The Portuguese economy, slowing down throughout 2023

The National Statistics Institute revised its GDP series upwards

The National Statistics Institute revised its GDP series upwards, raising growth for 2021 and 2022 to 6.2% and 6.9%, respectively. Although the economy showed significant strength in the first half of this year, with an average GDP growth of 0.8% quarter-on-quarter, the slowdown that is beginning to be reflected in the main economic activity indicators, as the rate hikes increasingly take their toll, leads us to cut our GDP growth forecast for 2023 as a whole by 20 basis points, to 2.4%.

The indicators for Q3 show that the economy continues to grow, albeit at a slower pace: car sales remain strong, but have fallen since the previous quarter, and sentiment indicators have weakened.

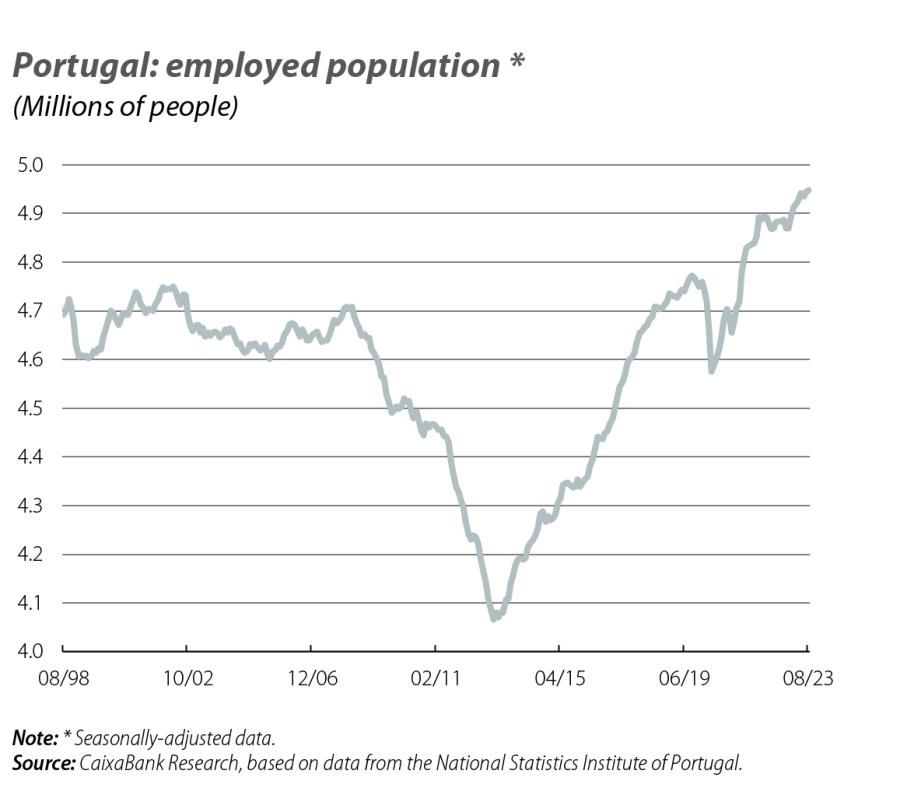

Although the labour market remains healthy, some indicators suggest a certain loss of buoyancy

The unemployment rate fell by 0.1 pps, to 6.2%, in August. Employment, meanwhile, rose by 0.1% monthly and 1.3% year-on-year, reaching almost 4.95 million, the highest level since the National Statistics Institute’s monthly series began in 1998. However, other indicators for August show a less rosy trend: (i) registered unemployment increased for the second consecutive month (4.4% year-on-year), (ii) the number of people made redundant exceeded 3,600 and (iii) job offers decreased by 24.7% year-on-year in August, to 16,034.

Inflation recovers its declining trend in in September

Headline inflation fell to 3.6% (previously 3.7%) and core inflation, to 4.1% (vs. 4.5%). We have revised slightly down our forecast for average inflation in 2023 (from 4.7% to 4.6%), taking into account the extension of the zero VAT measure on various food products until the end of this year. The main risk for the coming months will continue to be the pressure on the energy front, with the oil production cuts announced by Saudi Arabia and Russia.

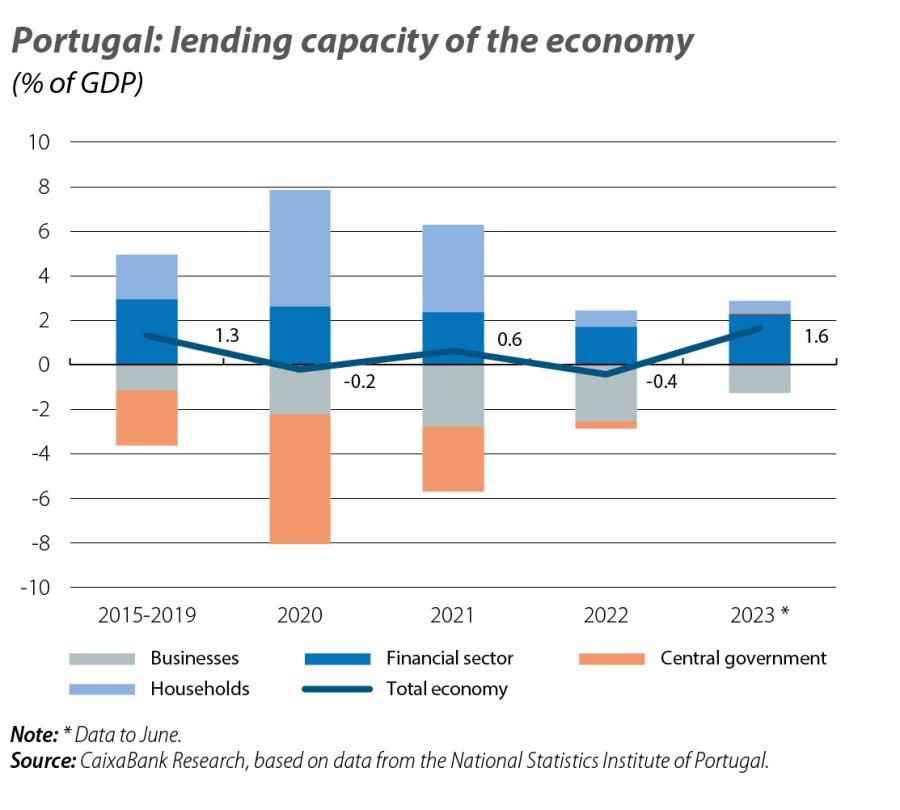

The economy’s lending capacity improved in Q2

In cumulative terms for the trailing 12 months to June, net lending stood at 1.6% of GDP. Of particular note was the 7-pp recovery of the non-financial private sector compared to the previous quarter: firms reduced their net borrowing to 1.3% of GDP, due to the improvement in the gross operating surplus, while households’ net lending improved to 0.5% of GDP thanks to the greater level of savings generated. For 2023 as a whole, we expect the economy to register a net lending capacity, something not seen since 2019.

Home prices grew faster than expected in Q2 2023

The National Statistics Institute’s Home Price Index shows that prices grew by a significant 3.1% quarter-on-quarter in Q2 2023, a rate not seen since a year earlier. For the first time, the average value of homes sold surpassed 200,000 euros, even in a context of a sharp fall in the number of sales (–3% quarter-on-quarter and –23% year-on-year). This dynamic introduces upside risks to our current average price growth forecast for this year (4%).