Adjustment of Portugal’s macroeconomic outlook

In this article we briefly review the main factors that have led us to slightly revise the macroeconomic outlook for 2024 and 2025.

The main change is derived from GDP growth in Q1 2024

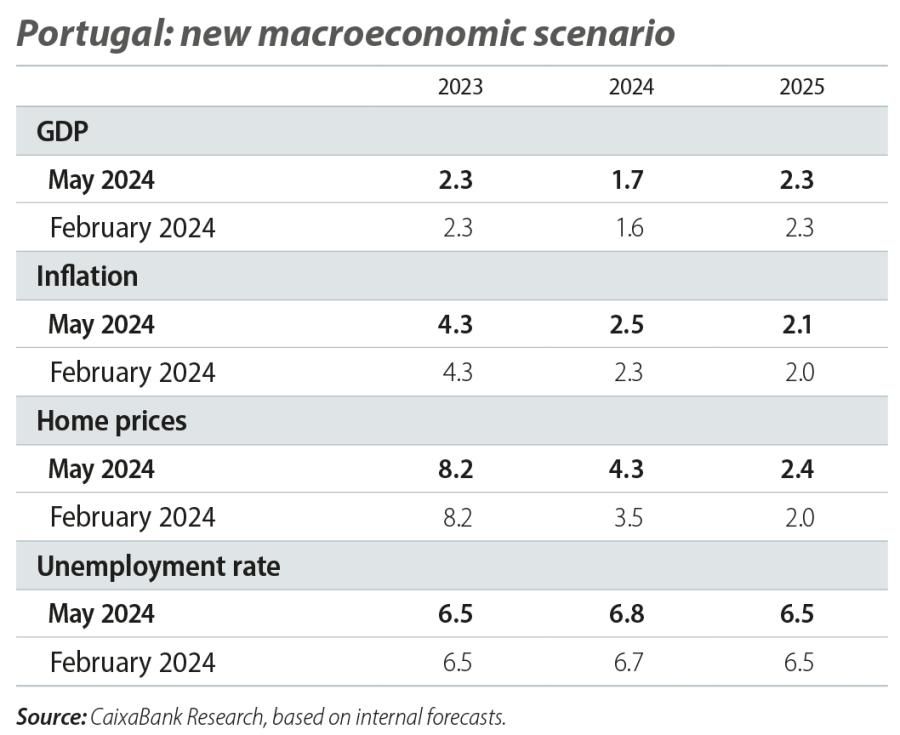

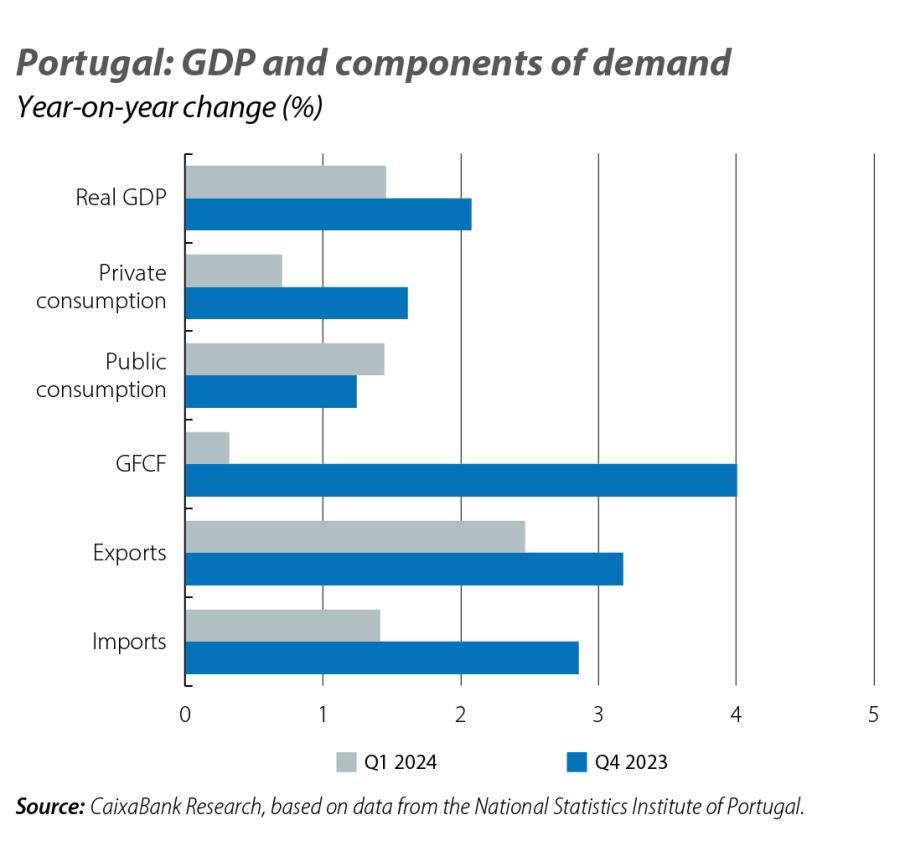

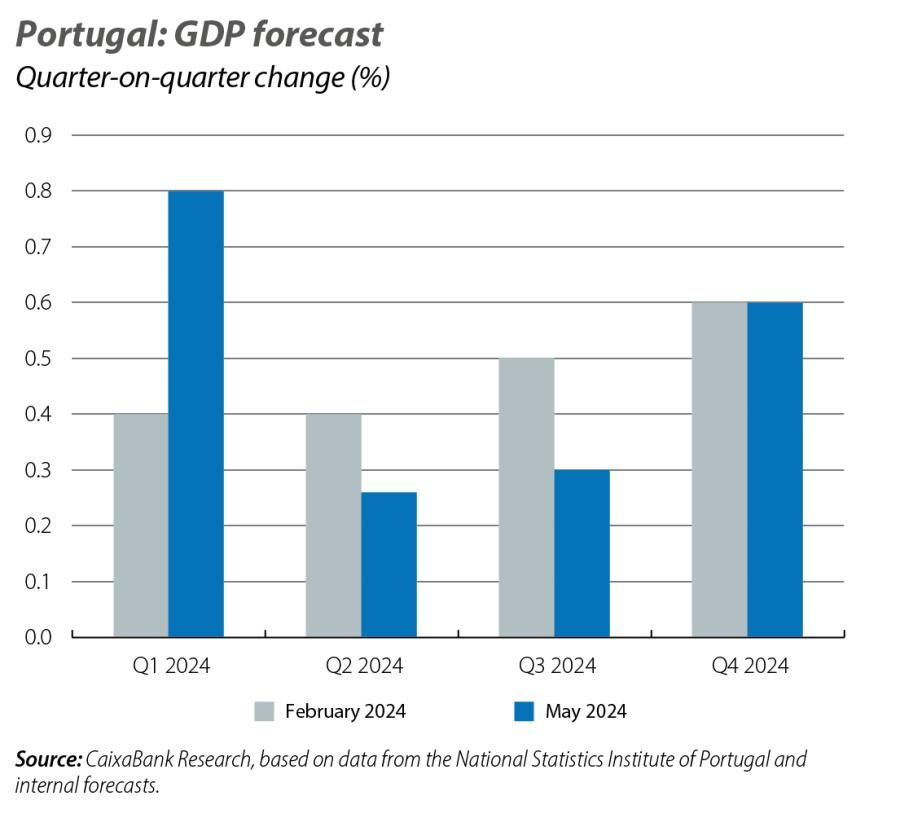

The main change is derived from GDP growth in Q1 2024 (0.8% quarter-on-quarter, according to the estimate by the National Statistics Institute, or INE), which was 40 pps higher than we forecast at the beginning of the year. According to the INE, the solid performance of Q1 is supported by the improvement in foreign demand, thanks to a 1.6% quarter-on-quarter increase in exports, which was accompanied by a 0.6% quarter-on-quarter contraction in imports.

The growth of domestic demand, meanwhile, slowed mainly due to the fall in investment, while private consumption remained buoyant and accelerated relative to Q4 2023. The fact that the Easter break fell mostly in March this year should have also favoured tourism activity in Q1.

