The Agrifood Sector Begins to Recover in 2024

Pending an assessment of the impact that the storm which hit Eastern Spain at the end of October may have had on agricultural production in the region, over the coming quarters we expect the positive trend in the sector to gather strength. That said, it will remain highly conditional on how costs evolve, as well as on the easing of the drought.

The Agrifood Sector Report 2024, published in October, provides a comprehensive review of the key activity indicators of the Spanish agrifood sector and confirms the revival of the agriculture, forestry and fishing sector in 2024. This recovery has been driven by moderating production costs and a promising improvement in weather conditions, which also allow us to be cautiously optimistic about the 2024-2025 season. Pending an assessment of the impact that the storm which hit Eastern Spain at the end of October may have had on agricultural production in the region,1 over the coming quarters we expect the positive trend in the sector to gather strength. That said, it will remain highly conditional on how costs evolve, as well as on the easing of the drought.2

- 1Our preliminary estimates, using data from the 2020 farming census, indicate that half of the useful agricultural land area in the province of Valencia has been affected. Taking into account the productive specialisation of the affected regions, the supply of citrus fruits (28% of the national total) and tropical fruits (18%) could be seriously diminished.

- 2The figures for activity indicators and prices that appear in this article reflect the latest available data as of the date of this Monthly Report. Therefore, these data differ slightly from those shown in the Agrifood Sector Report 2024, which was closed on 27 September 2024.

The primary sector recovers following the challenges of recent years

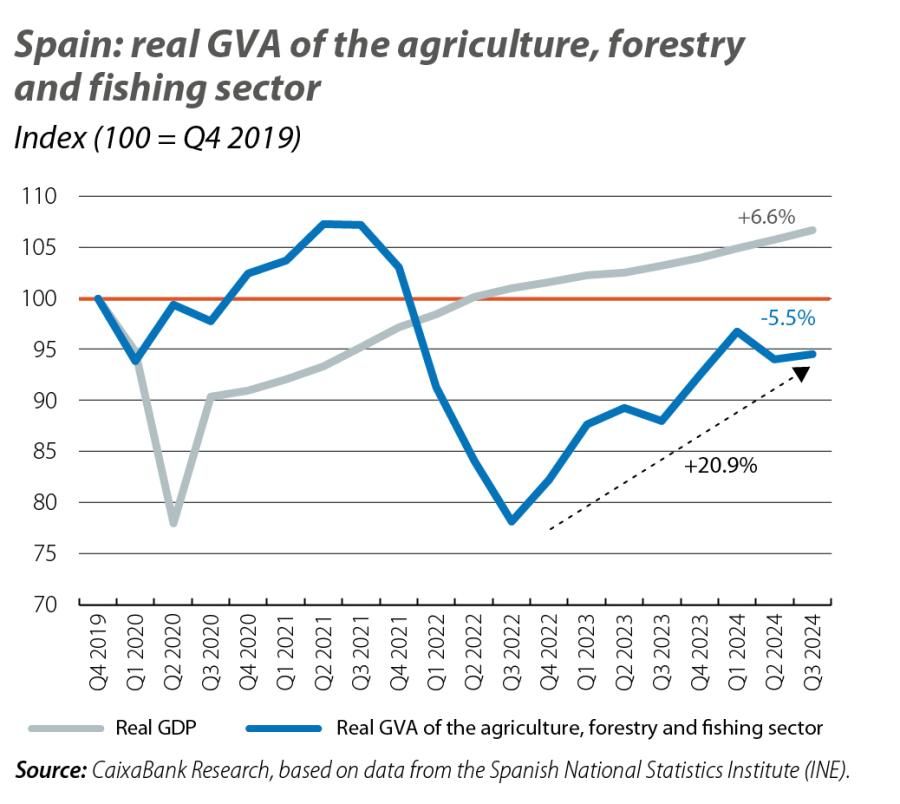

The sector has left behind the slump it experienced between late 2021 and the first half of 2023, when it endured adverse weather conditions and rising production costs, largely triggered by the war in Ukraine. Between Q1 and Q3 2024, the gross value added (GVA) of the agriculture, forestry and fishing sector recorded cumulative growth of 7.7%, far surpassing that of the economy as a whole (3.0%). Despite this improvement, the sector’s GVA remains 5.5% below the level of Q4 2019 and is far from regaining its relative weight in the economy as a whole (2.6% versus 3.0% in 2015-2019).

