Will political uncertainty hold back the international economy?

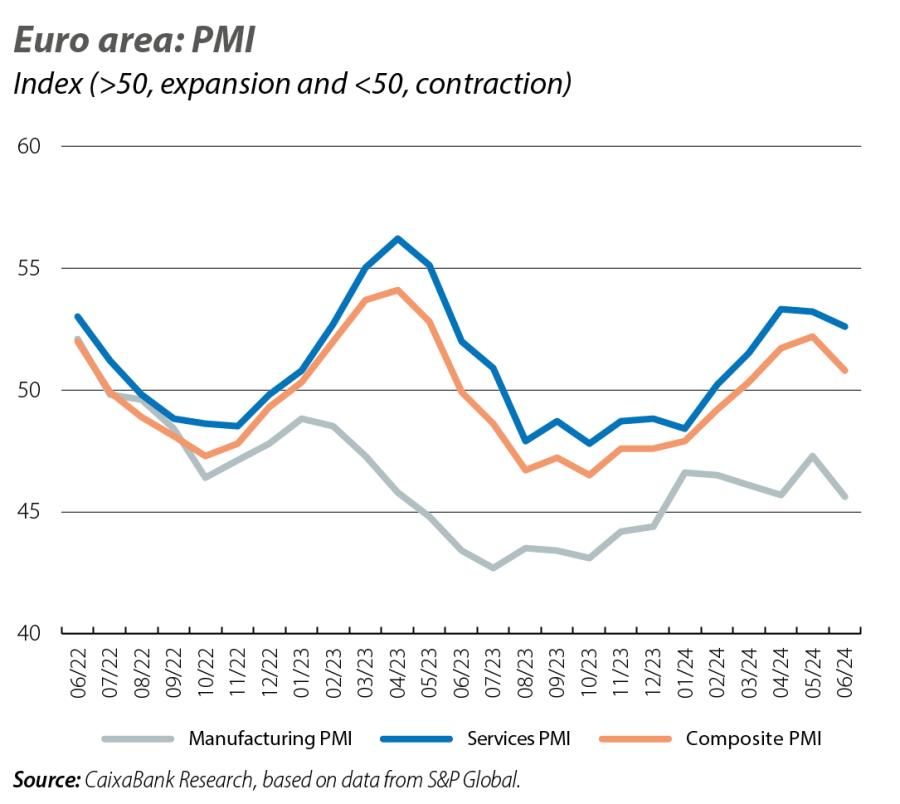

The economic recovery in the euro area continued during Q2, but it began to lose momentum in June. The Purchasing Managers’ Index (PMI) for the euro area remained at levels compatible with positive growth in June, but disappointed by falling with respect to the previous month, weighed down by an industrial sector that is slipping deeper into recession.

