The buzzword in the new international scenario: divergence

We are now almost half way through the year and it is time to take stock in order to update a set of economic scenarios in which the divergence in the pattern of inflation between the United States and Europe has been key to explaining the adjustment of interest rate forecasts.

We are already almost half way through the year and it is time to take stock in order to update the economic scenarios. The indicators that have been published seem to show that the US economy has already begun the long-anticipated soft landing, while the euro area and the United Kingdom surprised analysts with a more dynamic start to the year than expected. At the same time, inflation is proving more persistent than expected in the US, while in Europe its decline is adhering somewhat better to the «script» that we had anticipated. This divergence in the inflation pattern has been key in explaining the adjustments to our interest rate forecasts.

Despite the fact that inflation is turning out to be more persistent in the US than in other regions, one trend that is common to all cases is that its rate of decline has slowed substantially. In part, this slowdown is natural as the most abrupt forces of the inflationary crisis fade and the composition of the disinflation process changes. However, it also responds to greater demand-side pressure than had been expected a few months ago, as well as to the impact of the rise in commodity prices, some of which are trading at all-time highs (cocoa, copper, coffee, etc.). Moreover, in the specific case of industrial metals, part of their price rise responds to the impact of the new sanctions imposed on Russia, which prohibit Russian metals from trading on international exchanges from 13 April, thus introducing a more persistent upside risk to their prices.

Crude oil prices have shown notable volatility, reflecting the swings in the conflict in the Middle East. As long as this conflict remains active, the risks to the price of crude oil will continue to rise, in a context in which the conditions of its supply are also exerting upward pressures: the productive capacity of the US is reaching its limit, global stocks are at an eight-year low and OPEC has extended its current cuts until October. As a result, we anticipate that the average price of a barrel of Brent oil in 2024 will be around 87 dollars, eight dollars higher than the previous forecast, and 82 dollars on average in 2025, five dollars more than previously projected.

As for the price of gas in Europe, it has remained relatively stable and no significant rebounds are anticipated on the horizon, thanks to gas reserves being at an all-time high. This significant accumulation of stocks has been made possible by an uninterrupted supply of gas in a context of a milder winter than usual, which has kept demand in check. Consequently, we have hardly changed our forecast for the TTF gas price, which we expect to continue to trade at around the 30 euros/MWh mark through to the end of 2025.

The impressive resistance displayed by the US economy in 2023 seems to be starting to run out, although in reality this reflects a normalisation towards more sustainable growth rates and the indicators seem to suggest some stability in the country’s growth in the coming months. The sentiment indicators have tempered (for the manufacturing sector, they even anticipate a stagnation) and the extra savings accumulated during the pandemic have now been practically exhausted. Even the labour market indicators show emerging signs of exhaustion, although it is still very dynamic.

Consequently, all the indicators suggest that the economy has left behind the extraordinary growth rates of last year and that it will converge at rates closer to its potential of 0.4% quarter-on-quarter during the course of 2024 and much of 2025. These forecasts are based on the resilience that household consumption will continue to show, sustained by a labour market that remains buoyant. In addition, a revival of public spending cannot be ruled out, given that we are in an election year. In terms of investment, it will continue to benefit from the stimulus provided by the adoption of new technologies (such as artificial intelligence) and the development of the «green economy» under the Inflation Reduction Act (IRA); a programme with a budget of almost 416 billion dollars between 2023 and 2031. Thus, we revise the expected growth rate for 2024 and 2025 up by 0.2 pps, to 2.4% and 1.8%, respectively.

In this context, inflation in the US is showing greater resistance to the downside than we expected a few months ago, mainly because of the strong inertia of core inflation due to the shelter component, which includes both observed and attributed rental prices. Thus, we revised our headline inflation forecast for 2024 upwards by 0.6 pps, to 3.2%, and raised that of 2025 by 0.2 pps, to 2.2%. For core inflation, we raised the forecast for 2024 and 2025 by 0.5 pps, to 3.2%, and by 0.2 pps, to 2.6%, respectively.

As for the euro area, and after two quarters of declines, economic activity grew in Q1 2024 by 0.3% quarter-on-quarter, slightly beating expectations. The main indicators suggest that the recovery is underway, albeit a rather modest one, which supports our forecast that growth in the euro area will not exceed 0.4% quarter-on-quarter for the rest of the year. The three major economies will also show relatively stable performance and will grow at rates similar to those recorded in Q1 during the rest of the year. These forecasts are supported by the revival which we expect to see in private consumption, especially in the second half of the year. A labour market that is expected to remain buoyant (the unemployment rate is expected to remain close to its all-time lows), combined with further declines in inflation and the anticipated interest rate cuts, will help to boost consumption. Households will also have a significant savings buffer that will strengthen their balance sheets (it is estimated that, as a result of the pandemic, households have accumulated savings that exceed their usual level of savings by almost 8.0% of GDP). We also expect fixed capital investment to benefit from a wider deployment of NGEU funds: to date, some 224 billion euros (between grants and loans) have been distributed, out of the 672 billion that the Recovery and Resilience Facility has been allocated up until 2026. This scenario barely differs from the one we had previously been defending, so the adjustment to the growth forecast for the euro area is marginal and responds above all to the impact of a somewhat better than expected Q1: we have revised our growth forecast for 2024 by 0.1 pp to 0.8% and we keep the forecast for 2025 unchanged at 1.7%.

