China’s real estate sector: an updated diagnosis

After years of rapid expansion, the Chinese authorities have decided to put a stop to excessive leveraging in the real estate sector. Beginning in the summer of 2020 new limits on access to credit for property developers were imposed and the sector entered a prolonged phase of adjustment in which it still remains today.

After years of rapid expansion, the Chinese authorities have decided to put a stop to excessive leveraging in the real estate sector. On the one hand, they were concerned about the financial risks stemming from an uncontrolled housing bubble and, on the other hand, they had in mind the new guidelines of the «Common Prosperity» agenda, which in the real estate sector translated into the mantra «houses are for living in, not for speculation». In this context, beginning in the summer of 2020 new limits on access to credit for property developers were imposed and the sector entered a prolonged phase of adjustment in which it still remains today.

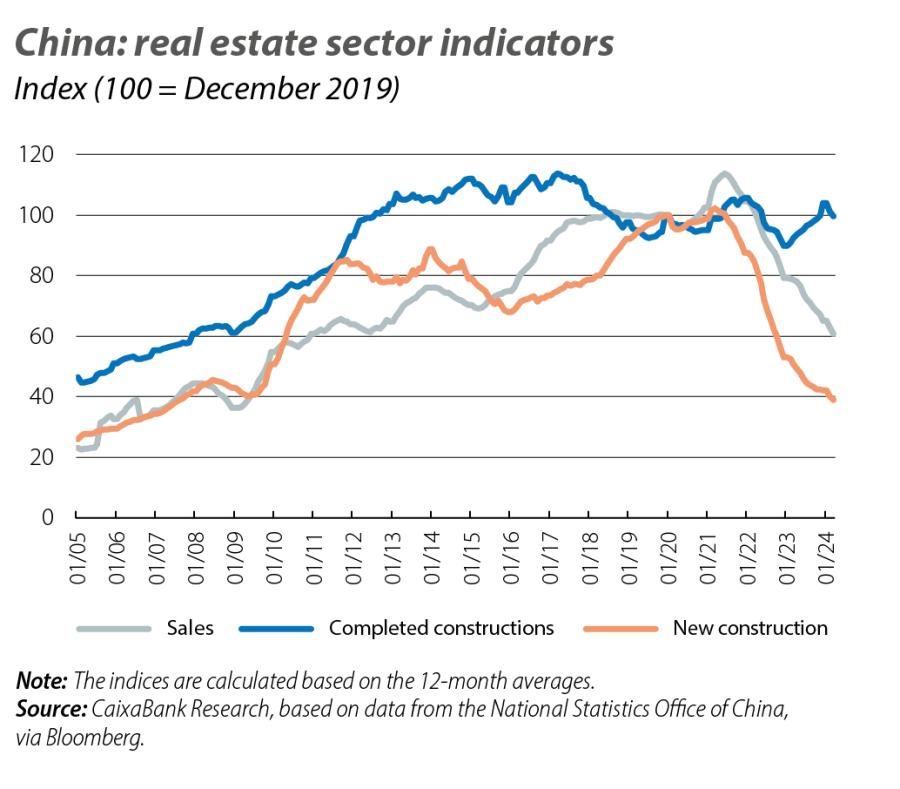

A quick take of the pulse suggests that this adjustment is proving to be rather dizzying, especially since 2021, when the crisis affecting the real estate giant Evergrande broke out, triggering intense scrutiny of the sector among investors while leading to a crisis of confidence among buyers and fears of contagion to the financial sector. Sales have plummeted by almost 50% since their peak and new construction has fallen by 60%, reaching levels similar to the post-financial crisis era (see first chart).

In this environment, the central role of real estate as a savings vehicle has led to a significant negative «wealth effect» among Chinese households. Moreover, while real estate was one of the main engines of the Chinese economy in the last decade, its weakness has diminished the Asian giant’s growth outlook and has degenerated into a crisis of confidence. Faced with this scenario, and in a context marked by the country’s structural slowdown, the authorities began to steadily relax regulations beginning in the second half of 2022.

