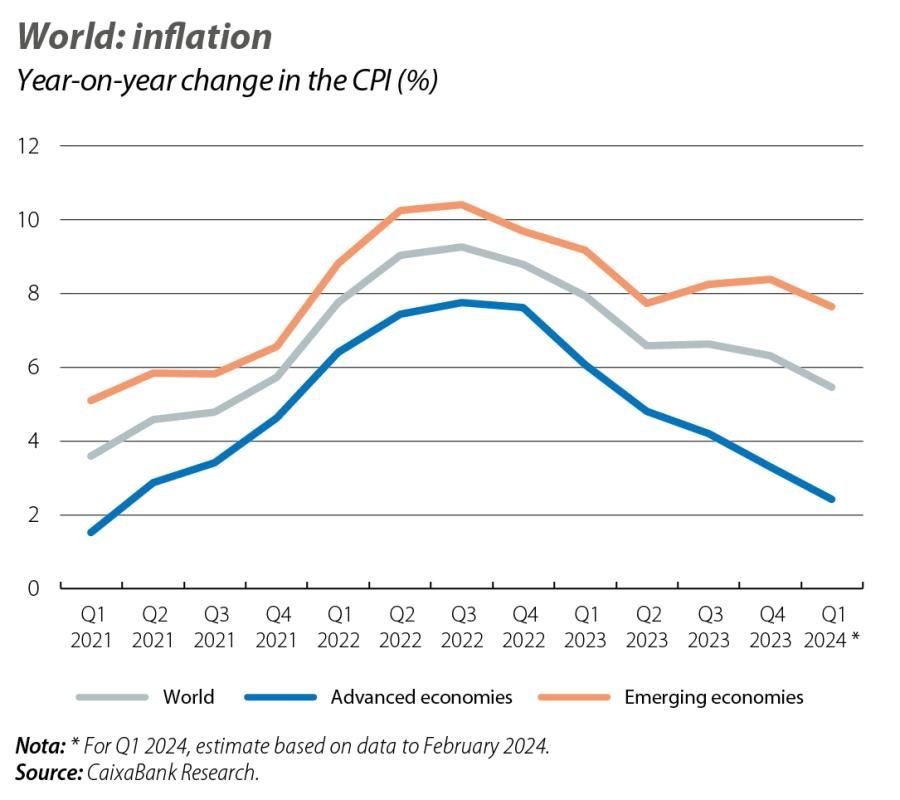

In recent quarters, the growth of the world economy has moderated amid the transmission of the monetary tightening process, the difficulties in China and an environment of high risks and uncertainty. Despite this, it is estimated that global GDP has managed to maintain a growth rate of slightly above 3% and close to its average for the last decade. This is thanks, at least in part, to the resilience of labour markets and the use of savings buffers accumulated during the pandemic, albeit with differing dynamics between the major regions. Some of these winds will blow less in favour in 2024 (for instance, in the US the post-pandemic excess savings have been virtually depleted, while the persistence of savings in Europe hides a change in their composition and a significant reduction in excess savings held in liquid assets). However, there are also positive signals, such as the global trade in goods returning to growth in recent months and, most notably, the steady decline of inflation, which has already led to rate cuts in some emerging economies (such as Brazil) and also leads us to anticipate a more widespread easing of monetary policy between the spring and summer (see the Financial Markets Economic Outlook section). Taken together, these two dynamics should support a revival of economic growth during the course of 2024.

...but with a demanding risk map

Negative factors continue to dominate the balance of risks surrounding global economic activity, particularly due to the combination of geopolitical tensions and potential supply-side disruptions, although there are also risks on the demand side (notably the risks of further transmission of the monetary tightening process of 2022-2023, as well as uncertainty surrounding what degree of inertia we will see in the inflationary pressures most sensitive to domestic factors). However, two concrete manifestations of these global sources of risk were appeased during March. Specifically, shipping costs steadily eased (having been under significant pressure at the turn of the year due to the tensions in the Red Sea) and the financial turbulence surrounding certain vulnerabilities was contained, including that related to New York Community Bancorp, which had previously fallen victim to the troubles in the commercial real estate sector in a restrictive interest rate environment.

