The mismatch between supply and demand determines the behaviour of Spain’s real estate market

The combination of rapid population growth and the gradual decline in interest rates, coupled with the lack of supply, is driving up home prices, particularly in the new housing market and in the most buoyant regions, as well as in those that are most popular with tourists.

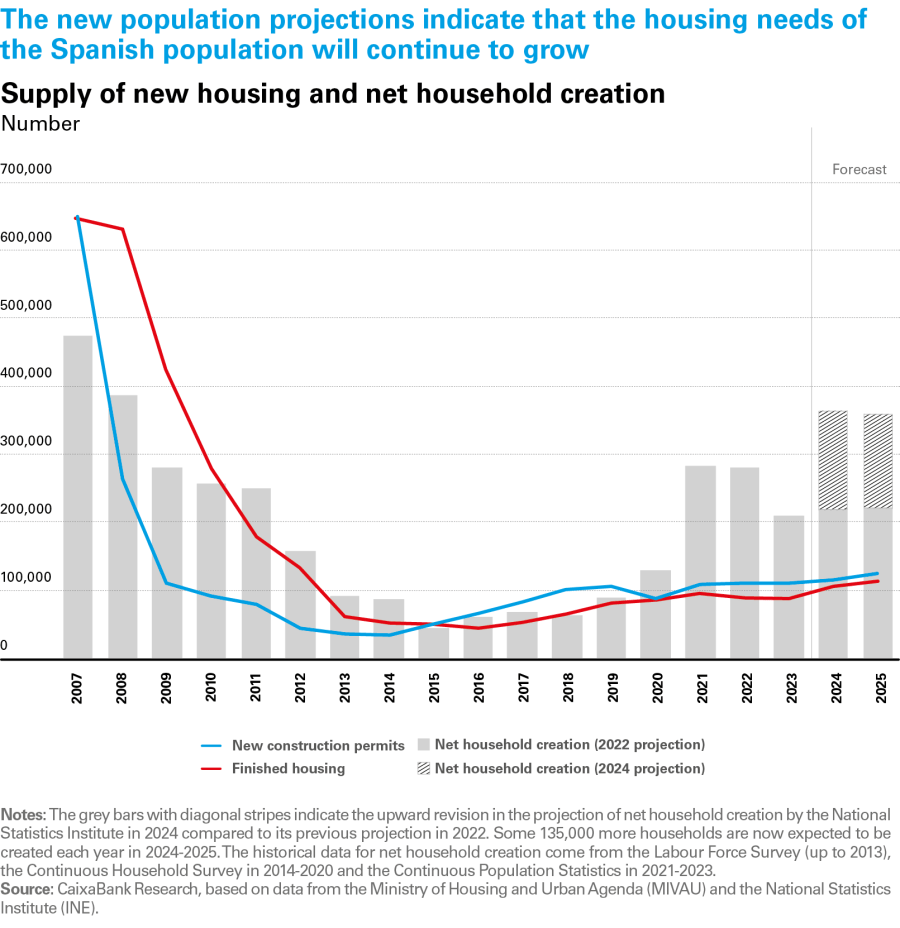

Housing demand in Spain remains very high, driven by the buoyancy of the economy, the strength of the labour market, population growth and foreign demand. Supply, however, remains rigid, affected by production costs and especially by the structural problems in the sector. Although the number of new construction permits has picked up in the opening months of 2024, the gap with respect to net household creation is significant. Moreover, the new projections for household creation published by the National Statistics Institute indicate that this gap will continue to widen in the coming years if supply does not react. The combination of rapid population growth and the gradual decline in interest rates, coupled with the lack of supply, is driving up home prices, particularly in the new housing market and in the most buoyant regions, as well as in those that are most popular with tourists.

The real estate market continues to show significant strength in 2024. The number of home sales in the opening months of the year declined slightly compared to the same period last year, down 4.1% year-on-year in the cumulative period from January to May.1 This nevertheless exceeds the average number of sales recorded in the pre-COVID decade (2010-2019) by 43%. In addition, all segments of residential demand are showing resilience, although new housing continues to enjoy particular appeal and the strength of foreign demand stands out, especially among residents in our country.

- 1. In 2023, home sales declined by 10% (to 585,000 units), due to the impact of the interest rate hikes and a correction after the exceptional figures of 2021-2022 which followed the pandemic. This decline was concentrated in the second half of the year.