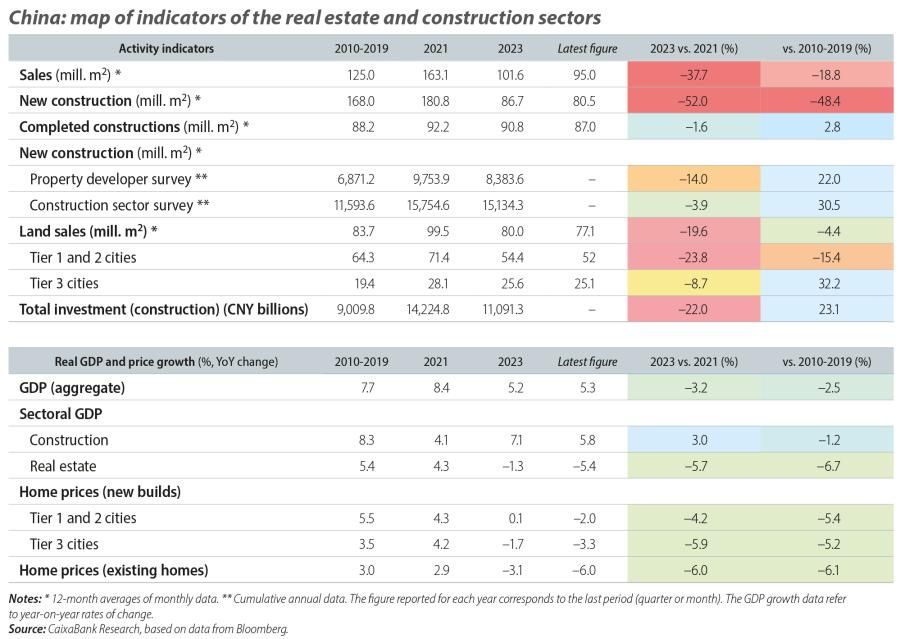

Specifically, limits on the granting of new mortgages and on the purchase of housing were relaxed in 2023, and several incentive mechanisms were introduced to encourage developers to complete projects already underway.1 All in all, these policies have led to a rebound in the number of finished construction projects, while the fall in new construction projects appears to have stabilised in recent months.2 On the other hand, if we analyse the data on the total area under construction for different purposes, we can see how the fall in activity overall is far more modest than in the real estate sector specifically. The total area under construction by housing developers has fallen by 14% since 2021, while the total area under construction that also includes infrastructure, construction in rural areas and social housing has fallen by just 4%. Also, although residential activity in urban areas has fallen significantly in recent years, construction activity as a whole still shows a moderate adjustment, partly due to direct action by the authorities and their investment in infrastructure and social housing, as well as the fiscal measures introduced to support non-residential investment.

- 1. The most common financing model, based on pre-sales, made this a key element of the intervention in the real estate sector, particularly as an instrument to ensure social peace, given that in the event of a large developer’s failure to comply, many households would find themselves in a highly vulnerable situation. In the last month, the Chinese authorities announced another series of support measures, with incentives for local governments to buy up housing stock not yet sold by developers and to allocate it for social housing. It is estimated that, between finished housing and construction in progress, developers may have between 1 and 2 billion m2 of unsold housing on their balance sheets.

- 2. In the last 12 months, an average of 80 million m2 of new housing has been built per month, while around 90 million m2 per month has been completed. This contrasts with the average for the period 2010-2019, when 170 million m2 of new housing was built per year, while the amount completed was also 90 million m2.

