The competitiveness of the Spanish foreign sector: current snapshot and 3D roadmap

The pandemic has been felt in all sectors of the economy, particularly in tourism services, a key sector for the Spanish economy. Nevertheless, the foreign sector held up very well in the face of an unprecedented shock, and despite not having this traditional contribution the current account managed to maintain a surplus. The starting point for rebuilding a path of sustainable growth is better than one might have expected.

Where the Spanish foreign sector is now: Spanish exports in the world

Focusing on the balance of goods in 2020, a year with a historic fall of 10.8% of GDP, Spanish exports of non-energy goods fell by 8.3%, but managed to remain above 250 billion euros (around 22% of GDP) for the fourth consecutive year.1 This, combined with the fall in imports, led to a coverage ratio for imports of goods of 0.95 and a deficit in the balance of goods of 1.2% of GDP, an all-time low.

To understand these good dynamics in the foreign sector in an environment of significant economic weakness, as well as the sector’s medium-term outlook, we must put the evolution of Spanish exports over the last decade in perspective. Between 2000 and 2008, the Spanish economy had an average current account deficit of 6.2% of GDP. This was a result of historical trade imbalances in both goods and income accounts (of –7.4% and –2.5% of GDP on average in this period, respectively) which were only partially offset by the surplus in the service account.2 Between 2009 and 2020, on the other hand, the current account registered an average surplus of 0.5% of GDP. This was driven by a significant improvement in the balance of non-energy goods, which went from an average deficit of –4.7% of GDP between 2000 and 2008 to a surplus of 0.1% starting from 2009, with 7 surpluses in 12 years.3

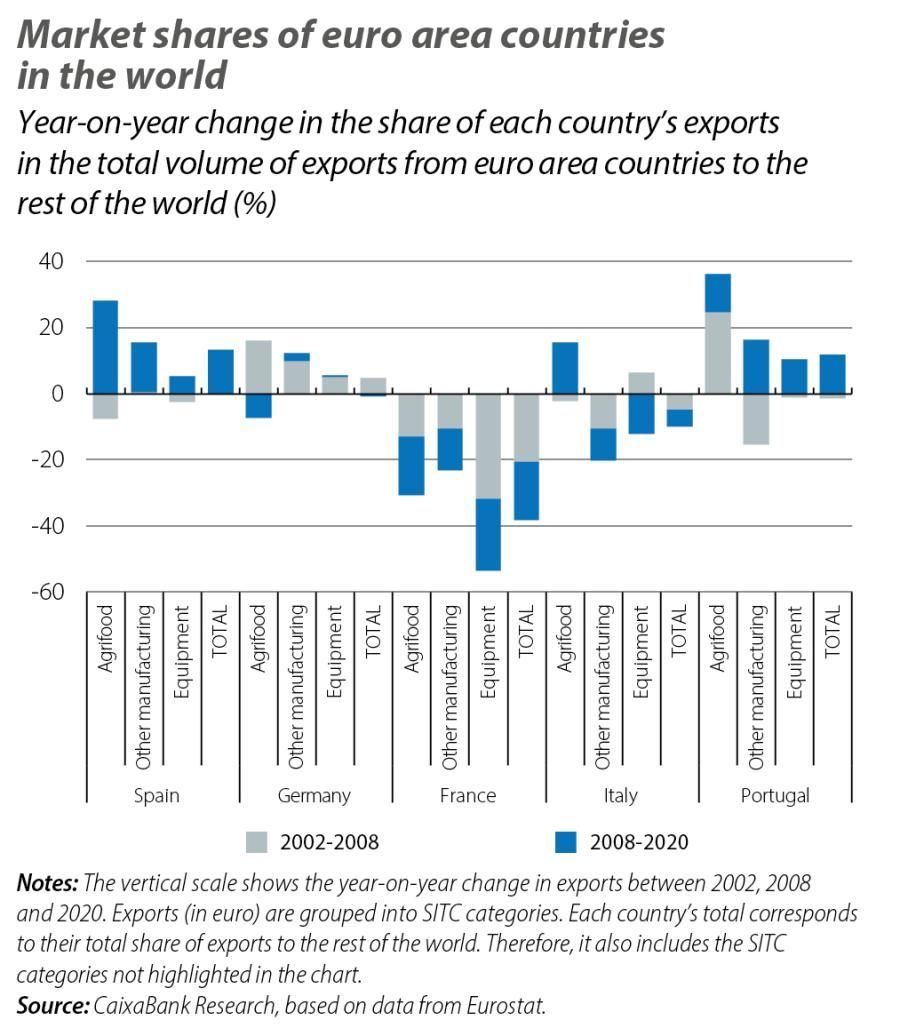

The coverage ratio for imports of non-energy goods thus increased from 0.78 in 2008 to a high of 1.13 in 2013, stabilising from then on at around 1 (see first chart). The improvement in the trade balance reflects the gains in competitiveness achieved over the last decade, both relative to euro area countries (as illustrated by the unit labour cost index in the first chart), which represent the main destination market for Spanish exports, and in comparison to the main international competitors in different economic sectors. Since 2008, the share of Spanish goods in the euro area’s total exports has increased significantly, from 6% to 6.8% (see second chart). The agrifood sector has performed particularly well. Between 2008 and 2020, the Spanish market’s share in the euro area’s agrifood exports rose by more than 2 pps from 9.8% to 12.6% – hoisting Spain up to seventh position in the global ranking.4But the success also extends to the manufacturing sector, both in equipment and transport goods and in other manufacturing segments. Since 2008, Spanish goods have gained considerable market share in these sectors, with gains of 5.4% and 15%, respectively (both sectors with market shares of between 6% and 7%). Moreover, in an environment of increasing international competition, these substantial improvements in the international position of Spanish exports compare with a stabilisation of Germany’s market share and with significant losses in the competitiveness of the manufacturing sectors in France and Italy, as well as the French agrifood sector.5

