With inflation relatively under control on the international stage, the focus is now on growth

The global economy continues to grow at different speeds in Q2. In the US, the labour market is beginning to show signs of moderation while inflation continues its slow downward trickle; Germany’s weakness conditions the euro area as a whole, and China’s economy faces a modest outlook for Q3.

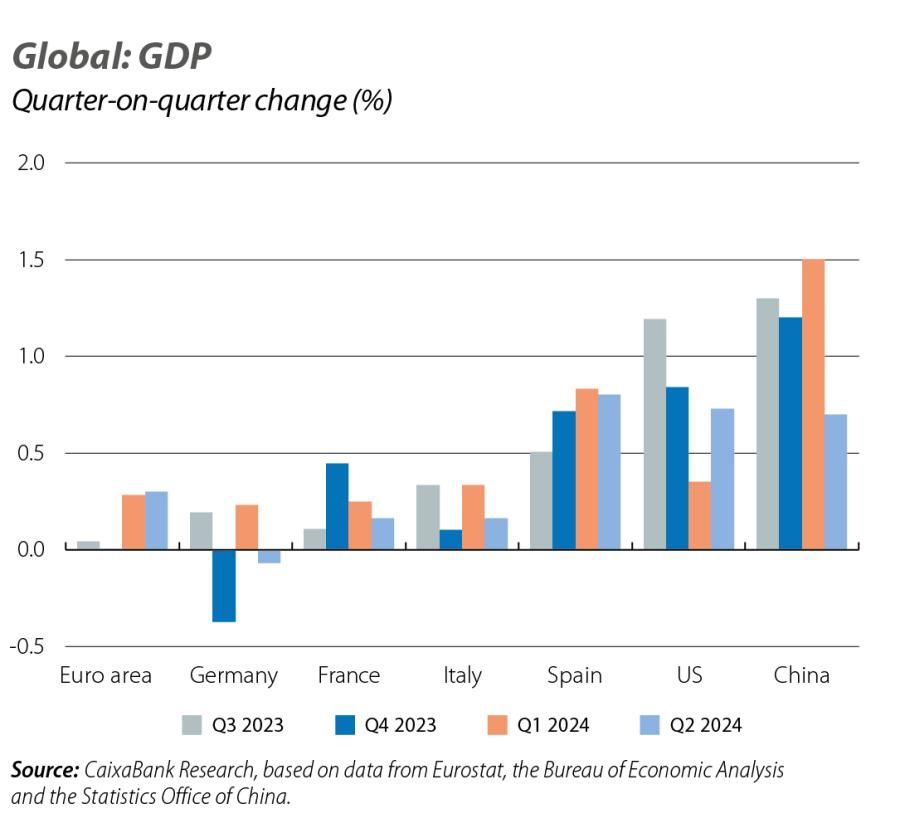

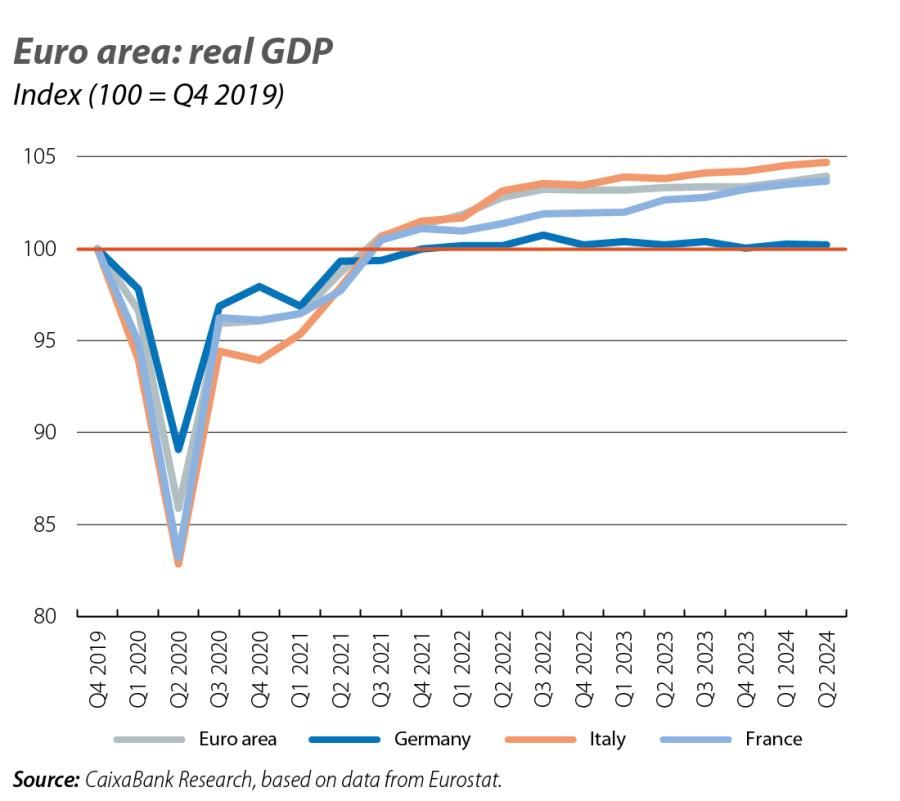

The US continues to show remarkable resilience and surprised analysts by growing 0.7% quarter-on-quarter (vs 0.4% in Q1), which will automatically lead to an upward revision of our growth forecast for 2024 (currently 2.4%). Meanwhile, the UK and Japan are growing at rather high rates (0.6% and 0.8%, respectively). The euro area, for its part, places its quarterly growth at 0.2%, after 0.3% in Q1, but there is substantial disparity between countries. Germany has disappointed by contracting 0.1%, while France and Italy grew slightly above expectations (both 0.2%), and Spain stood out by repeating the strong 0.8% growth of Q1. Finally, China disappointed by growing at a rate of just 0.7%, the lowest in two years. In Q3, it seems unlikely that growth in the major economies will accelerate relative to Q2.

