The markets assume high rates for longer

For much of April, the tone in the financial markets was marked by geopolitical risks and investors’ bets about the near future of monetary policy in the major developed economies.

For much of April, the tone in the financial markets was marked by geopolitical risks and investors’ bets about the near future of monetary policy in the major developed economies. The increase in hostilities in the Middle East and in the war between Russia and Ukraine, combined with renewed trade tensions between the US and China over tariffs on various metals, led to a rise in uncertainty among investors. In addition, signs of downward resistance in US inflation, amid a strong economy, led investors to postpone their expectations regarding the Fed’s rate cuts, and this had repercussions for a broad range of interest rates, for spreads in the yields between different regions and for exchange rate movements.

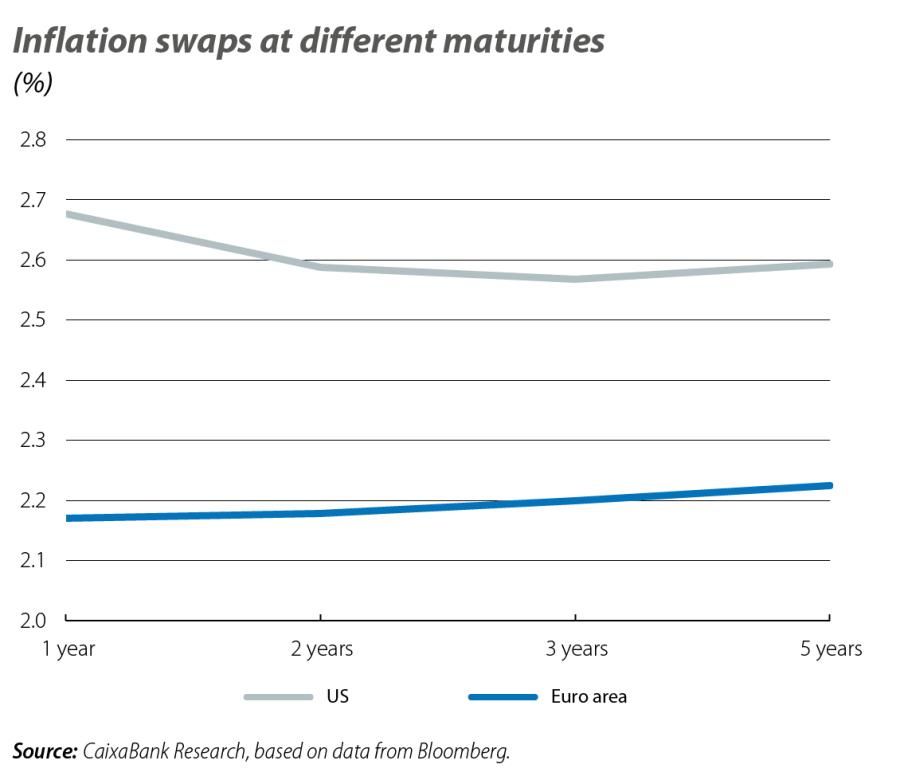

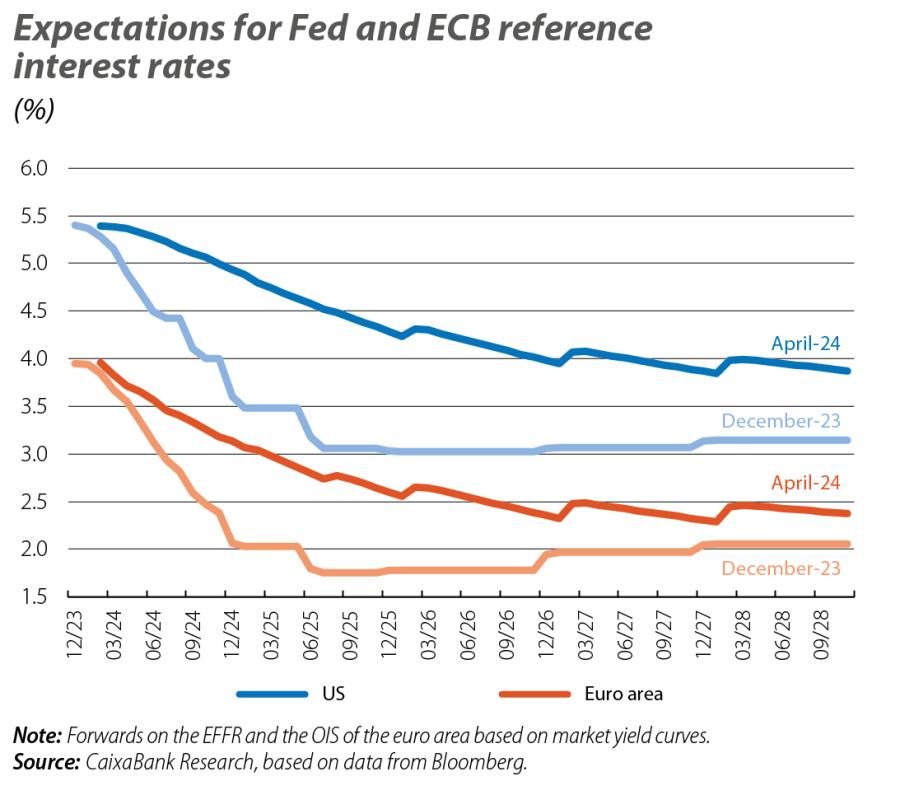

As investors had anticipated, in April the Fed kept interest rates in the 5.25%-5.50% range and, responding to investors’ doubts, indicated that the latest data have not helped to gain the confidence needed to prepare for a first rate cut. However, Fed chair Jerome Powell tempered this hawkish signal with some dovish messages, for instance by rejecting the possibility of an interest rate hike. In particular, the Fed wanted to convey a more balanced view, focusing the debate on how long interest rates should be kept high for and how long the central bank should wait before implementing a first rate cut. Thus, the Fed refused to open the door to a possible rate hike, pointing out that the current restrictive environment should be enough to end up bringing inflation down to 2%, although it will take longer than expected. On the other hand, at its April meeting the Fed also announced that