The Spanish economy is enjoying a rosy period

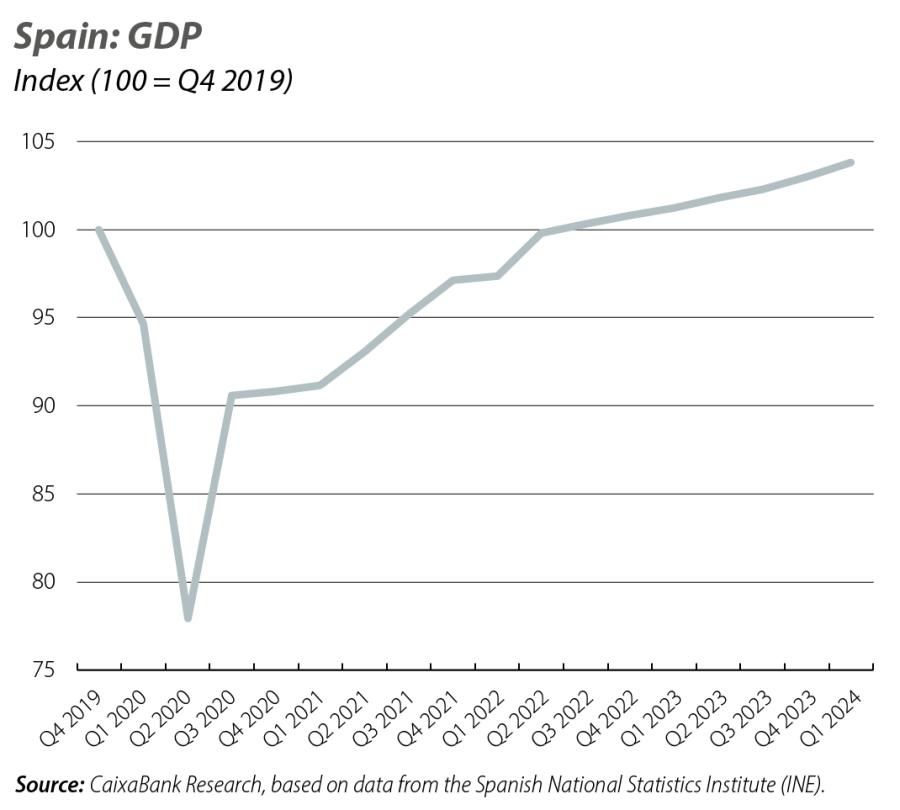

According to the new estimate produced by the National Statistics Institute, GDP grew by 0.8% quarter-on-quarter

in Q1 2024, 0.1 pps more than originally estimated. Behind this good performance lie several key elements: the strength of the labour market, the boost provided by dynamic immigration flows and the good data for international tourism, which have once again exceeded expectations.

