International business tourism since the pandemic

Despite Spain’s tourism model being highly competitive, the recovery of the different types of tourists has been uneven. This article examines how the reasons for international visits have changed, comparing the current situation with that of 2019, in order to assess whether there have been significant shifts in consumption patterns that are relevant to the sector.

Following a 2023 in which the main tourism indicators returned to the peaks of 2019, Spain’s tourism sector not only continues at full steam without showing any signs of cyclical exhaustion, but it has maintained its appeal throughout 2024, especially among international tourists. In 2024, we estimate that around 94 million foreign tourists visited our country, representing an increase of 9 million compared to 2023 (a growth rate of 10%).1

Despite Spain’s tourism model being highly competitive, the recovery of the different types of tourists has been uneven. This article examines how the reasons for international visits have changed, comparing the current situation with that of 2019, in order to assess whether there have been significant shifts in consumption patterns that are relevant to the sector. To this end, we use the statistics on international tourist arrivals published by the National Statistics Institute (FRONTUR), which distinguish between three main reasons for travelling: leisure, recreation and holidays; business and professional reasons; and other reasons.

- 1The figures mentioned in this article refer to the cumulative trailing 12 months to November, which is the latest data available as of the closing of this article, and are compared against the same period for 2019 and 2023.

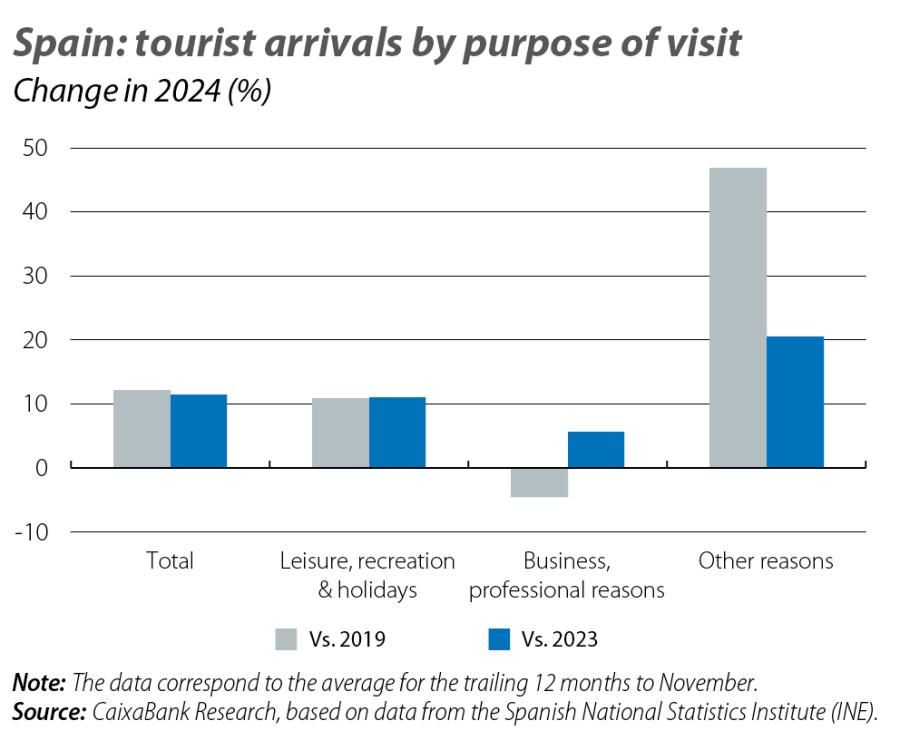

The main reason why foreigners visit Spain is for holidays and leisure. In 2024, 81 million foreign tourists visited our country for this reason (the so-called holiday and leisure tourist), around 8 million more than in 2019. However, the group that has grown the most is that of tourists travelling for «other reasons», surging by over 40% compared to 2019 (2.4 million additional visits in 2024). This category includes trips ranging from visits to see family and friends, to studies, to medical treatments or even religious pilgrimages, among others. While this category still accounts for a much smaller portion of the total compared to leisure and recreation, it now represents 8.2% of arrivals into our country, 2 points more than in 2019.

