New economic outlook: upward revision of Spain’s GDP growth forecast

Following the last update of the macroeconomic scenario in June this year, we have incorporated the new information that has come to light and have re-examined the main factors dominating the scenario.

Better starting point

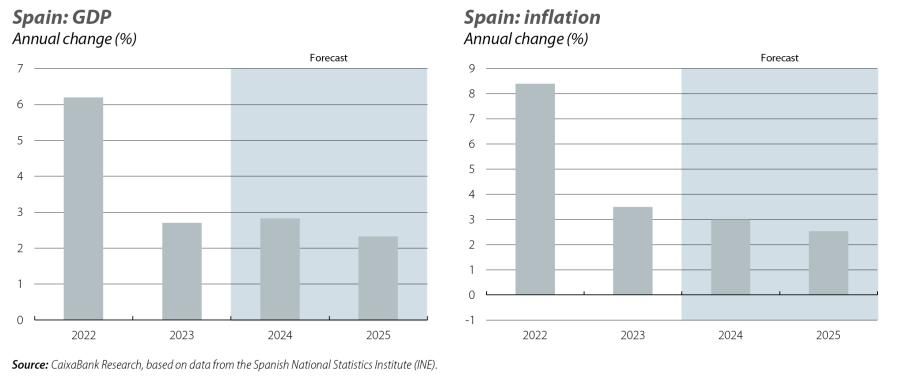

The Spanish economy once again performed better than expected in Q2 2024, growing by 0.8% quarter-on-quarter. This is a strong growth rate and is also higher than the 0.2% registered in the euro area. Adding to this surprise, there has been an upward revision of the historical series. According to the National Statistics Institute’s new estimates, between 2019 and Q2 2024, GDP grew by 5.7%, 1.0 pp above the previous estimate. Part of this upward revision of growth is concentrated in 2023, when GDP grew by 2.7% instead of the previously estimated 2.5%.

During the first half of this year, the Spanish economy enjoyed strong growth despite the many factors

working against it, such as the stagnation of the German economy and inflation and interest rates that remain high. Underlying this good performance are elements such as the strength of the labour market and the excellent international tourism data, which once again exceeded expectations. Domestic demand has maintained a more modest growth rate, but private consumption has been experiencing a steady revival and in recent quarters has been outpacing GDP. In the case of investment, although it outpaced GDP in quarter-on-quarter terms in Q2, it stands just 0.4% above the level of Q4 2019, while private consumption is 1.4% higher, despite a 3.1% increase in the population during this same period.1

The first activity data published for Q3 are as expected, pointing to a buoyant but slightly more moderate growth rate than in the first half of the year.

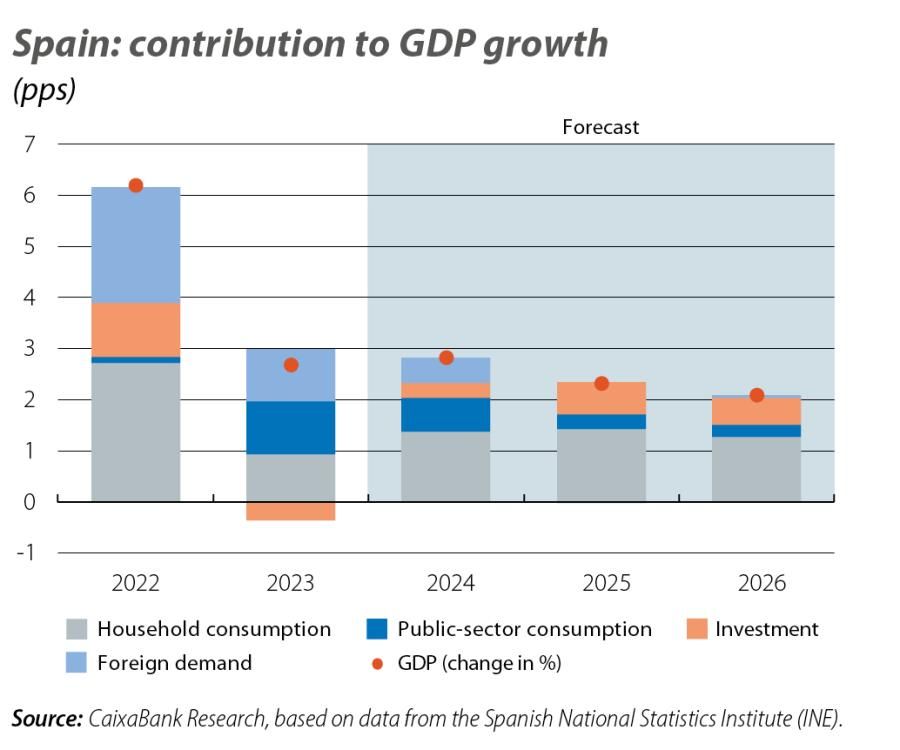

It should be noted that in recent years (2022-2023) foreign demand and public consumption have been the main drivers of growth, but they are expected to give way to private consumption and investment as the latter components enjoy a boost from the recovery of household purchasing power, the reduction of interest rates and the sturdiness of households’ and businesses’ finances.

