Survey of Household Finances: Spain is not a country for the young

The generation gap is widening in both income and wealth, according to the latest Spanish Survey of Household Finances published by the Bank of Spain: between 2001 and 2021, the median income of households with a head of the household aged under 35 fell by 19.8%, while in the case of those over 74 years of age it rose by 40.5%; and between 2002 and 2022 the total net wealth of households with a head under the age of 35 fell by 72.7%, while that of households headed by someone over the age of 74 rose by 98.7%.

Generation gap: a phenomenon that is intensified in income and wealth

This spring, the Bank of Spain published the 2022 Survey of Household Finances (EFF). This is the eighth edition of this study, which involves over 6,000 household surveys that are used to characterise the distribution of the main income and wealth variables of the more than 18 million households in Spain.

At the aggregate level, median household income increased by 1.1% between 2019 and 2021,1 while net wealth2 rose by 3.7% between 2020 and 2022.3 In 2022, therefore, the median income per household in Spain stood at 32,400 euros (mean average of 43,100 euros), while the median net wealth, the bulk of which comes from the value of real estate assets,4 was 142,700 (mean average of 309,000 euros).

- 1The income data correspond to the year prior to the survey, while the wealth data correspond to the same year as the survey. For instance, the 2022 EFF poses questions about households’ wealth in 2022 and their income in 2021, while the 2020 EFF asked about their wealth in 2020 and their income in 2019.

- 2Sum of real estate assets and financial assets, subtracting financial liabilities.

- 3All amounts in this article are at constant prices of 2022, i.e. corrected for inflation.

- 4In 2022, 83.8% of households owned real assets and the median value was 181,300 euros. On the other hand, 97.7% of households held financial assets and the median value of these was 16,200 euros.

