The risk of stagflation seeps into the financial markets

A tumultuous month marked by geopolitical risk and stimulus withdrawal

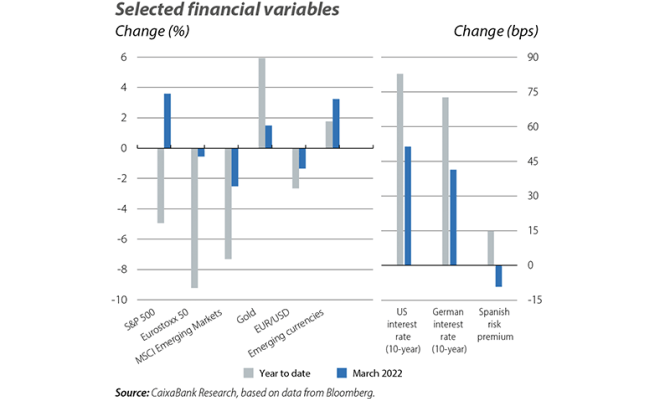

The financial markets continued to operate under a scenario of high uncertainty and volatility as investors assessed the implications of the war for economic growth, inflation and the withdrawal of the monetary stimulus. According to the preliminary data, the crisis appears to be exacerbating the upward pressures on prices, via rising commodity prices and a worsening of the supply bottlenecks, while the recovery in demand is deflating. In this context, the central banks have chosen to accelerate their monetary policy normalisation strategies (see the Focus «Fed and ECB, at different stages of the normalisation process» in this report). In the markets, these factors were reflected in climbing inflation expectations and sovereign interest rates, as well as in a strengthening of the dollar against the euro. The stock markets, meanwhile, recovered some of the recent declines, albeit overshadowed by a highly uncertain outlook for corporate earnings.

The commodity markets remain stressed

The uncertainty surrounding supply from Russia kept commodity prices at historically high levels, not only in energy but also in industrial metals and agricultural goods. The Brent oil price exceeded 120 dollars per barrel, levels not seen in the last 10 years. The price of European natural gas (Dutch TTF) also surged, accumulating a 79% increase since the beginning of the year. The rally in prices has added pressure on consumer countries to consider supply alternatives; the EU announced agreements for the sale of liquefied natural gas with the US, while negotiations on a possible nuclear deal with Iran intensified. OPEC and its allies, meanwhile, maintained their road map for a gradual increase in their supply of crude oil. On balance, the announcements do not seem to be sufficient to reverse the sharp rise in prices since the beginning of the year (see the Focus «Russia puts the global outlook for oil in check» in this Monthly Report).

The Fed expects to raise official rates at least seven times this year

On monetary policy, the US Federal Reserve was one of the first advanced-economy central banks to respond to the conflict in Ukraine by bringing forward its stimulus-withdrawal strategy. Thus, at its much-awaited March meeting, the central bank not only announced the first increase in official rates (of 25 bps, bringing them to the 0.25%-0.50% range), but also advised that it expects similar increases at each of the remaining six meetings this year, as well as bringing the average rate above the long-term level in 2023 (estimated at 2.4%, according to the Fed). It also confirmed that this summer it will begin to gradually reduce the size of its balance sheet. Since the March meeting, statements by FOMC members have tended to favour more aggressive rate hikes in order to contain inflation. As a result, investors have revised up their official rate forecasts, while the yield curve on the US Treasury has somewhat flattened.

The ECB also accelerates its stimulus withdrawal, but at a slower pace

The ECB also proved surprisingly hawkish in March when it announced that it would be bringing forward the reduction in its net asset purchases, following the upward revision in inflation forecasts. Thus, purchases of 40 billion euros will be carried out under the APP in April, 30 billion in May and 20 billion in June, marking a substantial revision compared to what was announced in February. Thereafter, the level of purchases will depend on developments in the economy, but the ECB clarified that they could be brought to an end during Q3. As for official rates, the ECB expects to carry out the first rate hike «some time after» the end of its net purchases. On this point, the speeches by the members of the ECB in recent weeks have revealed significant divergences within the Governing Council on when to initiate the rate hike cycle, although there seems to be a consensus that the process should be gradual and flexible, in contrast with the announcement by the Fed. The money markets reflect expectations that the ECB will approve increases of at least 50 bps by the end of the year. On the other hand, the Bank of England approved a further rate hike of 25 bps, although it was cautious about additional measures.

Meanwhile, investors are selling sovereign bonds and buying shares

As noted above, the hawkish rhetoric of the central banks and the tension in inflationary pressures have led to a sharp rise in sovereign debt rates, mainly through the increase in inflation expectations. In particular, the yield on the German bund reached 0.6%, its highest in the last four years, while the risk premia on euro area periphery debt remained stable. In addition, S&P confirmed Spain’s sovereign A rating and raised its outlook to «stable». The sell-off of sovereign debt tended to favour international stock markets, especially in the US, where investor sentiment was supported by the strong economic data.

Emerging markets are circumventing the March turbulence

In Moscow, the benchmark stock market index (MOEX) registered a 9% advance since its partial reopening on 24 March, while the losses of the rouble against the euro and the dollar tempered as the currency was sustained, in part, by the on-time payments in servicing foreign debt and by Putin’s announcement demanding gas payments to be made in roubles. In other emerging markets, currencies also recovered against the dollar, although the tightening of inflationary pressures and the more hawkish narrative from the Fed led some central banks to approve further official rate hikes. Finally, in China, the authorities backed new measures to prop up the economy and the markets, and these announcements supported the stock market and the yuan, helping to cushion the impact of the outbreak of COVID.