The data for Q2 are still scarce, but reflect a good tone

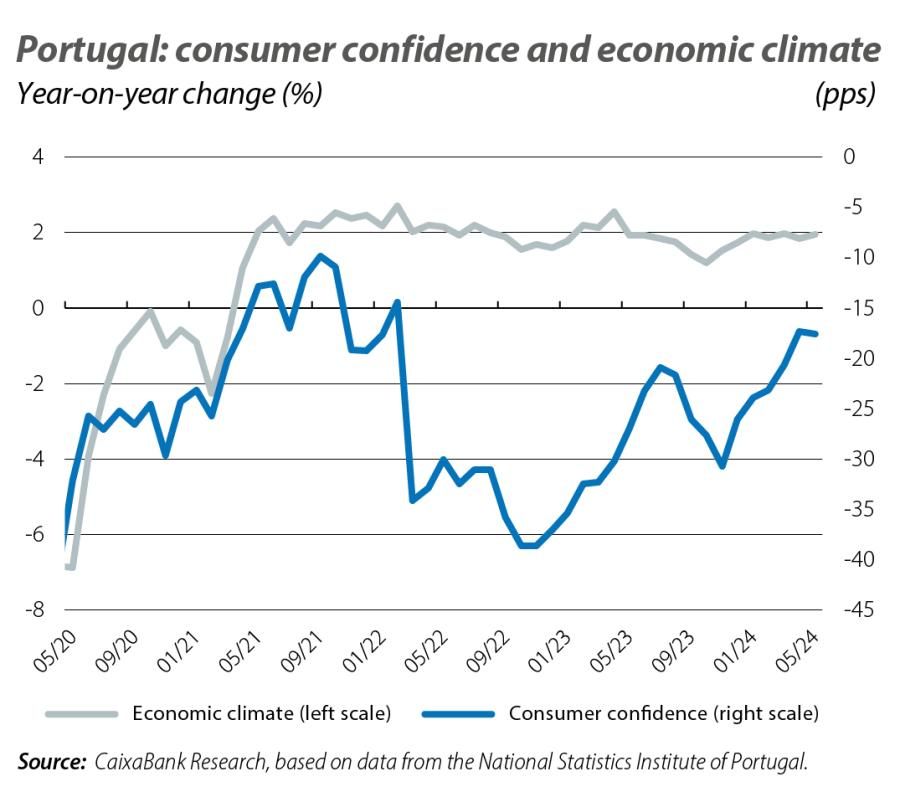

Retail sales increased by 1.8% year-on-year in April and, excluding fuels, exceeded the average year-on-year growth registered in Q1 by 2.8%; the economic climate indicator improved by 10 pps in May, standing at 1.9%. Conversely, consumer sentiment declined marginally in May to –17.6 points, down from –17.4 in April.

We expect economic activity to steadily pick up in the second half of the year as the disinflation process progresses and monetary policy is eased, and this will be reflected in financing costs and in economic agents’ expectations, as well as in the demand from our main trading partners.

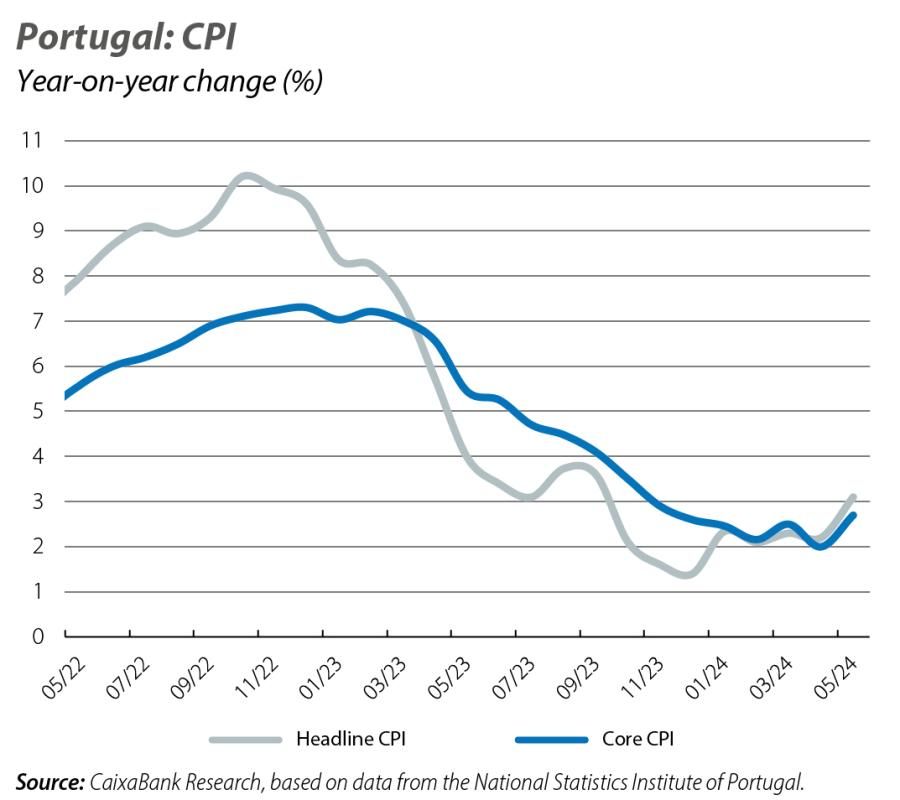

In terms of prices, we revise the forecast for average inflation in 2024 and 2025 slightly upwards

In terms of prices, we revise the forecast for average inflation in 2024 and 2025 slightly upwards, thus delaying when the 2% target will be reached until 2026. While we expect the inflationary pressures to gradually fade, we do not rule out the possibility of a temporary rebound, as we saw in March when the core inflation rate interrupted its 12-month consecutive decline. There are months where the upward base effects may be felt more strongly, such as May, as this was the month when the VAT reduction for certain foods was implemented in 2023.

