Spain’s energy trade deficit in figures

The Spanish economy’s trade deficit in energy products has increased considerably and it is unlikely to revert in 2023. In this article we analyse the figures behind the Spanish economy’s energy deficit in 2022 in order to understand what is driving it and what we can expect for 2023.

The deterioration of the energy deficit can be largely explained by the rise in natural gas prices. According to the foreign trade data recorded by the Customs Department up to November, the price of gas supplies in Spain – i.e. the average price paid for natural gas imports – stood at €57.3/MWh, 2.7 times higher than in the same period in 2021. Moreover, in that period, the volume of natural gas purchases grew by 17.7% compared to 2021, such that nominal imports increased by 212% compared to the same period in 2021. Despite the increase in nominal exports of 93%, the natural gas trade deficit reached 22.2 billion euros in the first 11 months of the year, the peak in the historical series for a January-November period (–6.7 billion in 2021).

Another reason for the deterioration in the energy balance has been oil, which in the first 11 months of the year amassed a deficit of 26.8 billion euros. This is due to the supply price of oil imports standing 68% above that of the same period in 2021, in line with the Brent barrel price in euros.1 Furthermore, the recovery in mobility has led to a further rebound in the volume of oil imports, with growth of 5.6% versus the same period in 2021, although they were still somewhat below 2019 levels.

As for the other two components of the energy balance, coal and electricity, the increase in the amount paid for coal imports (the price has increased by a factor of 2.2) has been offset by the rise in electricity exports, which are largely produced using imported gas (the value of exports has more than tripled).2

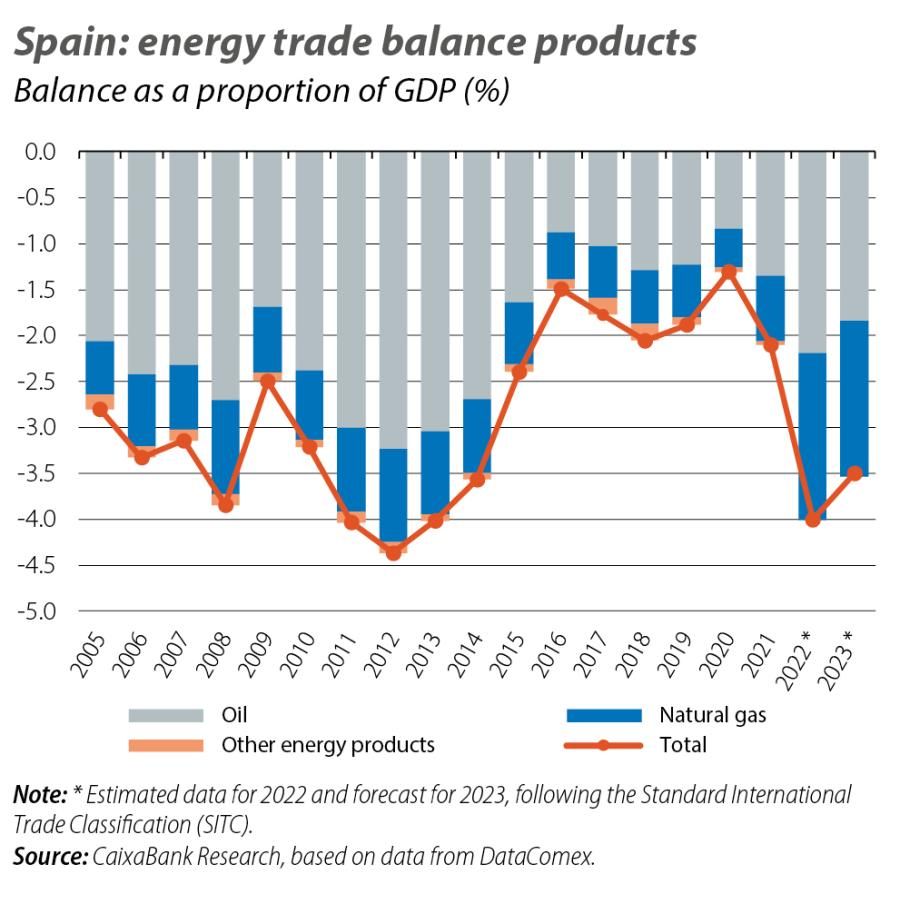

With all this, we estimate that the energy deficit closed 2022 at 52 billion euros, or 4% of GDP, 1.9 pps higher than in 2021. As can be seen in the first chart, from a historical perspective this is not a particularly significant deficit, as it is in line with the levels observed between 2005 and 2007, which is surprising given the energy crisis we are going through. This is because Spain’s energy balance is much more sensitive to the price of oil, due to the greater relative weight of these imports in the total energy purchases.3 Thus, despite the sharp rally in gas prices, we estimate that the gas trade deficit was 1.8% of GDP (1.1 pps more than in 2021), placing it below that of oil, which reached 2.2% (0.7 pps more).

- 1. Between January and October, the average Brent price was €96/barrel, 65% higher than in the same period in 2021.