it will slow down its quantitative tightening (balance sheet reduction process) from June. Specifically, treasuries will be allowed to expire at a rate of 25 billion dollars per month (previously 60 billion), while MBSs will continue to be allowed to expire at the rate of 35 billion per month. With all this, the markets ended the month betting on a first Fed rate cut in November and assigning almost a 50% probability to a second cut at the end of 2024.

In the euro area, the central bank also kept its monetary policy unchanged in April (the depo rate at 4.00% and the refi rate at 4.50%), but it did reinforce the expectation that in June it will make a first cut in its reference rates. This signal from the ECB was supported, on the one hand, by the sustained slowdown seen in most price indicators, despite the fact that some items are showing a little more inertia (such as services). On the other hand, the intention to cut rates was also underpinned by the euro area’s economic activity, which continues to show weakness despite some signs of improvement in the latest indicators. However, Christine Lagarde pointed out that we should not anticipate a path of sustained interest rate reductions beyond June, but rather that decisions will be taken «meeting by meeting» and based on the data. Finally, and in the face of the Fed’s greater caution before cutting rates, Lagarde was keen to distance the two institutions and reiterated that the ECB is governed by the needs of the euro area’s economic outlook, recalling that it is significantly different from that of the US, and she downplayed the consequences of a monetary divergence between the Fed and the ECB. With all this, the markets closed the month of April assigning a 90% probability to a cut of 25 bps in the ECB’s rates in June, and betting on a total of 75 bps of reductions in 2024 as a whole (with which the depo rate would end the year at 3.25%).

