Uncertainty in the interest rate outlook

Undoubtedly, the two key questions on investors’ minds and the central theme of the financial markets for much of the year – particularly in the last month – have been when the ECB and the Fed will lower interest rates and how many times they will do so in 2024. Thus, in May and early June the markets saw volatility in financial asset prices as investors sought clarity on the central banks’ future decisions.

These are the two key questions on investors’ minds and the central theme of the financial markets for much of the year, particularly in the last month. Investors are seeking the answer to these two unknowns amid any macroeconomic data and comments from central bank officials that might shed some light on the path ahead. Thus, in recent weeks, the direction of the markets has been shifting to the tune of what the data has suggested at each given moment. Initially, with indicators showing an easing in the inflation data and a certain cooling of economic activity, sovereign yields fell and stock markets rebounded, but this trend soon turned around amid data that raised doubts over the prospect of a rapid return of inflation to 2%, as well as rather hawkish comments from the central banks. On balance, in May and early June the markets saw volatility in financial asset prices as investors sought clarity on the ECB’s and the Fed’s future decisions.

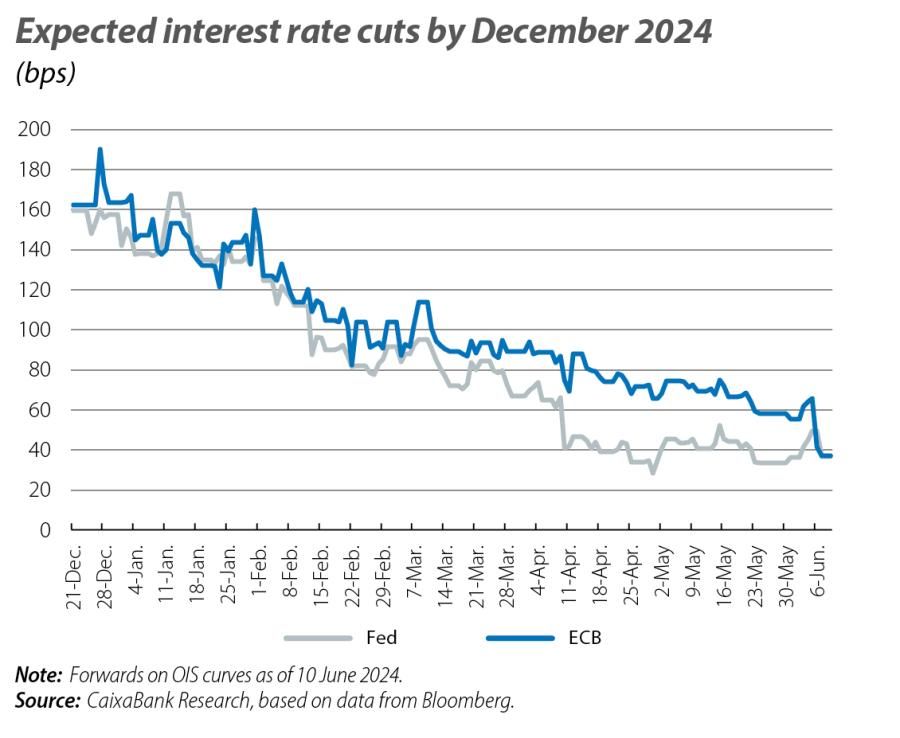

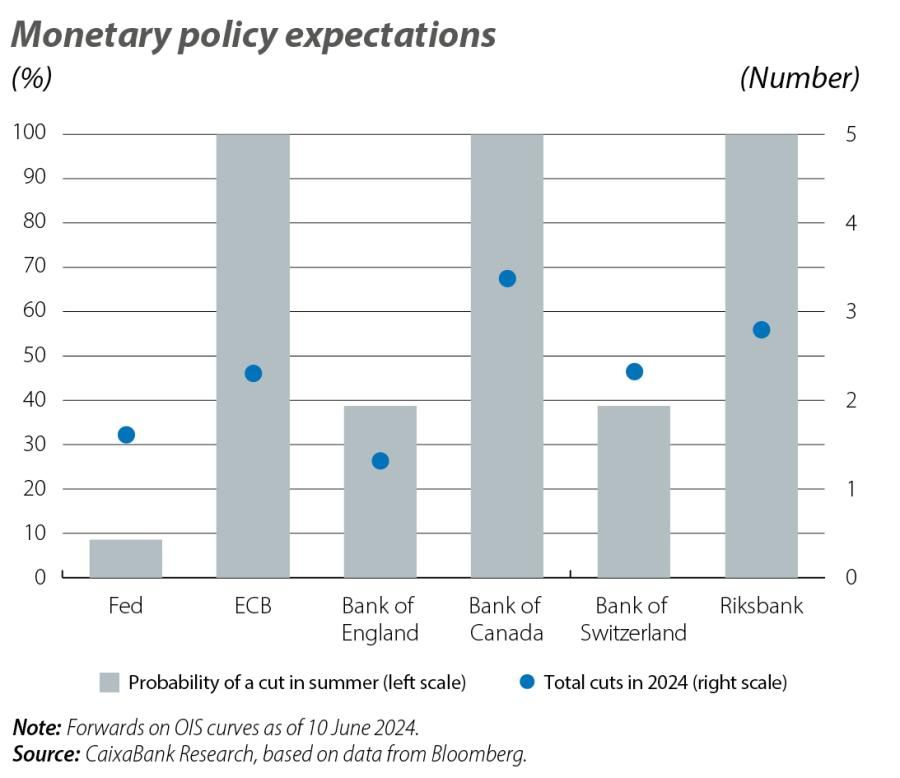

In May, Sweden’s central bank, the Riksbank, announced a 25-bp cut in interest rates to 3.75%. In doing so, it became the second developed-economy central bank to lower rates, following the Bank of Switzerland, which began the cycle of rate cuts in March. They were then joined by the ECB, which announced a 25 bp cut at its June meeting, bringing the depo rate to 3.75% and