Winds of change in the international economy

The tailwinds generated by the latest inflation data and strong labour markets coexist with a natural loss of cyclical momentum and, in particular, with an environment marked by high geopolitical risks. This combination of competing forces will determine the pace of growth over the coming quarters.

Temporary blip or a change of phase?

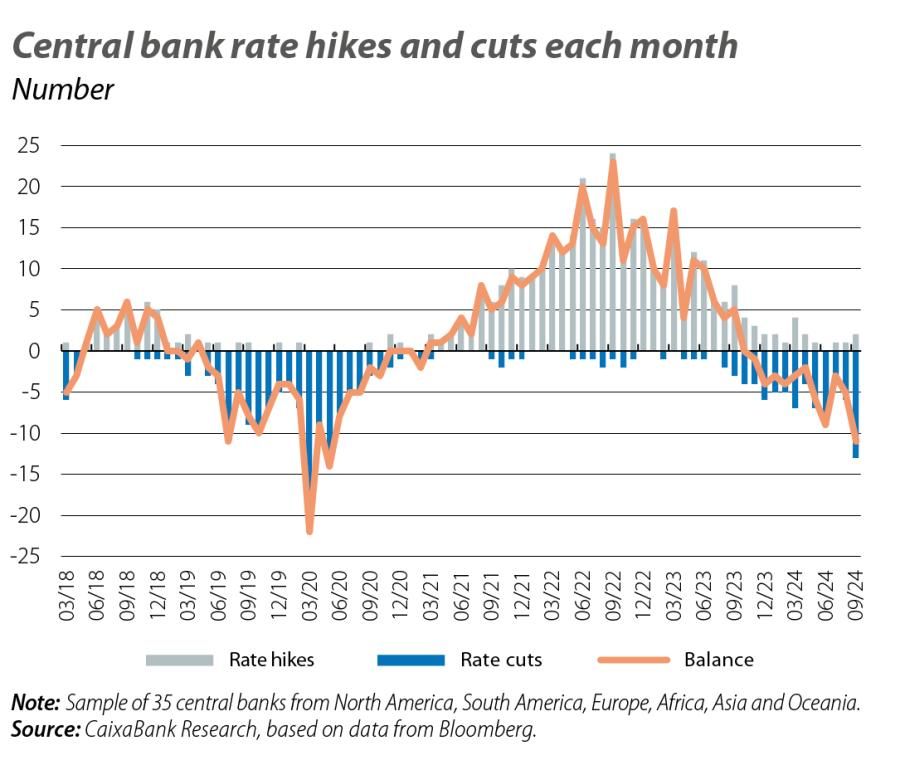

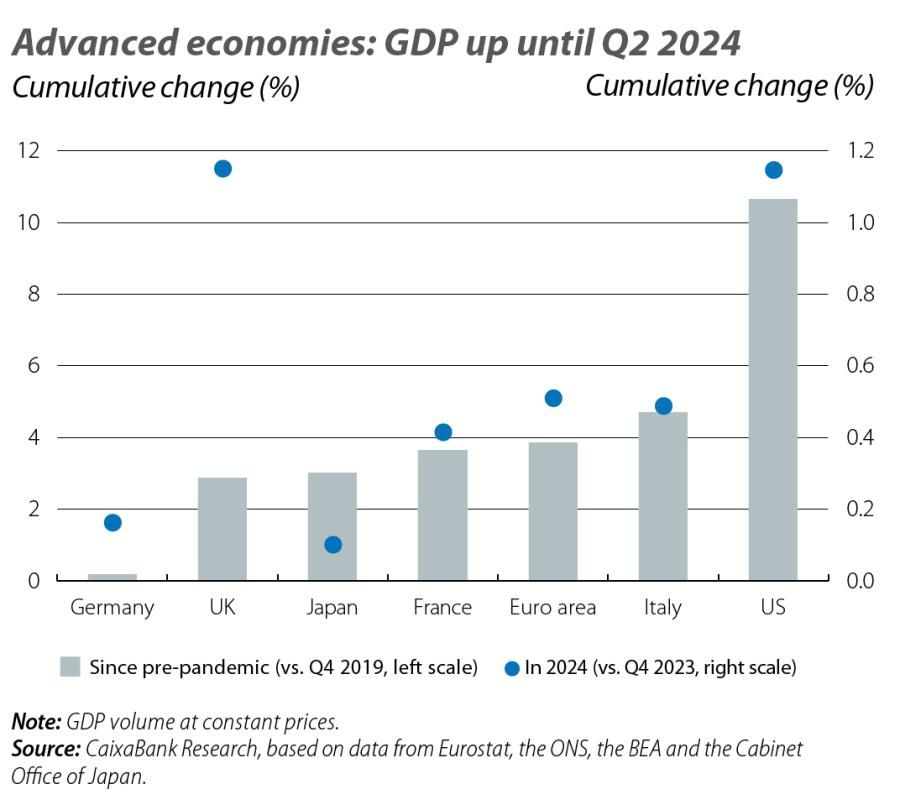

The world economy ended the first half of the year with global GDP growth of slightly above 3%. This is a similar rate to those recorded recently and was achieved in a context of restrictive monetary conditions (aimed at combating inflation). At the same time, the data confirm a disparate behaviour among the major international economies, with the US enjoying strong growth while that of the euro area remains sluggish and China continues grappling with its difficulties. In autumn, these dynamics continue, but with new nuances. The composite PMI for the world economy stood at 52.0 points in September, suggesting a slight slowdown in global growth (Q3 average of 52.4 points vs. Q2 average of 53.0). In parallel, the latest inflation data have been favourable and give monetary authorities, such as those of the US and the euro area, greater confidence when it comes to cutting interest rates in a sustained way. However, the boost from these tailwinds and the strong labour markets coexist with a natural loss of cyclical momentum and, in particular, with an environment marked by high geopolitical risks - a combination of competing forces that combination of competing forces that will determine the pace of growth over the coming quarters.

