Global recovery in 2021, but with uncertainties

Further outbreaks determine economic activity in early 2021

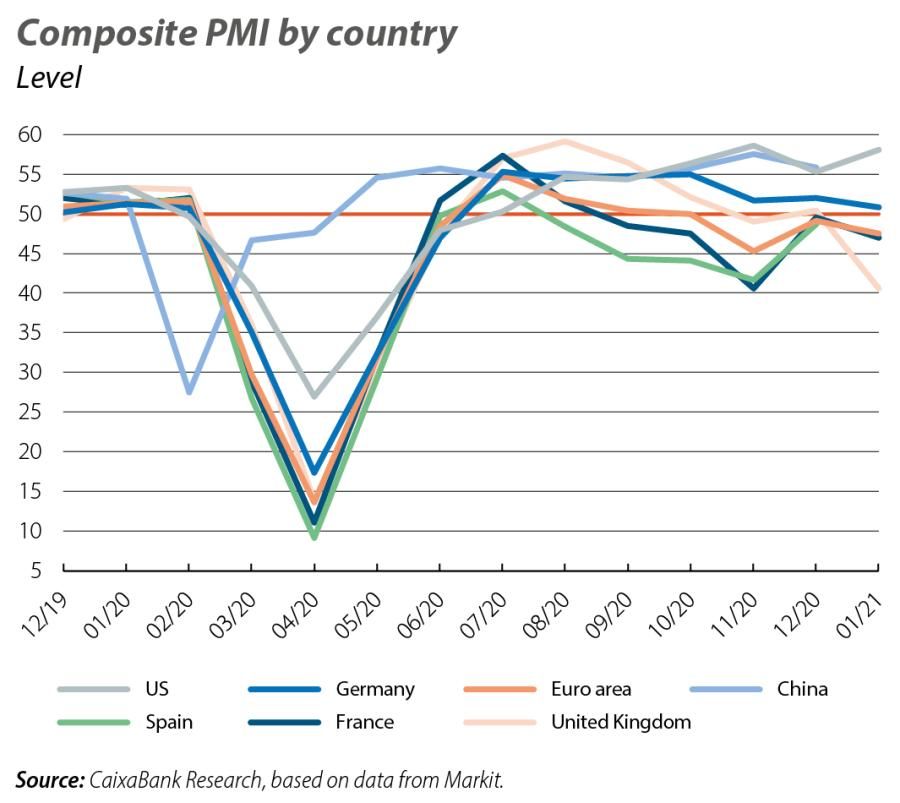

On the one hand, in European countries, where the outbreaks and mobility restrictions intensified towards the end of 2020 and remained in place in early 2021, the latest economic activity indicators show that the economy is still hampered by the pandemic. For instance, the euro area´s composite Purchasing Managers’ Index (PMI), which measures business sentiment, fell back to 47.8 points in January (49.1 in December) and remains below the 50-point threshold that separates expansionary from contractionary territory. This weakness is largely due to the decline in the services sector, which has been particularly affected by the aforementioned restrictions. In contrast, US economic activity continues to hold up better against the onslaught of the pandemic. This is because, despite the high incidence of COVID-19 in the country, many states have avoided imposing new restrictions on mobility. The exception was the important state of California, which in recent days has eased the strict limits on mobility that it had imposed at the end of last year.

Reasonably positive outlook for 2021 as a whole

In the medium term, the outlook for 2021 as a whole is reasonably positive: growth of 5.5% for the global economy, following an estimated contraction of 3.5% in 2020, according to CaixaBank Research’s latest forecasts. This is a very similar scenario to that presented by the IMF in its January Outlook update. In fact, the Fund has revised its forecast for the global economy slightly upwards, given the smaller-than-expected declines in economic activity in 2020 and the expectation of a stronger recovery in 2021 thanks to the vaccines. Moreover, while the IMF still sees downside risks, it considers them to be limited to early 2021, whilst in the medium term it notes that economic performance could be better than expected, precisely because of the roll-out of the vaccines. Although the scenario is dominated by the pandemic (with vaccines, treatments and new strains of the virus) and the economic measures needed to alleviate its effects on economic activity, we should not forget that geopolitical uncertainty will not disappear from the global landscape. In particular, tensions between China and the US will continue to be present with Biden in the White House (see the Focus «US: what will the new administration bring?» in the MR12/2020). In this regard, the new president has already signed an executive order that prioritises the purchase of American goods for contracts with the federal government. This is a step in line with the Buy American slogan proclaimed during his campaign, which is not dissimilar from his predecessor’s slogan America First. On the other hand, Janet Yellen, the new US Treasury secretary, criticised China’s «abusive» practices before the Senate Committee on Finance.