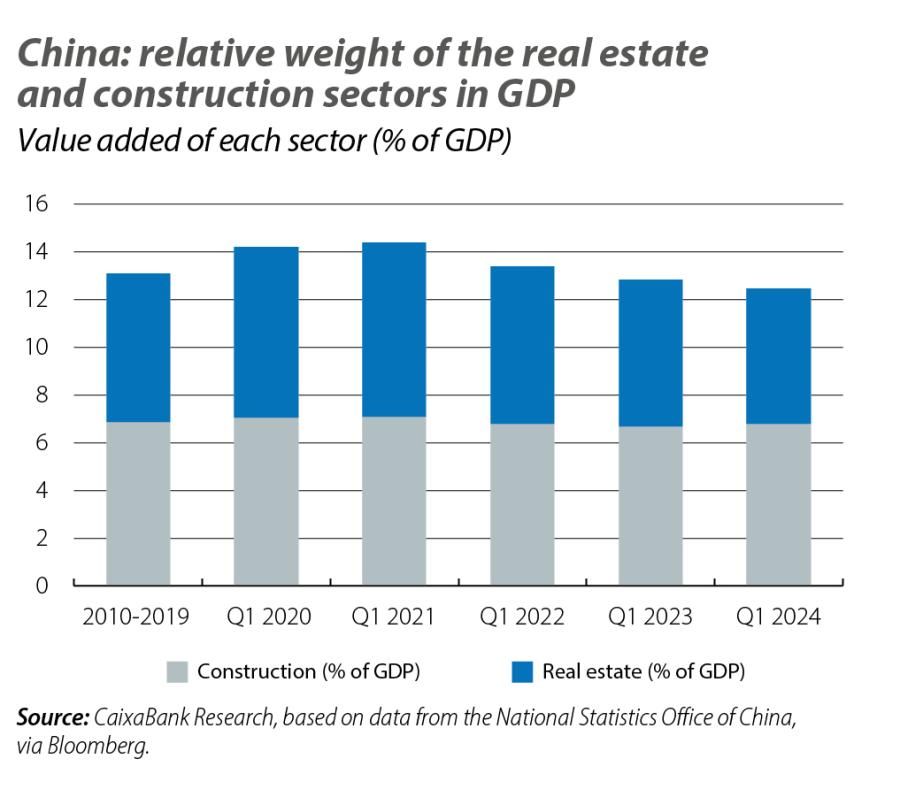

This dichotomy between the sharp adjustment on the demand side and the much more moderate adjustment on the supply side is illustrative that it will still take some time before the real estate crisis can be resolved. Thus, the slowdown has been much more acute in real estate than in the construction sector. In 2022 and 2023, the real estate sector registered negative year-on-year growth (of –3.9% and –1.3%, respectively), compared with an average growth of 5.4% between 2010 and 2019. In particular, real estate went from making a positive direct contribution of 0.3 pps to average GDP growth between 2010 and 2019 to making a negative contribution of –0.3 pps in 2022 and one of –0.1 pp in 2023 (the contribution of construction went from +0.6 pps to 0.2 pps and 0.5 pps in 2022 and 2023, respectively). Thus, the role of the real estate sector relative to the total economy has been steadily declining (see second chart).3

- 3. «Construction» includes any activity related to the construction (or demolition) of homes, commercial spaces and infrastructure. «Real estate» encompasses all services related to housing, such as purchasing, rental, maintenance or consulting services.

The latest activity data suggest that the most acute phase of the housing crisis may now be behind us, but there is still a long way to go. In this context, it is important to highlight four key elements for monitoring the sector’s future evolution.

Firstly, with demand at an all-time low, once the stock of housing currently under construction is exhausted, the adjustment in construction activity will intensify, and this could be reinforced by the slowdown that is expected in investment in infrastructure and in the manufacturing sector. Secondly, the rigidity observed in prices to date (new home prices have fallen by 6% or less since 2021 in the largest cities) makes the reduction in sales sharper and more prolonged, even if it may have limited the contagion to the banking sector. In this regard, further price declines in future could signal the willingness of the Chinese authorities to accelerate the adjustment process, but this would entail added risks for the banking sector and for household expectations. Thirdly, the international comparison suggests that the imbalances in the real estate sector tend to trigger long corrections, in terms of both their duration and their magnitude.4 Furthermore, despite the fact that the weight of the construction sector in China’s GDP is not too high compared with other large economies, the limited adjustment observed to date and its capacity to generate significant knock-on effects suggest that the sector will continue to hold back the economy’s growth in the medium term. Fourthly, it is important to stress that the situation is very different from region to region. For instance, the quarterly survey of construction companies reveals that, while the total area under construction in Beijing has increased by 15% since 2021, the reductions in other major cities, such as Hubei or Chongqing, exceed 15%. Also, the impact on local finances varies significantly between the different provinces and the fiscal capacity to respond to a protracted crisis in the sector will also be very different.

It seems that the Chinese authorities are managing to change the paradigm in the real estate sector and stabilise the first phase of the crisis. The adjustment on the demand side has been rapid, and a complete paralysis on the supply side has been avoided. However, this approach is also delaying the resolution of the structural problems within the real estate sector. China has gone from having virtually no private housing market in the early 1980s to a homeownership index of 90% today. This is one of the highest rates in the world, yet the country also has one of the highest rates of uninhabited housing, at around 20%. The next phase of the adjustment will thus present a more fundamental challenge: supply = demand.

- 4. China has had three years of adjustment, with a cumulative fall in prices of 10%. Although the experiences are very different, other historical examples with significant imbalances have led to longer adjustments. For example, the post-crisis financial adjustments in Spain and the US lasted between 5 and 7 years, with cumulative price declines in excess of 30%, while in Japan the real estate adjustment lasted almost two decades, with a cumulative drop in prices of around 50%. In addition, in the case of China, it is also important to highlight the significant differences between so-called Tier 1 cities, where there was a significant rebound in prices relative to income growth in the period 2010-2019, and Tier 3 cities, where the price increase recorded in the period 2010-2019 was far lower than in Tier 1 and 2 cities, and the problem seems to be focused in a chronic excess of supply.