The Fed and the uncertainties about global growth condition the end of the year in the financial markets

Following all these events, 2024 closed with gains in equities and with the dollar as the most strengthened currency, but with a significant increase in sovereign rates in the anticipation of higher inflation in the US, the unknowns surrounding the future of global geopolitics and the uncertainty about exactly how much more monetary policy will be eased.

The protagonists of 2024 pave the way for 2025

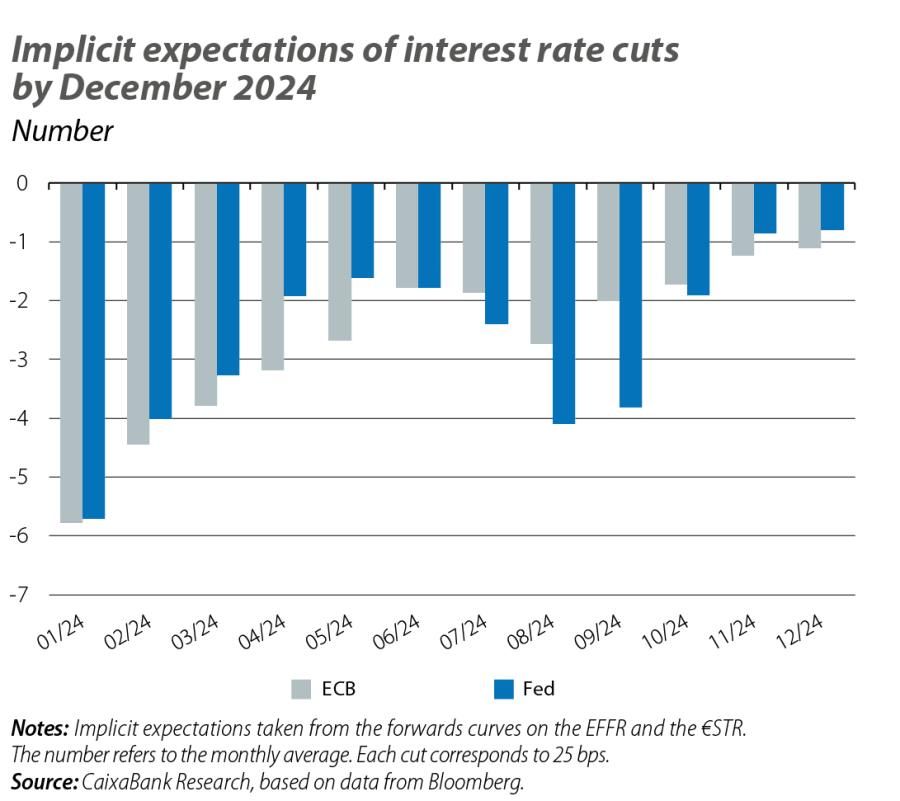

2024 was the year that marked the beginning of monetary easing. A large part of the movements in financial assets unfolded as a result of adjustments in investors’ monetary policy expectations. There were even some episodes of sudden shifts in market expectations which, just like central banks, adjusted according to the flow of macroeconomic data. The other key event was Donald Trump’s electoral victory, to which investors reacted with expectations of higher inflation and some doubts regarding global economic growth. The financial markets hit other milestones: the Bank of Japan put an end to the era of negative rates, geopolitical tensions intensified in the Middle East, expectations of the benefits of artificial intelligence (AI) boosted tech firms’ dominance in equity markets, the S&P 500 recorded two consecutive years of gains exceeding 20% (for the first time in over 25 years), Bitcoin hit 100,000 dollars, and France’s financial assets underwent a revaluation (the French risk premium practically doubled and consolidated at levels above that of Spain). Following all these events, 2024 closed with gains in equities and with the dollar as the most strengthened currency, but with a significant increase in sovereign rates in the anticipation of higher inflation in the US, the unknowns surrounding the future of global geopolitics and the uncertainty about exactly how much more monetary policy will be eased.

