Energy: with 2022 behind us, will 2023 be as turbulent?

We set out the revision of our forecast scenario for the price of oil and the price of European natural gas for the coming quarters.

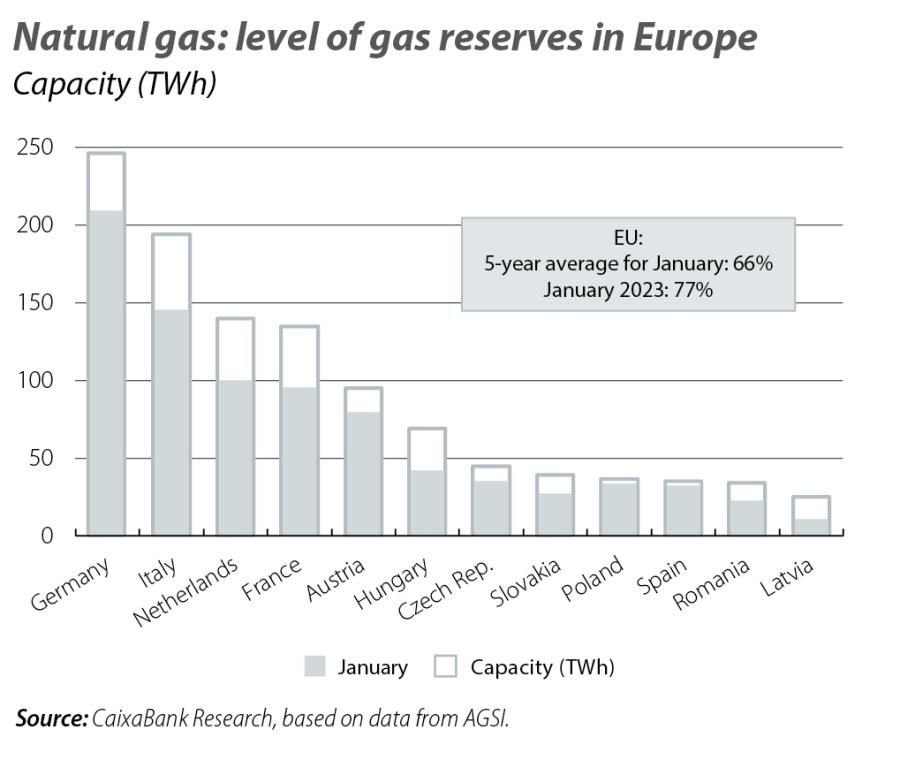

In 2022, energy commodity prices fluctuated significantly. The war between Russia and Ukraine – key players in the supply of these commodities – triggered a sharp rise in crude oil and natural gas prices, especially in Europe. However, in recent months there has been a significant moderation in energy prices compared to the peaks observed last August. There are several factors that have contributed to this improvement. On the one hand, the high level of gas reserves reached in Europe, together with the effort of governments, industries and households to reduce consumption, as well as a milder winter than usual, have helped European gas prices (the Dutch TTF) to fall by more than 80% since the summer. On the other hand, the oil price has stabilised in the face of a moderate growth outlook in China.

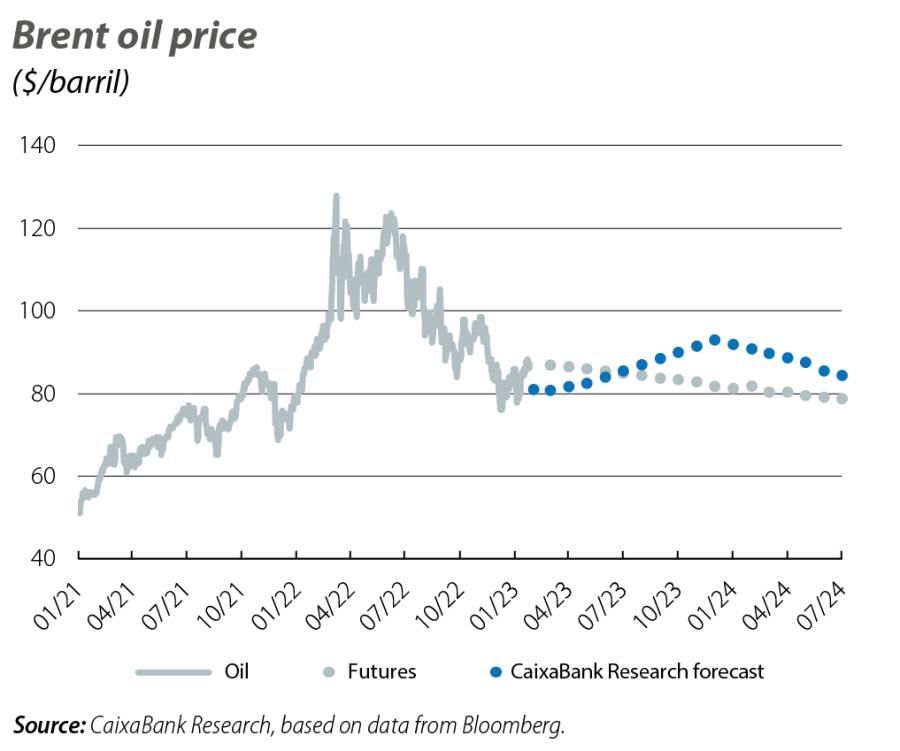

With all this, both the futures prices and the forecasts of most analysts in the sector reflect expectations that energy prices in the next 12 months are likely to be more favourable for economic growth. With this in mind, and together with the relative improvement in investor sentiment regarding these commodities, we have revised our forecasts for European oil and gas prices for the coming quarters.