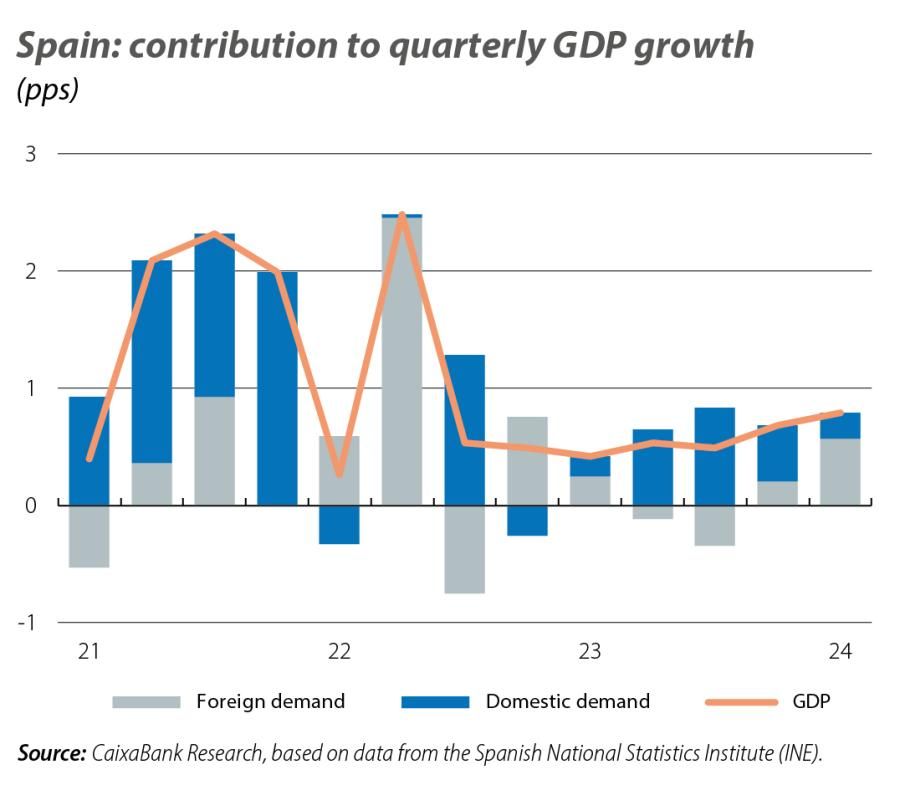

Dynamic GDP data for Q1, with an upward revision

According to the new estimate produced by the National Statistics Institute, GDP grew by 0.8% quarter-on-quarter in Q1 2024, 0.1 pps more than originally estimated. Behind this good performance lie several key elements: the strength of the labour market, the boost provided by dynamic immigration flows and the good data for international tourism, which have once again exceeded expectations. On the domestic demand side, the quarter-on-quarter growth of private consumption was a moderate 0.4%, while public consumption fell 0.6% quarter-on-quarter and investment posted a rapid increase of 2.6% quarter-on-quarter. Thus, the contribution of domestic demand to quarter-on-quarter GDP growth was 0.3 pps (0.2 pps in the first estimate). Foreign demand remained the main driver of growth, contributing 0.5 pps to quarter-on-quarter GDP growth thanks to an increase in exports of 3.3% quarter-on-quarter, which exceeded the 2.2% increase recorded in imports. The growth in exports was driven by tourism and the sector’s excellent start to the year: tourism services grew by a spectacular

17.4% quarter-on-quarter.

Looking ahead to the coming quarters, we expect domestic demand to take on a more prominent role, driven by the decline in interest rates, the traction of the European Next Generation funds and the strength of the labour market; indeed, investment still lies 2.2% below Q4 2019 levels, despite recording a notable increase in Q1 2024, and private consumption is only 0.5% higher, despite the fact that the population has increased by 3% since 2019. The upward revision of GDP growth in Q1 2024 introduces a slight upward bias in our GDP growth forecast for 2024 as a whole, which currently lies at 2.4%.