The ECB and the Fed converge in direction, but diverge in speed

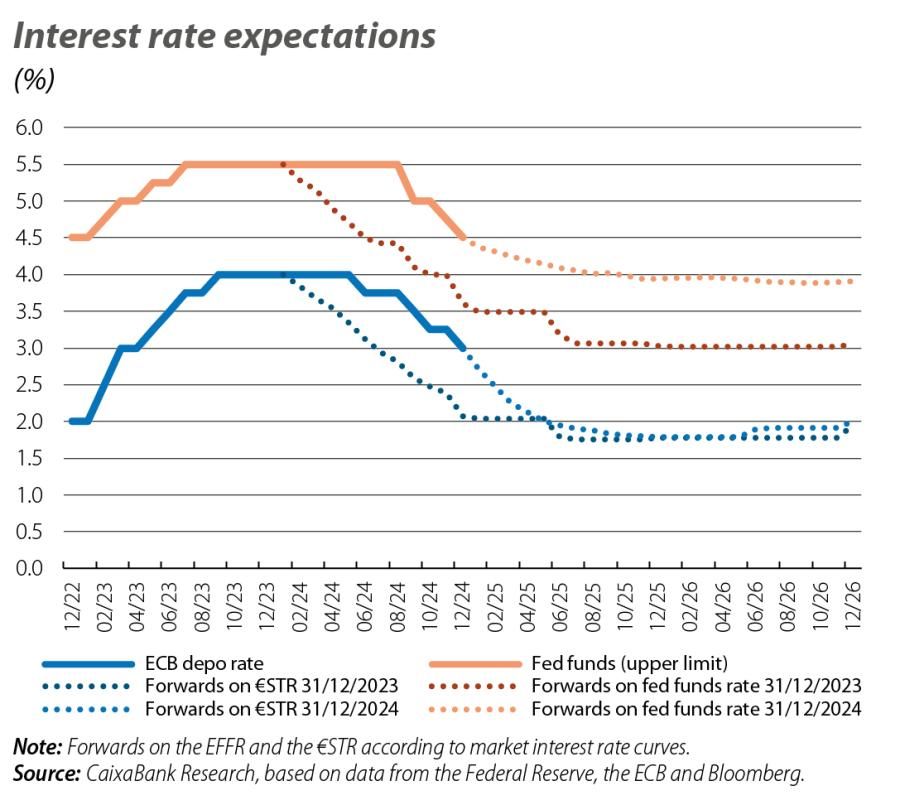

In December, both the ECB and the Fed lowered interest rates by 25 bps, leaving the depo rate at 3.00% and the fed funds rate in the 4.25%-4.50% range. In both cases, 100 bps below the peaks of 2023. The ECB’s tone pointed to further cuts in the coming months, supported by greater confidence that inflation will finally fall to the 2% target in 2025, as well as by expectations that the revival of economic activity will be slower. Thus, the markets are anticipating another 25-bp reduction in January, while also hinting at further cuts in the first half of the year, leaving the depo rate between 1.75% and 2.00% throughout the second half of 2025. The Fed’s tone, in contrast, was much more cautious, based on higher inflation expectations for the next two years and lower risks of a slowdown in the labour market. In the dot plot, FOMC members projected only two rate cuts in 2025, compared to the four indicated in the September update the financial markets are fully anticipating a single cut by mid-2025 (placing the fed funds rate in the 4.00%-4.25% range), with a probability slightly above 50% of a second cut by the end of the year.