CHINA

China, the only major economy that will have grown in 2020: +2.3%

The country was the first to suffer the effects of COVID-19, but it has also been the first to recover pre-pandemic levels of economic activity. Aggressive and rapid containment measures, substantial fiscal and monetary support, and a strong recovery in the global trade in goods have facilitated the Asian giant’s rapid rebound. In particular, in the final tranche of the year GDP grew by 6.5% year-on-year. This was not only higher than expected but also the highest since the end of 2018. In quarter-on-quarter terms, the growth stood at +2.6%, leaving the annual count at 2.3% (see the Nota Breve at www.caixabankresearch.com). In this encouraging context, in December industrial production grew by 7.3% year-on-year, the fastest pace since March 2019; retail sales grew by 4.6%, slightly below the figure for November (5.0%), and exports continued to register strong gains (+18.1% year-on-year), supported by the recovery of sales to the US. Despite the good figures, it is important to mention that the country continues to have imbalances which it must address, such as its excessive reliance on investment versus consumption or its high levels of indebtedness (especially in the private sector). These elements have prompted the government to place greater emphasis on improving the quality of economic growth and, in particular, that of credit. This is evident from the rise in defaults observed in the corporate bond market in recent months, since this trend has been tolerated by the authorities as they resume the process of financial cleansing, now that the economy is set on the road to recovery.

UNITED STATES

US GDP fell by 3.5% in 2020, after registering some growth in the final leg of the year

This is a much bigger decline than that registered in the Great Recession of 2009 (−2.5%), showing the severe impact that the pandemic has had on US economic activity. Nevertheless, in the second half of 2020, GDP was already growing at positive rates following the collapse in Q2 2020. Specifically, in Q4 2020, GDP grew by 1.0% compared to the previous quarter (4.0% annualised). This is a significant rate of growth which added to the exceptional advance registered in Q3 (+7.5% quarter-on-quarter), following the collapse in Q2 (−9.0% quarter-on-quarter). Thus, in Q4, GDP was only −2.5% below its pre-pandemic levels (see the Nota Breve at www.caixabankresearch.com).

A substantial recovery is anticipated in 2021, favoured by economic policies

For Q1 2021, further outbreaks and new variants of the virus could dampen the recovery. However, the latest economic activity indicators, such as the PMI or the New York Fed’s weekly indicator, continue to show an economy that is holding up better than most advanced European ones. On the other hand, the economic shock has been less intense and the recovery stronger, largely thanks to a rapid and decisive economic policy response. Specifically, while the Fed maintains a highly dovish monetary policy (see the Financial Markets section), the fiscal packages approved during 2020 (the most recent in late December) are estimated to amount to some 4 trillion dollars (~20% of GDP), half of which would be in the form of direct spending. Furthermore, President Biden has already announced that he intends to approve a new package to the tune of 1.9 trillion dollars. Although this will be decided in Congress, the Democratic majority in both houses could favour an agreement that deviates little from the new president’s substantial proposal. In view of all this, we have revised our US GDP forecasts for 2021 as a whole up by +0.7 pps to 4.9%.

EUROPEAN UNION

Euro area GDP fell by a considerable 6.8% in 2020, following a further contraction in Q4

As in the case of the US, this is a bigger annual decline than in 2009 (−4.5%). However, unlike in the US, euro area GDP fell in the last quarter of the year (−0.7% quarter-on-quarter, −5.1% year-on-year) after a decisive rebound in Q3 (+12.4% quarter-on-quarter). That said, the decline was somewhat lower than expected, as a result of more targeted restrictions which had less impact on the manufacturing sector and, possibly, due to a certain adaptation to the pandemic on the part of firms and workers (see the Nota Breve at www.caixabankresearch.com). By country, the fall in economic activity for 2020 as a whole has been uneven: GDP fell by 5.3% in Germany, 8.3% in France, 11.0% in Spain (see the Spanish Economy section) and 8.9% in Italy. This disparity reflects the different structure of the economy in each country, as well as the different containment and economic support measures implemented by the various governments. In the closing stages of the year, the differences between countries were also significant: France and Italy registered contractions, with GDP falling by 1.3% and 2.0% quarter-on-quarter, respectively, while Germany and Spain registered slight growth, with GDP growing by 0.1% and 0.4%, respectively.

Recovery in 2021, despite a difficult start to the year

While the end of 2020 was somewhat better than expected, Q1 2021 could be somewhat worse. The stress on health systems and the rise in the number of COVID-19 cases in major European countries in recent weeks have led to an extension of the mobility restrictions and could put the euro area’s revival on hold in Q1 2021. This is shown by sentiment indicators such as the composite PMI, which stood at 47.8 points in January, suggesting a slight contraction in economic activity in the first month of the year. As in Q4, the weakness at the start of the year is concentrated in services (the sector’s PMI stood at 45.4 points), while the recovery of industry appears to continue (at 54.8 points, the manufacturing PMI remained in expansionary territory in January). For the year as a whole, however, we expect to see a substantial recovery (+4.3%), which will accelerate from Q2 supported by progress in the roll-out of the vaccines as well as economic policies, including both Next Generation EU and the maintenance of a highly dovish monetary policy by the ECB (see the Financial Markets section). That said, this recovery will probably still be insufficient for the region as a whole to recover its pre-pandemic levels in 2021.