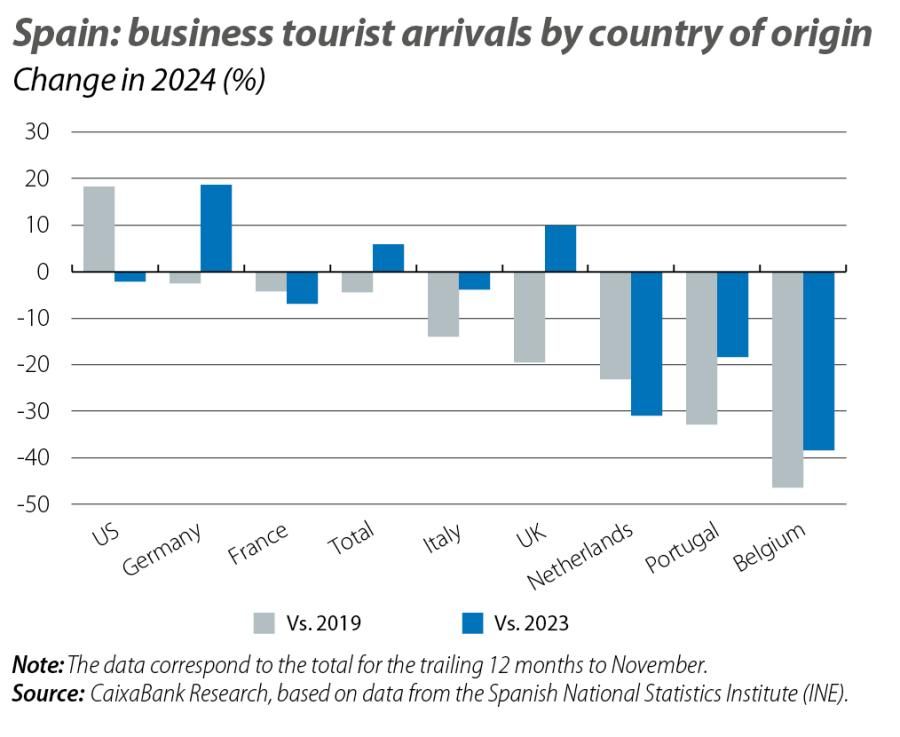

Finally, arrivals for business and professional reasons – the so-called business tourist – are the only ones that have not yet recovered their pre-pandemic levels: there is a gap of around 240,000 arrivals compared to the levels of 2019 and, moreover, this is the category showing the least growth (5.7% in 2024 versus 11% for leisure reasons and 21% for other reasons). Among the main source countries for business tourists, the biggest declines are found in arrivals of Portuguese, Belgian and British tourists, among others, while the only notable increase is in visits from the US.