The strength of the US stands out among advanced economies

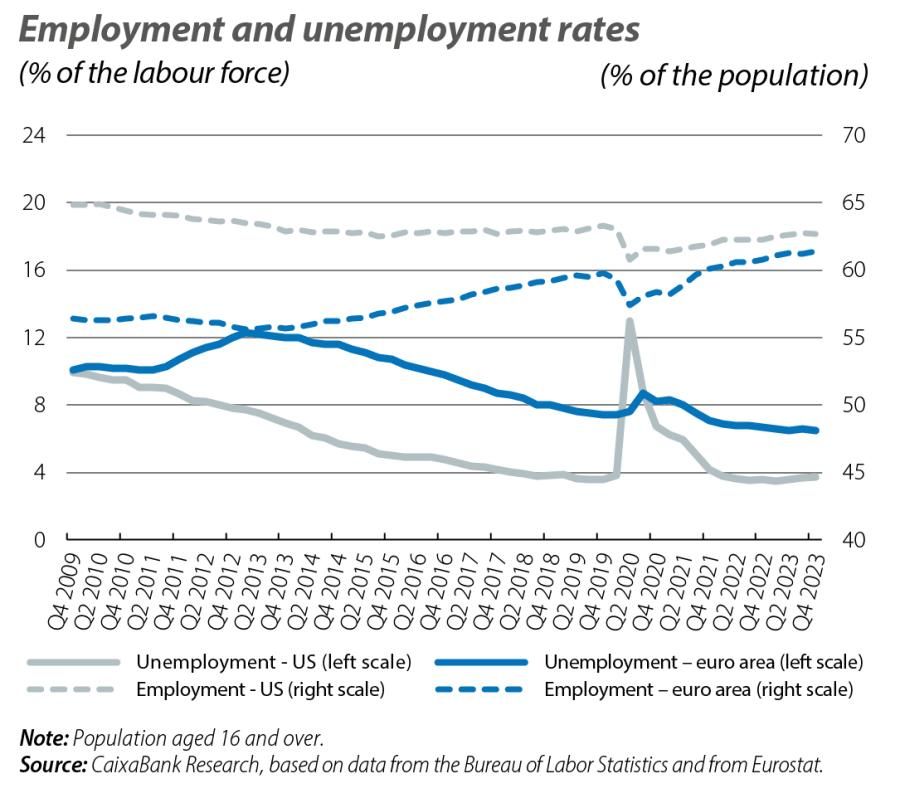

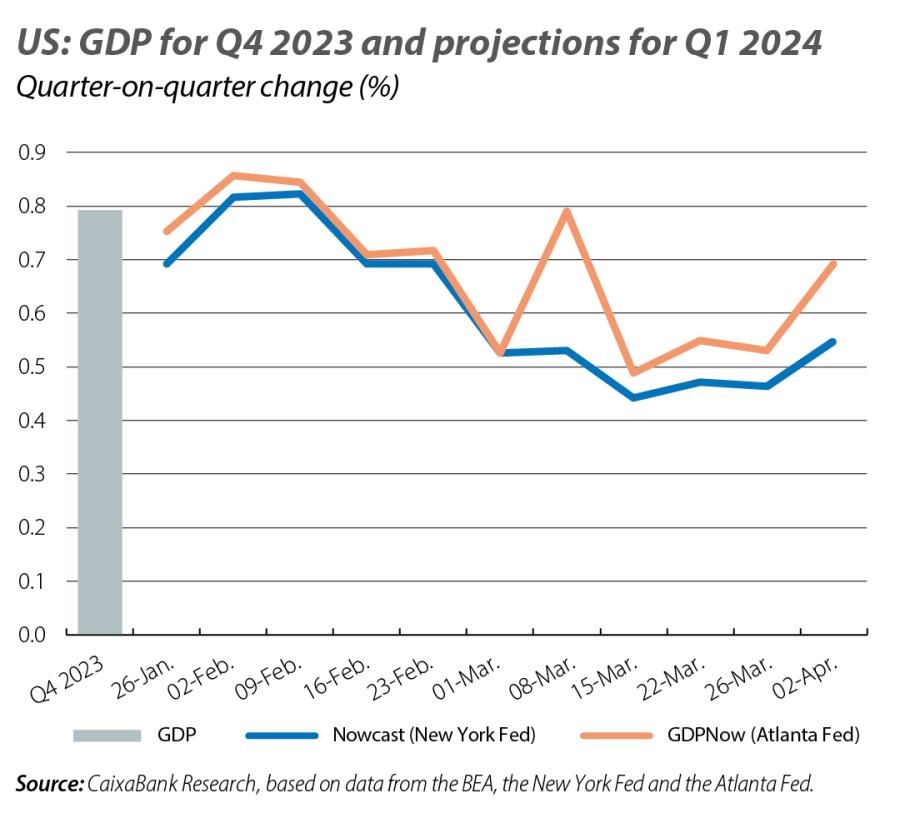

US economic activity completed a solid start to the year, with the manufacturing PMI rebounding to 50.3 points in March (in expansive territory for the first time since the end of 2022) and the services PMI remaining consistently above the expansionary threshold (51.4 points, and the Q1 2024 average above its Q4 2023 level). Moreover, it continued to be supported by the strength of the labour market, with the unemployment rate lying at just 3.8% and net job creation reaching 303,000 in March. Overall, the data suggest that US GDP could have grown by 0.5%-0.6% quarter-on-quarter in Q1 2024, a dynamic figure that coexists with a gradual fading of the inflationary pressures: according to the PCE, the benchmark index used by the Fed, inflation stood at 2.5% (headline) and 2.8% (core) in February. This strength of the US contrasts with the weakness shown by the rest of the major advanced economies. In particular, the United Kingdom fell into a technical recession at the end of 2023, with GDP contracting 0.3% quarter-on-quarter in Q4, and the monthly tracker produced by the country’s Office for National Statistics points to a 0.1% decline in January 2024. Japan, for its part, had also entered a technical recession in Q4, but emerged from it with a second GDP estimate that was revised upwards to +0.1% quarter-on-quarter.