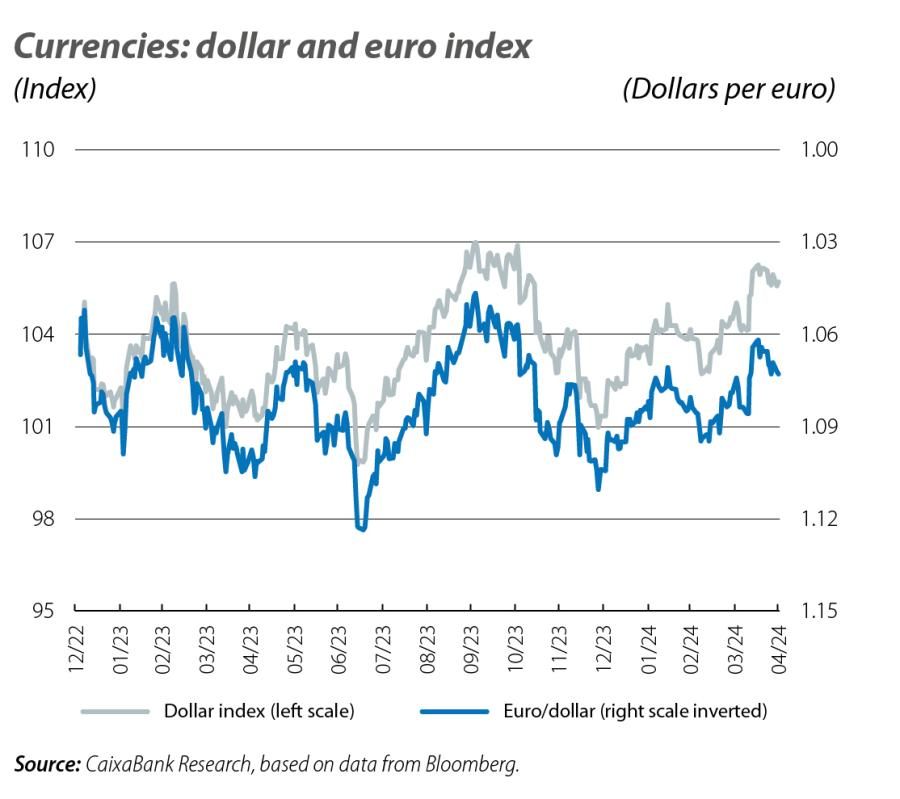

In April, the fixed-income markets were dominated by the combination of geopolitical risk and adjustments to expectations regarding monetary policy, and the month as a whole saw a widespread increase in interest rates on US and euro area sovereign debt. In the case of treasuries, there was an upward shift across the entire curve, with the yield on the 2-year bond reaching the 5% barrier for the first time since November, while the 10-year yield rebounded almost 50 bps. The euro area’s sovereign yield curves, meanwhile, moved in the same direction, albeit to a lesser degree, responding to the monetary divergence between the Fed and the ECB and the prospect of monetary policy being eased in the euro area sooner than in the US. This difference between the increase in yields on the two sides of the Atlantic, coupled with the US currency’s role as a safe-haven asset, favoured the appreciation of the US dollar against the euro to 1.067 dollars, as part of a movement in which the dollar gained strength against a broad swathe of major advanced and emerging-economy currencies (e.g. the dollar strengthened to a three-decade high against the yen).

