Europe’s moment: it is time to bolster our competitiveness

In the context of the European elections of 9 June, we bring forward the publication of the Dossier from June’s Monthly Report in order to contribute to the debate on the strengths and weaknesses of the Single Market at an economic level and some of the challenges that lie ahead: competitiveness, the impact of artificial intelligence, productivity and the capital markets union.

The years of European elections that mark the renewal of the main EU institutions are the ideal time to reflect on the strengths and weaknesses of the single market at an economic level and the challenges that lie ahead. This is the topic of this Dossier of the Monthly Report. In particular, one of the hottest topics in the public policy debate is that of competitiveness, in a very specific context marked by the restructuring of global value chains, the rise of China and the acceleration of the energy and digital transitions. In other words, we talk about the extent to which the European economy is capable of producing attractive goods and services, while maintaining and improving the well-being of its citizens in the long term. The determining factors include a set of institutions, policies and other elements that are interrelated and they include concepts such as human capital, the degree of innovation incorporated into the products and services that are produced by its companies, the efficiency of the productive and organisational processes of these companies, and many others. In which of them is the EU doing well and in which ones is it failing?

In order to organise ideas and narrow down the debate, the European Commission has published a revealing analysis that sheds some light on this complex issue.1 It identifies the nine major pillars that determine Europe’s competitiveness and analyses the European economy’s position in each of them.

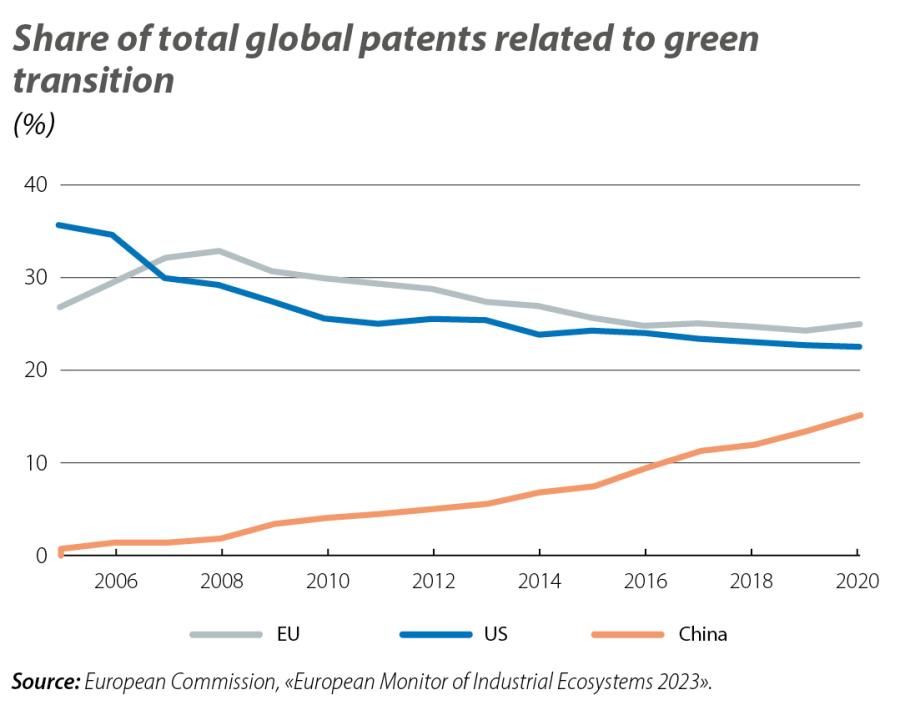

This analysis reveals that the EU is making good progress and is in a relatively comfortable position in the following three dimensions: reducing regulatory barriers that hinder the functioning of the single market, energy and international trade. The EU is doing particularly well in the case of energy thanks to the growth of renewable energies, which now account for 23% of energy generation in the EU, with the goal to reach 45% by 2030. If we look at the proportion that the EU represents in the total number of patents registered worldwide related to green technologies (see first chart), we can see that we remain in the lead, despite our relative weight in the total dwindling in recent years due to the emergence of China. Europe’s leadership is based on innovation in wind energy, where the EU held 62% of all patents in 2020, by which time China had already caught up with the EU-27 in patents related to solar energy. Despite the relatively positive assessment in the energy sphere, we cannot rest on our laurels: in a world in constant transformation, the EU faces the Herculean challenge of electrifying its energy demand, and this will require significant investments and the need to redesign the European electricity market in order to connect new clean energy production centres with consumption centres. In terms of international trade, the report highlights that the EU is the largest global exporter (accounting for 16% of all countries’ imports, slightly above China and well above the US) and that it is especially strong in the sphere of high-tech products and services.