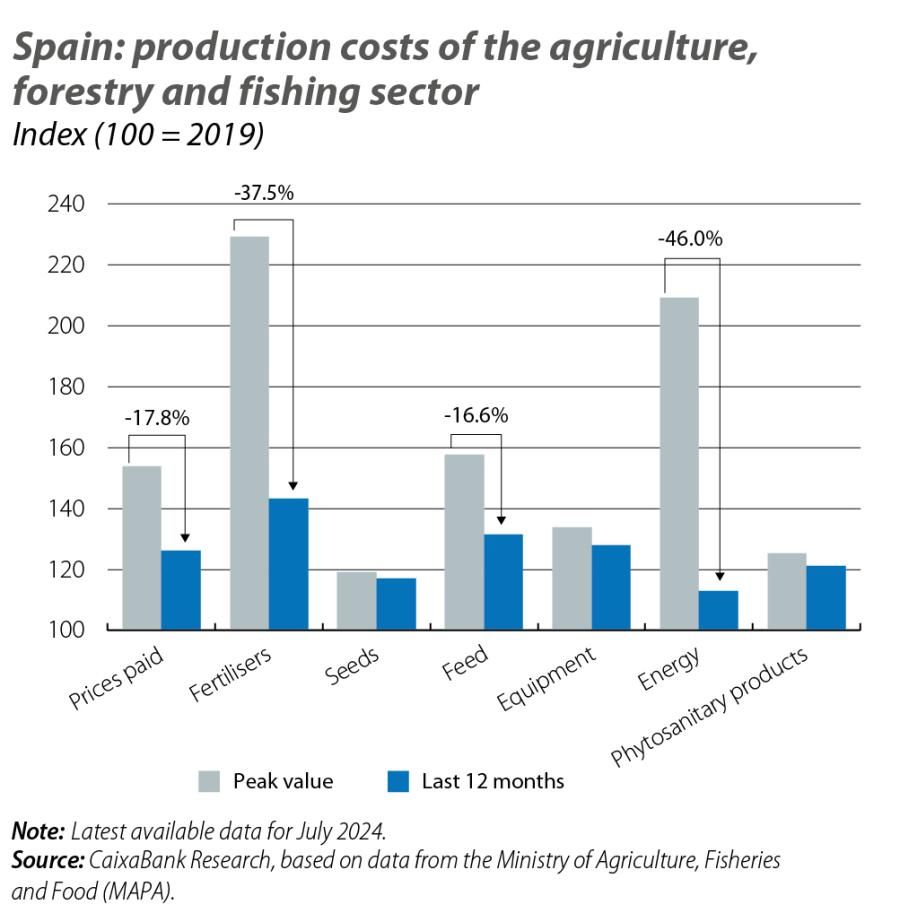

One of the key factors in the sector’s recovery has been the moderation of production costs: the prices paid by farmers have fallen by 18% from their peaks (in mid-2022), although they remain more than 20% above 2019 levels (see first chart). The biggest corrections from the peaks are found in energy costs, fertilisers and, to a lesser extent, animal feed, which is the biggest component of the sector’s intermediate consumption (accounting for around 55% of the total). In addition, all the indicators suggest that this trend will continue over the coming months: the international markets for energy products and agricultural commodities indicate that prices should stabilise or even fall slightly. However, the risks remain skewed to the upside, bearing in mind sensitive factors such as climate and geopolitics.

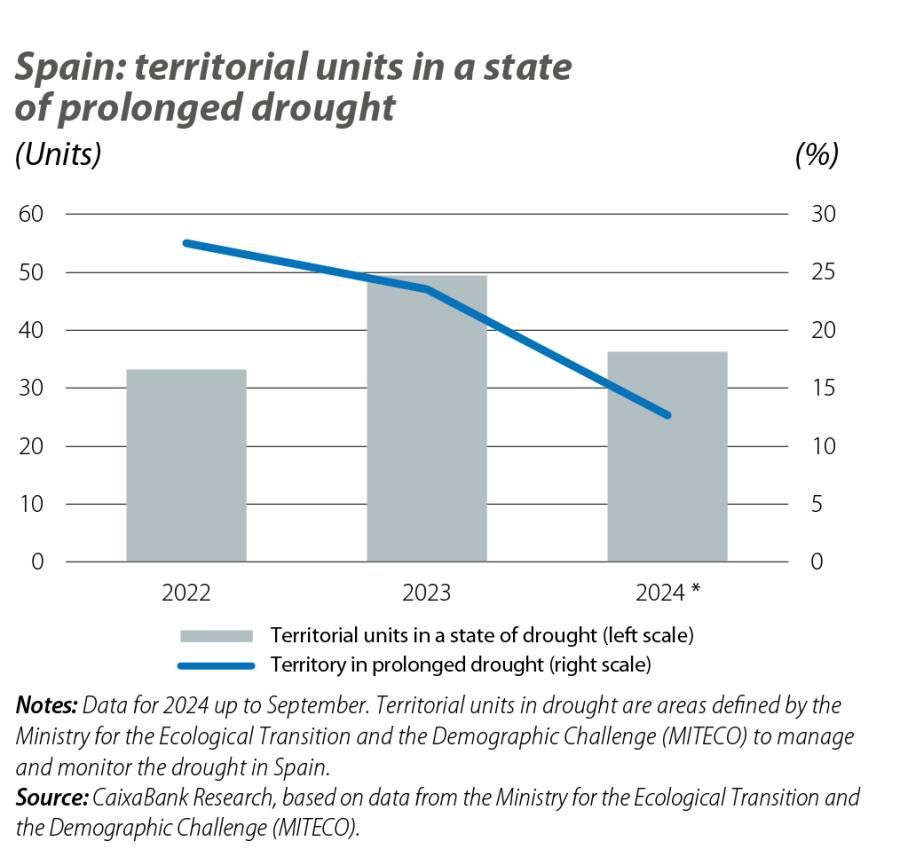

The drought has been the other key factor determining agricultural production in recent years. In 2023, vegetable production fell once again (12.2%) and more sharply than in other major European producers. This decline in production particularly affected products from rain-fed crops such as olive oil (–58.6%), cereals (– 4.8%) and wine and must (–21.1%). Since mid-2023, there has been an encouraging improvement in the drought, with a reduction in the affected territory, so plant production is expected to improve in 2024. In the current year up until September, an average of around 13% of the territory was affected by drought, compared to 35%-45% in the second half of 2022.

