The economy enters a more mature phase of the cycle

The pace of growth tempers. After growing at above 3% for three consecutive years, the latest GDP data confirm that the Spanish economy continues to grow at a steady rate, albeit somewhat below that of the last few quarters. In Q2, GDP grew by 0.6% quarter-on-quarter (2.7% year-on-year), 1 decimal point lower than in the previous quarter. As such, the economy is now entering a more mature phase of the business cycle, in line with the scenario envisaged by CaixaBank Research. Although growth will remain high in this new phase, it will be more moderate, both because the tailwinds that have benefited the economy in recent years are subsiding and because the slower growth of Spain’s major trading partners will limit the scope for growth in exports. Furthermore, the low household savings rate (5.6% for the last four quarters as a whole) suggests that the ability of private consumption to spur growth in domestic demand will be more limited than in the last three years. As a result, here at CaixaBank Research we expect economic activity to grow by a solid 2.7% this year and by 2.3% in 2019.

Domestic demand remains the main driver of growth, although its composition is unexpected. Due to a change in the publication format used by the Spanish National Statistics Institute, the first estimate of GDP for Q2 also includes a breakdown by component. Of particular note is the 2.9 pp contribution to growth of domestic demand, although the contribution of private consumption was lower than expected, growing by just 0.2% quarter-on-quarter (in 2017, its average quarter-on-quarter growth was 0.6%). Nevertheless, the continued strength of the labour market and the continuity of a positive climate of confidence will continue to feed the buoyancy in private consumption over the coming quarters. In addition, the lower growth in private consumption was offset by a strong rebound in investment, which grew by 2.6% quarter-on-quarter (0.8% in Q1), almost entirely hoisted up by investment in capital goods (5.5% quarter-on-quarter, the highest growth rate since Q3 2013). External demand, meanwhile, subtracted 0.2 pps from GDP growth, with the quarter-on-quarter fall in exports exceeding that of imports (–1.0% and –0.3%, respectively). Over the coming quarters, external demand is expected to make a small net contribution due to the higher oil price and the lower growth rate of the euro area.

The labour market remains buoyant. In Q2, the increase in the number of people in employment (469,900 people) was much higher than expected by CaixaBank Research (350,000), with the highest quarterly increase ever recorded in the historical series of the Labour Force Survey. In addition, the positive outlook in the labour market has led to an increase in the active labour force (+163.900 people in Q2), bringing the activity rate up to 58.8% (+0.3 pps). Furthermore, the unemployment rate fell sharply, down to 15.3%, which represents a reduction of 1.9 pps in the last year. It should be noted that this decline in the unemployment rate is common in Q2 due to the start of the tourist season. This is reflected in the good performance of the services sector, which generated 371,400 jobs, even more than the number observed in Q2 2017 (272,400). Looking forwards to the next few quarters, the improvement in the labour market is expected to continue, albeit at a more moderate rate (in line with the tempering of the growth rate of the Spanish economy).

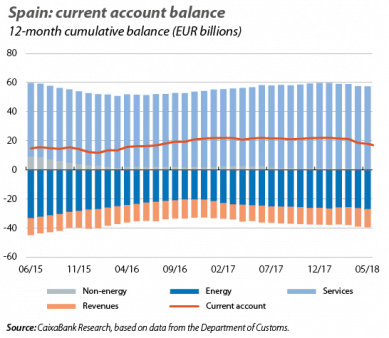

Trade in non-energy goods holds back the improvement of the foreign sector. In June, the current account surplus amounted to 16,246 million euros (+1.4% of GDP in the last 12 months in aggregate), considerably lower than the surplus of 21,962 million recorded in June 2017 (specifically, –0.5 pps of GDP). This poorer performance is mostly attributable to the deterioration of the balance in non-energy goods, in a context of slower growth in the euro area. In addition, the surplus of services fell by 1 decimal point in terms of GDP, driven particularly by the fall in exports of non-tourist services. All in all, the positive performance of the tourism sector will push the foreign sector to end the year with a current account surplus.

The public deficit continues to fall gradually. Based on the data up to May, the fiscal deficit stood at 1.3% of GDP, 3 decimal points below the figure for May 2017. Although the positive performance of the economy continues to propel revenues (6.2% growth in the year to date up to May), the higher growth of expenditure (4.1%), especially due to the increase in social benefits (3.0%) and gross capital formation (32.4%), has resulted in a more modest improvement in the public accounts.

New lending is growing at a good rate. In July, the European Commission published its surveillance report on the Spanish economy, drawn up following the financial assistance provided in 2014. The report highlights the resilience demonstrated by the financial sector during 2017 and early 2018 following the resolution of Banco Popular, the events in Catalonia and the spike in volatility in the markets caused by the formation of the new government in Italy. It also highlights the fact that the restructuring of the banking sector has encompassed the entire sector, not just the banks that received public aid. As a result, the sector has optimised its business model, cut costs and is better prepared to channel the flows of credit to the rest of the economy, as demonstrated by the latest data on new bank lending. In the year to date up to July, both credit for housing and consumer credit grew by more than 15%. In relation to non-financial companies, growth in lending to large firms, rose by 11.4%, well above the figure for 2017 (1.6%). Looking forwards to the coming quarters, we expect new bank lending to continue to rise, supported by the favourable financial conditions that are being sustained by the ECB’s accommodative monetary policy.