- 2. Coal and electricity accounted for 2.6% and 8%, respectively, of the total value of imports and exports of energy products in 2022.

- 3. In 2022, net imports of natural gas accounted for 24% of the total value of net energy imports in Spain, while oil accounted for 67%.

For 2023, we expect the energy deficit to moderate slightly to 3.5% of GDP, mainly due to the correction in oil prices. Thus, we expect that in 2023 the oil trade deficit will go from –2.2% of GDP to –1.8%.

On the natural gas side, we are unlikely to observe an increase in the energy deficit in 2023, given the combination of the recent decline in prices quoted in the TTF market, milder temperatures than usual in the last few weeks (which means less consumption of the accumulated reserves) and the approval by the European Commission of the TTF price cap at €180/MWh. Indeed, as of the end of January the futures markets were reflecting expectations of a moderation in the average price of the TTF in 2023 to well below €100/MWh, whereas in December they were pointing to prices of around €140/MWh. On the other hand, it is likely that as gas supply contracts are renewed in 2023 at current prices, the average cost may continue to rise. In any case, we expect real gas import prices to remain high. With this, we estimate that the gas trade deficit will stand at 1.7% of GDP, just 0.1 pp less than in 2022.

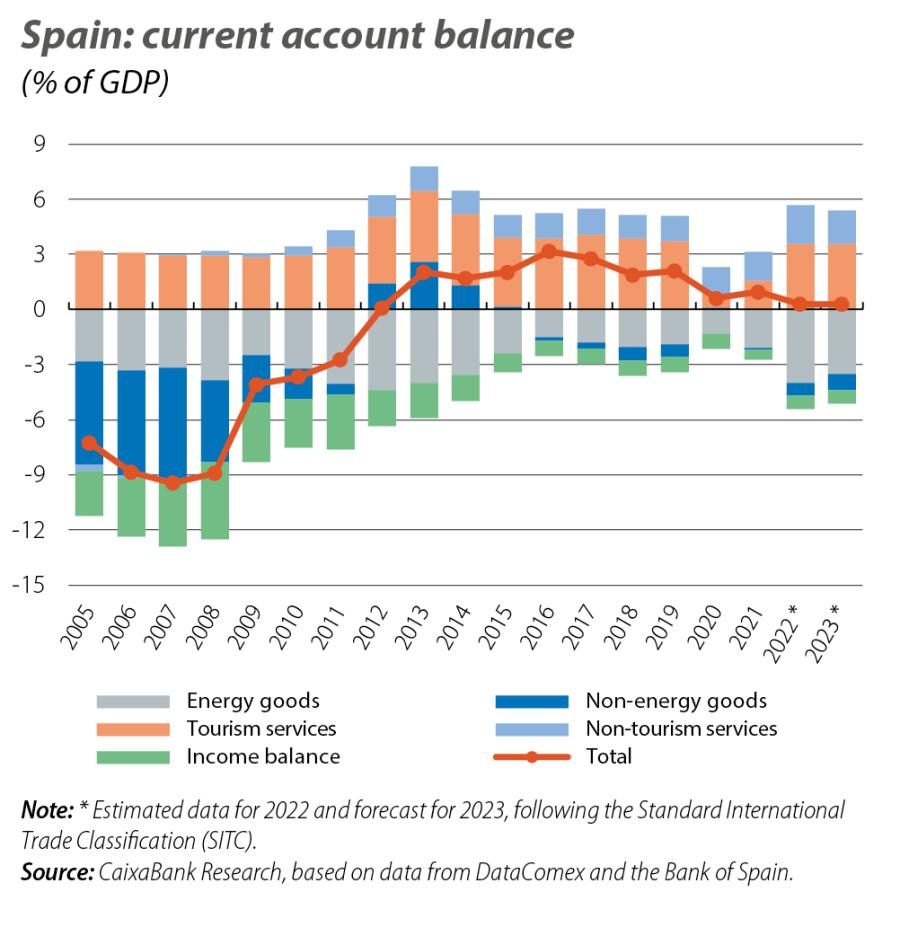

The worsening of the energy balance is having – and will continue to have – significant implications for the Spanish economy’s current account balance. Despite this, there are two factors that offset the high energy deficit: (i) the improvement in the travel trade balance, which we estimate ended 2022 with a surplus of 3.6% of GDP and which we expect to maintain its resilience throughout 2023 (in 2019 it reached a surplus of 3.7%); and (ii) the good performance of the non-tourism services balance of exports, which we estimate reached a surplus of 2.1% of GDP in 2022, the largest in the historical series. Thus, as shown in the second chart, we estimate that the current account balance reached a surplus of 0.3% in 2022 of GDP. For 2023, we expect the Spanish economy to achieve a similar surplus, which is a significant milestone for an economy so dependent on energy imports.

- 1. Between January and October, the average Brent price was €96/barrel, 65% higher than in the same period in 2021.

- 2. Coal and electricity accounted for 2.6% and 8%, respectively, of the total value of imports and exports of energy products in 2022.

- 3. In 2022, net imports of natural gas accounted for 24% of the total value of net energy imports in Spain, while oil accounted for 67%.