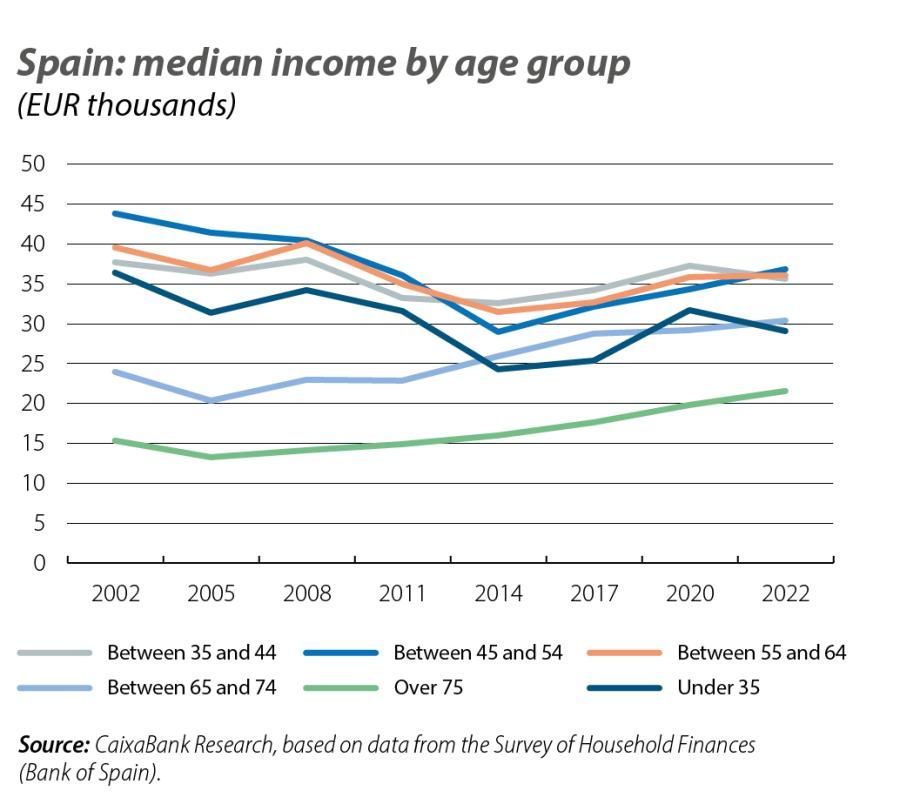

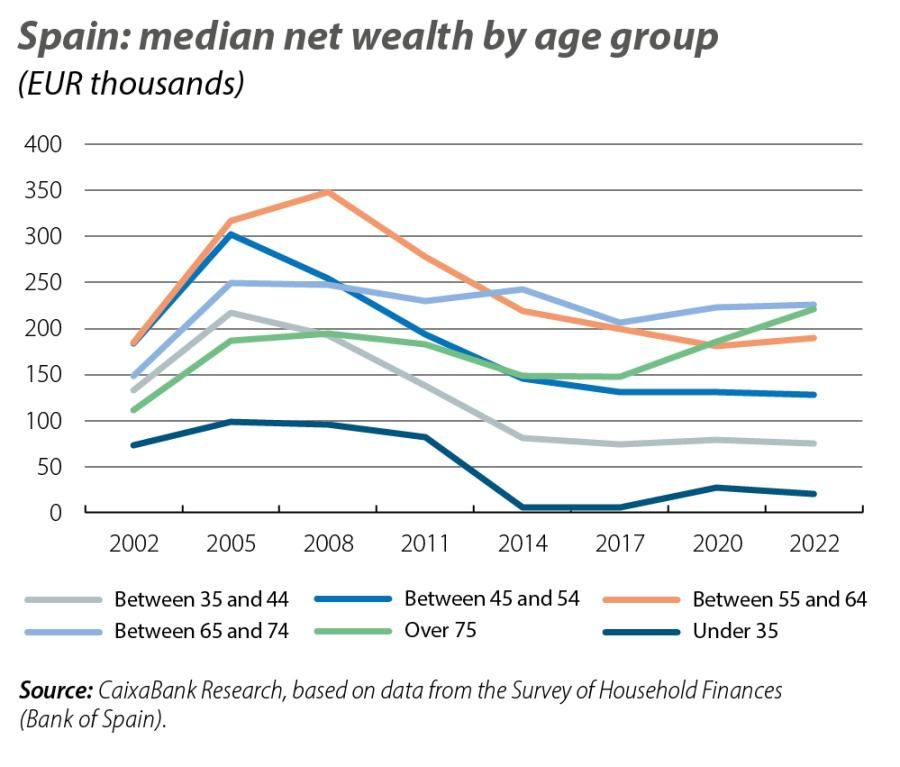

However, this situation at the aggregate level masks stark differences between generations. According to the data collected by the EFF, the generation gap is a question of both income and, above all, wealth: between 2001 and 2021, the median income of households with a head of the household aged under 35 (in 2022 prices) fell by 19.8%, while in the case of those over 74 years of age it rose by 40.5%. It should be noted, however, that both of these groups have a lower median income than other households. Moreover, households where the head of the household is older came from a more precarious starting point and remain the households with the lowest income. In addition, the wealth gap between the younger and older generations has also widened over the past two decades: the total net wealth of households with a head under the age of 35 fell by 72.7% between 2002 and 2022 and that of households headed by someone over the age of 74 rose by 98.7%.