- 1See «The 2024 Annual Single Market and Competitiveness Report» published by the European Commission in February 2024.

Before moving on to the four areas where improvement is needed, it should be mentioned that there are two pillars with a more neutral assessment, where the European economy is showing signs of improvement, and which pose a major challenge. Specifically, these are public investment and the circular economy. In public investment, the starting point is that the Next Generation programme is making a positive contribution in terms of mobilising investment and that the level of public investment in the EU (3.3% of GDP) is similar to that in the US. Looking ahead, if the digital and energy transitions are to be successful, it is essential that private investment be supported by public investment, to guarantee both the quantity and the quality of the investor mix. This will help ensure that the digitalisation and decarbonisation processes give rise to more vibrant European economic sectors. In this regard, the EU’s role in coordinating and accelerating large cross-border investments and ensuring that productive sectors are transformed without losing competitiveness will be essential. With regards to the circular economy, steady progress is being made towards a more efficient and sustainable use of commodities and we are halfway towards the targets set for 2030.

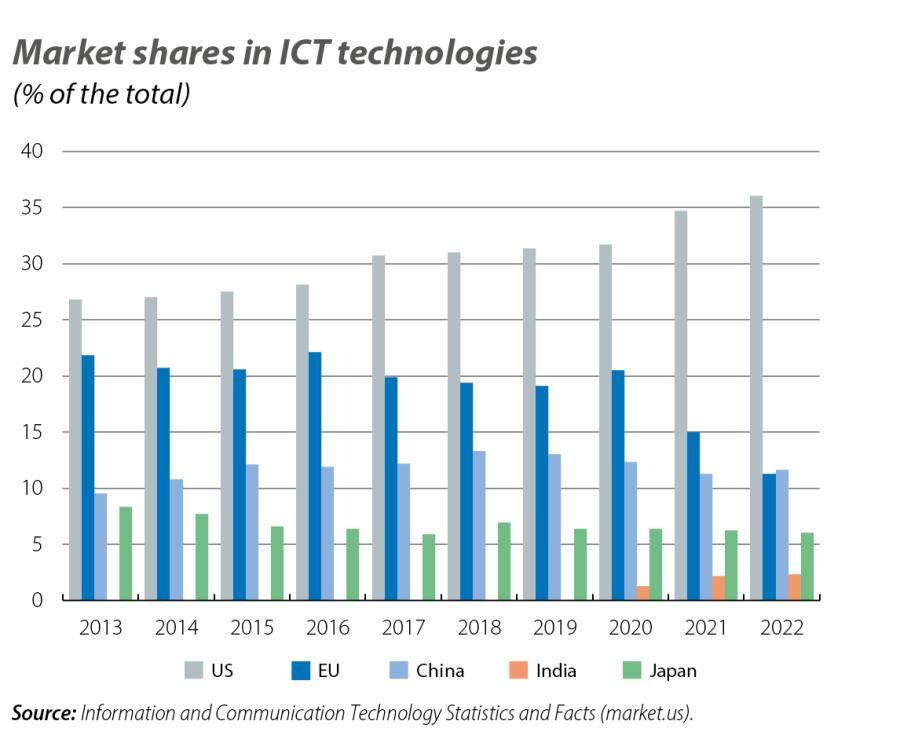

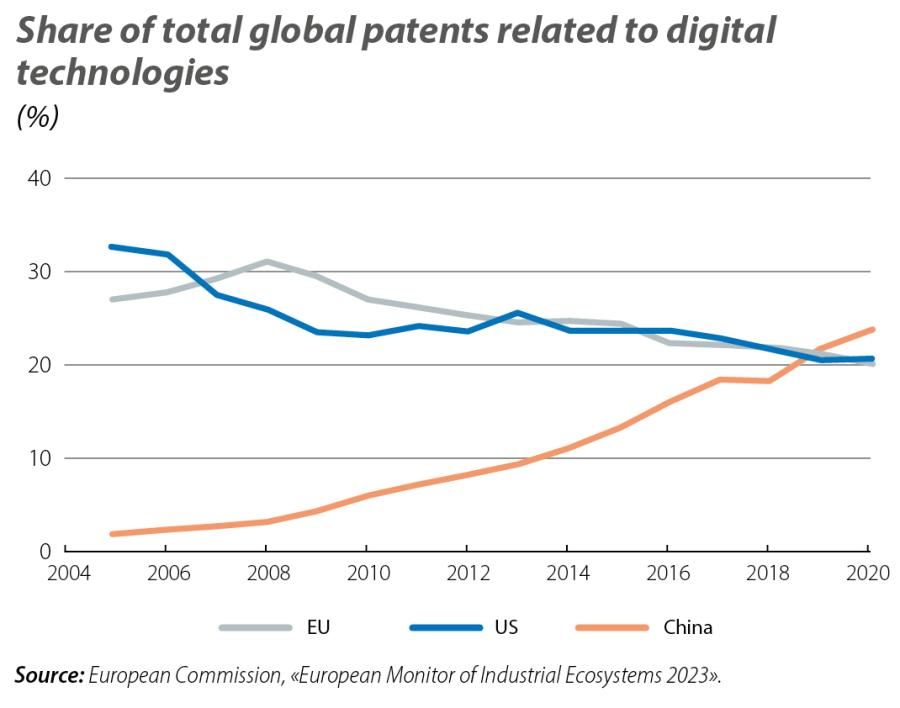

Finally, the four dimensions with the greatest room for improvement are digitalisation, access to private capital, research and innovation and human capital. With regards to digitalisation, there is one particularly revealing piece of data: the EU’s global share of the information and communications technology (ICT) market fell from 21.8% in 2013 to 11.3% in 2022 (see second chart), while in the US it rose from 26.8% to 36.0% in the same period. If we look at the EU’s global weight in digital patents, it fell by 4 pps between 2015 and 2020 to 21% of the total, a decline similar to that of the US. In technologies related to manufacturing and the Internet of Things, the report notes the EU has maintained its strength, but it has lost its edge in the robotics industry to China. Finally, the use of artificial intelligence (AI), a new technology with enormous disruptive potential as explained in the following article in this Dossier,2 is still low: it is used by 9% of European SMEs and 30% of large corporations.3 In order to redress the situation in the digital sphere, in his report on the single market, Enrico Letta4 proposes establishing a single market for telecommunications that allows pan-European operators to flourish, as well as a common regulatory framework in order to provide a boost to technologies such as 5G and reduce Europe’s dependence on digital services from outside countries.

- 2See the article «Artificial intelligence: challenges and opportunities for Europe» in this same Dossier for an in-depth analysis.

- 3Data from the European Commission’s Digital Decade Report (2023) with data from 2022. These adoption rates appear to be slightly higher than those in the US. According to the National Science Foundation, in 2022 25% of large corporations and 4% of SMEs in the US had adopted AI.