The gradual moderation of these limiting factors of recent years is key for the improvement which we are already seeing and which is fuelling a favourable outlook for the 2024-2025 season. Cereal production is expected to increase by 88% compared to the previous season, while grape production for must and wine is anticipated to climb 17%. The outlook for olive oil has also improved significantly, with production expected to rebound by around 50% compared to last season.

Spain’s agrifood industry, for its part, has also begun to experience a revival after two years of deterioration due to increased production and input costs. In the year to date up until August, industrial production grew by 1.4% year-on-year (the first increase since 2021), thanks to a moderation in the growth of production costs, especially energy and fertilisers. However, beverage manufacturing fell 4.2% in the same period due to a correction following the sharp rebound in 2021 and 2022.

Food inflation eases, offering relief to households

The rise in production costs in the food industry has largely been passed on to final consumer prices in recent years. Thus, food inflation peaked in February 2022 (16.7%) before embarking on a clear downward trend, falling to 1.6% by September 2024. In any case, the cumulative increase in food prices since 2019 (32%) has had a significant impact on Spanish households’ pockets: expenditure on food accounted for 26% of total household expenditure in 2023, compared to 23.4% in 2019, with other expenditure items falling accordingly.3

- 3For an in-depth analysis of the recent pattern of food inflation and the impact on households’ food expenditure in Spain, see the article «Food prices offer a respite» in the Agrifood Sector Report 2024.

Agrifood exports enjoy good health

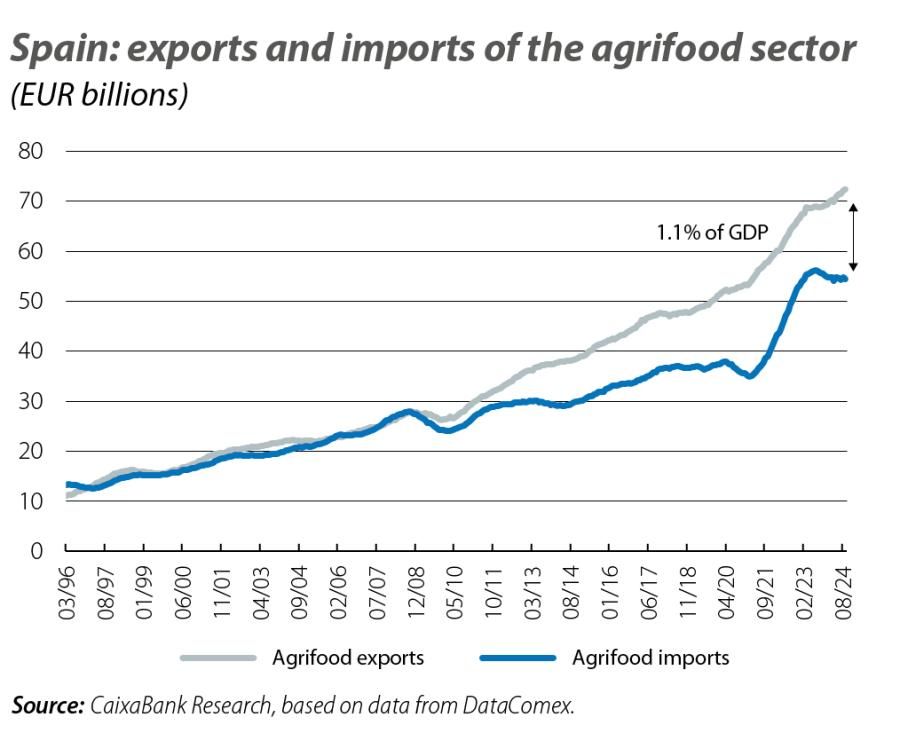

Agrifood exports have enjoyed a strong recovery in 2024, recording 4.6% growth in volumes (after two years of declines) and 6.7% in value terms in the cumulative period between January and August. The agrifood sector has maintained a significant trade surplus since 1996, being one of the highest among all sectors of the economy. In the first half of 2024, this surplus reached 1.1% of GDP, an impressive figure only surpassed by the exceptional results recorded in 2020 and 2021 during the pandemic.

The diversification of export destinations and the improvement in production have been key factors in this recovery. The main destinations for Spain’s agrifood exports include EU countries, but the sector has steadily managed to diversify its range of destinations to encompass emerging markets in Asia and Latin America, and this has helped it to overcome the many challenges it has faced in recent years.4

- 4The article «The good health of Spanish agrifood exports» in the Agrifood Sector Report 2024 includes a detailed analysis of the exports of Spain’s agrifood sector.