The markets, at the mercy of the elections and political uncertainty in June

Political uncertainty, the main source of volatility in the market, reduced investors’ appetite for risk in June, resulting in a marked reduction compared to May, although it remained high.

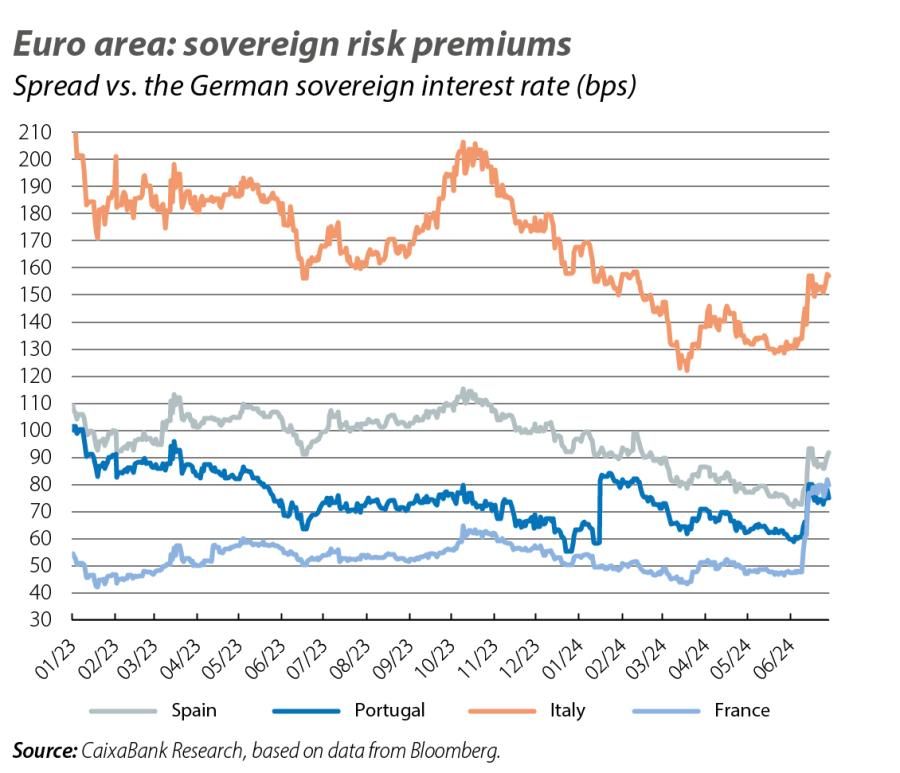

This source of instability reduced investors’ appetite for risk in June and, although still high, it moderated markedly compared to May. In developed markets, while the European elections did not bring any big surprises in aggregate terms, they did cause President Macron to call a snap general election. This, in turn, triggered some turbulence in European financial markets, with an increase in sovereign risk premiums and losses in the stock markets (particularly in France, where the movements were most intense, while the level of contagion to other economies was moderate). In contrast, across the Atlantic the US stock market continued to record gains and treasury yields fell amid a combination of lower pressure in the inflation data and strong economic activity. In emerging markets, Mexico’s elections were met with losses in local financial assets, while Indian and South African assets, which also saw post-election setbacks, bounced back in June.