A somewhat moderate recovery in the euro area

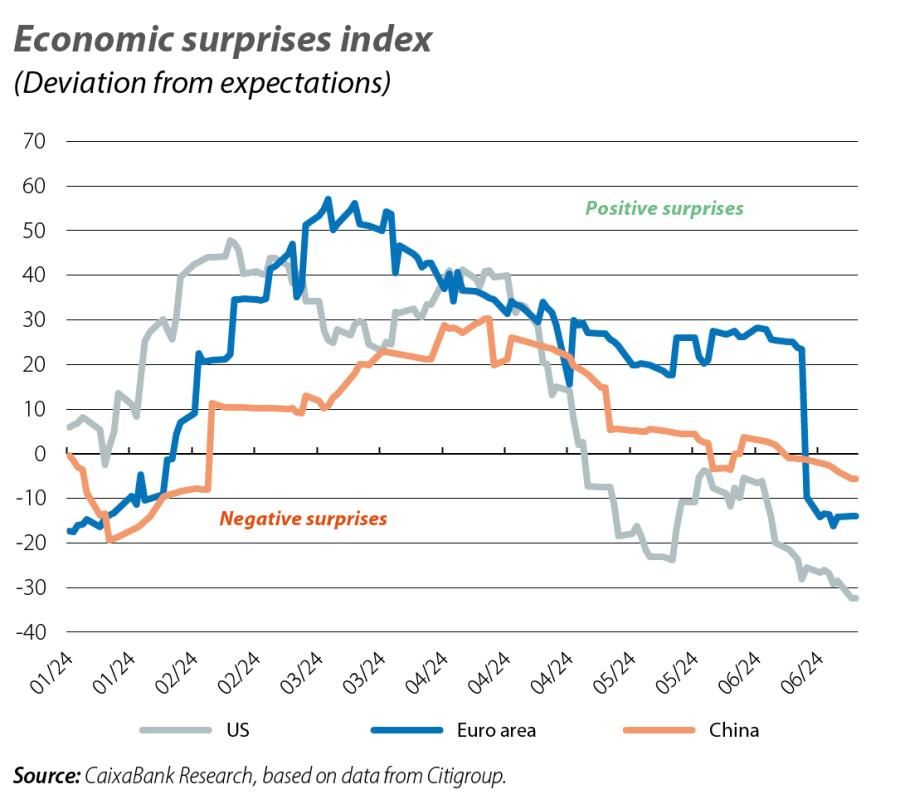

The economic recovery in the euro area continued during Q2, but it began to lose momentum in June. Among other indicators, the Purchasing Managers’ Index (PMI) for the euro area remained at levels compatible with positive growth in June, but disappointed by falling with respect to the previous month (50.8 vs. 52.2), weighed down by an industrial sector that is slipping deeper into recession (45.6 vs. 47.3). The German Ifo, meanwhile, fell in June (89.3 vs. 88.6) after four consecutive months of growth, thus falling further from the 100-point threshold that indicates growth rates consistent with its long-term average. These results are thus in line with the expected scenario of modest growth (both the consensus of analysts and CaixaBank Research predict an increase of around 0.3% quarter-on-quarter in Q2) and they would place euro area growth for 2024 as a whole at a sober 0.8%.

Increased political uncertainty in the euro area

Part of the deterioration shown by the business confidence indicators could reflect an increase in political uncertainty associated with the outcome of June’s European elections, insofar as these indicators are based on surveys conducted just after the elections were held. Although the traditional parties maintained the parliamentary majority, the rise of forces at the extremes of the political spectrum led to a snap general election being called in France. Following the second round, the unexpected victory of the left-wing coalition (NFP), which won 182 of the 577 seats in the Assembly, and the resistance of President Macron’s party (168 seats) put Le Pen’s party in third place (143 seats). The result is a highly fragmented parliament in which no political force has the necessary majority to impose its agenda, meaning that pacts will have to be reached between them. As detailed in the Financial Markets Economic Outlook section, all this raised doubts among investors about the correction of the fiscal imbalances. This, in turn, caused financial turbulence in a context in which France is starting from a situation with a high deficit and significant public debt (5.5% and 110.6% in 2023, respectively) and in a month in which the European Commission initiated excessive deficit procedures with France itself, in addition to Italy, Hungary, Poland, Malta, Slovakia and Belgium.