the refi rate to 4.25%, as had been already widely anticipated by the markets. The question is now the pace of cuts during the rest of the year. President Lagarde was very emphatic in her message that any new decisions would be guided by the data, and stressed that lowering rates in June does not entail a commitment to future cuts. The markets read this emphasis as a hawkish statement and, whereas in early May money markets were anticipating three rate cuts this year, at the close of this publication they were only anticipating one more (bringing the total expected number of cuts in 2024 to two). After all, besides Lagarde’s comments, we must take into account the better-than-expected GDP growth in Q1 and the fact that inflation is falling more slowly than anticipated, which is raising doubts in the markets about whether the ECB will implement as many rate cuts as had been anticipated at the beginning of May.

Also in Europe, while the Bank of England opted not to lower rates at its May meeting, it showed a more dovish tone and two of its members even voted in favour of a rate cut. However, following an uptick in inflation in April and the announcement of an early general election at the beginning of July, it appears likely that interest rate cuts will begin after the summer. It is also around that time that the Fed is expected to lower rates for the first time by 25 bps, with some uncertainty surrounding the exact month and how many times it will do so this year. In recent weeks, the Fed has appeared concerned about inflation, which remains above 2% and for which the outlook is shrouded in uncertainty. At the close of this report, the markets were clearly anticipating only a single rate cut in the remainder of the year, as the Fed is expected to keep rates high for longer, until it is sufficiently confident that inflation will steadily fall.