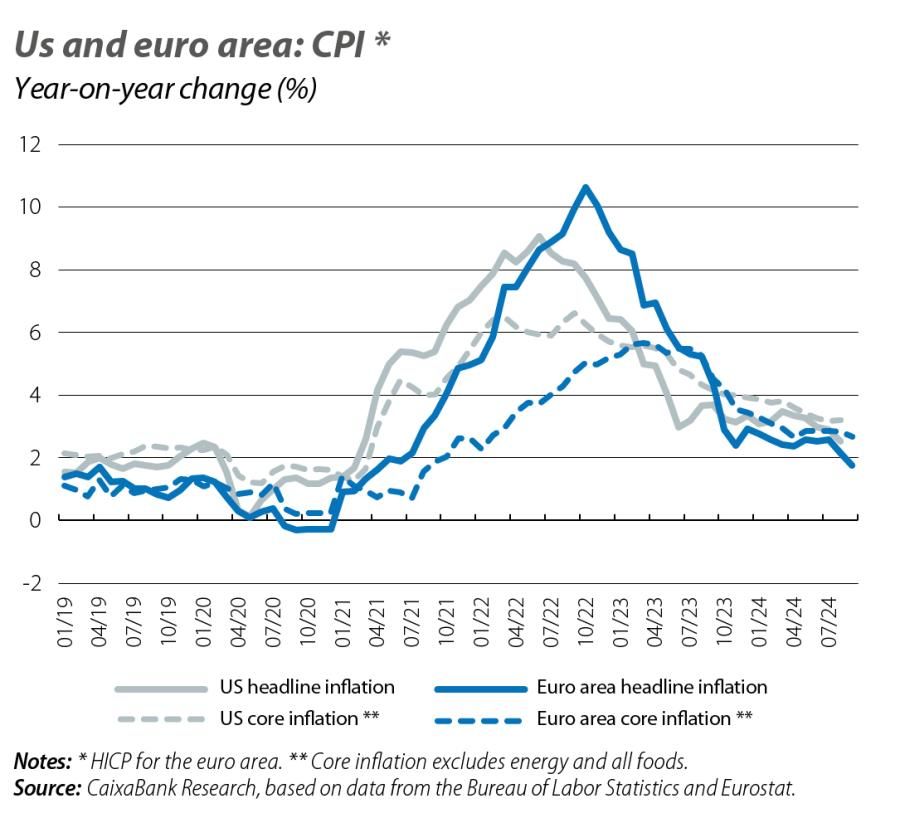

Inflation: the arrival of autumn brings good news

The rate cuts introduced in September by the Fed (–50 bps, the first cut in the cycle) and by the ECB (–25 bps, the second cut in the cycle) were accompanied by increased confidence in the two central banks’ victory against inflation. In the US, PCE inflation (the Fed’s benchmark) fell to 2.2% in August (while the core index, which excludes energy and food, has been below 3.0% since February). In the same vein, in the euro area headline inflation reached 1.8% in September, falling below the ECB’s 2.0% target for the first time since June 2021. In addition, core inflation in the euro area fell to 2.7%. On the one hand, this is a 30-month low, but on the other hand it reflects a much more gradual reduction of the more inertial price pressures (such as services, which remained at 4%) and also serves as a reminder that underlying inflation has not yet completed its trajectory towards 2%.