Sharp rise in sovereign yields

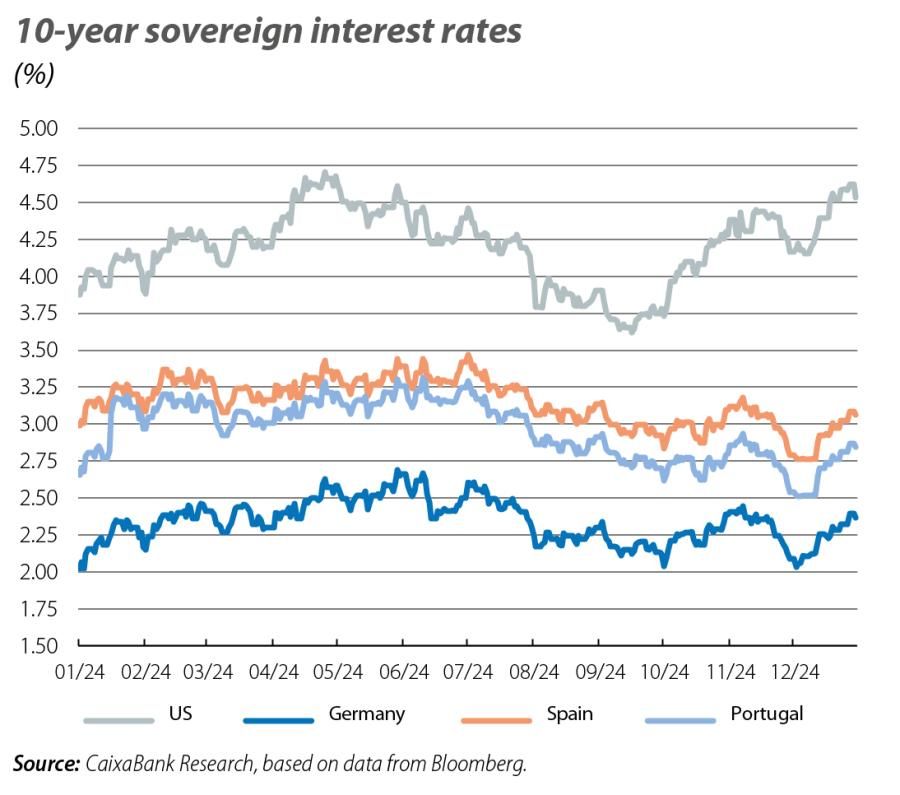

The sovereign debt markets made a hawkish reading of the Fed’s message and treasury yields rose by more than 15 bps in the medium- and long-term benchmarks between the day of the meeting and the end of

the month. Despite the fact that the Fed has lowered rates by 100 bps, the expectation of higher inflation, coupled with a more cautious approach to monetary easing in the future, has driven up sovereign yields. In fact, treasury yields in the long end of the curve have followed a diametrically opposite pattern of behaviour to that of the fed funds rate, surging more than 90 bps since the rate cuts began. Across the Atlantic, although the ECB’s message was dovish, sovereign yields were affected by contagion from their US counterparts and rose by 30 bps in December, with risk premiums in the periphery remaining relatively stable.