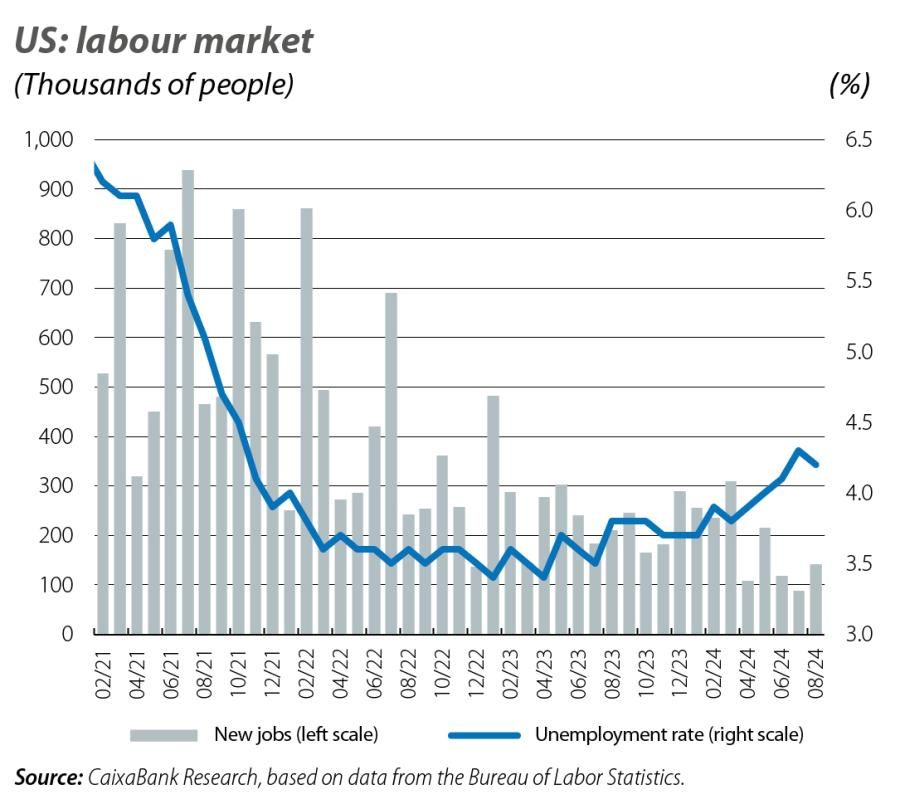

The employment data have been one of the major protagonists of the last month. In July, non-agricultural job creation disappointed by standing at only 89,000 jobs (after a downward revision), while the unemployment rate rebounded 0.2 pps to 4.3%. The market reaction was significant (see the Financial Markets Economic Outlook section) due to the apparent sign of recession indicated by the rise in unemployment: the Sahm Rule states that, when the average unemployment rate for the past 3 months exceeds the lowest level of the last

12 months by 0.5 pps, we are on the verge of a recession. We believe that this hypothesis is excessive and that it also does not match the message sent by job creation in August: 142,000 new jobs and an unemployment rate that fell 0.1 pp to 4.2%. What is evident is that in recent months job creation is slowing down (the average monthly creation in the first half of the year exceeded 200,000). However, this pattern reflects an orderly normalisation of the labour market, consistent with a steady slowdown of the economy in the second half of the year due to the impact of the monetary tightening process. Therefore, we believe that the likelihood of a recession in the short term is very small.

The main business climate and consumer confidence indicators, meanwhile, suggest that we could see a greater cooling of the industrial sector in Q3. The PMIs for July (54.3) and August (54.1) are above the average for Q2 (53.5) and clearly exceed the 50-point threshold which denotes positive growth. This good performance is likely explained by the renewed dynamism observed in services (55.2 in August), which more than offset the sharp deterioration recorded in industry (48.0). The hard data for July point in this direction: the monthly rates for retail sales grew by 1.0% and household consumption by 0.4%, while industrial production fell by 0.6% and orders of capital goods, excluding transport and defence (a proxy for investment in fixed capital), fell by 0.1%.