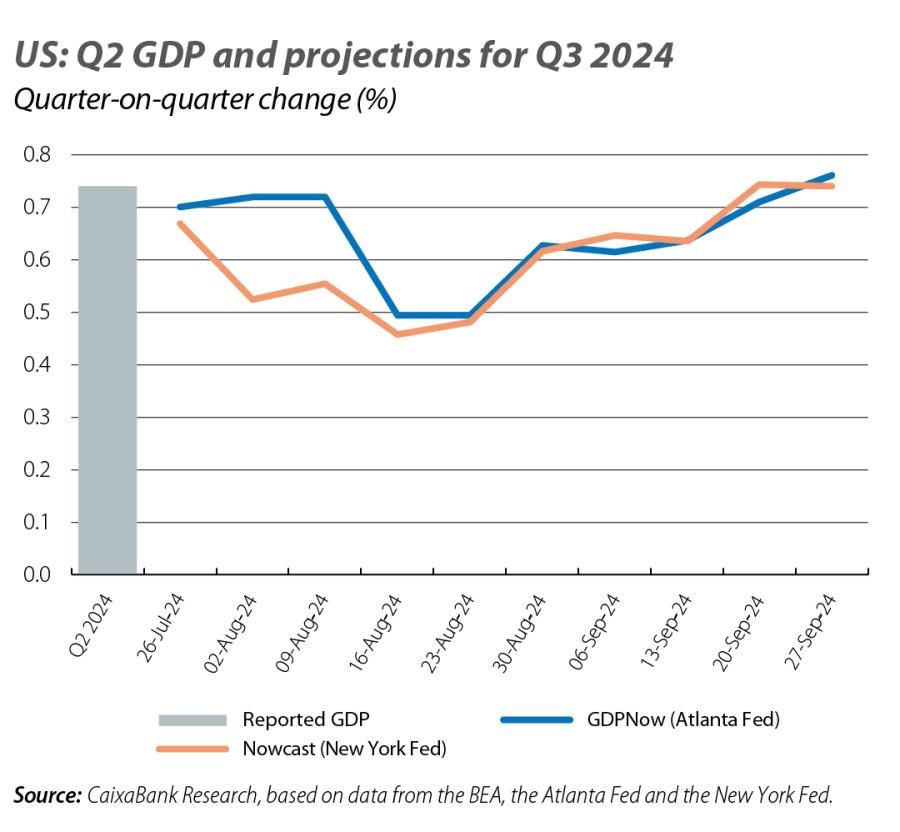

US economic activity remains strong

US economic activity remains strong, recording the fastest growth among advanced economies. After registering significant GDP growth of 0.7% quarter-on-quarter in Q2, the indicators suggest that the US continued to grow at a steady pace in Q3. In particular, in September the ISM index for services accelerated to 54.9 points, marking a new high since February 2023, although this contrasts with the weakness of the manufacturing ISM index, at 47.2 points. September’s employment and unemployment indicators, for their part, remained positive in a context of transition towards a more balanced labour market. Specifically, the unemployment rate even fell 0.1 pp to 4.1%, while 254,000 new jobs were created, once again beating expectations. Thus, the activity trackers suggest that US GDP has sustained a growth rate of around 0.7% quarter-on-quarter in recent months.

Uneven slowdown in the euro area

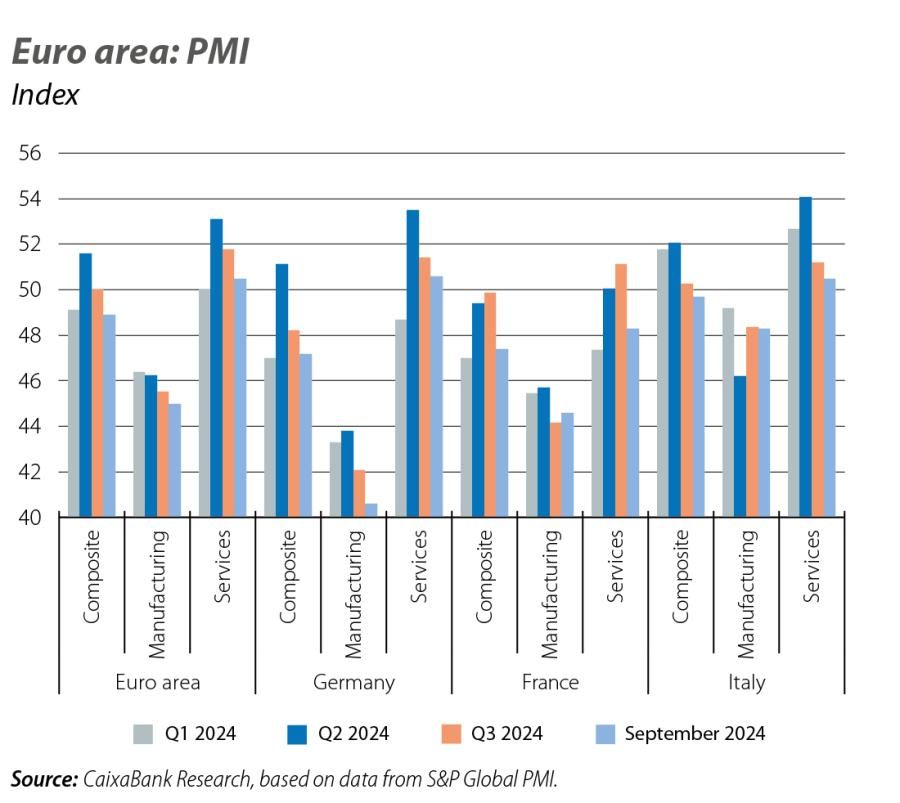

The PMIs suggest that euro area activity has been losing steam in recent months, with the composite index falling to 49.6 points in September (slightly below the 50-point threshold that delimits contraction), weighed down by the difficulties in manufacturing (45.0) and the slowdown in the expansion of services (51.4 points, a seven-month low). However, the weaker momentum of the euro area as a whole masks very diverse situations at the country level. On the one hand, Germany continues to experience difficulties (composite PMI of 47.5 points in September, contracting throughout Q3 and in the last 15 months it has only surpassed the 50-point threshold three times). On the other hand, the periphery maintains a better tone, especially in economies such as Spain. In the middle we find the other two large economies, France and Italy, with a neutral PMI in the quarter as a whole (50.3 points in both cases) and where the public accounts are back under the microscope: the European Council placed both economies under an «excessive deficit procedure» in July, and at the end of September in France the new government led by Michel Barnier acknowledged that the public deficit may end up above 6% in 2024 (compared with 4.4% expected at the beginning of the year).