- 1In historical terms, this decline compares to the 14.2% drop in exports in 2009, following the 2008 financial crisis, in the midst of a recession which caused Spain’s GDP to shrink by 3.8%. Exports of non-energy goods from Spain accounted for 16% of GDP at the end of 2008.

- 2The balance of services registered a surplus of 3.6% of GDP on average between 2000 and 2008, largely thanks to tourism services, with a surplus of 3.5% of GDP in the same period.

- 3The services balance also helped, generating an average surplus of 4.9% between 2009 and 2020. Non-tourism services played a major role, with an average surplus of 1.5% of GDP over the period (well above the 0.1% average for the previous period). Similarly, the income balance registered an improvement, climbing to a deficit of 1.6%, on average. On the other hand, the energy balance deteriorated slightly, with its deficit worsening from 2.7% of GDP between 2000 and 2008 to 2.9% between 2009 and 2020.

- 4For more details, see the article «The resilience of Spanish agrifood exports» in the agrifood Sector Report.

- 5The case of Portugal is more similar to that of Spain, with an 11.9% increase in the market share of Portuguese goods, going from 1.2% to 1.4% between 2008 and 2020. In Portugal, agrifood and manufacturing goods also stood out, registering gains of over 10%, as did the chemicals sector, with an 8.1% increase in the country’s share of exports.

The 3 Ds of competitiveness: diversify, decarbonise and digitalise

In addition to these sectoral trends and the gains in competitiveness across the breadth of the Spanish economy, another promising trend is the growing diversification of the export base. This is reflected in the steady increase in the number of firms making regular exports, which has gone from some 35,000 in 2010 to around 47,000 in 2018, and whose trade volume amounts to 97% of the total declared volume of exports (compared to 93% in 2010). Among these regular exporting firms, medium-sized enterprises – defined as those with between 50 and 250 employees – registered a 62% increase in their trade volume, while the number of medium-sized exporting enterprises rose by 25% (see third chart).6Taken together, this development reflects an improvement in both the extensive and the intensive margin. In other words, it represents an expansion of the export base and also of the average size of the exporting firms. This can also be considered an additional factor in the competitiveness of Spanish exports, insofar as larger firms are associated with greater efficiency and better access to financial markets.

- 6In turn, the volume of trade of both large corporations and of micro and small enterprises that regularly export rose by around 56%, while the total number of these companies grew by approximately 33%, in both cases.

In parallel, data suggests that Spain’s foreign sector has already begun the decarbonisation process in recent years. The intensity of carbon dioxide (CO₂) in Spanish exports decreased by 22% between 2009 and 2019, compared to 8.5% across the euro area as a whole (see fourth chart).7 Besides being a good sign for the decarbonisation of the economy, this factor could be an indication that Spanish firms are in a good competitive position for the initial stages of the climate transition and the major structural reforms that lie ahead. Finally, together with the decarbonisation of exports, the digitalisation process will intensify over the coming years, with the emergence of new opportunities related to e-commerce, but also with the challenges that will test businesses’ ability to reinvent their production and management processes in order to become more competitive. More than ever, these transformations will underscore the importance of investment in infrastructure and human capital, which is widely recognised as one of the major challenges facing the Spanish economy.8

- 7Looking at CO₂ intensity in exports from the major EU economies during the same period, it declined by 16% in Germany, by 11% in France and by 1% in Italy. Malta and Romania are among the economies that reduced the carbon content of their exports the most, both by more than 50%. At the other end of the spectrum, in Portugal this figure increased by 27%.

- 8See, for example, P. Cuadrado, E. Moral-Benito and I. Solera (2020). «A sectoral anatomy of the Spanish Productivity Puzzle». Occasional Papers nº 2006, Bank of Spain. And Bank of Spain (2019). «Challenges for the Spanish economy in the postpandemic scenario» in the 2019 Annual Report. For a detailed analysis of the digitalisation of the Spanish economy, see the Dossier «Digitalisation and European funds: a winning pair» published in the MR03/21.

Where the Spanish foreign sector is heading: the time to take the next step forward is now

Over the coming years, the Spanish economy will face significant challenges. Diversification, digitalisation, and decarbonisation could emerge as the most visible faces of the profound structural transformation that will take place. To this end, within the next few months the Spanish economy will receive a major impetus in the form of funds from the NGEU programme. Having defined the roadmap, all that remains is to execute the plan: to reach the podium in this arduous triathlon, all the available tools will need to be used to maximise the speed of execution and minimise the risk of hitting stumbling blocks along the way. The continued success of the Spanish export sector will depend on each D, for detail.