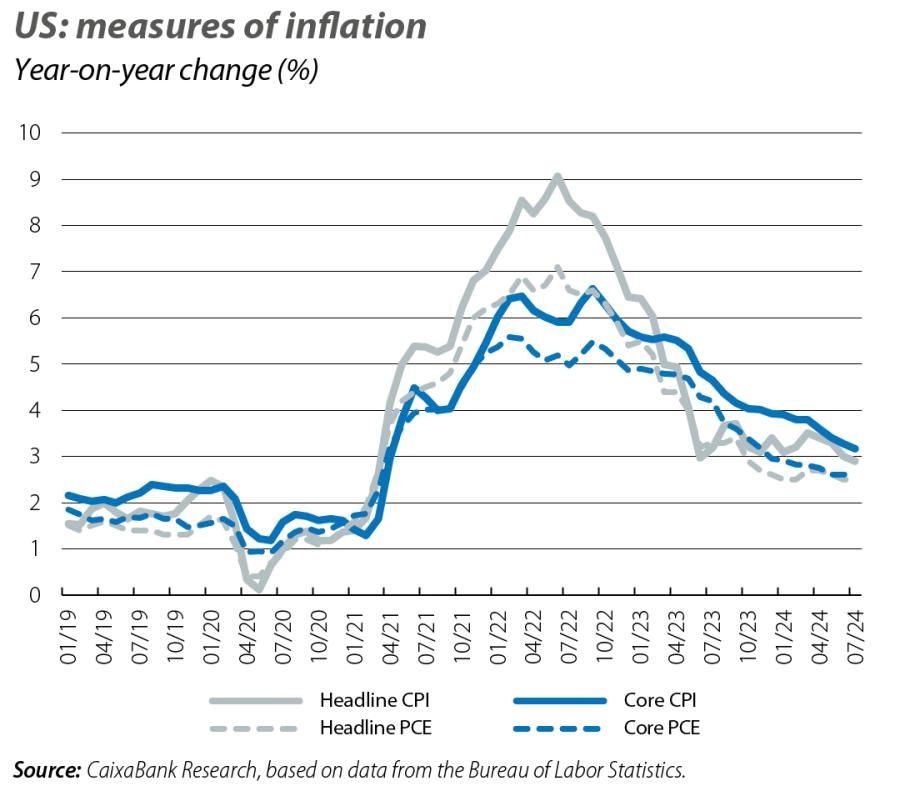

In July, both headline and core inflation fell 0.1 pp, to 2.9% and 3.2%, respectively. The private consumption deflator, meanwhile, kept its year-on-year growth rate unchanged at 2.5% for the total rate and at 2.6% for the core index. Although inflation has slowed its convergence towards the 2.0% target rate in recent months, expectations are well anchored, which explains the change in the Fed’s discourse (see the Financial Markets Economic Outlook section).

Germany’s GDP contracted in Q2 (–0.1% quarter-on-quarter) and the pattern in the main industrial climate and confidence indicators over the summer render the chances of a significant rebound in economic activity in Q3 somewhat unlikely. According to the ZEW, in August the percentage of respondents who see no change in the situation rose to almost 50%; the Ifo fell in July and August, standing at 86.6 (100 indicates growth at around its average rate), and the PMIs fell over the summer months below the 50-point threshold which indicates positive growth. All the indicators suggest that the economy will not be able to recover the lost ground in the short term, thus a downward revision of the already modest 0.2% growth estimated for 2024 is required. With regard to the other large economies in the region, the «pull effect» for the French economy of the Olympic Games in Paris stands out: the business climate and confidence indicators in August reached levels compatible with growth in Q3 exceeding that of Q2 thanks to the services sector. Consequently, the GDP of the euro area as a whole could maintain the growth rate recorded in Q2 in Q3, although the risks are concentrated to the downside.