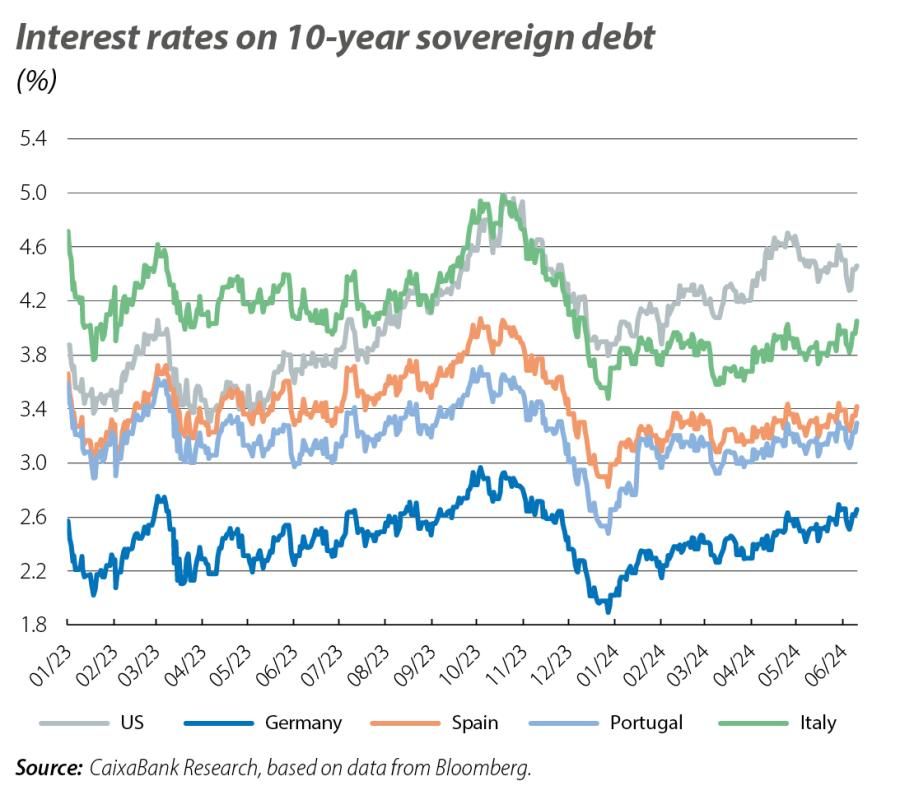

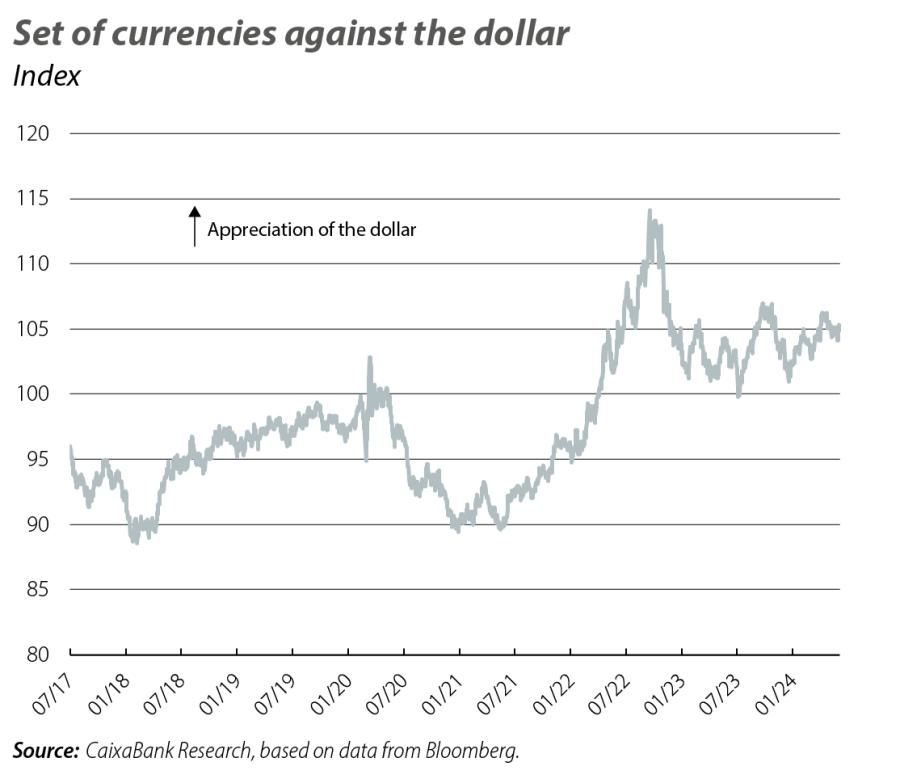

The same uncertainty that concerns the Fed is also affecting the financial markets. In the sovereign debt markets, yields began the month by falling after new data indicated signs of cooling in US economic activity (a slight increase in the unemployment rate and a fall in the ISM manufacturing index) and particularly after it was revealed that inflation fell in April. The 10-year benchmarks accumulated falls of up to 35 bps in the US and up to 15 bps in the euro area. However, more hawkish comments from members of the ECB and the Fed, as well as the publication of PMIs which showed a rebound in economic activity, were enough to turn market sentiment around. Since then, yields on sovereign bonds have steadily risen, even pushing the German 10-year benchmark to its six-month high (2.70%). This rally received additional impetus from the ECB’s restrictive message at its June meeting regarding its future decisions, as well as from US labour market data for the month of May, which stoked expectations of rates remaining higher for longer. Given this scenario, the dollar, which traded most of the month within a narrow range, appreciated in the latest sessions against its main peers, bringing the euro to 1.07.

