What big data reveals about consumption in Spain

We analyse the recent trend in consumption in Spain based on data from the CaixaBank Research Real-Time Economics portal, which we have expanded with information on direct debit payments, as well as more detail on each individual sector and on the evolution of e-commerce.

In November 2022, CaixaBank Research launched the Real-Time Economics portal,1 a pioneering tool for monitoring the Spanish economy based on the bank’s internal data, aggregated and duly anonymised. The portal contains information in real time on household consumption, inequality, wage trends and the real estate and tourism sectors. In June this year, the portal has been expanded with new lines of analysis and more granular detail in the areas of consumption and tourism,2 increasing the number of series available from 800 to 2,200.

In the field of consumption, the new portal incorporates information on direct debit payments, such as water, electricity, gas and telephone bills.3 Furthermore, the detail of the breakdown of consumption by sector has been expanded to include information on fashion, furniture and catering, to cite just a few examples (see the table for further details). Information on the evolution of e-commerce has also been incorporated. This article analyses the recent trends in consumption using data from the portal.

- 1See the Focus «Real-Time Economics: the new portal by CaixaBank Research», for further details.

- 2For tourism, a more detailed breakdown of tourists’ countries of origin has been added and new series have been published for analysing the evolution of tourism using 100 as a baseline for the same month of 2019 (pre-COVID benchmark), in addition to the existing series showing year-on-year changes.

- 3See the Focus «Spanish household spending on bills in 2023, a respite after a gruelling 2022» in the MR02/2024, for further details.

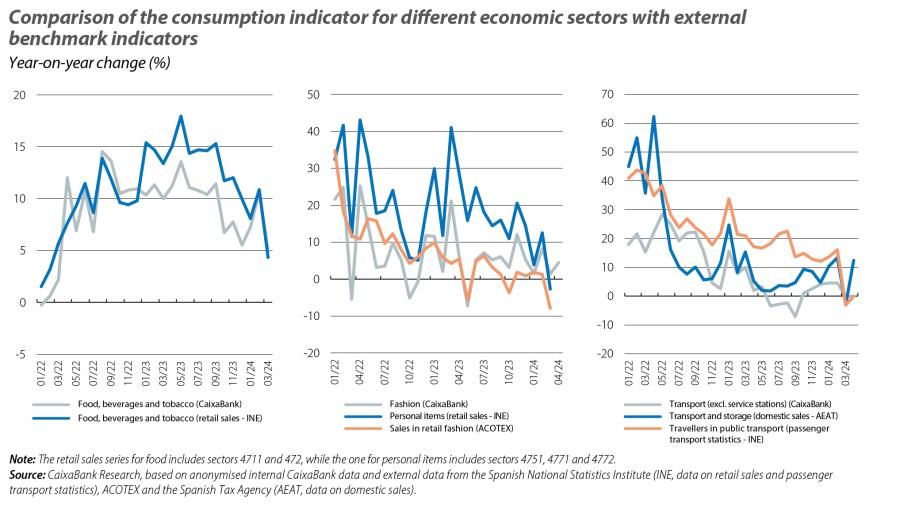

One of the indispensable requirements of the new economic indicators incorporated into the portal is that they must be of a high-quality. To this end, we have compared them with other variables from external references. In the first chart we can see how, despite differences in the definitions between the various data sources, the series follow similar trends.4The indicators drawn up using internal data also allow developments to be monitored with a greater degree of immediacy, since they are published monthly and just a few days after the end of the month.

- 4See the methodological document from the Real-Time Economics portal for further details on how the indicators are built and validated:

https://www.caixabankresearch.com/es/nota-metodologica_rte.

Evolution of consumption in Spain according to internal CaixaBank data

The growth of the Spanish economy is proving more robust than expected in a context in which interest rates remain high and growth in the rest of the euro area is showing signs of weakness. In recent months, economic activity has been driven by the good performance of the labour market, immigration flows that remain strong and the buoyant international tourism data. Moreover, private consumption is expected to remain dynamic, as household incomes will steadily regain purchasing power and the ECB is expected to continue lowering interest rates. Is this proving to be the case?