Energy commodities showed a mixed behaviour: on the one hand, gas prices in international markets are well below the levels of 2022-2023 and remain fairly stable, due to reserves being above historical averages; on the other hand, Brent oil has recorded prices above the levels we were predicting at the beginning of the year. Although in recent months the relationship between supply and demand for crude oil does not appear to be under strain, the geopolitical tensions triggered by the war between Israel and Hamas have significant potential to cause oil price disruptions: Iran is OPEC’s fourth largest producer and more than 30% of all crude oil exported by sea passes through the Hormuz and Bab el-Mandeb Straits. The persistence of inflation in services is noteworthy, as they account for over 40% of the headline index and in the first four months of 2024 it stood above 4% year-on-year. In short, our slight upward revision of inflation reflects the revision – also upwards – of Brent oil prices, and while there remains considerable uncertainty, we estimate that the dominant trend will be one of gradual normalisation.

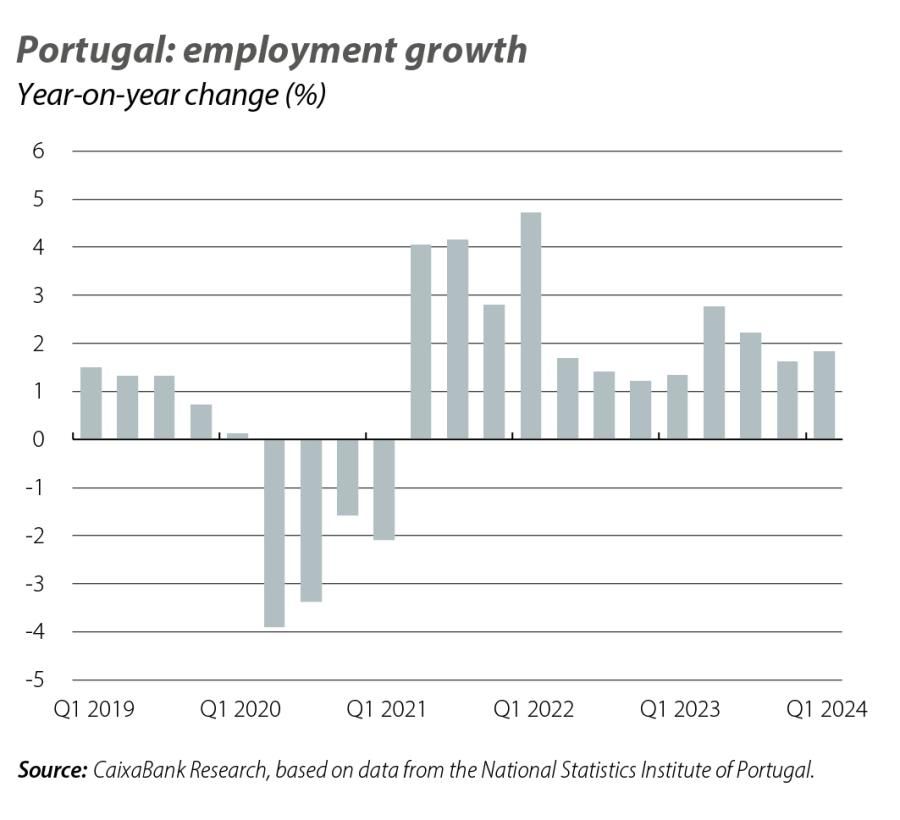

With regards to the labour market, the adjustment to the forecasts is slight, with an increase of just 10 pps in the unemployment rate in 2024 to 6.8%

This revision is due to the more significant growth of the labour force in Q1 compared to the initial forecast. The labour market continues to perform well, as reflected in the record number of people in employment at the end of March (over 5 million), as well as in the wage rises slightly above inflation since March 2023 and in the fact that the sector that created the most jobs in Q1 2024 (civil construction) is pro-cyclical and labour-intensive. However, the slowdown in the economy compared to the previous year, combined with positive migration balances and below-peak (although still high) job offers, will likely result in a lower capacity to absorb workers.

Finally, we revise upwards our forecast for the home price index for 2024 and 2025

In the previous estimate, we did not yet have data for the final quarter of 2023, which have proved to be higher than projected. This has resulted in a greater knock-on effect, which partly explains the upward revision for 2024 (from 3.5% to 4.3%). More relevant, however, are the data we now have for the beginning of this year: on average, prices rose by 0.7% per month in each of the first three months of the year, while the number of property sales grew in the quarter, both in quarter-on-quarter and year-on-year terms. On the other hand, in March, prices based on bank valuations published by the INE recorded the sharpest monthly increase since January 2023 (+1.28% to 1,580 euros per square metre). This pattern appears to reflect a market that remains highly resilient in a context of still limited supply and strong demand.