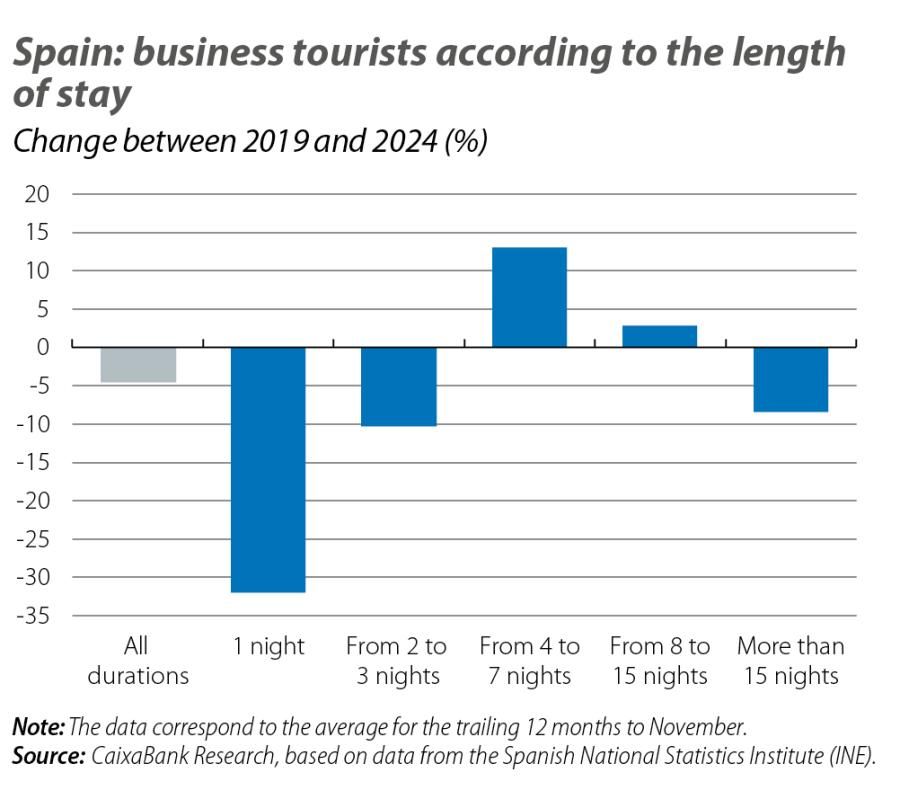

Post-pandemic labour trends – with the significant rise of teleworking, the exponential use of tools that facilitate virtual meetings and cuts in travel expenses by companies – explain the decline in international tourists travelling to attend meetings in other countries, which generally entail shorter stays. In fact, visits by business tourists lasting less than three days have fallen by 16% between 2019 and 2024.

On the other hand, there is an increase in longer visits, which encompass trips to attend trade fairs and professional events that cannot be conducted virtually. Visits lasting between 4 and 15 nights grew by 11% compared to 2019 and now account for 46% of all business tourist arrivals, 6 points more than in 2019. In fact, the MICE sector (Meetings, Incentives, Conferences and Exhibitions), which includes the holding of trade fairs and sectoral or business events, is becoming increasingly attractive in our country, with an increase in the number of exhibitors and attendees recorded in both 2023 and 2024. The majority of this business segment is concentrated in the most economically buoyant regions and those with the greatest international projection: Madrid, Catalonia, Andalusia and the Valencian Community account for 75% of business tourists in our country.2

- 2Spain hosts world-leading trade fairs and sectoral events: in Madrid, FITUR (tourism), Fruit Attraction (agrifood sector) and ARCOmadrid (art); in Barcelona, Mobile World Congress (telecommunications and IT) and Alimentaria (agrifood sector). In 2024, the number of attendees and exhibitors at these fairs increased at double-digit rates compared to 2023, in the 10%-19% range, according to data published by the organisers themselves.