Regarding inflation, both the headline and the core measures have shown a marked correction from their peaks, adhering relatively well to the scenario that we have been showing, and we continue to anticipate that headline inflation will converge towards the target over the coming quarters. Therefore, we have revised our inflation forecast for 2024 up by just 0.2 pps, to 2.4%, due to the aforementioned revision of energy prices, and we keep the forecasts for the rest of inflation measures unchanged.

As for the outlook for other economies, of particular note is the upward revision of almost 0.5 pps in the United Kingdom’s 2024 growth forecast, placing it at 0.5%, due to an unexpected good Q1 (0.6% quarter-on-quarter, after two quarters of contraction). In China, an also slightly more dynamic Q1 than expected leads us to raise the expected growth rate for 2024 by 0.2 pps to 4.8%. Nevertheless, the questions that continue to hang over the country’s residential sector advise caution over the coming quarters, and we cut the growth forecast for 2025 by 0.2 pps to 4.2%.

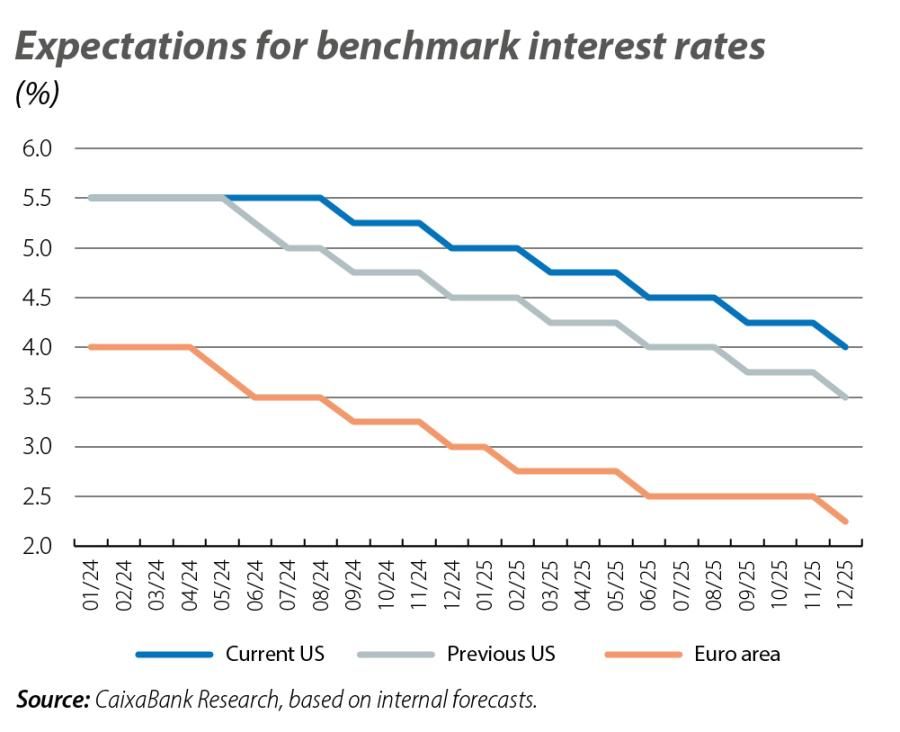

To close, another of the most significant changes in the scenario has been the adjustment of expectations regarding the Fed’s official interest rates. In fact, the resilience of inflation and the buoyancy of economic activity lead us to delay when we expect the Fed’s first rate cut to occur until after the summer, and we expect only two rate cuts of 25 bps in 2024, compared to the four initially forecast (–50 bps for the year as a whole vs. –100 bps in the previous scenario). Meanwhile, we keep our scenario of four cuts by the ECB of 25 bps each unchanged, beginning in June, which would bring the official rate down to 3.0% by December (although we do not rule out the possibility of just three cuts in the end). This «de-synchronisation» between the Fed and the ECB will likely be reflected in a stronger dollar in the short term, although in the medium term a convergence in growth rates and monetary policy between the euro area and the US would favour the euro, which we expect to recover an exchange rate of around 1.10 dollars per euro in 2025.