Japan and the United Kingdom enjoy a revival

Among the large advanced economies, the diverse realities go beyond the euro area. Also noteworthy are the cases of Japan and the United Kingdom, which are ahead of only Germany in terms of their post-pandemic recovery. However, in recent months both economies have begun to leave this weakness behind. In the first half of 2024, UK GDP recorded quarter-on-quarter growth of 0.7% in Q1, followed by 0.5% in Q2 (the best figures in two years), while Japan rebounded 0.7% quarter-on-quarter in Q2. The PMIs also suggest that the positive dynamics continued at the end of Q3, with the composite indicator at 52.6 points in the UK and 52.0 points in Japan.

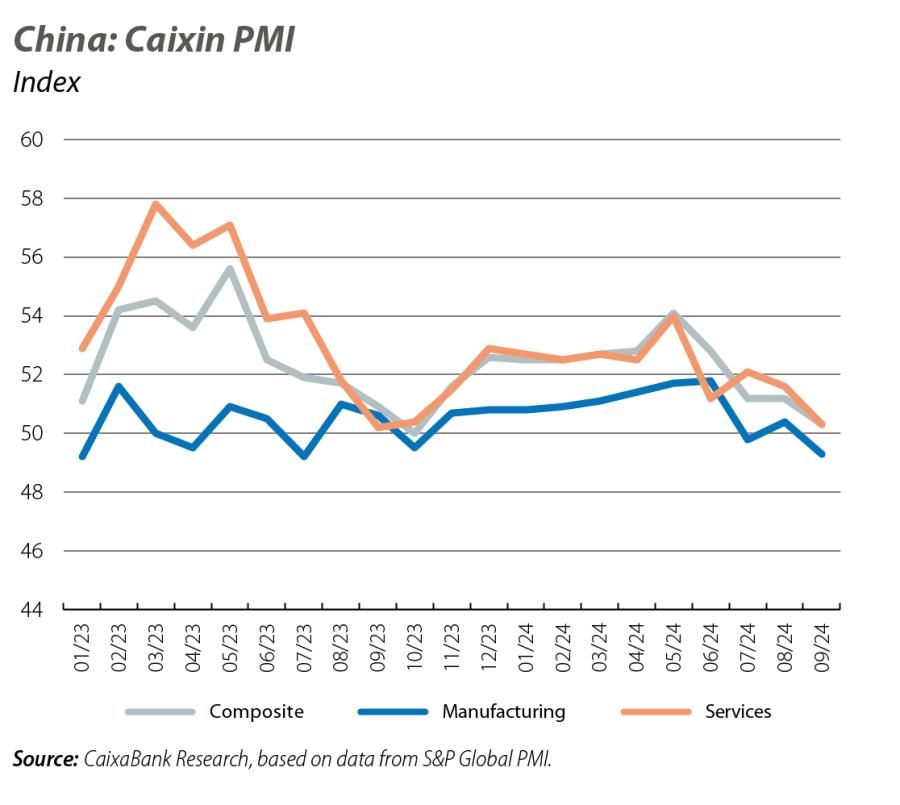

China approves new measures to boost the economy, although it continues to suffer from structural weaknesses

The Chinese economy is still struggling to find the momentum sought by the authorities, weighed down by the housing crisis and weak domestic demand, and with a growth outlook below the official target («around 5%» for 2024). In fact, in September the country’s PMIs lost steam yet again, with the composite index sliding to 50.3 points, just above the 50-point barrier and leaving the Q3 average (50.1) well below that of the first semester (52.9). In this context, the Chinese authorities announced a new cyclical stimulus, with a combination of monetary easing measures (the central bank lowered interest rates by 20 bps and mortgage rates and the cash ratio by 50 bps) and support for the real estate sector (with lower liquidity requirements for buying homes). Moreover, while there has been no official announcement yet, everything indicates that a fiscal stimulus package is on the way.