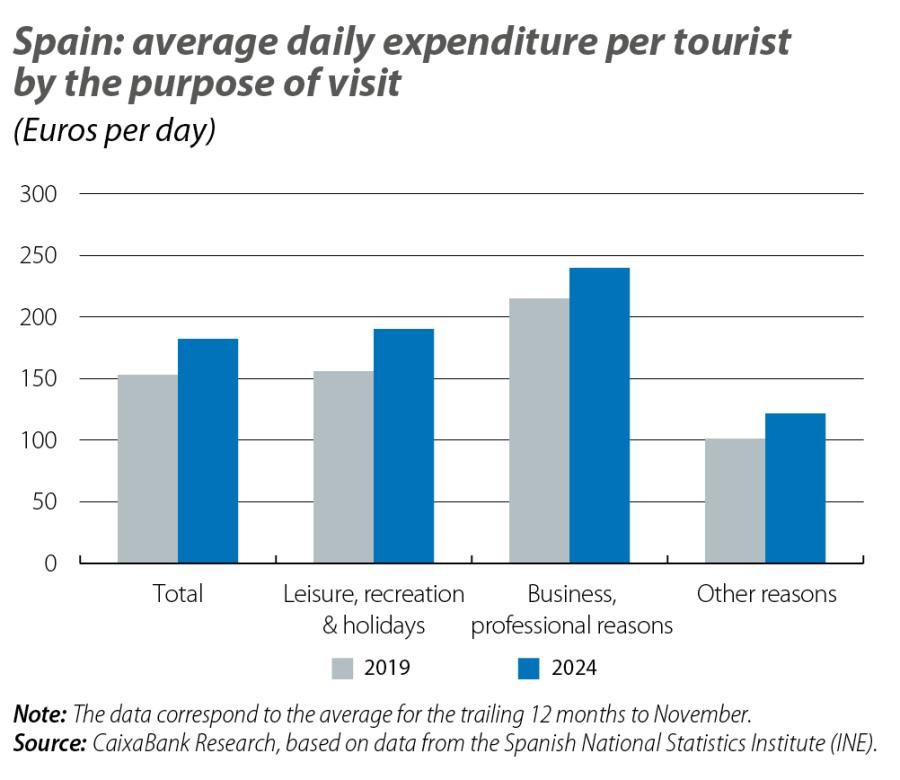

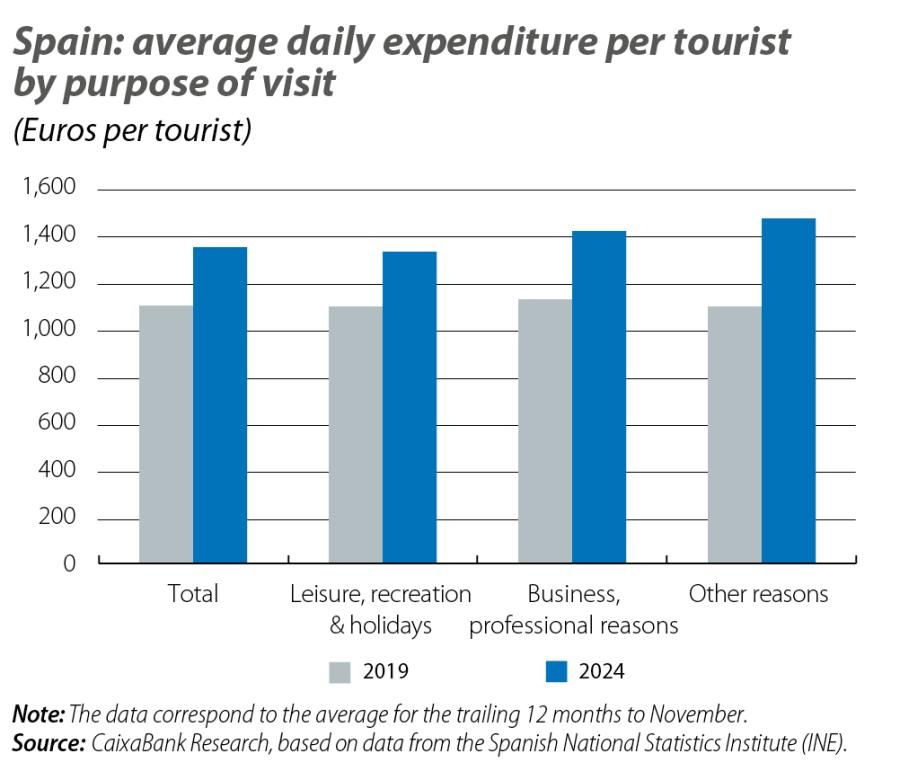

In any case, business tourism accounted for 6.0% of all arrivals in the period 2016-2019, and this figure has fallen to 5.4% in 2024. In this regard, this business segment has room for improvement in the medium and long term, and this could be an additional reason for tourist arrivals in the coming years. The recovery of this segment is particularly important for Spain’s tourism sector. Firstly, this is because these tourists spend more than average: in 2024, they spent around 1,400 euros per tourist (100 euros more than the average holiday tourist) and around 240 euros per day (50 euros more per day than the average tourist). In 2024, revenues associated with business travel amounted to 7.126 billion euros. Secondly, this group is especially important for our hotel sector: in 2024, 86% of business tourists stayed in a hotel in our country, compared to 68% of holiday tourists and 33% among those visiting for other reasons.