The euro area has not yet left behind its sluggish economic activity

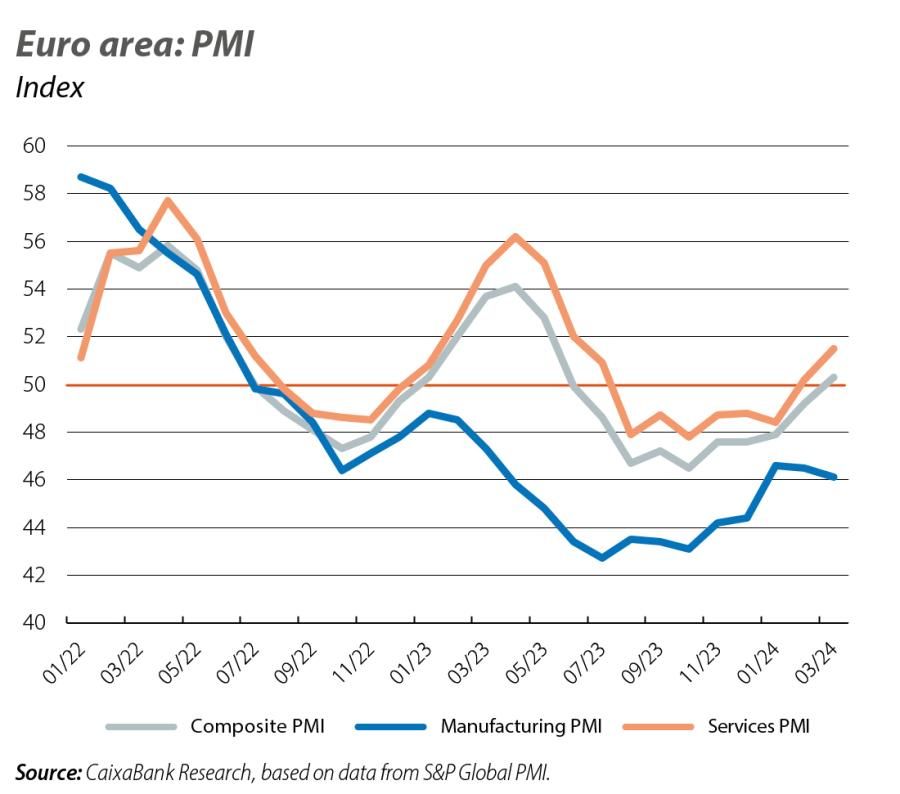

Euro area GDP has been fluctuating up and down within the ±0.1% quarter-on-quarter range for five quarters now (since Q4 2022), and the set of indicators for Q1 2024 suggest that this dynamic has continued at the beginning of the current year (the consensus of analysts expects growth of +0.1%). However, there are some indications that hint at an revival of economic activity, such as the recovery of the services PMI to 50.2 points in February and to 51.5 in March (in expansionary territory for the first time since July 2023) and a somewhat less negative manufacturing PMI (above 46 points throughout Q1 2024, which although in contractionary territory represents the best figure since March 2023). This is all thanks to the greater momentum among the countries of the periphery and a degree of improvement in France, while Germany’s economic activity remains fragile. Moreover, although some labour market indicators are showing signs of moderation (for instance, the European Commission’s employment expectations indicator stood at 102.6 points in March vs. 105.2 on average in 2023), unemployment remains stable and at a low level (6.5% in February), while employment is at peak levels. Taken together with wage growth at around 4% (Indeed.com indicator at 3.9% in February, wages negotiated at 4.5% in Q4 2023), this should facilitate a recovery in