The moderation in industrial activity worldwide and a milder than usual winter in Europe contributed to a decline of one million barrels a day (b/d) in the demand for crude oil in Q4 2022.1 During this period, and despite the reduction in supply from OPEC and its allies,2 there was a surplus in crude oil stocks of around 80,000 b/d, which helped to drive down the Brent barrel price at the end of 2022 to its lowest level in 12 months (76 dollars).

- 1. According to data from the International Energy Agency (IEA), in Q4 2022 the demand for crude oil fell by 910,000 b/d in year-on-year terms in OECD countries and by 130,000 b/d in China.

- 2. OPEC and its allies agreed to cut the net supply by 2 million b/d from the target production of 33 million b/d, beginning in November 2022.

For 2023, in a context in which the global economy is expected to expand, we believe that the global demand for oil will recover, with the rebound in the second half of the year being particularly pronounced. China’s economic reopening, despite uncertainty over how fast it will occur and what shape it will take, will play a key role in that increase. The IEA and OPEC agree that global oil demand will reach an all-time high in 2023 (101.7 million b/d), 2% higher than the previous year, and that around half of this increase will be due to China’s reopening. While supply and demand are likely to remain balanced during the first two quarters of the year, the anticipated buoyancy of consumption during the second half of the year could push prices upwards if the supply does not react sufficiently. OPEC’s limited flexibility to agree on production increases and the reduction in oil exports from Russia3 (the third biggest producer in the world behind the US and Saudi Arabia) are likely to be the main obstacles in this regard. In addition to these factors, the gradual recovery in the economic scenario ought to be accompanied by a moderation of the strength of the US dollar and a greater risk appetite among investors, both of which tend to add upward pressure on prices.

On the basis of these aspects, we estimate that the Brent oil price could rise over the course of the year, potentially exceeding 90 dollars by December (with a 2023 average of 86 dollars).

- 3. The main international organizations stress that, despite the high degree of uncertainty regarding the outlook, with the EU embargo on Russian oil exports coming into force and the 60-dollar price cap imposed on the Urals barrel by the G7 on 5 December, Russian oil exports to the rest of the world could be reduced by 20%.

Last summer, the cut-off of Russian gas supplies to Europe via Nord Stream 1 caused the price of the Dutch TTF (the main benchmark in Europe) to surge to record levels (339 euros/MWh), as well as setting off alarm bells about the risk of a winter marked by blackouts and energy restrictions across the continent.

Fortunately, the worst omens have not materialised and prices have dropped by 80% since the August peak. Among the main factors that have favoured this sharp reduction we find, on the one hand, the increase in imports of liquefied natural gas (LNG), which facilitated the rapid growth of natural gas reserves in much of Europe, reaching a peak of 95% at the beginning of November. In addition, the demand for European gas (for both industrial and household use) fell by 12% in December compared to the average of the last five years as a result of the optimisation of energy use, the commissioning of renewable and nuclear energy sources and the milder weather.

All this means that the first few weeks of 2023 are proving clearly more favourable than expected and that the most extreme scenarios have been diluted. However, despite the improved confidence among investors and European governments, 2023 will still be a demanding year. The challenge of replenishing reserves ahead of next winter with the reduced contribution from Russia4 will be key in determining European gas prices. The lower imports from Russia will no doubt have to be offset by more purchases from the US, Qatar, Nigeria or Algeria (Norway does not expect to materially increase its exports). In the second half of the year, China is also expected to increase its demand for liquefied natural gas, which will push up prices. However, the containment of European demand, the increase in the regasification capacity in some northern European countries5 and the progress in reducing natural gas in the energy mix will continue to have a cushioning effect on prices. Similarly, experts in the sector point out that if this winter ends with gas reserves at above 50% of capacity, then the supply outlook for the winter of 2023 will be relatively secure.

- 4. In 2022, European imports of natural gas from Russia, through the four main gas pipelines (Turkstream, Ukraine, NordStream and Yamal Europe) amounted to 43.7 billion cubic meters. In 2023, only the first two are expected to be operational, so imports could halve.

- 5. JP Morgan estimates that between 2023 and the beginning of 2024, the countries of north-western Europe will be able to increase their regasification capacity by some 37 billion cubic metres a year.

Given these considerations, we have significantly revised down our gas price forecasts, but we maintain a more conservative forecast (average price in 2023 of 113 euros/MWh for the Dutch TTF) than that anticipated by the markets at this early stage of the year. In addition to the challenges already mentioned, it should be noted that factors such as a quicker than expected recovery in economic activity in China or an increase in the restrictions on the flows of energy supplies from Russia, besides introducing new doses of volatility, could fuel upward pressure on the already stressed markets.

- 1. According to data from the International Energy Agency (IEA), in Q4 2022 the demand for crude oil fell by 910,000 b/d in year-on-year terms in OECD countries and by 130,000 b/d in China.

- 2. OPEC and its allies agreed to cut the net supply by 2 million b/d from the target production of 33 million b/d, beginning in November 2022.

- 3. The main international organizations stress that, despite the high degree of uncertainty regarding the outlook, with the EU embargo on Russian oil exports coming into force and the 60-dollar price cap imposed on the Urals barrel by the G7 on 5 December, Russian oil exports to the rest of the world could be reduced by 20%.

- 4. In 2022, European imports of natural gas from Russia, through the four main gas pipelines (Turkstream, Ukraine, NordStream and Yamal Europe) amounted to 43.7 billion cubic meters. In 2023, only the first two are expected to be operational, so imports could halve.

- 5. JP Morgan estimates that between 2023 and the beginning of 2024, the countries of north-western Europe will be able to increase their regasification capacity by some 37 billion cubic metres a year.