The growth of housing demand, one of the most positive surprises of 2021

In a context of gradual recovery of the Spanish economy during 2021, the trend in the real estate market has been very encouraging, especially on the demand side.

In a context of gradual recovery of the Spanish economy during 2021, the trend in the real estate market has been very encouraging, especially on the demand side. Up to October there were 468,000 sales, up 36% compared to 2020 and 8.3% compared to 2019, and the level of activity is on course to have reached 545,000 sales by the end of 2021, the highest figure since 2008. Among the autonomous community regions, there are only three that did not recover their pre-pandemic activity levels in 2021 (up to when there is available data): the Basque Country, which has been badly affected by the health crisis, and the Canary Islands and Balearic Islands, which are the most dependent on international tourists.

Much of this revival is driven by the materialisation of the pent-up demand and «forced» savings that were accumulated during the lockdowns and while the strict mobility restrictions were in force, as the combination of these factors and the favourable financing conditions have made buying and investing in real estate more appealing. However, as time passes by, some of the aspects that have characterised the post-lockdown demand are beginning to fade: (i) the revival of demand is not only being driven by new housing, but also by existing housing, which is gaining momentum and already exceeds pre-COVID levels; (ii) the preference for living outside major cities or provincial capitals has been moderating; (iii) the size of the homes being bought appears to have stagnated in Q1 2021, having increased markedly in 2020; (iv) the portion of sales relating to detached houses peaked at the end of 2020, and (v) the demand among foreigners is gradually picking up, especially since the summer, following the easing of mobility restrictions and the arrival of non-residents.

In 2022, the main factors influencing residential demand will continue to support activity

Despite the new wave of infections, the outlook for the year as a whole is favourable and we expect the labour market to maintain a good rate of job creation; household disposable income is showing clear signs of recovery and much of the pent-up savings accumulated at the height of the pandemic are also being spent on housing investment; household formation is recovering following the decline it suffered during the months of lockdown; foreign demand for housing will hopefully continue to recover, and financing conditions will remain favourable. Despite all this, the intense growth rate of 2021 does not seem sustainable, and certain temporary factors that have boosted demand in 2021 will fade in 2022. Thus, we expect that sales will moderate to levels similar to those of 2018-2019, slightly above 500,000 transactions per year.

Supply is recovering, but could be hampered by supply shortages

The steady rate of construction completion certificates seen in 2020 continues: in the first nine months of 2021, some 68,600 homes were completed, up 13% compared to 2020 and 26% versus 2019. However, these figures do not reflect the current status of the supply of new housing, as in many cases they refer to developments which were begun prior to the pandemic. Planning permissions for new housing, meanwhile, are up 26% year-on-year to September, but are still 4% below 2019 levels.

In any event, if the current pace is maintained, some 105,000 such permits will have been issued in 2021 as a whole, very much in line with 2018 and 2019. Moreover, the medium- and long-term outlook for new housing production remains positive, given the strength of the factors driving demand and the the arrival of the European NGEU recovery funds, which will act as a catalyst by being allocated to renovations and boosting the supply of rental housing. On the other hand, rising commodity prices and supply chain problems could hamper the housing supply. According to data from Eurostat, the sector’s costs are growing at a rate of over 12% per year as of September (all-time peak), while the prices of certain supplies are growing by over 16%.

Housing prices are beginning to climb

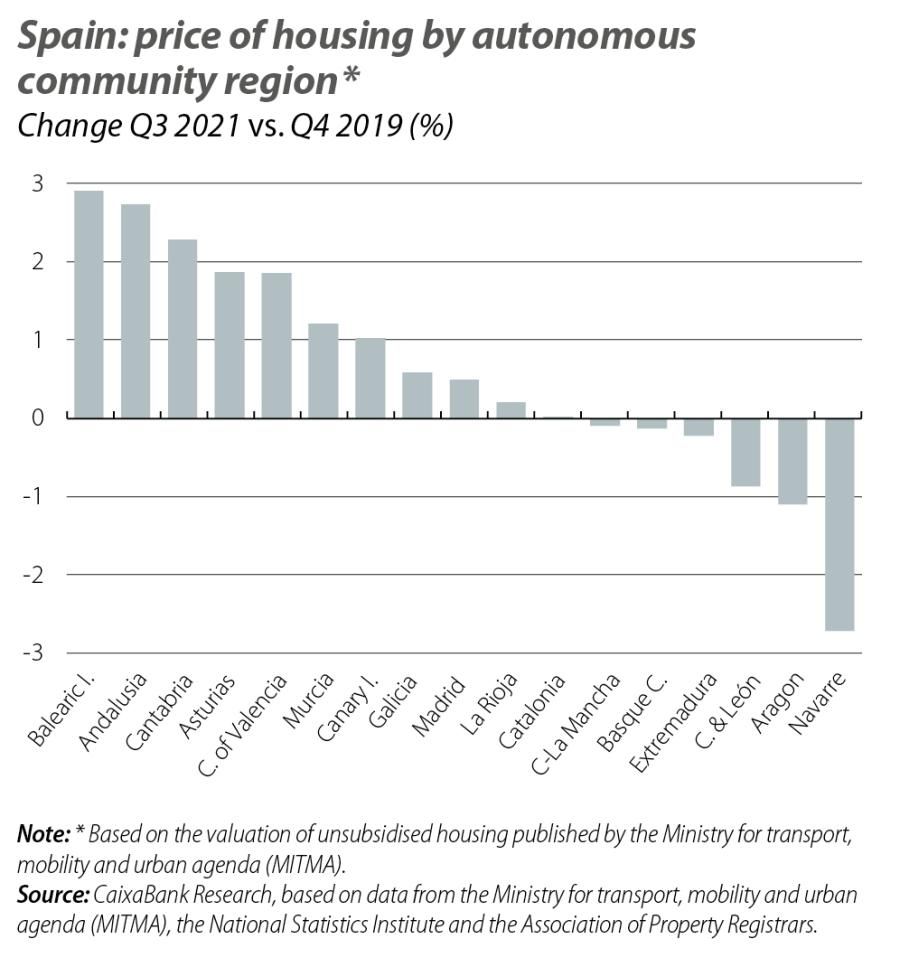

The widespread rise in demand and the property development sector’s reduced capacity to respond are driving up prices, especially in the new housing segment. Since the year-on-year rates reached their low point between Q4 2020 and Q1 2021 (depending on the indicator), prices have followed an upward trajectory throughout 2021, rising by between 3.3 pps (National Statistics Institute’s price index) and 5.5 pps (Association of Property Registrars’ price index) up to Q3 2021. Thus, prices are 6.6% above pre-pandemic levels, albeit still 12% below the 2007 peak (according to the NSI price index). This trend is observed in all autonomous community regions, albeit to different extents, and not all regions have yet surpassed pre-pandemic levels (Navarre, Aragon and Castile and León, among others).

In the short term, the greater pull from demand compared to supply, the rise in construction costs (an effect which is proving more persistent than initially expected), as well as simply the inertia of housing prices all suggest that they will continue to climb.

In the medium and long term, given the absence of imbalances in the main factors which determine demand and supply, we do not expect prices to enter a worrying upward spiral; rather, their growth will probably be more in line with changes in household income, particularly once the «champagne effect» of demand has been diluted, supply has recovered more significantly and commodity prices have moderated.