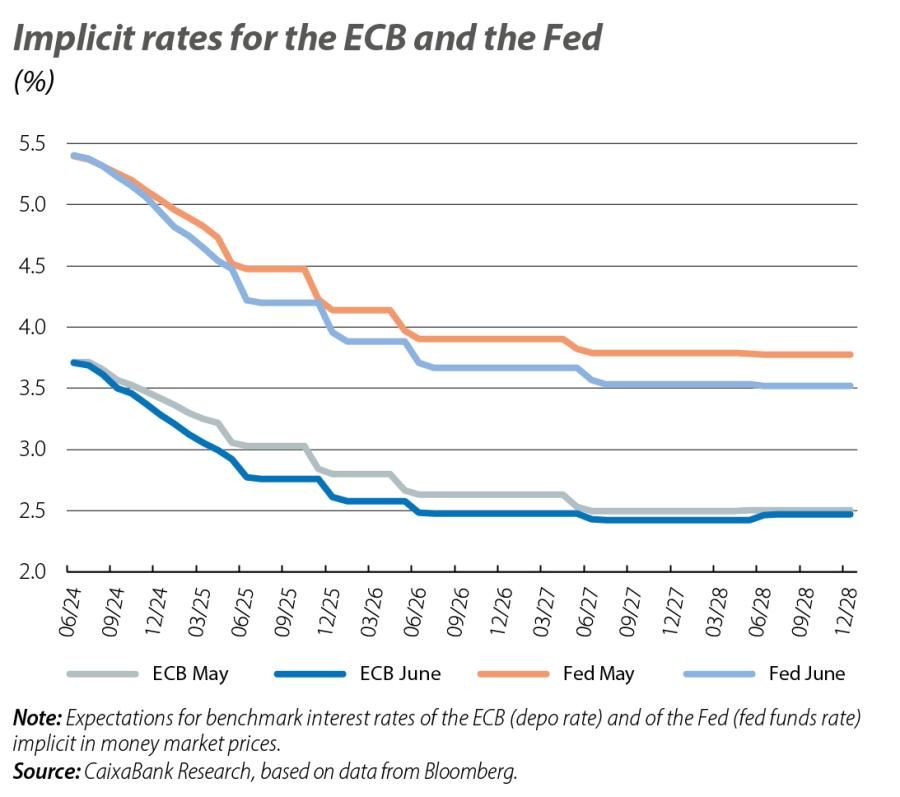

After being in synchrony for many months, the central banks in developed economies are beginning to show different sensitivities when it comes to interest rates. In June the ECB implemented an anticipated cut of 25 bps in its benchmark rates (bringing the depo rate to 3.75%), although since the meeting its leaders have already made a point of cooling expectations of another rate cut in July. Investor expectations, meanwhile, indicate that the next cut is likely to come at the September meeting if the economy performs as expected. The Fed, for its part, kept rates unchanged in June, although its members reflected a lower propensity to cut rates this year (specifically, compared to the three rate cuts suggested in March, June’s dot plot pointed to a single rate cut in 2024, albeit with a significant number of members defending two). Thus, at the end of June, the rates implicit in the money market were anticipating another rate cut by the ECB in September and, with a 60% probability, an additional one in December, while for the Fed the markets were pricing in an initial rate cut in September (70% probability) and another in December. On the other hand, the central banks of both Canada and Switzerland cut rates in June (in the case of Switzerland, for the second time this year), while the rest of the major developed central banks did not make any changes. Among these, the Bank of Japan stood out as the only one expected to raise rates in the remainder of 2024 and in 2025.

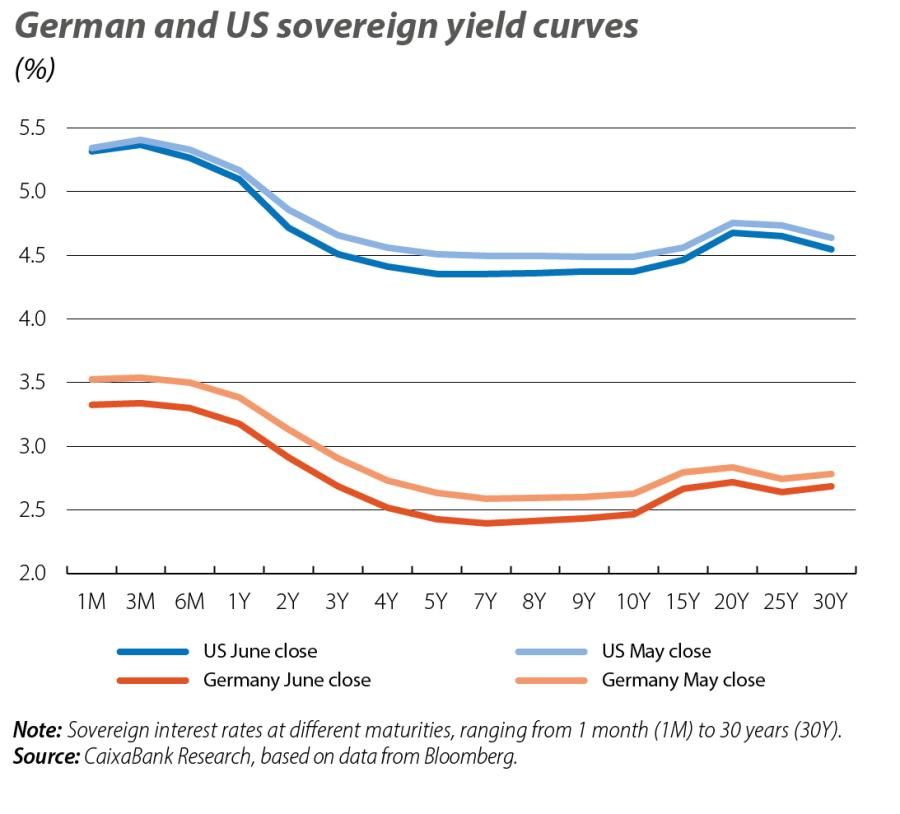

In the euro area, the rebound in political uncertainty and some below-expected economic activity data in June resulted in a sharp downward shift in the German sovereign yield curve, which was more intense in the short sections than in the long sections. Simultaneously, the peripheral 10-year risk premiums increased significantly in the month, with the French premium leading the movement (more than 30 bps) and inducing a degree of contagion to the rest of the peripheral economies (Italy, more than 25 bps, Spain around 20 bps, and Portugal around 15 bps). The increase of the French premium brought it to levels not seen since 2012 and slightly higher than Portugal’s. On the other hand, the US curve also shifted downwards.