The number of home sales in the first few months of the year has remained high, with a 4.1% decline year-on-year

The demand for new homes remains high, despite having experienced a higher price increase than existing homes.2 Specifically, new home sales stand at around 110,000. This is a similar level to the average number of new construction permits granted in the last three years, suggesting that the market is easily absorbing all the production that is completed. However, new home sales remain below the average for the decade 2010-2019, limited by the shortage of new developments. On the other hand, the volume of activity in the existing home market remains well above the historical average. This is due to the high demand for housing, which cannot be satisfied by new builds, as well as the lower prices in this market segment (on average, prices are 16% cheaper than among new homes, according to data from the Ministry of Housing and Urban Agenda, MIVAU).

- 2. Between Q1 2020 and Q1 2024, the price of new homes (per the INE) grew by 31.4% in nominal terms, while that of existing homes increased by 18.6%.

The demand for new homes remains high despite the increase in prices. However, the available supply limits the number of sales

New houses show the greatest appeal, but sales are limited by the lack of supply

Sales involving foreign buyers, including both residents (thanks to immigration flows) and non-residents (thanks to the international appeal of our country), remain a key factor in the resilience of the housing market. Although it is moderating compared to the peaks recorded in 2022, sales activity remains historically high. In the period 2021-2022, sales to foreign buyers made an exceptional contribution to the increase in the total number of sales in Spain, especially in the most buoyant areas (Madrid and Catalonia) and the most touristy ones (the Mediterranean coast and the island regions). An analysis of the most recent quarters reveals, on the one hand, that the decrease in sales to foreign buyers has occurred in the non-resident segment (international second-home buyers) and, on the other, that the rate of decline has been steadily moderating. The new population projections produced by the National Statistics Institute point to a significant increase in the foreign population residing in Spain (780,000 people per year in 2024-2025), suggesting that we will see continuity in the buoyancy of housing demand among foreign residents.

Sales involving foreign buyers, including both residents and non-residents, remain a key driver of housing demand in Spain

