CaixaBank Sectoral Observatory: a look at the evolution of the Spanish economy from the perspective of its sectors

In this Focus we present the main conclusions of the Sectoral Observatory, a new publication by CaixaBank Research in which we offer a clear and detailed analysis of the evolution of the Spanish economy from the point of view of its sectors.

In this Focus we present the main conclusions of the Sector Observatory, a new publication by CaixaBank Research in which we offer a clear and detailed analysis of the evolution of the Spanish economy from the point of view of its sectors. To this end, we have developed a new tool, the CaixaBank Research Sector Indicator, which allows us to track the evolution of 24 sectors in the spheres of economic activity, the foreign sector and the labour market. This indicator allows us to visualise the health of the various sectors in Spain and where they lie in the cycle, making it easier to assess their future outlook at the individual level.1

- 1For further details of the methodology used to build this indicator, see the methodology box in the Sector Observatory 2024 (https://www.caixabankresearch.com/en/analisis-sectorial/observatorio-sectorial/indicador-sectorial-caixabank-research).

From the dispersion of economic activity followingthe pandemic...

Thanks to the new indicator, we observe that the major shocks the Spanish economy endured between 2020 and 2023 have had a widely varying impact on the different sectors, which increased the degree of dispersion between them in the pattern of economic activity:

- The COVID-19 pandemic in 2020 caused a sharp and widespread fall in economic activity, especially in the sectors most dependent on social interaction: leisure and entertainment, catering and accommodation. Subsequently, the rapid and intense recovery generated significant rebounds in activity.

- The bottlenecks in global value chains that followed beginning in 2021 dealt a blow to the manufacturing industry, especially the automotive sector.

- The war in Ukraine and the energy crisis in 2022 drove up production costs, which had a more severe impact on the most energy-intensive branches of industry: the agrifood sector (primary and processing industries), the extractive industry, the construction auxiliary industry, textile and footwear, paper and refining were the branches that were hardest hit.

- Finally, the increase in interest rates since mid-2022 harmed the sectors that are most dependent on external financing, such as real estate and some branches of industry.