- 4See E. Letta (2024), «Much more than a market: Empowering the Single Market to deliver a sustainable future and prosperity for all EU Citizens», European Commission.

As for access to private capital,5 this is an Achilles heel of the EU market and a shortcoming that we cannot afford to live with if private investment is to pick up. In this regard, the Commission emphasises that the size and highly disaggregated nature of the EU’s capital markets is clearly inadequate to support growth in the medium term. In fact, the capitalisation of the EU stock market, as a percentage of GDP, is less than half that of the US, despite the higher level of savings in Europe. Venture capital, which allows innovative companies with limited access to external financing to thrive, is 0.09% of GDP, paling compared to the US (0.75%) or China (0.58%). In his report on the single market, Enrico Letta has also raised the alarm about the lack of a capital market in Europe and has put forward bold proposals to address this. The proposals include launching a long-term savings financial product at the European level in order to stimulate retail investments and creating a European risk-free asset with a view to ensuring the stability and uniformity of the EU’s financial market.

Finally, it is worth making two brief comments on innovation and human capital. The total investment (public and private) in innovation in the EU is 2.2% of GDP; this is well below that of the US (3.4%) and varies significantly from region to region, making it difficult to extend it throughout the continent. Here the EU can promote policies and tools to enhance synergies between business sectors and academic institutions, thus facilitating a better diffusion of innovation while also supporting start-ups and scale-ups.6

In terms of human capital, the widespread setback of European countries in the education sphere, according to the PISA report, has caused cold sweats that are fully justified. We are at a delicate juncture, as we do not know how educational needs will evolve in the face of accelerated and continuous changes in technology. Continuous learning is key, but currently only 1 in 3 adults in the EU participates in training activities each year. The difficulties in attracting qualified staff who are fully trained in digital and green skills (so-called white blackbirds) will be the order of the day, but the low level of labour mobility in Europe does not help.7

In short, the EU faces a triple challenge: (i) how to successfully incorporate new technologies, with a special mention of AI, to increase its potential growth while mitigating labour market disruptions to prevent the rise of Neo-Luddism; (ii) how to boost investment and improve productivity in a context of marked variations between countries and high investment needs,8 and (iii) how to achieve a true integration of its capital markets in order to finance these investments. These are precisely the topics covered in depth in the following three articles of this Dossier. Read on!

- 7Only 3.8% of workers born in the EU work in a European economy other than the one in which they were born and only 17% of EU citizens have lived or worked at some point in their lives in a country other than their own.

- 8See the article «Productivity growth in Europe: low, uneven and slowing» in this same Dossier.