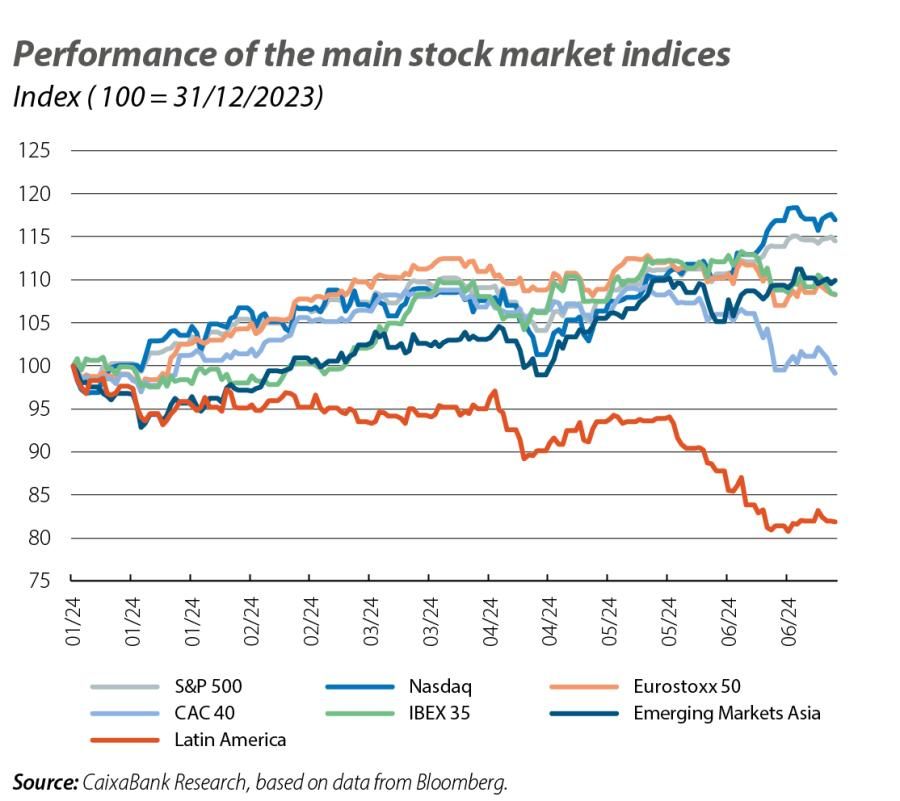

June brought mixed results in the European and US stock markets. In the case of the former, political uncertainty and the widening of peripheral spreads led to contagious among higher-risk assets, triggering losses in France’s CAC 40 index, as well as in the other national indices. In the US, meanwhile, the big tech firms once again capitalised on the declines in sovereign rates and the prospect of lower interest rates. This, coupled with sustained interest in AI-related companies among investors, led to gains in the Nasdaq index and spurred the S&P 500 to new all-time highs. This good performance, however, was not widespread, and both the weighted S&P 500 and the Russell 2000 index suffered setbacks in the month. On the other hand, the emerging-economy indices performed particularly well, thanks to the Asian stock markets (excluding the Chinese indices) and in spite of the poor performance of the Latin American stock markets, especially in Mexico, which recorded sharp losses in June.

