Portugal: favourable medium-term outlook for growth

The pandemic continues to ease as the economy shows strong signs of recovery

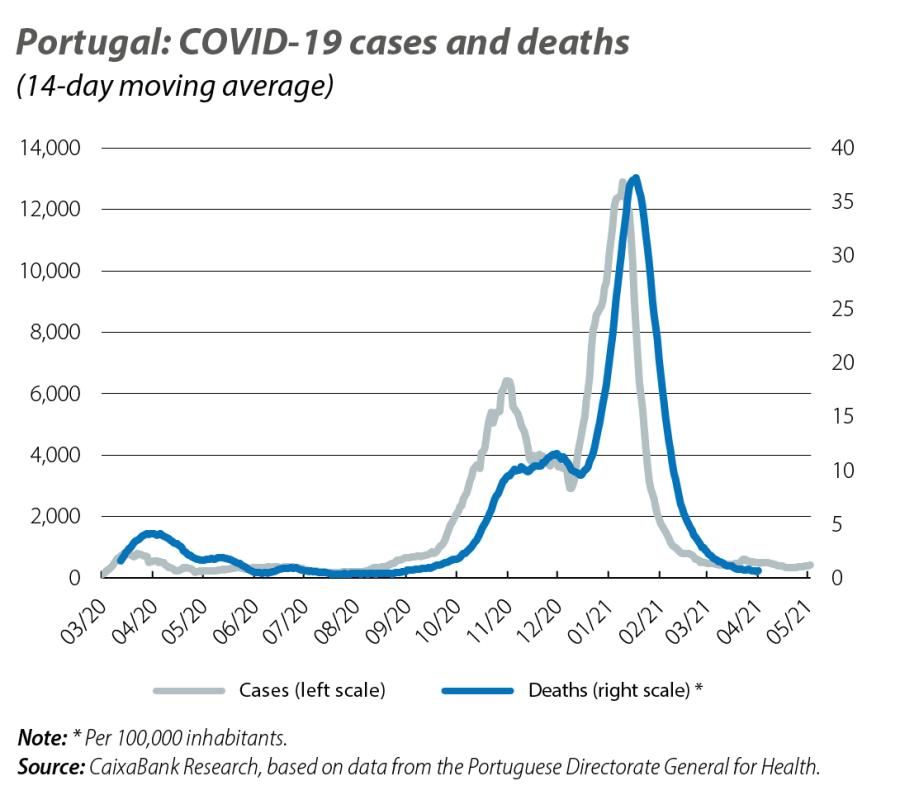

According to the available data, the COVID-19 figures continued to improve, with the number of cases falling and the vaccination rate rising. As of 23 May, 32% of the population had already received at least one dose of the vaccine, and in the age groups at greatest risk this figure stood at around 95%. This progress has allowed the country to take the final steps in lifting the lockdown in early May. Thus, with a few exceptions, the economy can now be considered fully operational. In this context, the economic activity indicators registered a strong recovery, with the Bank of Portugal’s daily economic activity indicator rising by 7% quarterly on average for the first 52 days of Q2. Consumption-related indicators are also recovering, albeit still below 2019 levels. For instance, in April car sales quadrupled and electronic payments grew by over 50%. Investment, estimated using gross fixed capital formation, grew 3.7% year-on-year in Q1 thanks to the 12.2% rise in investment in machinery and the resilience of construction, which registered a 6.4% growth in investment. On the supply side the improvements are also evident, albeit less pronounced, partly because the latest available figures date back to March when the country was in full lockdown. Although the recent developments are encouraging, the GDP decline in Q1 (–3.3% quarter-on-quarter and –5.4% year-on-year) led to the 2021 growth forecast being revised down to 3.7%, 1.2 pps less than the previous forecast. However, due to the strong growth expected in the second half of this year, the movement for 2022 was in the opposite direction, with growth revised upward to 4.7%, 1.6 pps more than the previous forecast. In short, the medium-term outlook for the Portuguese economy is improving and the cumulative growth anticipated in 2020-2022 is now 0.3% (previously –0.1%).

Signs of slight improvement in the labour market

In Q1, employment declined by 49,000 people compared to the previous quarter. Despite the drop, this is a smaller decrease than that observed during the first general lockdown (–142,600). The unemployment rate, meanwhile, decreased to 7.1% (–0.2 pps compared to Q4 2020). However, the volume of hours actually worked fell by 6.4% quarter-on-quarter, equivalent to two hours less a week on average, due to factors such as quarantines. The unemployment rate, meanwhile, stood at 6.9% in April, while unemployment registered in job centres declined quarter-on-quarter (–8,963 people), in contrast with the increases of the previous four months. However, the figure registered for unemployment is still significantly higher than prior to the pandemic (+108,326 people compared to February 2020). Considering the positive effect of the employment support measures, we have revised down our forecast for the unemployment rate in 2021, bringing it to 7.8%, although there is significant uncertainty as to the impact of the restrictions on business activity.

The second lockdown and the bolstering of measures to combat the pandemic led to a deterioration in the public accounts in the first four months of the year

In the cumulative balance up to April, the budget deficit stood at 6.9% of GDP, compared to 2.5% in the same period of 2020. This increase is explained by the significant drop in incomes (–6.3% year-on-year) and the significant increase in expenditure (5.2%). Almost all of the expenditure increase was due to current transfers, many of which were linked to the pandemic. In fact, COVID-related measures, including those related to income and expenditure, amounted to 3.4% of GDP. Despite the persistent uncertainty, we anticipate that the impact of these measures on the public accounts will be diluted in the second half of the year with the improvement in the control of the pandemic, progress in the vaccination roll-out and the recovery of the economy.

Tourism is the sector hardest hit by the pandemic

The strict lockdown that was in place for two months of Q1 has been reflected in the number of tourists, which plummeted by 90% compared to 2020 and 2019. However, the outlook for the rest of the year is reasonably positive (up 25% for 2021 as a whole versus the 2020 figures), far from 2019 levels. This improvement is the result of the progress in the vaccination campaigns both nationally and internationally, although it could be affected by the British authorities’ decision to exclude Portugal from the list of safe destinations (British tourists are among the most important for Portugal, accounting for around 8% of all tourists in 2019).

The real estate market continues to hold up

According to Confidencial Imobiliário (CI), prices rose 3% year-on-year in April, up 3 decimal points from March. Similarly, valuations rose by 8% year-on-year in April, 1.1 points more than in March. Finally, data from CI regarding property sales in Q1 show growth of 5.1% quarter-on-quarter and 21% year-on-year. This improvement and the persistence of support factors (low cost of financing, prudent management of the end of the moratoria and the extension of the golden visa scheme until the end of the year) suggest that prices will continue to climb in 2021, albeit at a somewhat more moderate pace. Thus, our forecast is that they will grow by 2.3% in 2021 (8.4% in 2020).