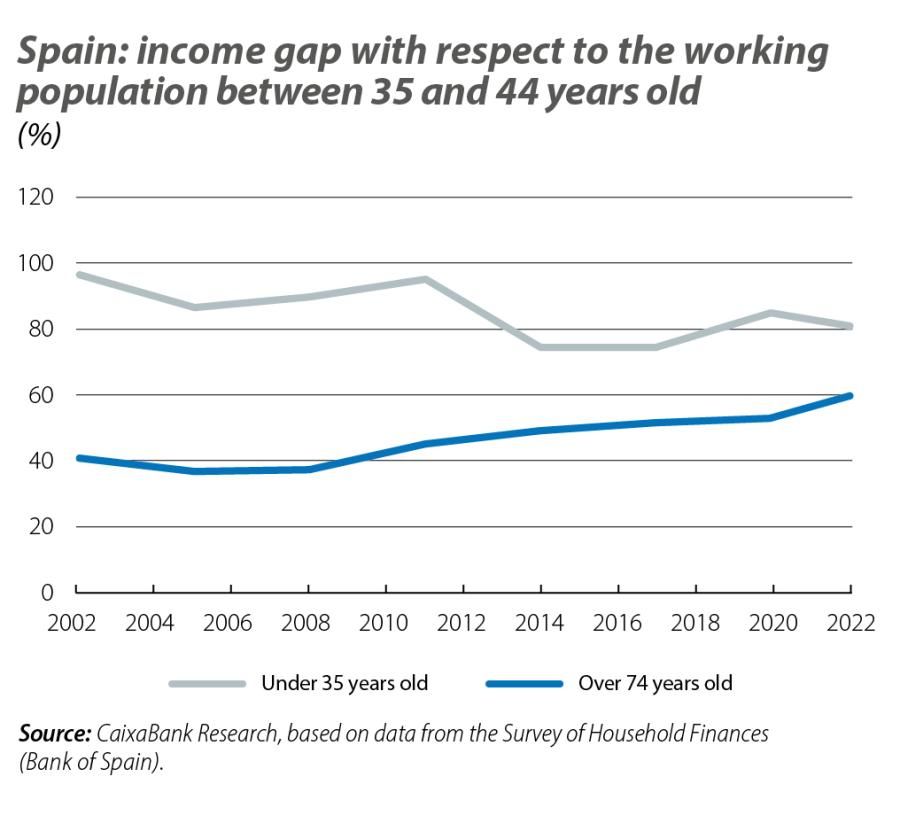

Another way to illustrate the evolution of the generation gap is by analysing the income and wealth of young people and older people relative to the main working age group (35-44 years). The third chart reveals that the incomes of young people have fallen by more than 14 points since 2002 relative to the working-age population, starting from a very similar level, while those aged over 74 have seen their income gap narrow by 20 points. Performing a similar exercise with net wealth, we see that the ratio of young people relative to the working-age population has gone from 55% in 2002 to 26% in 2022, while for the elderly it has risen from 84%... to almost triple the wealth of households aged between 35 and 44 years in 2022!

Homeownership, a key factor in the widening of the generation gap

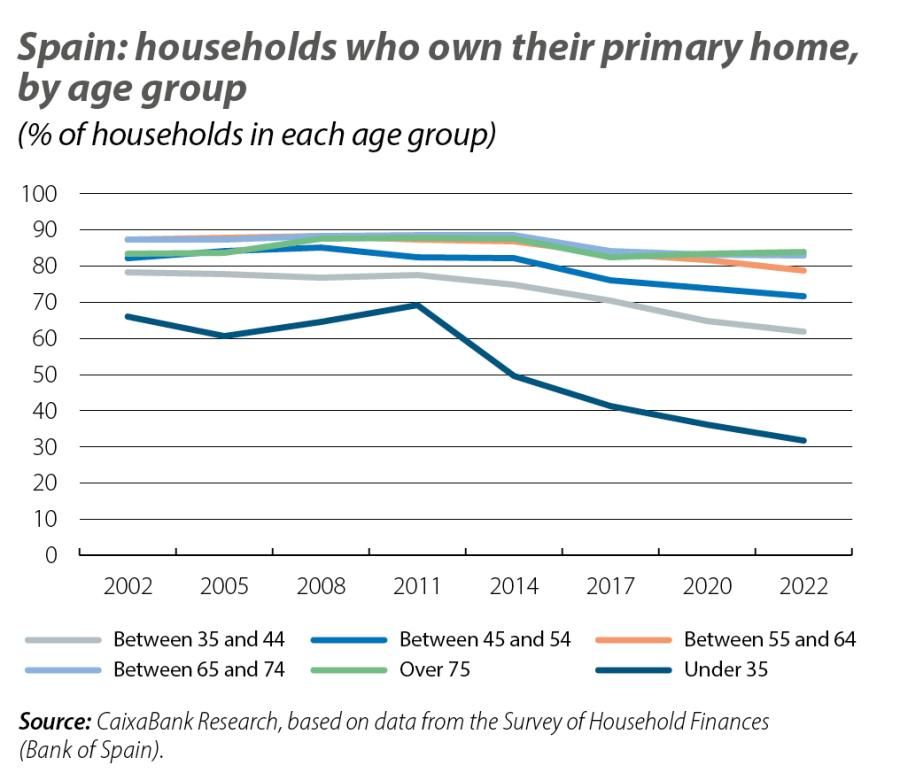

The divergence in net wealth between young and old is largely explained by real estate: over the past 20 years, there has been a marked decline in the proportion of young people who own a home, going from 66% in 2002 to 31.8% in 2022. Moreover, among those who have bought a home, the ratio of the median value of their primary residence relative to that of the elderly has gone from 1.5 in 2002 to 1 in 2022, possibly reflecting the fact that young people are buying smaller properties or ones located in cheaper areas than was the case a few years ago.