The sale of houses to foreign buyers remains a key factor

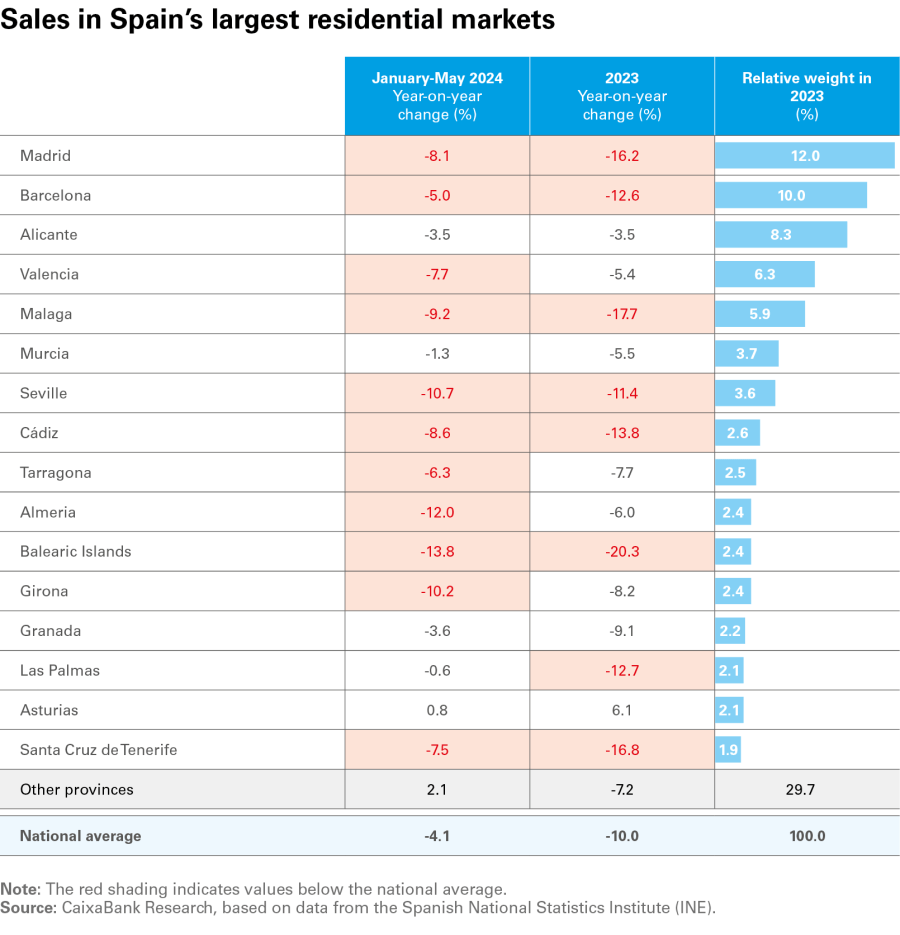

Despite the fact that across Spain as a whole the number of home sales in the first four months of 2024 remained at similar levels to those of the same period in 2023 (–4.1% year-on-year in the cumulative period from January to May), an analysis by province reveals that home sales are declining in some of the country’s major housing markets. In the following table we can see that 15 out of the 16 largest provinces in terms of the number of transactions3 experienced a decrease in the number of sales in the first five months of 2024.

The sharpest falls were recorded in the Balearic Islands (–13.8%), Almeria (–12%), Seville (–10.7%), Girona (–10.2%), Malaga (–9.2%), Cádiz (–8.6%) and Madrid (–8.1%). These declines are in addition to those recorded in 2023, which generally speaking were already in excess of 10% of the national total. The cases of Barcelona and Las Palmas are also noteworthy, as despite registering moderate declines in the first five months of 2024 they had experienced a sharp fall in 2023. In contrast, in the rest of the provinces, the number of sales decreased more moderately in 2023 (–7.2% versus –10% for the national total) and 2024 is also bringing more favourable results (2.1% year-on-year increase in the cumulative total from January to May). The ability of these more secondary markets to sustain the demand for housing is limited, so we expect to see some moderation in activity in the second half of the year.

- 3. These 16 provinces contribute 70% of the total number of sales.

Home sales have fallen in 15 out of the 16 largest housing markets

The outlook for housing demand over the coming quarters is favourable, as most of the factors that have been supporting the sector will remain present: economic buoyancy, high job creation that favours an increase in real disposable income in a context of falling inflation, and sturdy household finances. In addition, according to the new population projections by the National Statistics Institute, the boost provided by demographics could increase, while we must also consider the interest rate cuts that the ECB has begun to implement. In June, the central bank introduced the first cut of 25 bps in its benchmark interest rates (placing the refi rate at 4.25% and the depo rate at 3.75%), and the financial markets are anticipating two further rate cuts in the second half of 2024. This decline in benchmark interest rates is gradually translating to market interest rates: the 12-month Euribor stood at 3.65% in June 2024, some 0.36 points down on the value of a year ago, and the financial markets expect it to fall to around 3.25% by the end of 2024.4

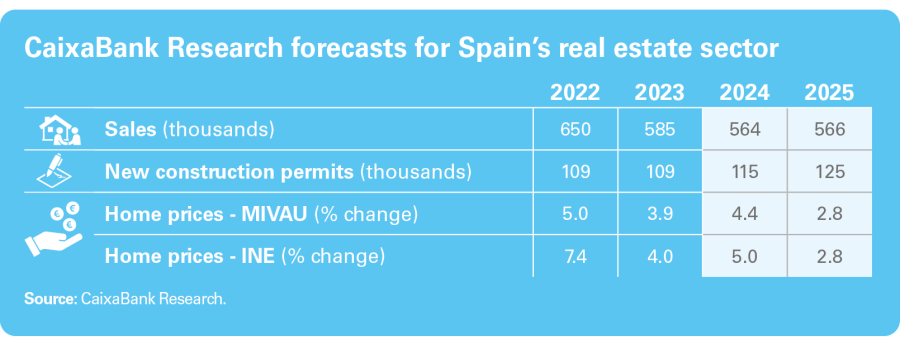

The strong demand witnessed in the early months of the year and the fact that the short and medium term outlook remains favourable have led us to raise our forecast relative to the previous report we published at the beginning of the year. Specifically, we now expect the volume of sales to reach around 565,000 homes per year in the period 2024-2025 (versus the previous estimate of 550,000).

- 4. For an analysis of our monetary policy expectations in the euro area, see the Central Bank Observatory on the CaixaBank Research website.