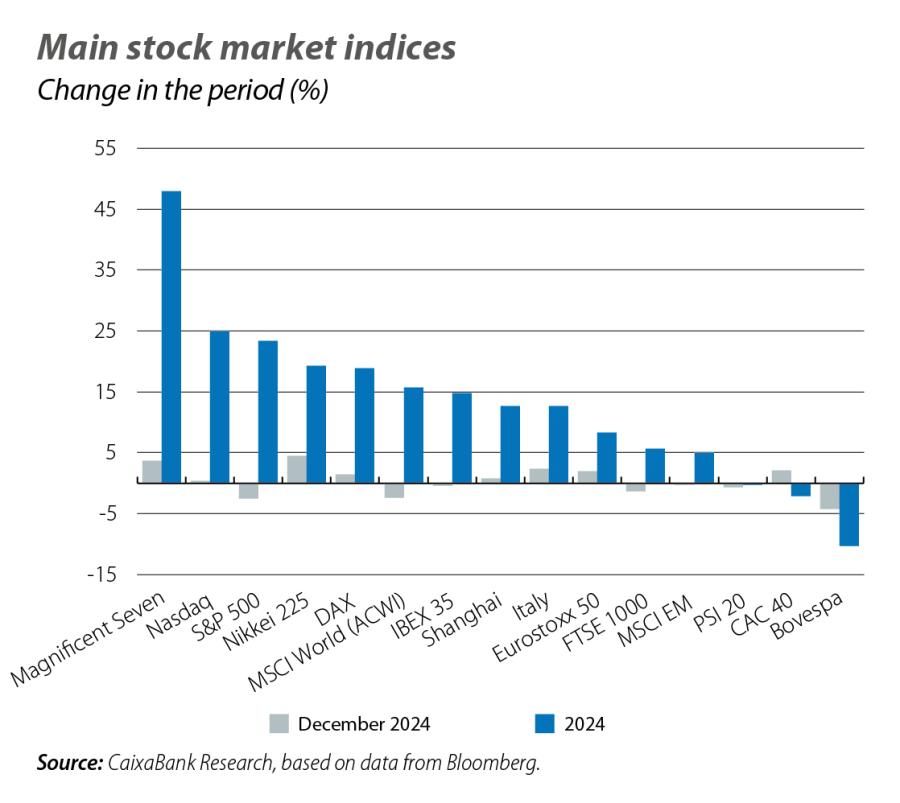

A positive year, but a mixed December, for the stock markets

2024 was a generally positive year for global stock markets. The MSCI ACWI global index accumulated gains of as much as 15% (following +20% in 2023) and, with a few exceptional cases, most of the major stock indices closed the year in the green. Of particular note was the performance of the Magnificent Seven (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla), with cumulative gains of almost 50% in 2024, fuelled by expectations regarding AI, as well as the Japanese stock market (+19%), which benefited from interest rates still close to 0% together with a weak currency. However, the 2024 rally, which received a boost in November following Trump’s victory, lost steam after the Fed cooled expectations of rate cuts at its December meeting. As a result, and with the exception of the big tech firms, equities recorded slight losses in the final month of the year in both the US and some countries of the euro area. After all, on the cusp of 2025, the uncertainty surrounding the effects of Trump’s economic policies and the path of monetary policy weighed on investor sentiment at the end of the year. The biggest declines and the greatest volatility in December were recorded in Brazil (the Bovespa fell 4% in the month and 10% in the year), where the deterioration of the fiscal outlook led to a significant loss of investor confidence.

