Spain faces a first quarter still highly restricted by the COVID-19 pandemic

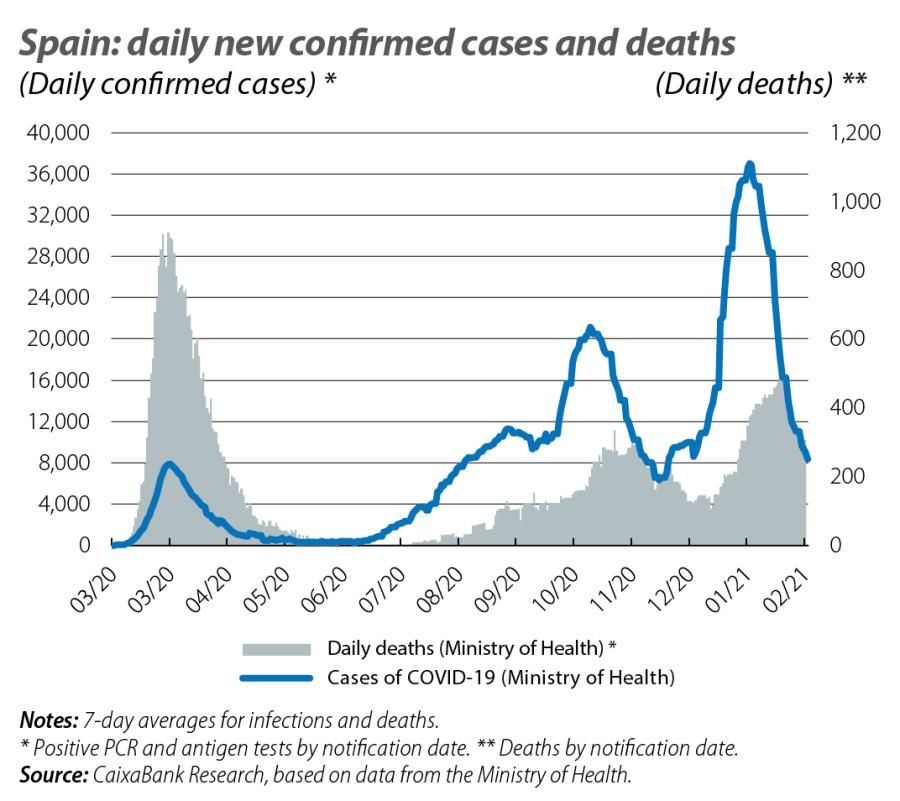

February passed without major developments in the outlook for the Spanish economy in 2021, for which we continue to anticipate an average growth of 6%. In particular, the latest economic activity indicators suggest a stagnation or a slight decline in GDP in Q1. This should not come as a surprise considering that most of the mobility restrictions have remained unchanged so far this quarter. The pandemic has loosened its intensity in February – the cumulative 14-day incidence has fallen below the extreme risk level (250 cases per 100,000 inhabitants) for the first time in two months, and the pressure on hospitals continues to decline – but for Q1 as a whole we can expect to see a similar level of restrictions as in Q4. In this regard, our outlook scenario foresees a Q1 with the economy held back by the restrictions and a recovery beginning in the spring with the vaccination of the highest risk groups. After all, it should be recalled that over 60s account for the bulk of hospitalisations and ICU admissions (around 70%) as well as deaths (over 90%), with only 20% of the total infections. Therefore, the vaccination of this age group is key for enabling a more widespread easing of the restrictions. The recent acceleration of the vaccination rate

is an encouraging sign, supported by the growing volume of Pfizer and AstraZeneca vaccine shipments to Spain.

The latest data are consistent with a rate of economic activity in Q1 similar to that of Q4. For instance, the CaixaBank consumption indicator – which measures spending on cards issued by CaixaBank, non-client spending registered on CaixaBank POS terminals and cash withdrawals carried out at CaixaBank ATMs – shows an 11% year-on-year decline in February. This is slightly worse than the figure for January (–8%) and brings us back to where we were last November (also –11%). Data on workplace mobility remained below the levels of Q4 2020, despite some improvement this month. Finally, the services PMI for February remained at contractionary levels (43.1 points), while the manufacturing PMI returned to expansionary territory (52.9 points in February and 49.3 points in January) with the highest figure since July 2020. Taken together, these data indicate that the Spanish economy remains on hold in Q1.

After several months of higher-than-expected resilience in the labour market, the weakness of the services sector took its toll in February: in seasonally adjusted terms, social security affiliation declined (–30,000 people in the economy as a whole and –49,000 in the services sector) and registered unemployment increased (+20,000), bringing it to over 4 million people. In addition, the number of employees on furlough was revised upward to 928,000 at the end of January (a revision of +189,000) and stood at around 900,000 at the end of February, while the number of social security affiliates not on furlough declined by 6.8% year-on-year in February (worse than the –6.0% decline in January). Looking ahead to the next few months, we expect the labour market to remain highly affected by the pandemic and to show uneven performance between sectors, with gradual improvements in those sectors less affected by the restrictions on activity (such as industry and construction) and more modest performance in the case of those most affected (such as hospitality and retail).

In January, there was a significant rebound in inflation, which climbed from –0.5% in December last year to 0.5%, driven by the surge in electricity prices. This surge was undone in February and inflation fell to 0%, although the decline went beyond the energy components, as the core indicator (which excludes energy and unprocessed foods) fell by 3 decimal points to 0.3%. For the rest of the year, inflation is likely to be volatile as various pandemic-related base effects are undone. One of the most significant of these will be the low oil prices, which have returned to pre-pandemic levels in early 2021, having fallen below 30 dollars in the spring of 2020.

Specifically, the current account balance stood at +0.7% of GDP (8 billion euros), compared to +2.1% in 2019 (26.6 billion euros). Indeed, the trade deficit in goods improved during the year, although this was largely due to the collapse of imports in the face of the pandemic. In contrast, the surplus in the balance of service deteriorated considerably in the face of the massive decline in the tourism sector, the external balance of which fell by slightly more than 80% last year. For further details, see the Focus «COVID-19 and international trade: an asymmetric impact» in this same Monthly Report.

Debt stood at 1.3 trillion euros, an increase of just over 122 billion. In GDP terms, debt reached 117.1%, +21.6 pps compared to the 2019 year end. This is a very significant increase, albeit a logical one in the context of the pandemic. This final figure was slightly lower than the government’s forecast (118.8% of GDP), owing to higher than expected economic growth in the second half of last year. We expect the public deficit, meanwhile, to have stood at around 11% of GDP last year (we will find out the final figure at the end of March). Although very high, this is somewhat better than expected thanks to a stronger recovery in tax revenues in the second half of 2020. For this year, the economic recovery will help to bolster the public accounts, although total public spending is expected to remain at levels similar to 2020, so the deficit will remain significant.