Spanish inflation and rising oil prices: different this time?

Inflation has livened up over the last few months in Spain. In August 2016, when inflation was still negative (–0.1%), it began a strong upward trend that brought it to 3.0% by February 2017. This entire upswing is due to the rise in oil and electricity prices. But two key issues hover over the next few months. How this upswing will affect the price of the rest of goods as, to date, it has been limited to the energy components of the CPI. And whether the impact on Spain’s inflation will be greater than on the euro area as a whole, since this could erode the gains made in competitiveness over the past few years.

Higher oil prices affect inflation through three different channels. First, they have a direct impact on fuel prices. Spain is affected more than the euro area as a whole since fuels account for 7.7% of the Spanish CPI compared with 4.2% in the euro area. Fixed taxes are also lower in Spain, so fuel prices fluctuate more in line with oil prices. Second, higher oil prices have an indirect effect on other components as they increase those production costs intrinsically linked to oil, such as transport. Third, there are also second-round effects which result from changes in the inflation expectations of economic agents and which, for instance, could influence wage negotiations.

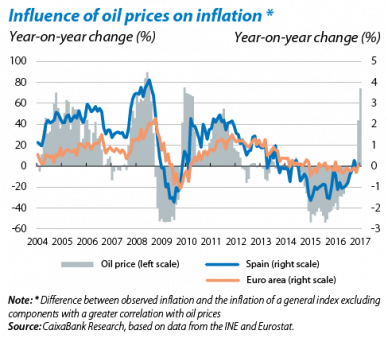

One way to measure these three effects, both for Spain and the euro area, is by breaking down the CPI into 94 components. The correlation is then calculated between each component and the price of oil,1 classifying components into two groups depending on whether this correlation is significant or not. A general price index is then constructed using only those components not correlated with the price of oil. The difference between observed inflation and this general index indicates the influence of oil prices on the price of the rest of the goods.

The first finding from this analysis is that, over the last 15 years, there is a larger share of components correlated with oil in the Spanish CPI than in the euro area’s CPI. Specifically, in Spain the correlated components (excluded from the general index) have a joint share of 59.1%. This is far above the euro area figure where the excluded components account for 36.7%. The biggest differences between Spain and the euro area occur in restaurants and accommodation services, with a combined share of 13.8% in the Spanish CPI. In both cases the correlation with oil prices is high in Spain but almost zero in the euro area.

This greater share of oil-correlated components in the Spanish case means that Spain’s inflation increases more sharply than in the euro area whenever crude oil becomes more expensive. When oil prices rocketed between 2007 and 2008, the effect of this increase on Spanish inflation was 4.1 pp (difference between observed inflation and the general index in August 2008) while in the euro area this was 2.3 pp in November.

We have already witnessed the direct effects and perhaps some indirect effects of rising oil prices this January and February. Should we expect the same from the second-round effects as in the past? There are reasons to believe that the structural reforms implemented over the past few years and the resulting de-indexation of inflation (labour costs, pensions and government taxes) might prevent the story from repeating itself.

1. Specifically, for each component i the following model is estimated: