The sensitivity of inflation to the euro’s appreciation

In his latest appearance before the European Parliament, Mario Draghi commented that the current recovery is based on a increased activity which should push up inflation over the coming quarters. However, he noted that the recent appreciation of the euro, up by 11.5% in 2017 against the dollar and by 6.4% against the euro area’s main trading partners (see the first chart), could make it difficult to recech the inflation target. As we will see, this appreciation will affect inflation expectations for 2018, pushing them down slightly.

The main channel through which exchange rate fluctuations affect inflation is by changes in import prices. When the domestic currency appreciates, the prices of foreign products denominated in foreign currencies fall. Cheaper imports push down the price of both final and intermediate goods, and thereby inflation. This mechanism, known as the pass-through, has been examined and monitored by national economic authorities given its importance in forecasting domestic inflation. Several studies suggest that the pass-through is never one hundred percent. In other words, a 1% appreciation results in a less than 1% reduction in inflation.1 Moreover, the effect on inflation is not immediate. In fact, the peak does not occur until four to five quarters after appreciation.

Different studies show that exchange rate pass-through is decreasing in the euro area for various reasons, including the grouth of euro denominated import invoices. In 2004, euro area imports from countries outside the monetary union but denominated in euros accounted for 48.8% of the total compared with 51.7% in 2013. In turn, the percentage of euro-denominated imports of services grew from 53.8% to 61.5% over the same period.2 Another explanation for a smaller pass-through in the euro area is the increase in exchange rate hedges using financial instruments that temporarily insulate importers from exchange rate fluctuations.3 Both factors mean that firms insure their margins against movements in the euro’s value without having to adjust their prices, thereby reducing the pass-through in the euro area as a whole.

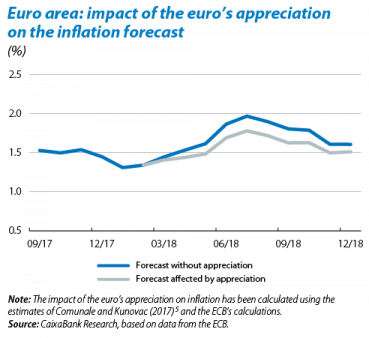

The evidence available to date suggests that exchange rate pass through varies depending on the reason behind the exchange rate fluctuation.4 According to ECB estimates, the euro’s appreciation in 2017 is mainly due to a larger increase in domestic demand and to the change in expected monetary policies. Taking these factors into account, and based on the historical relationship between the exchange rate and inflation, we can conclude that, in 2018, inflation will be approximately 0.15 pp lower than the expected rate before the euro appreciated. This difference should therefore not alarm the authorities nor conjure up the spectre of deflation, but it does take the euro area further away from its inflation target.

1. Among other articles, see Krugman, P. (1986), «Pricing to market when the exchange rate changes», NBER Working Paper Series.

2. See BCE (2014), «The international role of the euro».

3. See BCE (2016), «Exchange rate pass-through into euro area inflation».

4. See Forbes, K. et al. (2016), «The Shocks Matter: Improving our Estimates of Exchange Rate Pass-Through», External MPC Unit Discussion, Paper No. 43.

5. See Comunale, M. and Kunovac, D. (2017), «Exchange rate pass-through in the euro area», ECB Working Paper.