purchasing power and, therefore, in demand over the coming quarters. In addition to all this, headline inflation fell to 2.4% in March and core inflation dropped to 2.9% (below 3% for the first time since February 2022) – two dynamics that open the door to a first ECB rate cut in the coming months.

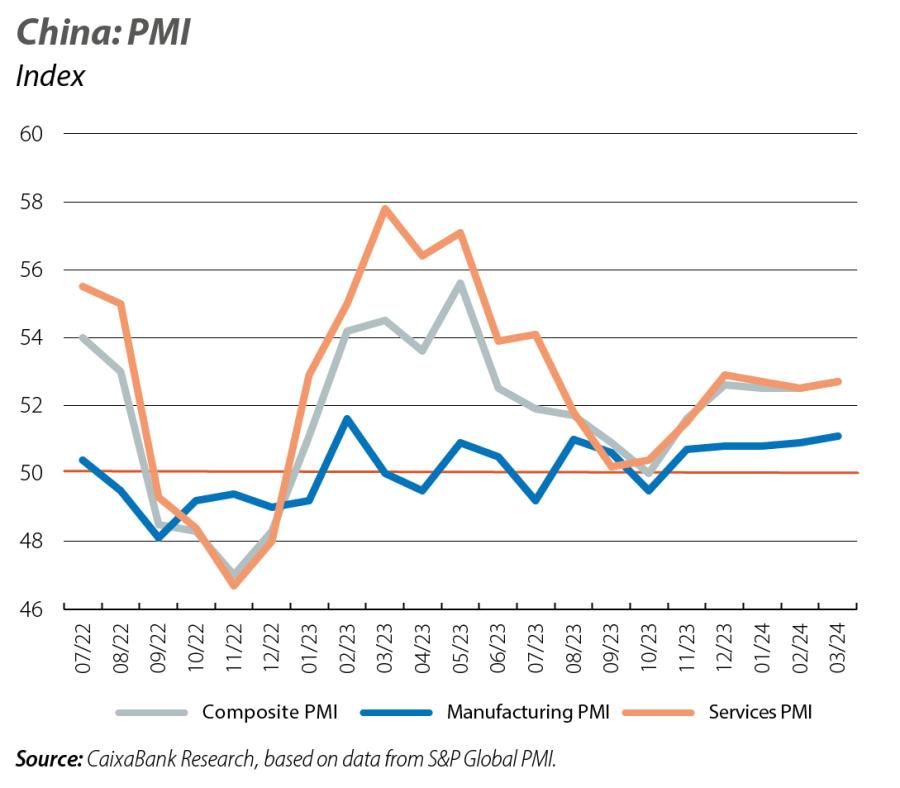

India’s growth tops the BRICS, with China giving way to the new leader

The divergence of dynamics among advanced economies is also found in the major economies of the emerging world, where there is significant contrast between the two growth leaders: India and China. India ended 2023 with GDP accelerating to 8.4% year-on-year in Q4, far surpassing forecasts and spurring an improvement in the growth outlook for 2024 according to the analyst consensus. In China, the latest indicators show a more dynamic economic activity than at the end of 2023, thanks to industry and the pull of exports and investment (between January and February, industrial production rose by 7.0% year-on-year and fixed investment by 4.2%). However, Chinese domestic consumption remains somewhat sluggish (retail sales growth slowed to 5.5% year-on-year in January-February, after standing at 7.4% in December) and the crisis in the real estate sector looks set to continue. As a result, the consensus of analysts anticipates that GDP growth for 2024 will fall short of that of 2023 and also somewhat below the 5% target announced by the authorities.