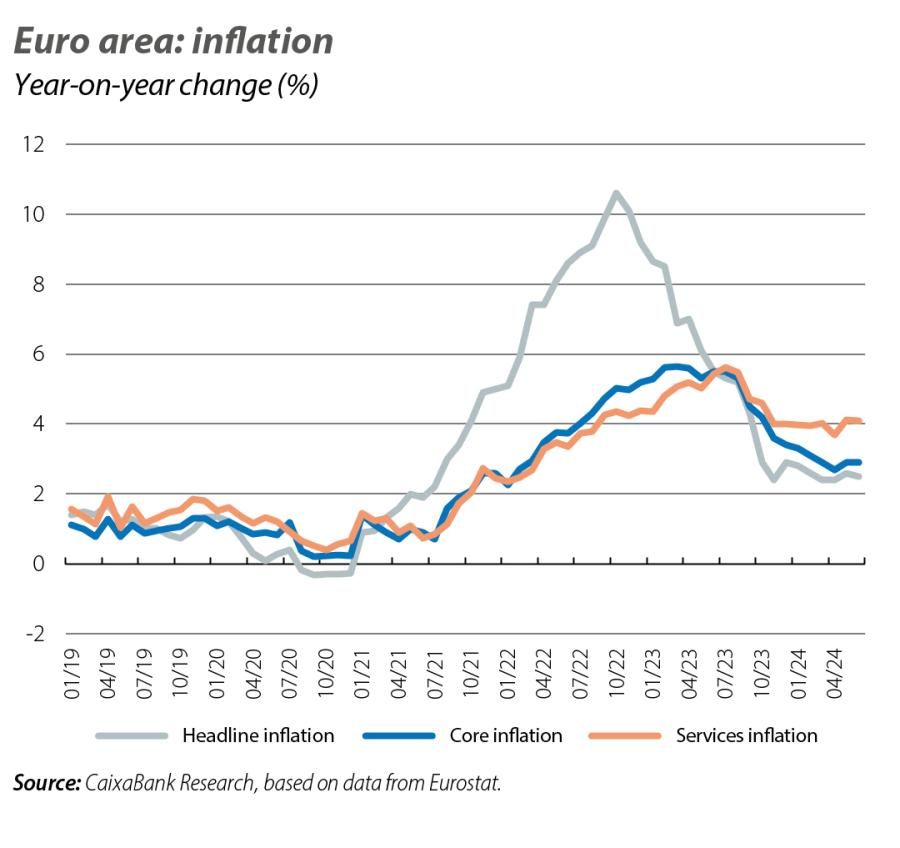

Euro area inflation slows down

Inflation fell 0.1 pps in June to 2.5%, while core inflation (which excludes food and energy) remained at 2.9%. Thus, following the sharp decline of the last year and a half (inflation had reached 10.6% in October in 2022), the pace of the decline in the last mile to reach the 2% target has slowed, as the source of the disinflation in energy is gradually exhausted (energy prices have stabilised in year-on-year terms, after falling by more than 10% at the end of 2023) and the effort falls on inertial components (such as services, which remained at 4.1% in June).

The indicators in the US continue to paint an outlook of solid growth, albeit with a slowdown