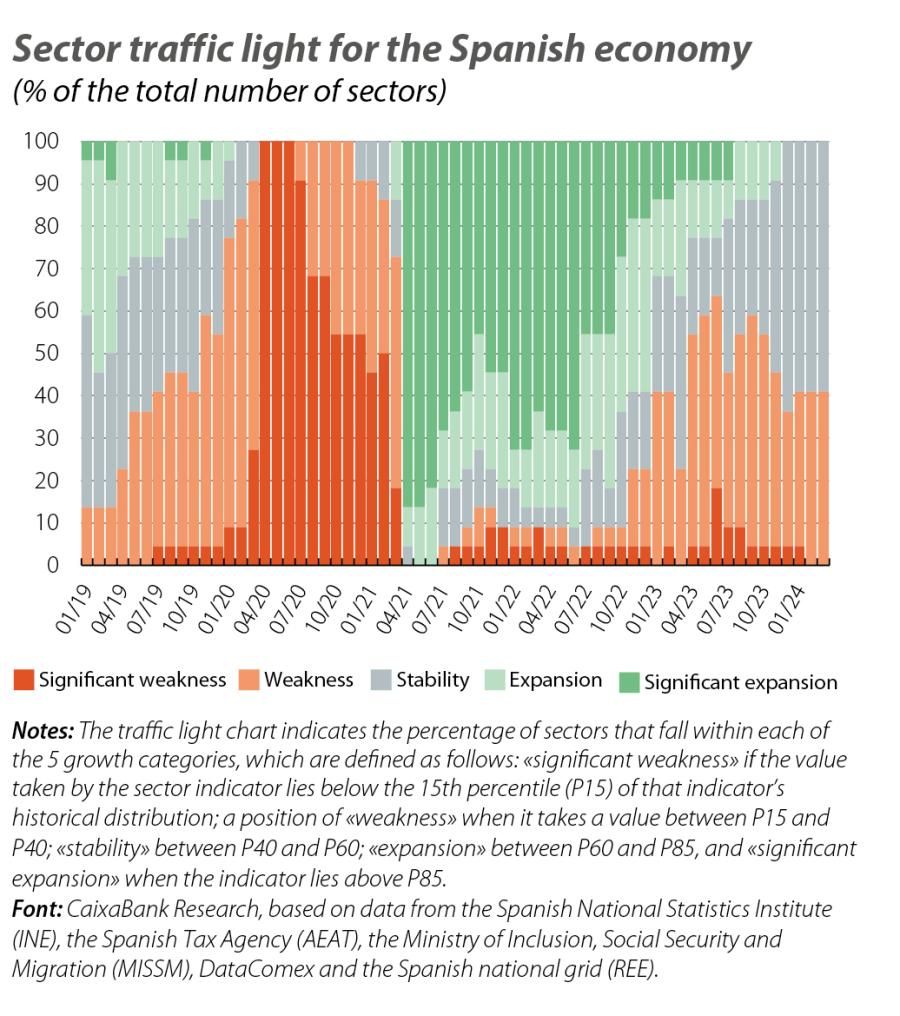

...to a gradual homogenisation of the performance among the sectors

As these shocks have been gradually absorbed, the performance of the various sectors is becoming increasingly homogeneous. Our sector traffic light chart shows that, in the first few months of 2024, around 60% of the sectors have maintained stable growth.2 Furthermore, our analysis of the indicators in the different spheres (economic activity, the labour market and the external sector) allows us to conclude that the strength of the labour market is the primary factor behind the resilience shown by all sectors across the board. On the other hand, it also reveals that the support provided by the foreign sector steadily faded from mid-2023 onwards and there are few signs of improvement in the latest data.

- 2The sector traffic light is a chart in which the various economic sectors are classified into five categories according to their rate of growth. In particular, a sector is considered to be in a position of significant weakness if the value taken by the sector indicator lies below the 15th percentile (P15) of that indicator’s historical distribution; a position of weakness when it takes a value between P15 and P40; stability between P40 and P60; expansion between P60 and P85, and significant expansion when the indicator lies above P85.

Where in the cycle does each sector lie?

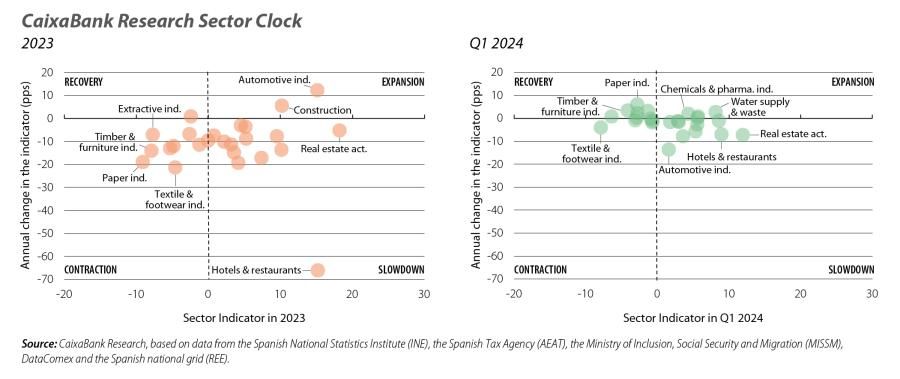

Taking a closer look at the various economic sectors, the CaixaBank Research Sector Clock allows us to visualise where in the cycle each sector lies at any given time. Specifically, the Sector Clock shows the indicator’s level on the horizontal axis and its change in the last year on the vertical axis. In this way, the resulting quadrants offer a picture of the sector’s current position and its recent trend: expansion (indicator in positive territory and with growth in the last year); slowdown (positive indicator, but with a decrease in the last year); contraction (negative indicator and in decline in the last year); and recovery (negative indicator, but growing in the last year). Comparing the Clock for 2023 with that of the opening months of 2024, we can see where the sectors currently lie in the cycle, as well as their recent trend:

- In the opening months of 2024, the sectors are grouped near the centre of the clock, which indicates less dispersion between them.

- The chemicals and pharmaceutical industry, water supply, retail, and professional and administrative activities show an improvement and have moved into the expansion quadrant.

- Many industries have also improved, having moved into the recovery quadrant after several years weighed down by the rise in costs (the timber, paper, extractive, refining and construction auxiliary industries).