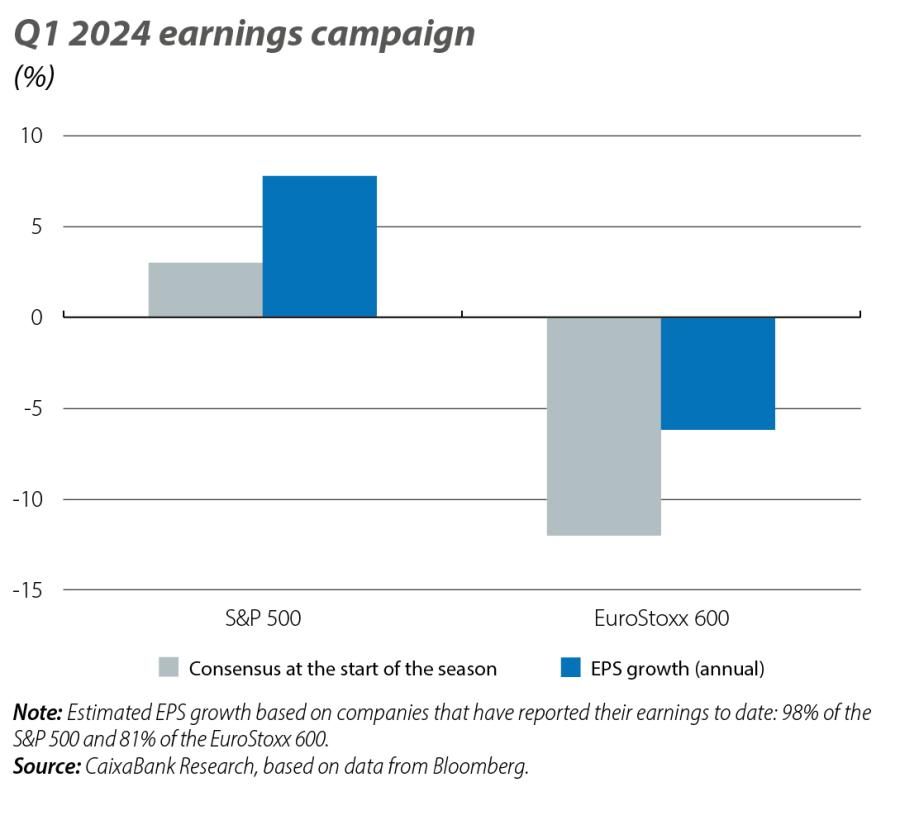

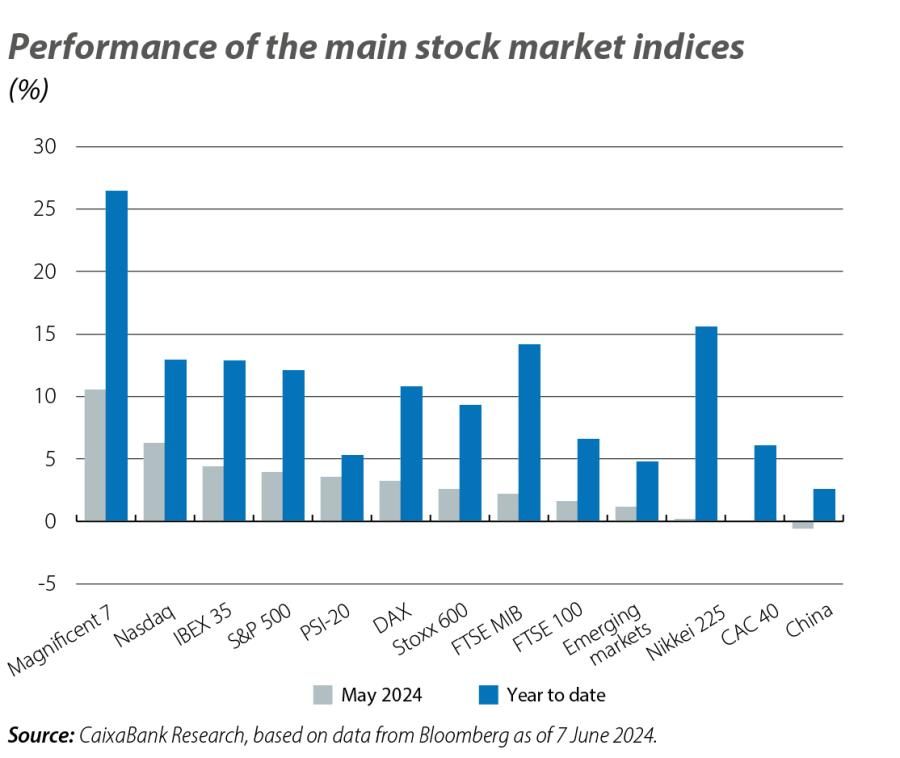

The sharp fall in sovereign yields at the beginning of the month, coupled with the conclusion of an earnings season that showed better-than-expected profit growth in Q1, triggered a new rally in the stock markets after having experienced setbacks in the previous month. In fact, the S&P 500, the Nasdaq, and the French and German indices reached new all-time highs. However, as sovereign yields made a U-turn, the stock markets lost momentum and during the second half of May they recorded losses, although these were not significant enough for the main indices to close the month in the red. By sector, US tech stood out, climbing +10% during May, as did the euro area’s banking sector, which after having advanced almost 4% last month has now accumulated a gain of around 20% in 2024 to date.

For the first time this year, the Brent barrel price fell (–7.7% monthly in May), placing it at around 81 dollars, mainly due to the weakening of China’s economic outlook. All this occurred in the lead-up to the meeting of OPEC and its allies on 2 June, at which members agreed to extend the voluntary production cuts in some countries (2.2 million barrels per day, or bpd) until Q3 2024, with a gradual phase-out planned through to the end of 2025, as well as the extension of the general cuts of 3.66 million bpd through to December 2025. Conversely, metal prices, both precious and industrial, recorded new advances (accumulating growth of over 12% since the beginning of the year). These were driven, on the one hand, by the tensions between supply and demand that exist in many of these assets and, on the other, due to the attractiveness of the financial performance of these assets compared to others such as equities or currencies.