If we focus on financial assets, there have also been significant changes that have caused the generation gap to widen and which suggest a lower capacity to save among the young. In 2002, the median balance held by young people in accounts and deposits available for making payments was 2,120 euros, and in 2022 it was 3,270 euros. For those over 75 years of age, meanwhile, it has gone from 2,650 to almost 15,000 euros. The participation of young people in other types of financial assets, such as investment funds and pension or insurance schemes, has also declined significantly.5 In any event, financial assets account for just 21% of total gross household wealth in 2022 (21% for young people and 28% for those over 74), meaning that the affordability of homeownership is the main cause of the widening of the generation gap.

- 5In 2002, 5.5% of young households had investment funds and 18.6% had pension or insurance schemes. By 2022, these percentages had fallen to 4.9% and 12.5%, respectively. In the case of households over 75 years of age, 2.6% had investment funds and 2.1% had pension or insurance schemes in 2002; by 2022 these percentages had surged to 14.8% and 12.1%, respectively.

Fall in households’ outstanding debt and financial stress: widespread, including for young people

On the liabilities side, there has been a widespread fall in household debt across all segments, reflecting the marked deleveraging process that has taken place among Spanish households since 2010. Focusing on the most recent period, the median outstanding balance of debt on a primary home among all households with debt fell by 9.7% between 2020 and 2022, the balance related to other properties has fallen by 27.3% and that of consumer loans has fallen by 9.2%.6

If we look at the reduction of the outstanding balance of households with debt by age group, we see that young people are among those who have seen the biggest reduction in their median balance of debt on a primary home (–14.2% between 2020 and 2022). This is a slightly bigger reduction than for households where the head of the household is aged between 35 and 55, but slightly smaller than for those between 65 and 74 years old. With a smaller proportion of young households owning a home, the proportion of households with mortgage debt has also decreased: only 20.6% of households with a head of the household under the age of 35 have taken out a mortgage to acquire their primary home (–24.4 pps compared to 2002). Furthermore, the degree of indebtedness among young people seems reasonable relative to their income (as we shall see, the financial stress indicators for young people are below average). However, a higher proportion of young households have debts related to consumer loans (28.5% in 2022, +5.2 pps compared to 2002).

The decline in the level of indebtedness has enabled a reduction of the financial burden between 2020 and 2022, despite the rise in interest rates. In fact, the median financial burden, measured as debt service payments (repayments + interest) as a proportion of indebted households’ incomes, declined significantly between 2020 and 2022, going from from 15.8% to 13.7%, the lowest in the entire historical series. The reduction in the financial burden has been even greater for households under 35 years of age (going from 15.5% in 2020 to 12.1% in 2022).

Finally, the proportion of households that are usually considered financially vulnerable – those with financial burdens in excess of 40% of the household’s gross income – has also decreased significantly between 2020 and 2022, from 10.5% to 8.1% of all households (the peak reached during the financial crisis was 16.8%). In the case of young people, just 4.7% of those in debt are considered vulnerable, although it should once again be recalled that only 58% of households with a young head of the household (which obviously do not include young people living with their parents) had taken out some form of debt.

In short, the 2022 EFF reveals that households are in a stronger financial position at the aggregate level, with a decrease in the level of debt that has allowed them to reduce their financial burden. However, when it comes to distribution, the gap between generations continues to widen, especially in terms of wealth.

- 6Note that the reduction in the balance of debt reflects both repayments of existing debt (including normal and early repayments) and the balance of new loans and credit. The interviews of the 2022 EFF were conducted between Q2 2022 and Q1 2023, such that it already partially reflects the impact of the interest rate hikes.