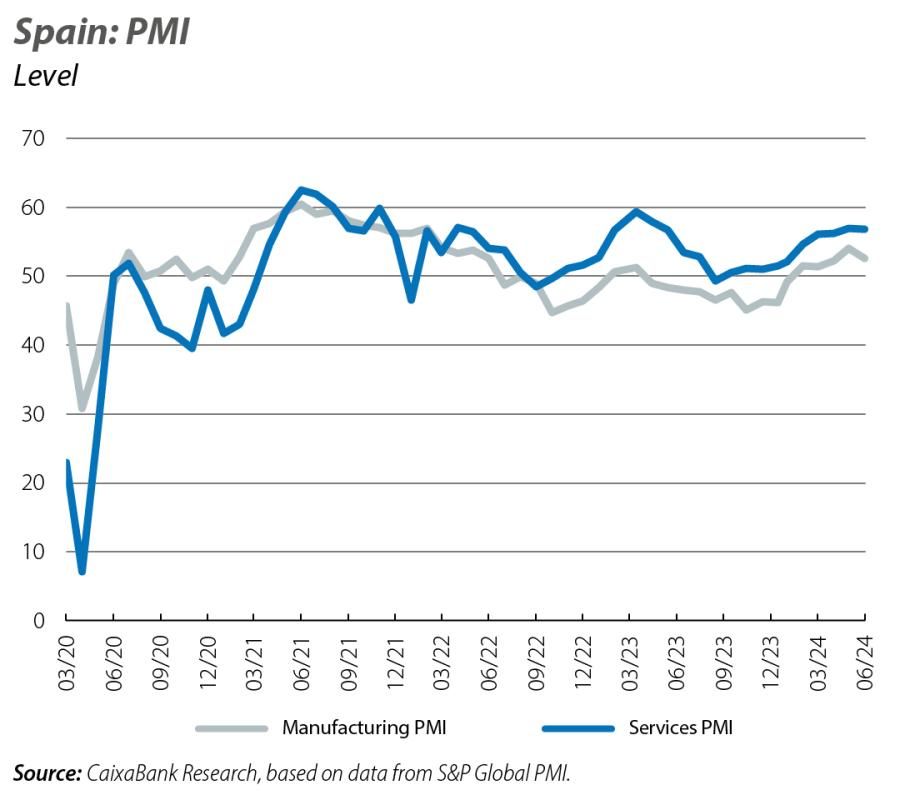

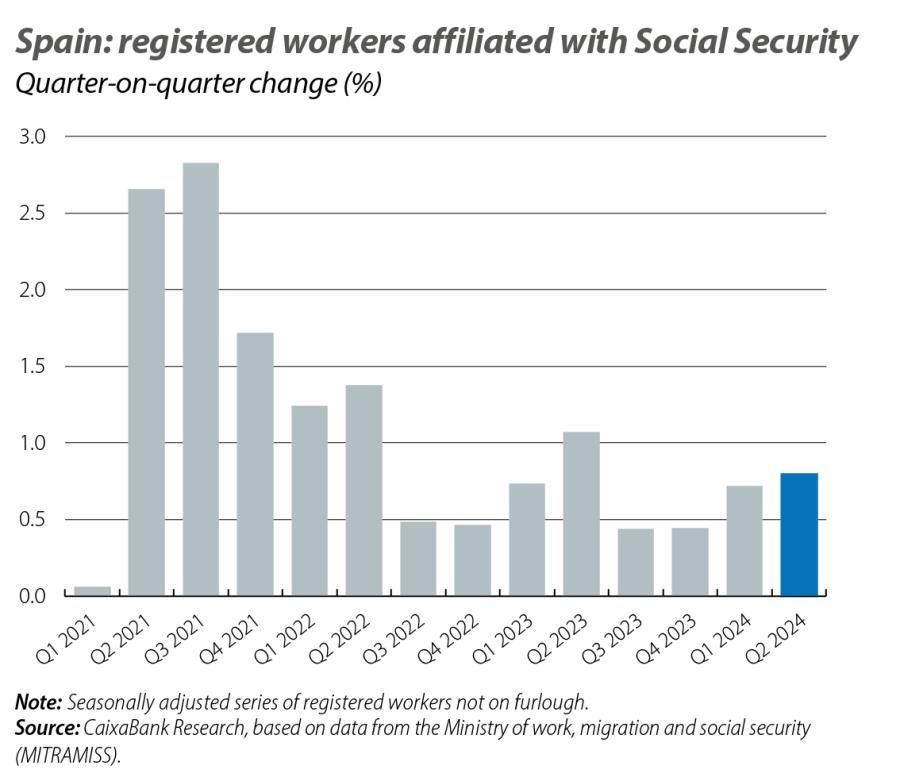

The good economic activity data for Q2 and a thriving labour market point to another very dynamic quarter

Especially noteworthy is the acceleration in job creation in the quarter: in Q2 as a whole, the number of registered workers, corrected for seasonality, grew by 0.8% quarter-on-quarter, up from 0.7% in Q1. This suggests that the Q2 GDP figure due to be published at the end of July will also be a good one. However, job creation was somewhat weaker in June than in previous months: in seasonally adjusted terms, the number of registered workers grew by 31,300 people, compared to over 60,000 in May. As for the business sentiment indices, for the fifth consecutive month the manufacturing PMI in June once again stood within expansive territory (above 50 points), specifically at 52.6 points, contrasting with the contraction at the European level (in June, 45.8 points). However, the pace of expansion was somewhat slower and more modest compared to May (54.0 points). The services PMI, meanwhile, remains well within expansive territory: in June it stood at 56.8 points, practically the same as in the month of May (56.9), which had marked a 13-month peak for the index.