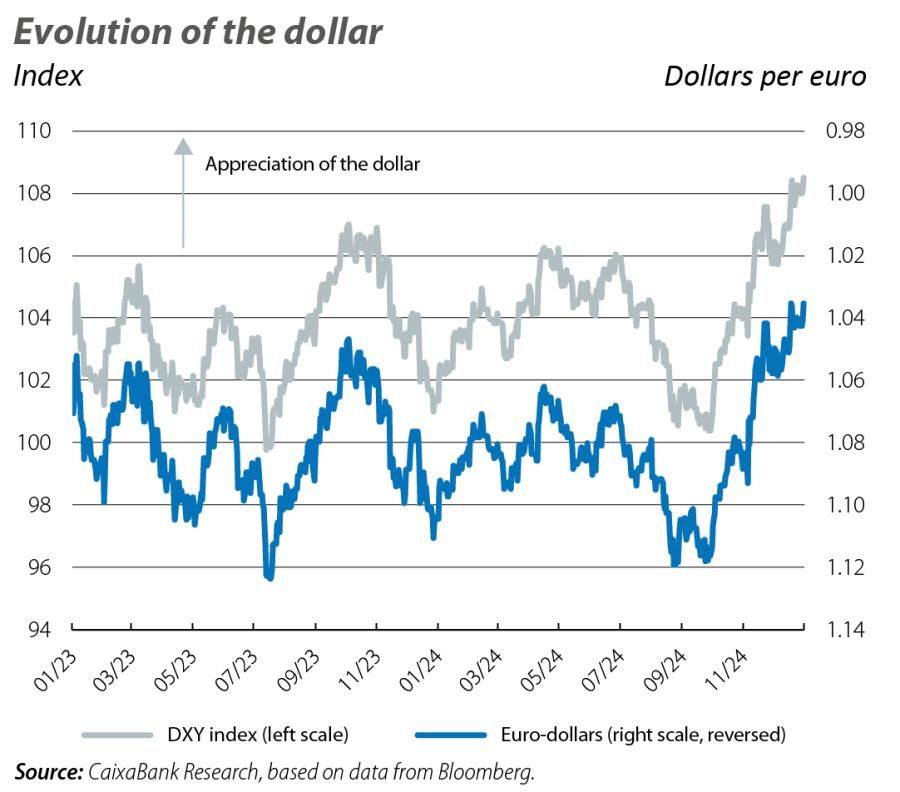

The dollar strengthens

The dollar continued to appreciate, recording gains exceeding 2% in the month against a basket of advanced-economy currencies (+5% since Trump’s victory and +7% for 2024 as a whole) and reaching its highest level since 2022. Against the euro, the dollar was up by 2% in December, even reaching 1.03 dollars (a two-year high). Against the yen, the appreciation was even greater (+11.5% in 2024 and +5% in December) due to the wide gap in interest rates and the Bank of Japan’s resistance to raising rates again (keeping them at 0.25% in December). In emerging countries, the worst-performing currency was the Brazilian real, which fell more than 20% against the dollar in the year as a whole, amid fiscal turbulence.

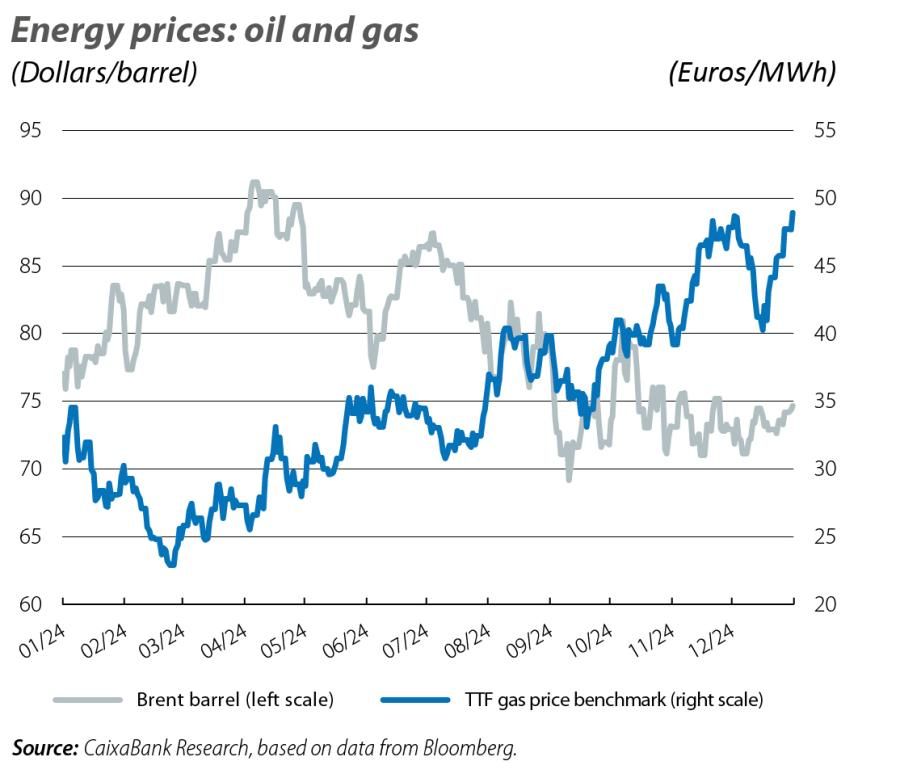

Relative stability in oil prices and relative volatility in gas prices

In December, the Brent barrel traded in a narrow band between 72 and 74 dollars, in a market with relatively abundant supply and in which expectations for demand were weighed down by the weakness of the Chinese and European economies. Thus, the price of a barrel of Brent closed 2024 four dollars below the level of the start of the year, and well below the 90 dollars seen at the height of the tensions in the Middle East. TTF gas prices, for their part, yo-yoed last month, finally closing at almost 50 euros/MWh (compared to an average price of 35 euros/MWh for 2024 as a whole) in anticipation of the end of the agreement that allowed Russian gas to flow through a pipeline that crosses Ukraine.