Sector growth in 2025: robust and across the board, but with some differences

In 2024, all sectors of the Spanish economy have recorded growth, with only a few exceptions. In addition, the number of sectors in a situation of weakness has steadily declined, while that of sectors in expansion has increased. The outlook for 2025 is equally promising, although a slight moderation is anticipated in some cases.

In 2024, all sectors of the Spanish economy have recorded growth, with only a few exceptions. In addition, the number of sectors in a situation of weakness has declined, while that of sectors in expansion has increased, thanks to the gradual absorption of the significant shocks of recent years: the pandemic, supply problems, the energy crisis, rising production costs, drought and rising interest rates. The outlook for 2025 is equally promising, although a slight moderation is anticipated in some cases. In this article of the Dossier, we will explore how the various sectors of the Spanish economy have evolved throughout the year and what we expect in 2025.

2024 recap: widespread growth, but with nuances

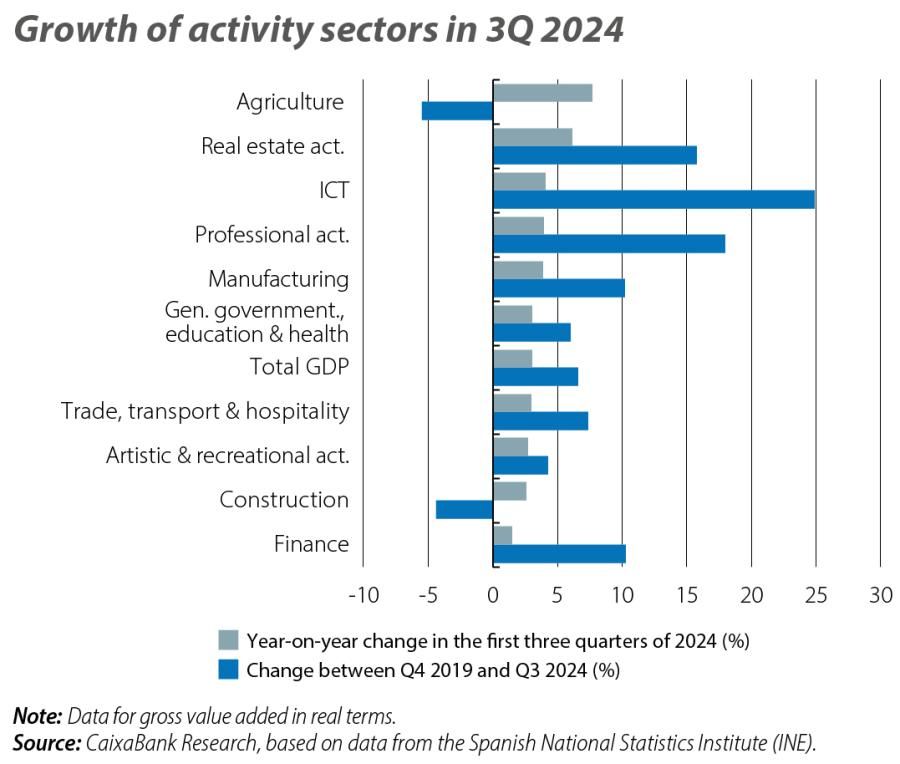

The Spanish economy has shown strong GDP growth throughout 2024, exceeding 3% year-on-year in Q2 and Q3. In the manufacturing industry, this growth has been particularly robust in some branches, such as the chemicals, pharmaceuticals and paper industries, driven by a moderation of energy bills and an increase in exports. However, sectors such as the textile and extractive industries have continued to shrink. Special mention should be made of the automotive industry, which experienced a strong rebound in 2023, following the sharp fall in the post-pandemic years. However, the sector is currently beginning to show signs of weakness as it faces key challenges in the transition to electric vehicles due to fierce international competition, particularly from China. Overall, the manufacturing sector grew by 3.9% in the first three quarters of 2024 compared to the same period in 2023, and in Q3 2024 it exceeded the level of Q4 2019 by 10.2%, while the GDP of the economy as a whole exceeded that level by 6.6%.

Within services, those related to tourism have continued to record strong growth, albeit at a lower rate than in 2023, due to the normalisation of growth rates now that the effects of the pandemic have been left behind.1 Besides tourism, other service sectors are also performing very well, such as real estate activities, which has been favoured by strong housing demand and lower interest rates. Also of note is the strong growth of higher value-added services, such as information and communications, and professional, scientific and technical activities, sectors that are increasingly open to the outside world: exports of non-tourism services grew 9.9% year-on-year in the period from January to August on a cumulative basis, representing 6.9% of GDP.

The agriculture, forestry and fishing sector has also made a remarkable recovery, with 7.7% year-on-year growth in the first three quarters of 2024. This has been thanks to the improvement in weather conditions and the gradual reduction in production costs, enabling the sector to overcome the sharp fall experienced in 2022. Despite this positive trend, the GVA of the sector is still 5.5% below the level of Q4 2019.2

Finally, the construction sector has registered strong growth (2.6% year-on-year in the first three quarters of 2024), but it still lies 4.4% below its pre-pandemic figures. The stabilisation of production costs and the strength of demand are supporting a certain revival of the housing supply, as shown by the number of new construction permits being granted (+16.4% year-on-year between January and August 2024). Non-residential construction remains very weak, but there are signs of stabilisation according to the amount of the official government tender (–1.4% year-on-year between January and June, compared to –10.6% in 2023).