- 1Data from the National Statistics Institute’s Continuous Population Statistics.

Revision of the underlying assumptions of the scenario

The underlying assumptions of the scenario have shifted in a direction that reinforces the narrative that consumption and investment ought to gain prominence at the expense of foreign demand.

Firstly, we anticipate somewhat more favourable financial conditions than those considered previously and the cycle of interest rate cuts will be more rapid than in our previous scenario. In the euro area, inflation has been moderating and is expected to reach the ECB’s 2% target in the second half of 2025. In this context, our current scenario contemplates four rate cuts of 25 bps in 2025, one more than in the previous scenario, which would bring the depo rate down to 2.25% by the end of 2025.

As for the price of oil, the materialisation of the economic slowdown in China and the expectations of a possible increase in OPEC production have led to a notable fall in the price of Brent in recent months. This leads us to revise downwards our forecast for crude oil prices in 2024 and 2025, placing the average price in 2024 at 80.4 dollars per barrel (7 dollars less than in the previous scenario) and below 75 dollars per barrel in 2025 (also 7 dollars less). This change has a positive impact on our economy, given that we are a net importer of oil. In the field of energy, however, this positive impact from oil is partially offset by the upward revision in gas prices due to the possible changes to gas flows from Russia passing through Ukraine.2

In terms of activity in the foreign markets, the world economy remains robust, although the outlook for the latter part of the year has weakened. In the euro area, we have revised our growth forecast for 2024 down by –0.1 pp to 0.7%, and for 2025, –0.4 pps to 1.3%, mainly due to Germany’s weakness. This slightly more adverse scenario reinforces the narrative that the growth of Spanish exports will slow in 2025.

- 2See the Focus «Modest deterioration in the growth outlook for the international economy» in this same report.

Outlook

The good data for Q2 of this year, together with the upward revision in the growth rate for 2023, lead us to revise upwards our forecast for GDP growth for 2024 as a whole to 2.8% year-on-year (0.4 pps more than in the previous scenario). For 2025, the latest data and the global context discussed in the previous section reinforce the factors that support a GDP growth forecast of 2.3%, which is still a buoyant rate but is slightly lower than in 2024.

In terms of inflation, the latest data support our previous scenario and the changes are minor. In particular, we revised the average inflation for 2024 down from 3.2% to 3.0%, due to a better than expected evolution of inflation in food, energy and industrial goods. In contrast, services inflation is proving more persistent than expected, limiting the scope of the revision. For 2025, we maintain our forecast for average inflation at 2.5%.

Beyond this aggregate figure, the new scenario for the Spanish economy reflects a gradual change in the pattern of growth. Foreign demand (see first chart) will gradually give way to domestic demand as the main driving force. After all, the euro area is showing very modest growth rates, while the US and China economies are slowing. On the other hand, the tourism sector, after recovering and far exceeding pre-pandemic levels, should also normalise its rate of growth, although it will remain high.

As for domestic demand, on the side of private consumption, this will grow in excess of 2% in 2024 (1.7% in 2023) and will accelerate slightly in 2025. The factors behind the revival of consumption include the recovery

of purchasing power and the fall in interest rates. Looking ahead, consumption has room to grow more rapidly given the high household savings rate in light of the sharp rise in gross disposable income in recent quarters – which has seen a year-on-year growth rate of 9.8% in the first half of 2024, far outpacing inflation and household creation. On the other hand, we expect investment to gain momentum in 2025 after receiving a boost from the cycle of interest rate cuts and greater traction in the execution of the Next Generation EU (NGEU) funds.

The good outlook in our scenario is not limited to activity growth. The labour market, although moderating slightly after the excellent results of the first half of the year, will continue to contribute to the growth of domestic demand. Specifically, we expect the average number of new registered workers to reach almost 500,000 in 2024 and to exceed 400,000 in 2025. We maintain our forecast for the unemployment rate at 11.6% in 2024 and 11.2% in 2025, as in the previous scenario. The rapid growth of the labour force, with an average annual rate of 1.6% anticipated in 2024 and of 1.5% for 2025, will limit the decline in the unemployment rate despite the significant job creation.

The risks surrounding the new forecast scenario are material. On the one hand, consumption and investment could grow at a faster rate than anticipated if the rate cuts accelerate or if households release their accumulated savings more quickly. The main downside risks are geopolitical in nature. At the international level, a further escalation of the conflict in the Middle East could lead to a spike in oil prices and reverse the process of moderating inflation, with the resulting impact on economic activity. Also, a deterioration of Germany’s weakness or a widespread increase in tariffs, which will depend on the outcome of the US election, are other risks that must be taken into account, not forgetting the slowdown of the Chinese economy. At the national level, it is important that the execution of NGEU funds gains traction in order to support the recovery of business investment.

In conclusion, the economy faces the final stages of 2024 and 2025 with an encouraging outlook. The main challenges that the Spanish economy has faced so far, such as the impact of inflation and the interest rate hikes, are beginning to fade. On the other hand, the steady recovery of households’ purchasing power, their solid financial position and a global context which, despite a slight deterioration, remains buoyant, paint a picture of a relatively favourable outlook.