Despite the granting of new construction permits showing some dynamism in the first four months of 2024 (+14.4% year-on-year, reaching 114,700 homes in the last 12 months), the supply of new housing remains insufficient considering the fact that in 2023 some 208,000 new households were created, according to the Continuous Population Statistics produced by the National Statistics Institute.5 In addition to the structural factors that have weighed down the sector in recent years (shortage of land earmarked for development, difficulties in finding skilled labour, etc.), there are other more cyclical factors, such as high construction costs (despite stabilising in 2024, they remain 29% above 2019 levels) and regulatory uncertainty, among others. In spite of the need to drastically increase the supply of housing, the outlook is one of moderate increases in the coming quarters, since these factors are unlikely to be resolved within the current forecast horizon. In particular, we expect around 115,000 new construction permits to be granted in 2024 as a whole, gradually rising to 125,000 in 2025.

- 5. According to the Labour Force Survey, net household creation stood at 265,000 in 2023.

The National Statistics Institute’s recent update to its population and household projections for the next 25 years reveals that the country’s housing needs will be greater than previously estimated. On the one hand, net household creation of around 330,000 households per year is now anticipated in the period 2024-2028, compared to a figure of 215,000 households according to the previous projections for the same period. On the other hand, the average household size will continue to shrink in the coming years, and even more sharply than according to the previous projections. The combination of smaller households and a growing population means greater housing needs in the medium term.

The average household size will continue to shrink in the coming years. The combination of smaller households and a growing population means greater housing needs

It should be noted that there is significant variation from region to region in terms of the mismatch between supply and demand. The chart on the following page shows the number of new homes completed in the period 2022-2023 (the supply of new housing) in each region in proportion to net household creation (the demand for housing under either ownership or rental). In some regions, the number of new homes completed in the last two years falls far short of the demand, since it covers less than 30% of the households created (notably in the Valencian Community, Catalonia, the Canary Islands, Murcia and Galicia). This is a key factor in explaining the rise in property prices, as well as rental prices.6 Indeed, the rental price indicators produced by the main real estate portals (offer prices of new contracts) show considerable increases (6.3% year-on-year on average between January and May according to Fotocasa, and 12.7% year-on-year on average between January and June according to Idealista) and with an upward trend. The sharp price rises in new rental contracts is aggravating the housing affordability problems, an aspect which we analyse in detail in the article «The challenge of increasing the supply of affordable housing in Spain» in this same report. However, it should be recalled that in 2024 the update of rental prices in existing contracts is limited to 3%, in the absence of any other agreement between the parties. In fact, the rental component of the CPI, which encompasses the evolution of all rents (both new and existing contracts) shows much more contained increases of 2.2% year-on-year in June 2024.

- 6. For an in-depth analysis of the relationship between population and home prices, see the article «Population and home prices in Spain: a close relationship» in the Real Estate Sector Report of S1 2024.

The combination of a slight moderation in demand (although it is holding up better than expected) and the failure of supply to really take off is driving up home prices. We saw a moderation in 2023 due to the impact of the rise in interest rates, with advances of around 4% both according to the home price index produced by the National Statistics Institute (INE), which is based on transaction prices, and according to the appraised value of unsubsidised housing published by the Ministry of Housing and Urban Agenda (MIVAU). However, prices accelerated in the second half of 2023 and rose further still in Q1 2024 relative to the average recorded in 2023 (in year-on-year terms). The increase was particularly pronounced in the case of new housing (+10.1% year-on-year).

In the coming quarters we expect that falling interest rates and the mismatch between supply and demand will continue to support the growth of home prices. As a result of all of the above, we have increased our forecast: we now expect home prices (according to the INE index) to grow by 5.0% in 2024 (3.5% estimated previously) and by 2.8% in 2025 (2.5% previously).

In the coming quarters we expect that falling interest rates and the mismatch between supply and demand will continue to support the growth of home prices

There is an important revaluation in the case of new housing, which is 35% above the 2007 maximum in nominal terms

If we take a broader historical perspective on the pattern of home prices, and we place the benchmark at the peak reached during the real estate boom (Q3 2007), we see that the National Statistics Institute’s home price index in Q1 2024 stood 0.6% above the previous peak in nominal terms. However, in real terms, it is well below the levels of 2008, specifically 27% below. In any case, what we do observe is a significant rise in the value of new housing, which is 35% above the 2007 peak in nominal terms and just 1.8% below in real terms. This trend is no surprise given the high demand for this type of housing, which better satisfies buyers’ preferences due to its standards, location and greater energy efficiency, among other factors, as well as due to the greater impact of the increase in construction costs in this segment.

Home prices are far from the peak of 2007 in real terms