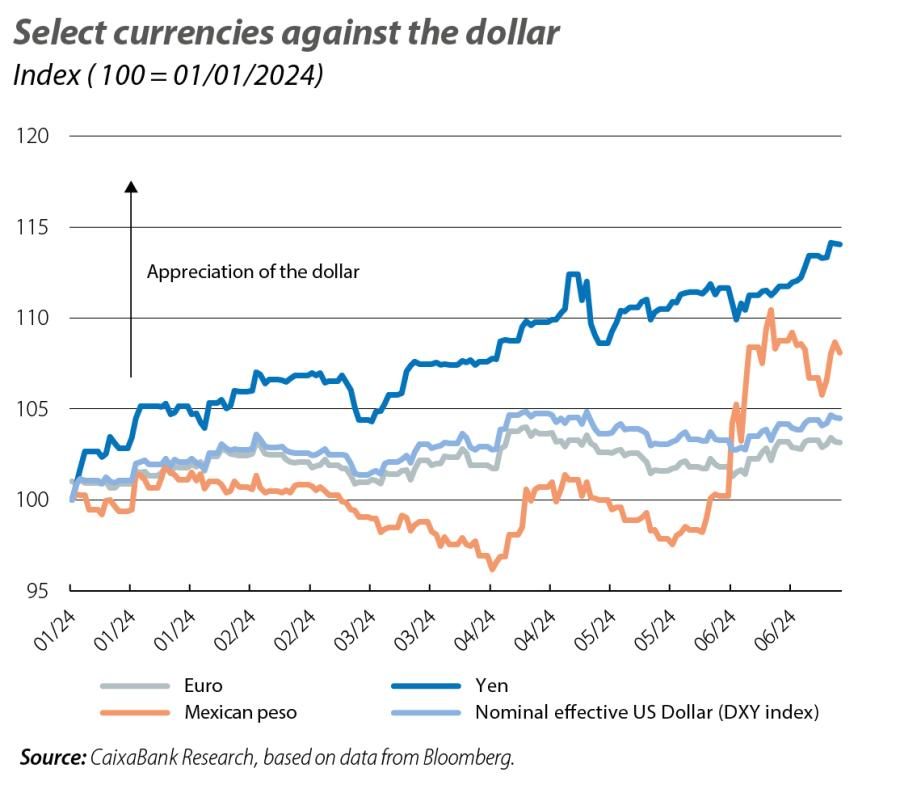

The US currency was favoured by the country’s macroeconomic strength, as well as by the various pockets of global geopolitical risk, which caused it to appreciate by more than 1% against the basket of other major currencies. Among the emerging currencies, the depreciation was most pronounced in the case of the Mexican peso (which lost almost 8% in the month) and the other Latin American currencies (COP, BRL and CLP), which were weighed down by political factors and different expectations of fiscal deterioration in the medium term. Among the developed-economy currencies, both the euro and the sterling weakened against the dollar in June as political uncertainty rose. On the other hand, the yen showed significant weakness for yet another month, reaching a 38-year low despite the fact that the Bank of Japan’s officials toughened the tone of their statements in recent weeks.

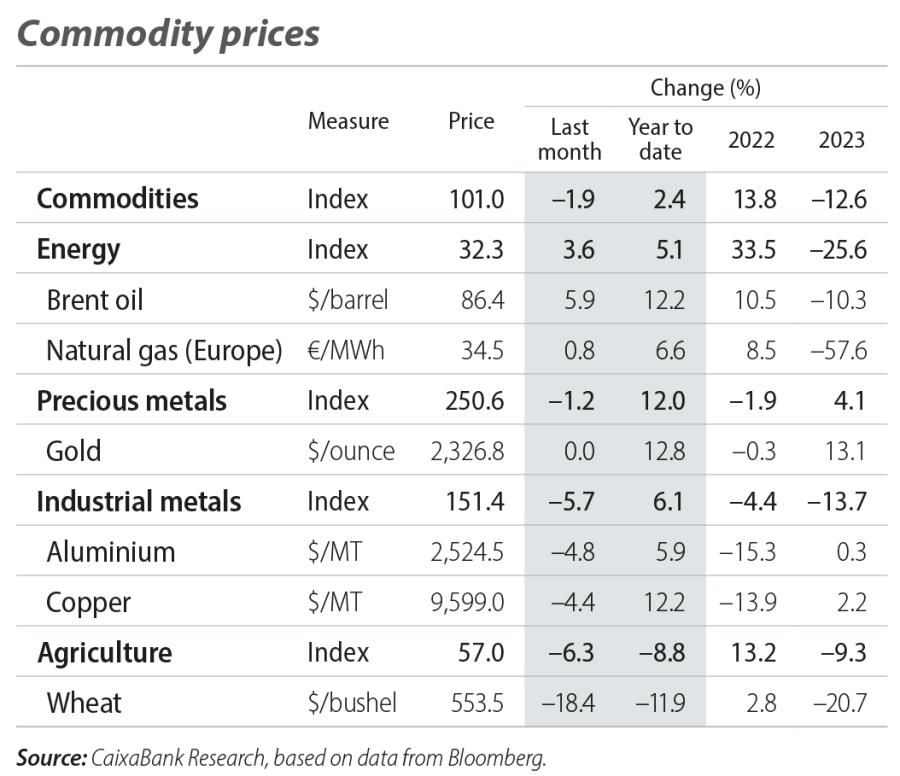

The month saw a rise in crude oil prices, in a context marked by OPEC’s announcement that it will extend its current production cuts through to October, at which point it will begin to gradually reverse them, as well as by global geopolitical instability and weak Chinese demand, which prevented further increases. On the other hand, June provided a respite in the rise in metal prices, which had been sustained and significant in the year to date (and, in many cases, looks set to continue, as we analyse in the Focus «Can metals gain more «shine»?» in this same report). This pause was partly due to increased investor confidence in the future path of the Fed’s monetary policy, which in June diminished the appeal of metals as a hedging asset.