- Real estate activities, transport equipment manufacturing and the hotels and restaurants sector have moved into the slowdown quadrant, although they remain among the best performing sectors.

- The agrifood sector and the textile and footwear industry remain in the contraction quadrant and are joined by wholesale trade.

Outlook for the Spanish economy and its sectors: what we expect in 2024 and 2025

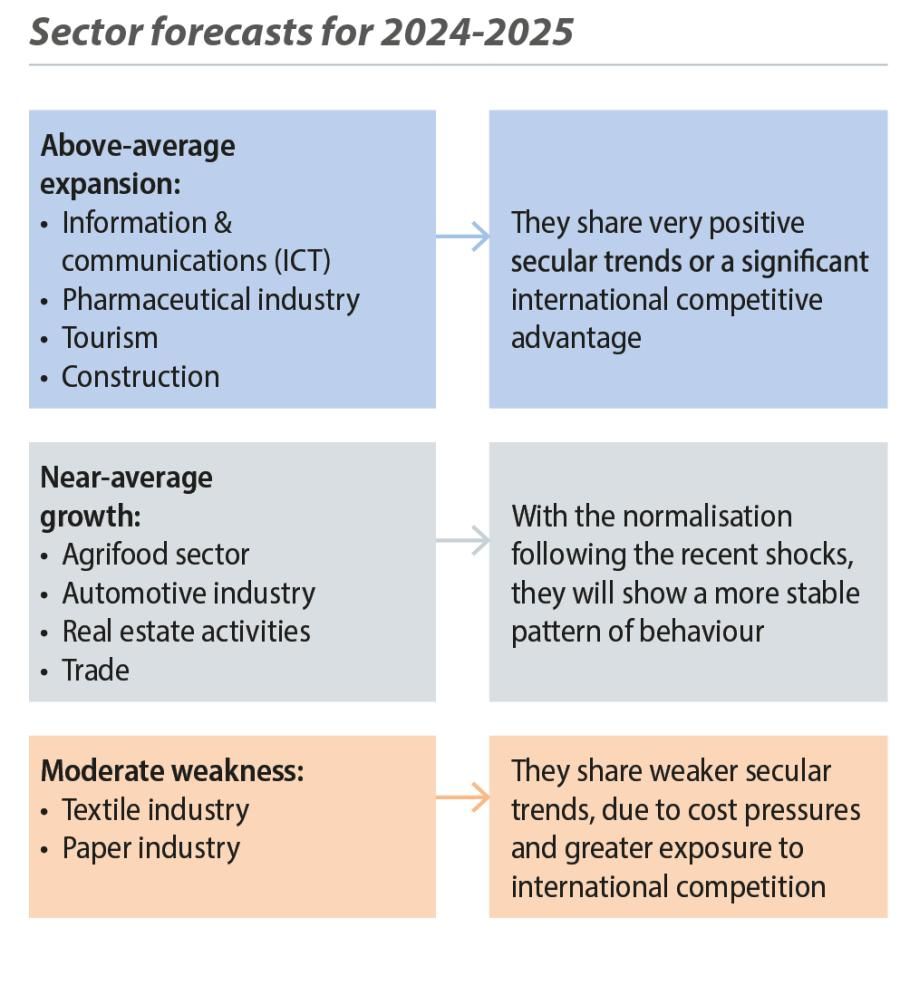

The outlook for the Spanish economy for 2024-2025 is positive, although a slight moderation is anticipated in GDP growth. Specifically, it is expected to fall from 2.5% in 2023 to 2.4% in 2024, before consolidating at a rate of 2.3% in 2025, according to CaixaBank Research’s latest forecasts. In this scenario, we expect that the dispersion of growth rates between sectors will continue to gradually reduce, as the impact of the rise in production costs and the interest rate hikes is gradually diluted. In fact, we do not expect GVA to contract in any of the sectors analysed, and the different growth rates will be largely determined by the medium and long-term trends.

Some of the sectors in which we expect to see the highest growth rates in 2024-2025 include those linked to the digital transition (such as information and communication technologies, and professional services) and sectors in which Spain is highly competitive (such as the pharmaceutical or tourism sectors). At the other extreme, the textile and paper industries are the sectors we expect to show more moderate growth.