The Portuguese economy loses momentum in Q2

Portugal’s GDP recorded only a small advance in Q2, and job creation and inflation slowed in August.

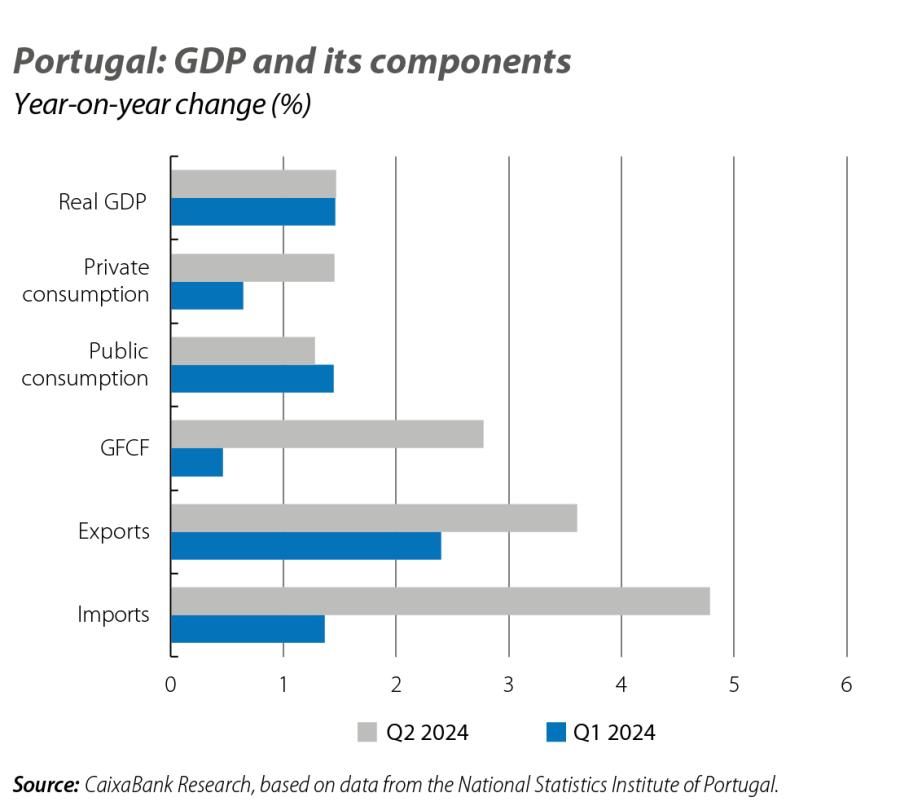

In Q2 2024, GDP grew by just 0.1% quarter-on-quarter, marking a significant slowdown from the 0.8% recorded in Q1. This pattern is explained by the slowdown of exports and the acceleration of imports, which has led to foreign demand making a negative contribution to quarter-on-quarter GDP growth (–0.4 pps). This contrasts with the positive contribution from domestic demand (+0.5 pps), which has been supported by investment in machinery and transport equipment. Private consumption, on the other hand, is slowing. In annual terms, GDP growth remains at 1.5%.

Although the figure for Q2 was lower than that anticipated by CaixaBank Research, we remain reasonably optimistic about the path of economic activity in the second half of the year thanks to tourism, the correction of inflation and the fall in financing costs. Moreover, the gradual increase in the execution of European funds will support investment. Consequently, we continue to project GDP growth in excess of 1.5% in 2024, and with upside risks.