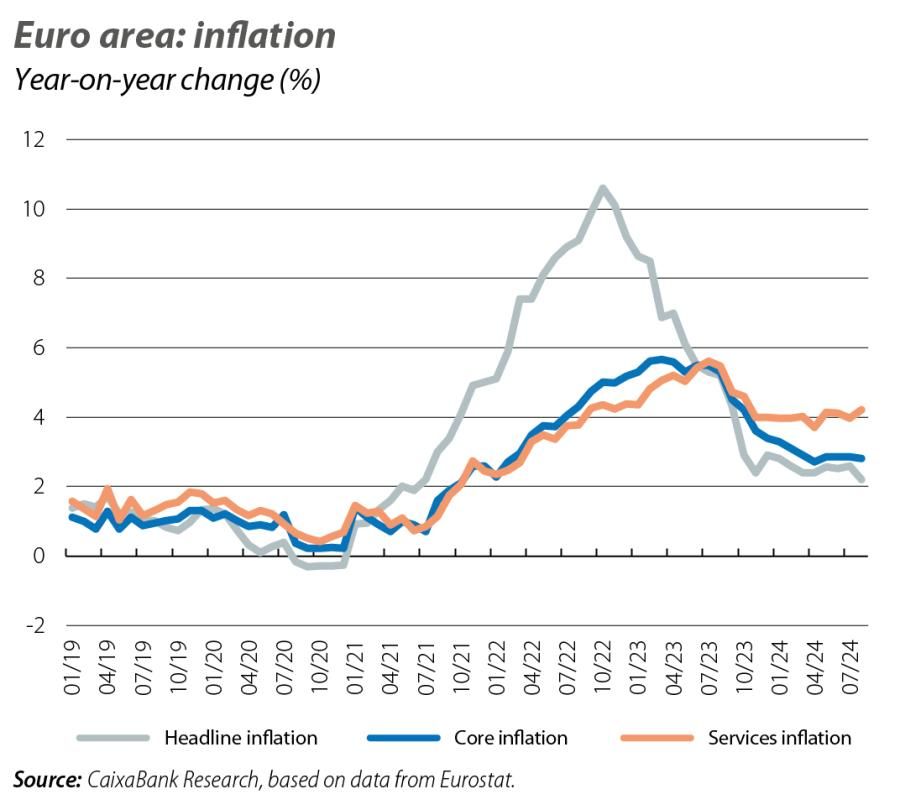

Headline inflation fell 0.4 pps in August to 2.2%, while core inflation fell 0.1 pp to 2.8%. In addition to the significant fall in energy prices (–3.0% vs. 1.2%), there was also a slowdown in the price of goods (0.4% vs. 0.7%), indicating that the disinflationary process is beginning to spread to more components of the price index. In addition, the moderation in negotiated wages (3.6% year-on-year in Q2 vs. 4.7%) reduces the risk of second-round inflationary tensions. Nevertheless, inflation in services remains rather high and in August it even rebounded 0.2 pps to 4.2%, marking its highest level since October 2023, although the impact of the Paris Olympics must be taken into account.

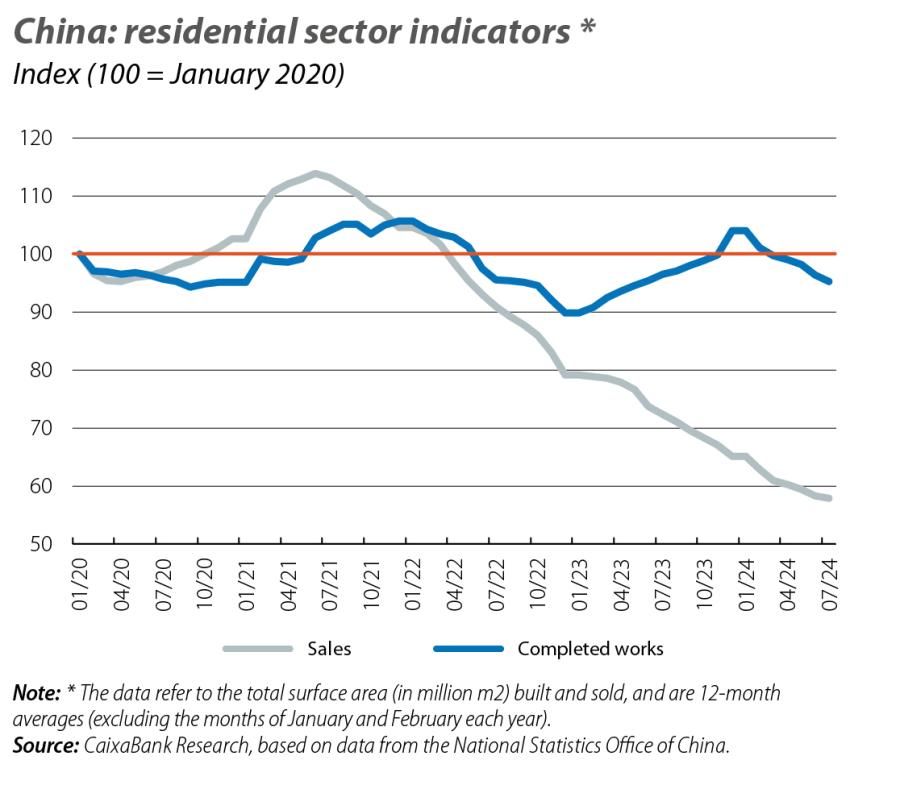

The residential sector remains the biggest drag on the Chinese economy: home prices continue to fall and in July they fell relative to their cyclical peak by 7.6% for new housing and by around 14% in in the case of existing housing. In addition, the number of homes for which construction was started fell by more than 23% in the current year to July and the number of homes completed, by almost 22%. Investment in fixed assets is also struggling to bounce back, and in the year to date up until July the growth of this variable slowed to 3.6% (3.9% up until June). Consumption is also struggling to gain momentum and the apparent recovery in retail sales in July (2.7% year-on-year vs. 2.0%) responds to a base effect, with a breakdown by component that shows that households are cutting back on anything they can other than essential goods. Industrial production also lost some momentum in July (5.1% year-on-year vs. 5.3% previously), most notably in the case of car production: 4.4% year-on-year, compared to 9.0% on average in the first half of the year, and a far cry from the double-digit growth of the previous years. In short, this evidence of a slowdown would justify greater fiscal stimulus to ensure that the growth target of 5.0% in 2024 is achieved.