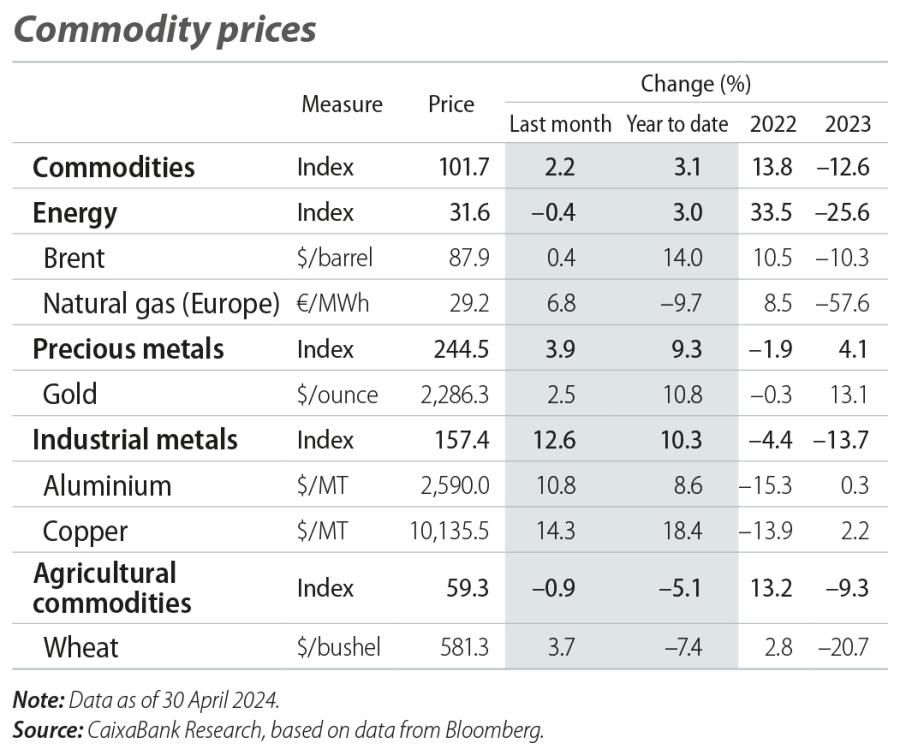

The conjunction of the attacks between Iran and Israel, with their potential repercussions for the oil supply (Iran is the third-largest producer of OPEC), and the extension of the production cuts by OPEC and its allies caused the Brent barrel price to trade at around 90 dollars for much of April. Industrial metal prices also rose, with copper leading the charge, as the growth expectations for global economic activity improved, especially in China.

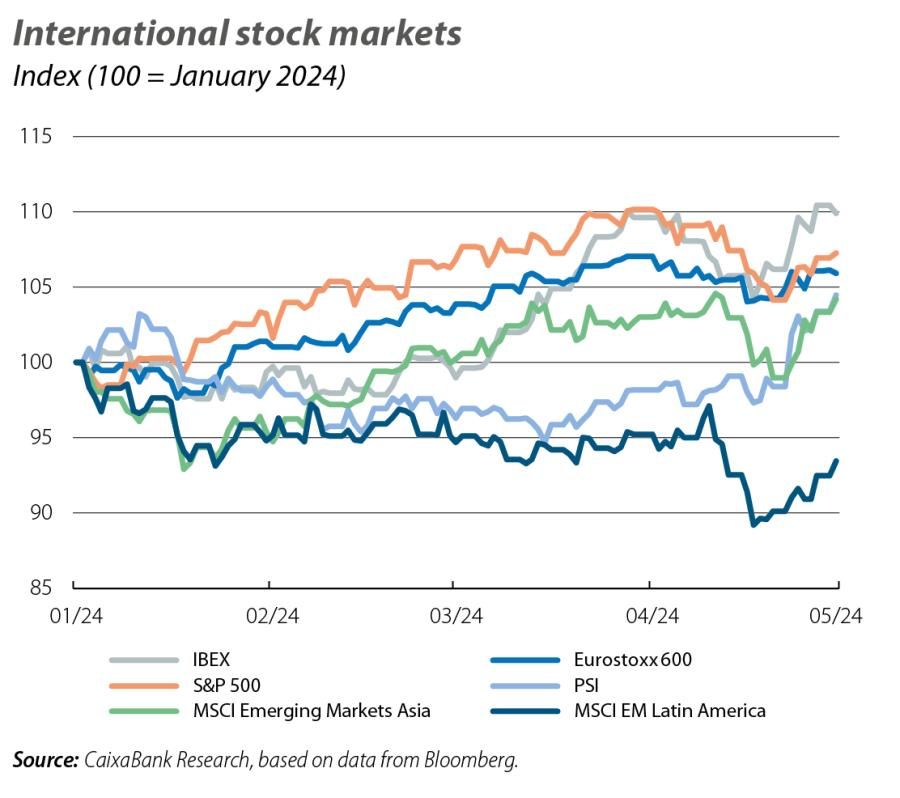

In this scenario, and fearing that the restrictive monetary conditions could continue to strain corporate margins, the major stock market indices suffered widespread losses in April. The US indices accumulated the largest decreases (S&P 500 –4.2%, Nasdaq –4.5%), weighed down by the sharp rise in treasury yields and faced with a Q1 business earnings season getting underway with more contained profits than expected in some of the big financial and tech companies. In the euro area (EuroStoxx 50 –3.2%), the declines were more moderate thanks to the ECB’s anticipated rate cut, and with a somewhat differential performance between the stock markets of the bloc’s core (DAX –3.0%, CAC 40 –2.7%) and periphery (IBEX 35 –2.0%, PSI-20 +5.3%).