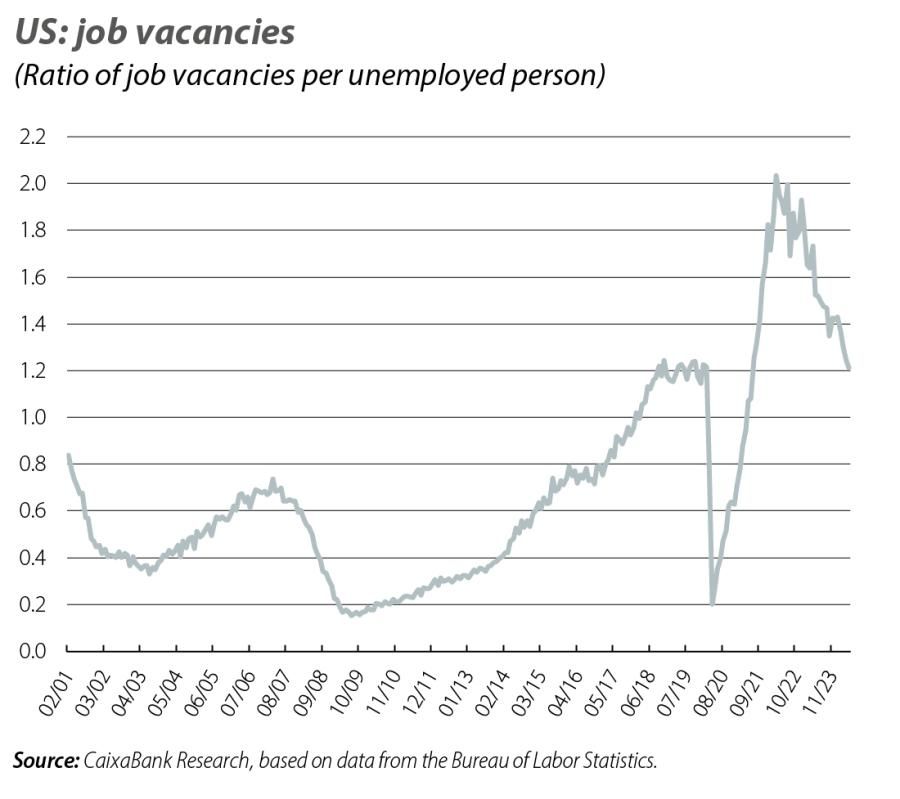

In June, the composite PMI consolidated at one of its highest levels in the last two years (54.6 vs. 54.5) and the New York and Atlanta Feds’ nowcasting models point to growth rates in excess of 0.5% quarter-on-quarter in Q2 2024 (0.3% in Q1). However, there are also ever-increasing signs of an orderly loss of momentum. In May, job creation continued to exceed the average of the previous 12 months and the unemployment rate stood at 4.0%, but other labour market indicators signal a degree of normalisation. For instance, the vacancy rate continues to decline (1.2 in May, down from the high of 2.0) and the employment component of the ISM index, in both manufacturing and services, indicates a modest slowdown in the pace of job creation.

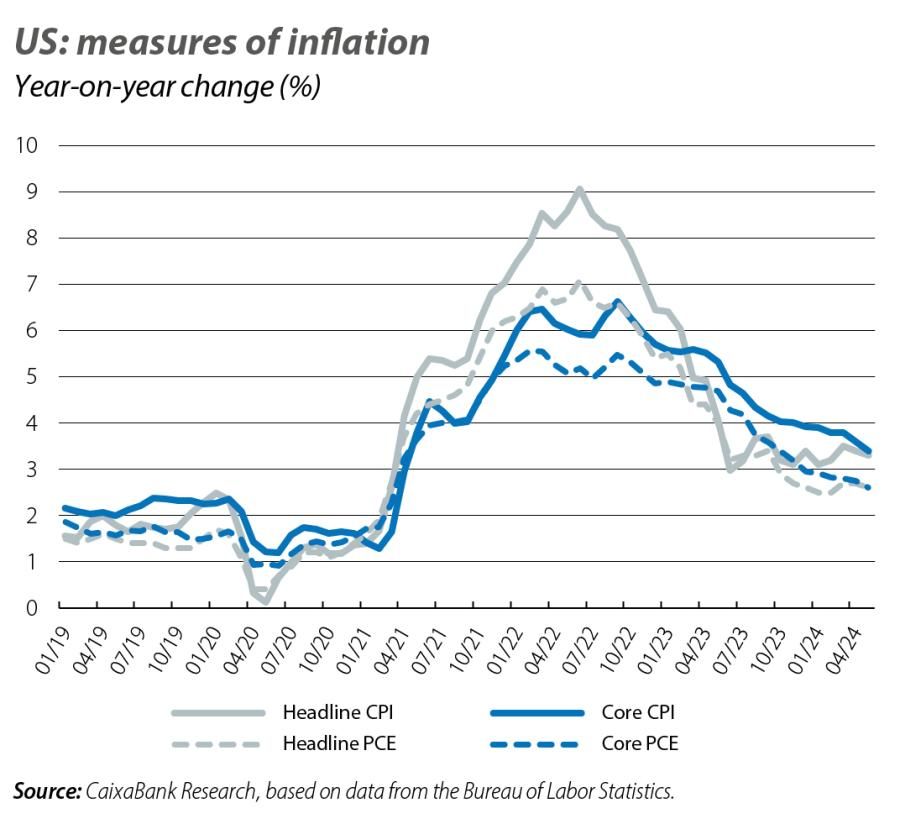

Private consumption moderates, while inflation provides better news

US private consumption grew less than initially estimated in Q1 (0.4% quarter-on-quarter vs. the initial estimate of 0.6%) and the weakness of retail sales in April and May suggests that this pattern will continue in Q2. In this regard, it is estimated that practically all the excess savings accumulated during the pandemic have been exhausted. With regard to US inflation, in May, and for the second consecutive month, it was once again below the level expected by the consensus of analysts, both in the case of headline inflation (3.3% vs. 3.4% in April) and for the core index (3.4% vs. 3.6%). However, the shelter component (housing-related services) continues to show considerable downward resistance (5.4% vs. 5.5% in April) and this is holding back the decline in inflation, since this component accounts for over 35% of the CPI basket. Shelter is also a component of the PCE price index, which is the benchmark used by the Fed, although it accounts for a smaller portion than it does in the CPI. This explains why inflation measured with the PCE is lower, but it does not prevent it from showing greater inertia than expected in recent months (2.6% vs. 2.8% in April). With this, the Fed reiterated its prudence regarding the start of rate cuts.