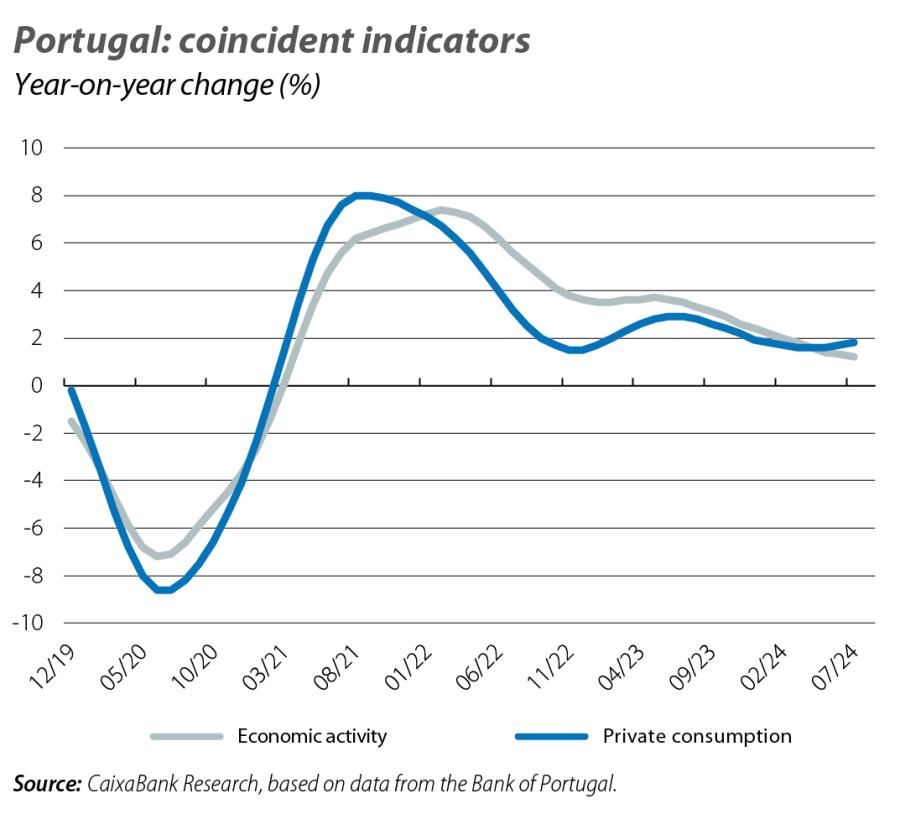

On the one hand, the Bank of Portugal’s economic activity indicator slowed in July, pointing to a year-on-year growth of 1.2%, while the indicator corresponding to private consumption accelerated once again in July, to 1.8% year-on-year. The sentiment indicators for August, meanwhile, reveal signs of caution among consumers and optimism in the construction and industrial sectors. Finally, tourism continues to show strong growth, with year-on-year increases in the number of tourists and overnight stays of 6% and 5%, respectively.

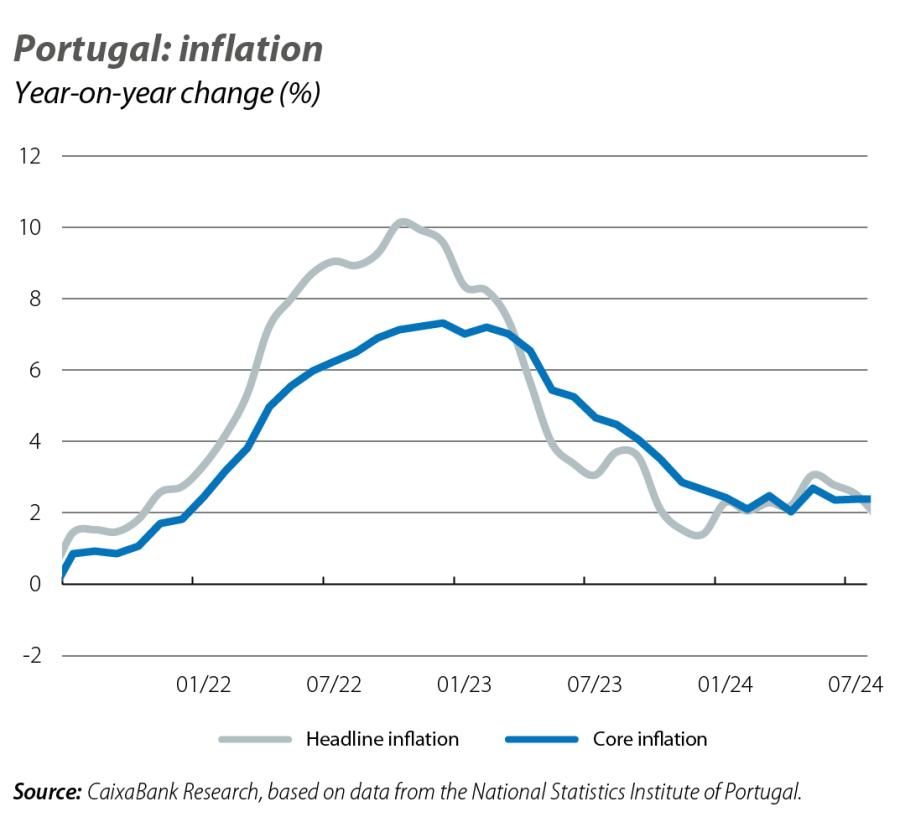

60 pps lower than in July, as a result of a 1.4% fall in energy prices and a slowdown to 0.8% (2.8% in July) in the case of food. Excluding these two components, the core inflation rate has stabilised at 2.4%, confirming the slow pace of the disinflationary process. The story over the coming months could be less favourable, especially given the pattern in energy prices: the government recently announced the partial withdrawal of the fuel support measures. Also, starting from October, electricity and gas prices and tariffs will be updated. These factors support our expectation of a rebound in inflation in the closing months of the year, while the core rate will remain at around 2.4%.

In Q2, the pace of jobs growth slowed from 2.8% year-on-year in Q1 to 1.0%. This brings the total number of workers to 5.1 million, the highest figure since Q3 2008. As for wages, the average real monthly gross remuneration per worker increased by 3.6% in Q2, pointing to a recovery in the purchasing power of those in employment – a positive sign for the momentum of private consumption.