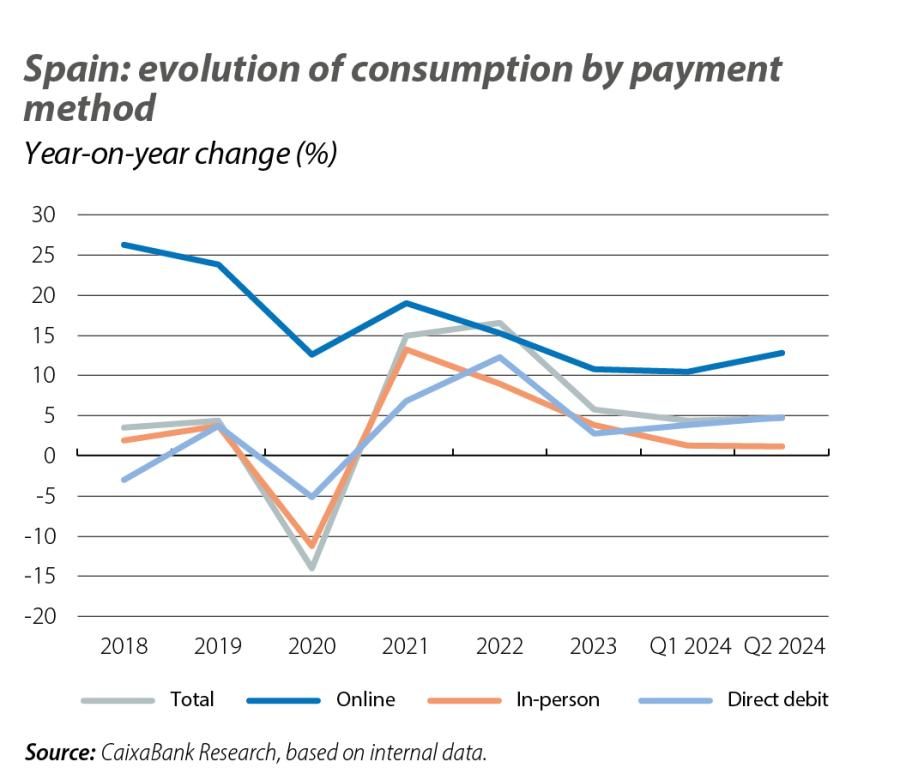

Spaniards’ consumption closed Q2 growing by 4.7%, which represents a slight acceleration compared to Q1 and a very similar growth rate to 2023, although inflation has moderated slightly. Among the various items of expenditure, e-commerce particularly stands out, recording a growth rate of 12.9% in Q2 2024, 2 pps higher than the figure for 2023. Also, spending on direct debit charges continues to show rapid growth, recording a rate of 4.9% in Q2 2024, due in part to increased spending on water bills.

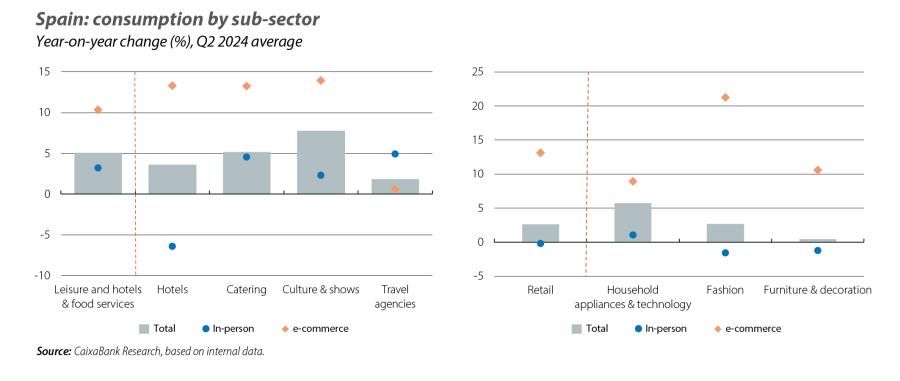

In-person consumption expenditure has maintained a more moderate growth rate in Q2, climbing 1.2% (1.3% in Q1 2024), but with significant differences between the various headings that comprise it. The biggest increases are found in spending on culture and entertainment, with growth of 2.3% in the quarter, as well as on catering, with an increase of 4.6%. Spending on food also continues to record a significant increase, at 3.7%, although the rate of this increase is clearly declining, partly due to lower inflationary pressures.

The items of in-person expenditure that show a weaker trend are those related to furniture and decoration, and appliances and technology. In both cases, spending increased significantly during the pandemic. Since then, it has followed a more sluggish pattern than the rest of the items of in-person expenditure. However, it should be noted that in the case of expenditure on household appliances we are seeing a change in consumption patterns in favour of a greater role of purchases made via e-commerce. Thus, while this component of in-person expenditure grew by only 1.1% year-on-year in Q2 2024, the increase in the case of online purchases stood at 8.9%. In furniture and decoration and in fashion we see a similar trend, with a growing role of online spending to the detriment of in-person spending. On the portal, we can see how young people are, by far, the group that makes a greater proportion of their purchases online.However, we can also see how older people are gradually adapting their spending pattern to this channel.