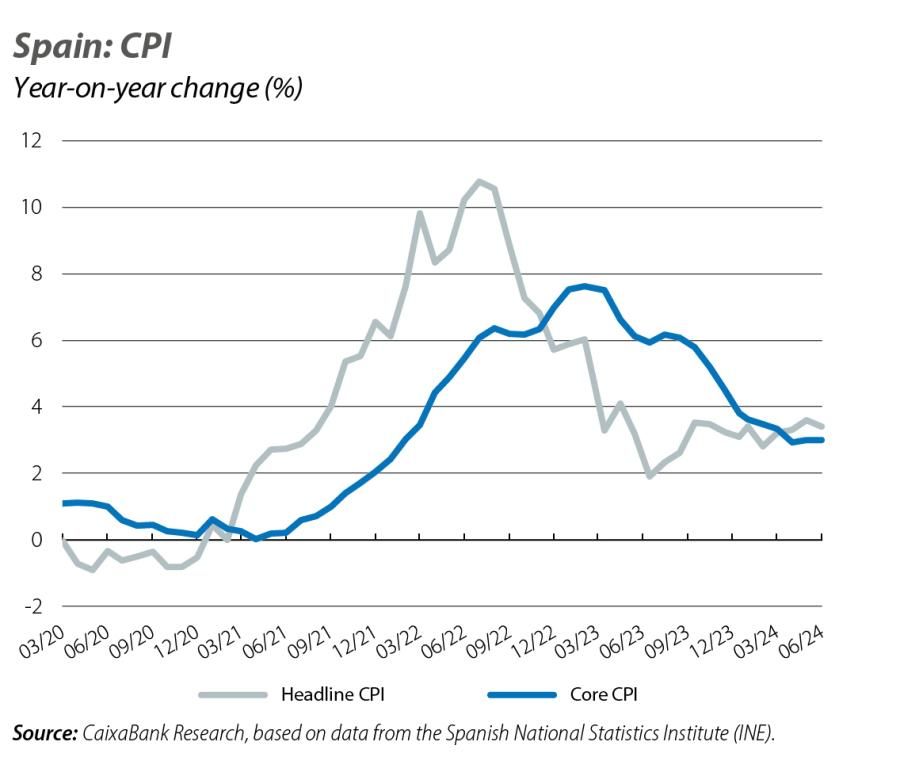

Slight moderation of headline inflation in June due to fuels

Headline inflation fell 20 bps in June to 3.4%, according to the flash CPI indicator published by the National Statistics Institute. This was lower than expected, thus returning inflation to its downward path which had been truncated since March. The slowdown in headline inflation was mainly due to lower fuel prices, in contrast to the rise recorded in June 2023. Core inflation, meanwhile, which excludes energy and unprocessed food, stabilised at 3% in line with expectations, in a context in which it is expected to fall, albeit very gradually due to the persistence of inflation in services. It should be noted that the non-core components will continue to be affected by the gradual withdrawal of tax cuts: the government has announced that VAT on essential foods will remain at 0% until September and will rise to 2% between October and December (usually 4%), while VAT on pasta and seed oils will remain at 5% between July and September, before rising to 7.5% between October and December (usually 10%).

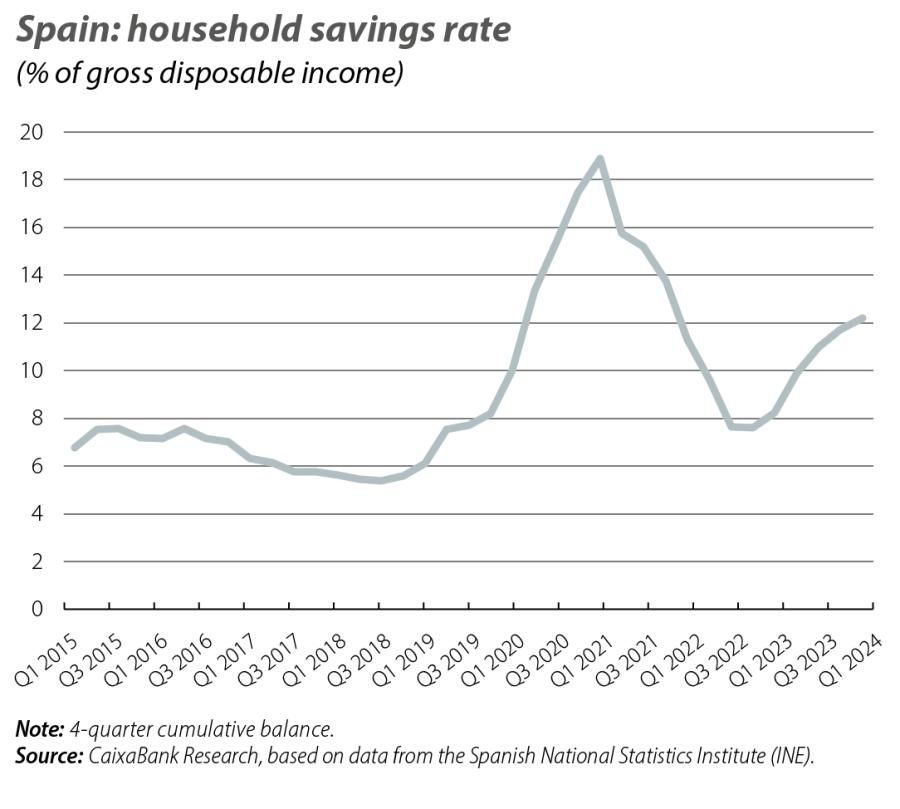

The buoyancy of household gross disposable income continues in the opening months of 2024 and gives wings to the savings rate

Nominal household gross disposable income, without seasonal adjustments, grew by a significant 8.0% year-on-year in Q1, largely thanks to the strength of the labour market. This increase was higher than that of household expenditure on final consumption (5.3% year-on-year), a combination which led to a further increase in the savings rate, placing it at 14.2% of gross disposable income (static figure, corrected for seasonality). This is a higher figure than that of the previous quarter (13.0%). In the last four quarters as a whole, the savings rate rose to 12.2% from the 11.7% recorded in Q4 2023.

Spain avoids the excessive deficit procedure due to the better outlook for 2024

Despite the budget deficit in 2023 reaching 3.6% of GDP, the fact that a deficit of 3% is expected in 2024, and below that threshold in 2025, has led the European Commission not to initiate this sanctioning procedure for Spain. The latest budget execution data support the reduction of the deficit this year: up until April, the consolidated general government deficit, excluding local government corporations, was 0.39% of GDP, slightly lower than the 0.42% recorded in April 2023. In the cumulative balance to April, tax revenues grew by a notable 6.5% year-on-year and social security contributions by 7.1%, while public expenditure rose by 4.9% year-on-year.