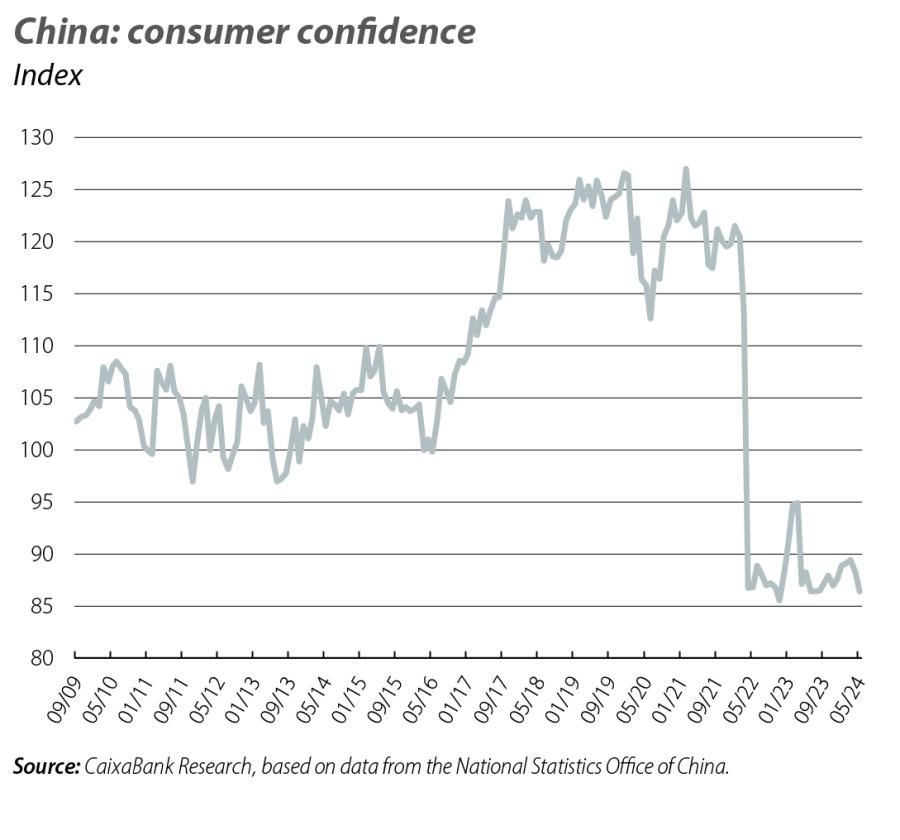

Good short-term outlook for China, but medium-term risks persist

The Chinese economy offers some mixed signals, but on balance it continues to grow at a steady pace, supported by the economic measures implemented and the growth of exports (14.5% year-on-year in May), thanks to the boost provided by the sale of products related to the green economy. Thus, investment in fixed capital grew in the year to date up to May by 4.0% year-on-year, compared to the 4.2% registered in the first four months of the year. Meanwhile, industrial production lost some of its momentum in May (5.6% vs. 6.7% year-on-year), while retail sales managed to recover (3.7% vs. 2.3% year-on-year). As for the situation in the housing market, the difficulties persist and, despite the measures taken by the government, the downward trend in prices has not yet been reversed. On the other hand, in June the EU announced an additional tariff of up to 38% on Chinese electric vehicles on a provisional basis (no later 5 July, and definitively in November). This decision follows the one taken by the US (where they want to apply a tariff of almost 100% on electric cars imported from China from 1 August), as well as the measure proposed by Turkey to apply a tariff of 40% on any vehicle manufactured in China (including both hybrid and internal combustion vehicles) from 7 July.