- 1Specifically, we estimate that tourism GDP has grown by 6% in 2024 (compared to 7.6% in 2023), although its contribution to GDP growth has remained very significant (0.8 pps in 2024 versus 0.9 in 2023).

- 2See «Spain’s agrifood sector enjoys a revival in 2024 thanks to the moderation of production costs» in the Agrifood Sector Report 2024.

Which sectors will lead the growth in 2025?

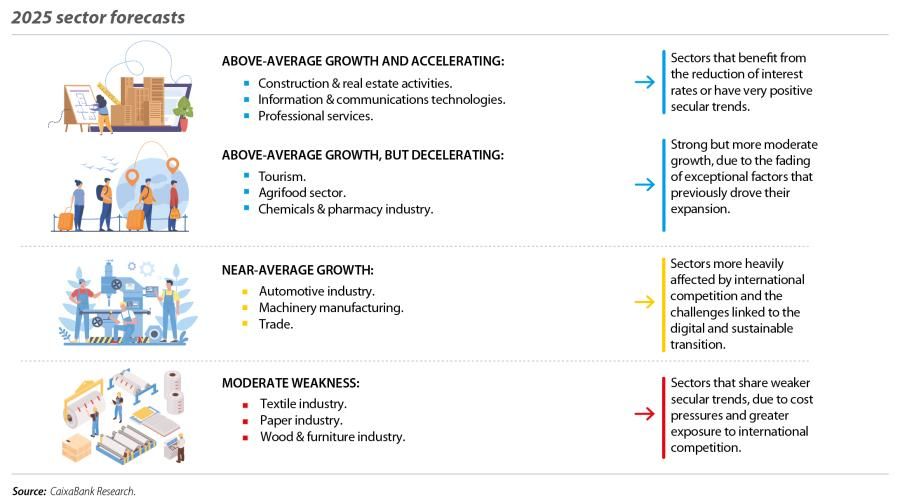

We expect the Spanish economy to grow by 2.3% in 2025 – a very significant rate, albeit slightly more moderate than in 2024 (2.8%).3 This slowdown (of 0.5 pps) is largely explained by the lower contribution of the tourism sector, which we expect to contribute between 0.4 and 0.5 pps to GDP growth instead of the 0.8 pps of 2024. In any event, we expect to see growth in tourism GDP in real terms of 3.4%, which is higher than that of GDP for the economy as a whole, meaning that the role of the tourism sector in the economy will continue to grow (going from 13.0% of total GDP in 2024 to 13.2% in 2025). After breaking all records in 2024,4 we predict that the tourism sector will continue to expand thanks to a continued reduction of its seasonality (stronger growth outside the peak season), the recovery of real disposable income in the source countries (as the inflationary shock finishes dissipating) and the perception of geopolitical stability in Spain.

Besides tourism, we expect other service sectors, with very positive secular trends, to continue to perform very well in 2025. These include the information and communications technology (ICT) sector and professional, scientific and technical activities, both of which are drivers of the digital transition and are highly investment-intensive, and which will therefore benefit from the fall in interest rates. In fact, the rate cuts that began in 2024 will have their greatest impact on the real economy in 2025, and this will be a key factor for certain sectors that are highly sensitive to financing costs, such as construction and real estate activities.

The improvement in financing conditions will also boost investment in equipment across the board, and especially in the manufacturing sector, which is more investment-intensive than services. Within the manufacturing sector, we expect the pharmaceuticals industry to outperform the rest, as it is highly competitive at the international level, as well as being highly specialised, and it is a major driver of exports and R&D investment.

On the other hand, in the case of the most energy-intensive branches of manufacturing (paper and graphic arts, chemicals, and the construction auxiliary industry, among others), which have experienced strong growth in 2024 thanks to the fall in energy bills, the growth rate is expected to normalise. In any event, these industries will continue to benefit from the competitive advantage offered by the lower energy costs which Spain’s industrial sector is currently enjoying relative to its European competitors. The path of the automotive industry will continue to be largely determined by the profound technological transformation and the significant international competition in the production of electric vehicles.

Finally, the agriculture, forestry and fishing sector will continue to recover, supported by improved weather conditions and cost reductions. However, the capacity to adapt to climate change will be crucial for the long-term sustainability of this sector and the agrifood industry.

In short, the Spanish economy is showing broad-based strength, with key sectors such as ICT, professional activities, the pharmaceuticals industry and tourism driving growth. Nevertheless, cost pressures and international competition pose major challenges, especially for the automotive industry. The outlook for 2025 is positive thanks to the easing of financing conditions, the investments of NGEU funds and the competitive advantage provided by lower energy costs. Taking advantage of this favourable economic situation will be key to continue diversifying and strengthening Spain’s business sector.