Fears of recession shake the financial markets

The financial markets continued to operate in a scenario of high uncertainty and volatility. Three months after Russia launched its invasion of Ukraine, the conflict is no longer cited as the main risk factor among investors, having been overshadowed by concerns about the signs of weakening in the global economic recovery and, most importantly, about the urgency for the central banks to withdraw the monetary stimulus in the face of the persistent inflationary pressures. Fears of a hard landing fuelled increased demand for safe-haven assets and a flight of capital from risky assets. The turbulence in the markets is tightening in the financial conditions, becoming yet another headwind in what is already a difficult global macroeconomic scenario.

In this context, the international stock markets fell significantly for much of May, although this trend reversed in the closing days of the month. The decline was most pronounced in the US indices, where the S&P 500 amounted a 14% decline compared to the peak at the beginning of the year, equivalent to half of the losses suffered during the first wave of COVID-19 in the spring of 2020. In Europe, the trend has been more mixed, with cumulative declines from the peak of 12% in the German DAX and 4% in the Spanish IBEX. The high volatility was also reflected in the currency markets, with the dollar appreciating to 1.038 against the euro, although it subsequently yielded and closed the month at around 1.07. Sovereign debt yields, meanwhile, registered a sharp correction in the US (–9 bps to 2.84% for the 10-year bond), but rose in Germany (+18 bps to 1.1%), while the risk premia on the debt of the euro area periphery increased.

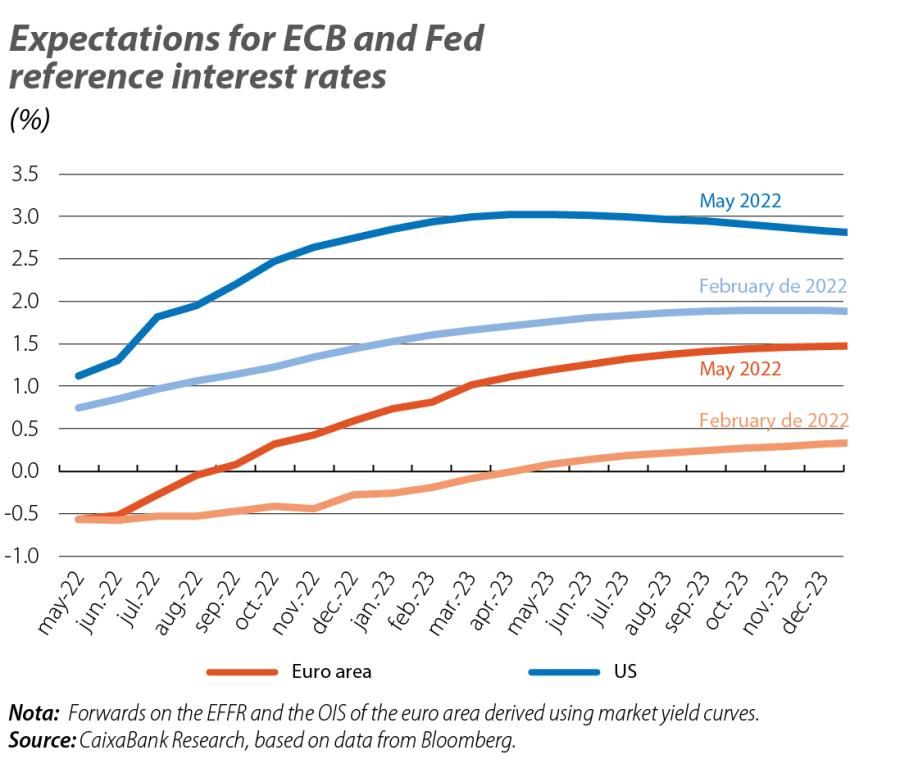

In the euro area, the intensification of inflationary pressures triggered a hardening of the ECB’s narrative with a view to removing the monetary expansion measures. Its members’ statements thus now assume that net asset purchases will cease this quarter, while also indicating that there is consensus to initiate the rate hike cycle in July. In a post on the central bank’s website, its president, Christine Lagarde, stated that she expects the period of negative rates to end as early as Q3, although she also emphasised that the normalisation process will be carried out gradually and flexibly. In contrast, the more hawkish members of the Governing Council have raised the possibility of more aggressive rate hikes in the short term, in line with the implicit rates reflected in the money markets (increases of 100 bps this year).

Meanwhile, at its much-anticipated May meeting, the US Federal Reserve raised interest rates by 50 bps, bringing them to the 0.75%-1.00% range, and announced that it intends to bring rates to more normal levels soon by implementing similar hikes at the next two meetings (June and July), according to its chair Jerome Powell. The Fed will also begin reducing the size of its balance sheet from June onwards, at a faster pace than in the previous cycle (see the Focus «On the reduction of the central banks’ balance sheets» in this same report for more details). According to Powell, the US economy is well positioned to withstand a more restrictive monetary policy without necessarily triggering a recession, although this scenario has been questioned among investors. In other countries, the Bank of England and the central banks in Australia and New Zealand agreed to raise their official rates at their May meetings. The exception remains the Bank of Japan, which has kept its accommodative policy intact, leaving the yen fluctuating at close to its lowest values of the last two decades.

The heightened uncertainty surrounding the war in Ukraine, the tightening of financial conditions in the West, the escalating global inflationary pressures and the new COVID outbreaks in some regions continued to undermine investor interest in emerging countries. Thus, according to the International Finance Institute, in April there was a further decline in net portfolio flows to these economies (–4 billion dollars), adding to the 7.8-billion-dollar decline of the previous month. There is also some rotation in favour of commodity-exporting regions. In response, some countries’ central banks approved further official rate hikes, particularly in Asia. The exceptions were the central banks of Russia and China (PBoC). The former announced a 300-bp cut in the benchmark rate, bringing it to 11%, while the latter agreed a reduction in the rate for five-year loans, which serves as a benchmark for mortgage lending. The collapse in China’s economic data and the accommodative tone of the PBoC were reflected in a further weakening of the yuan against the major currencies.

Although highly volatile, energy prices continued to climb during the course of the month, primarily driven by uncertainty surrounding the ongoing conflict in Ukraine and the tightening of the sanctions imposed on Russia – factors which more than offset investor doubts about the evolution of the global economy. In this context, the higher demand from Europe, in its quest to replace supplies from Russia, helped to narrow the gap in the benchmark energy prices between the US (Henry Hub for gas and WTI for oil) and Europe (Dutch TTF and Brent). On the other hand, food prices remained high, with cumulative year-to-date increases of 49% for wheat and of 30% for corn. In contrast, the lower demand from China was reflected in a reduction in industrial metal prices.