Portugal: 2021, the year of the recovery, and 2022, that of the consolidation

The Portuguese economy will accelerate its growth rate in 2022

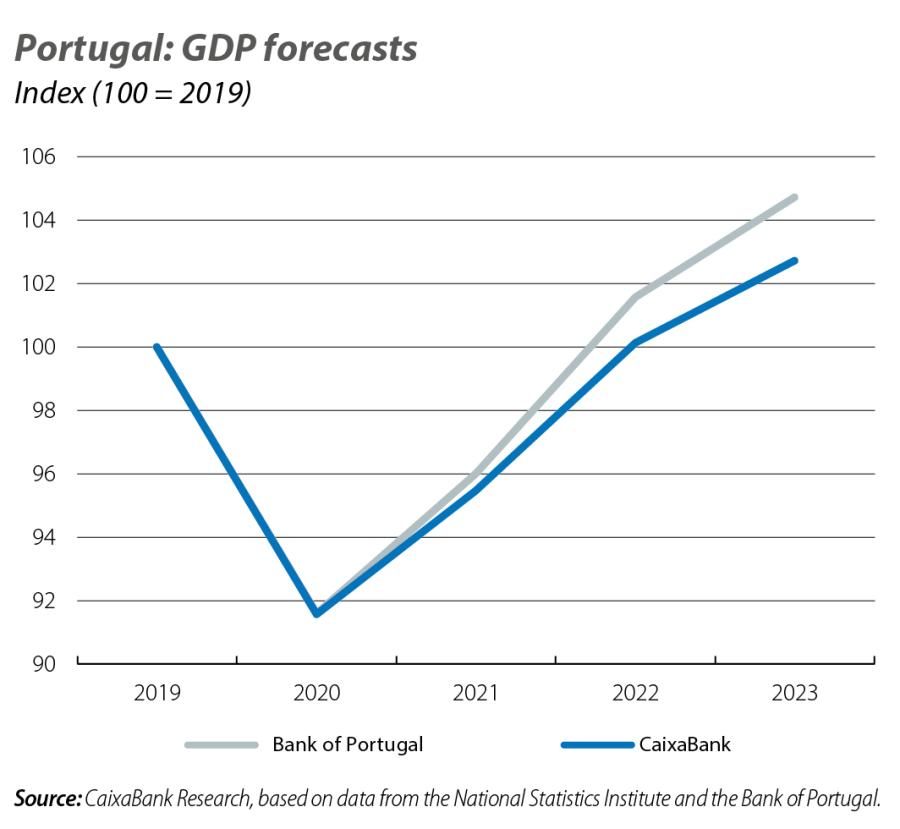

The COVID-19 pandemic continued to determine the economy’s performance throughout 2021, with a significant rise in infections at the beginning of the year leading to restrictions, although the rapid roll-out of the vaccinations allowed the country to end the year with around 90% of the population fully vaccinated. In a context marked by the gradual easing of restrictions on the back of the successful vaccination campaign, GDP will have grown by 4.3% in 2021 as a whole according to our estimates. This is a significant recovery, but still insufficient to offset the historic drop registered in 2020 (–8.4%). However, the emergence of the new, more contagious Omicron variant, the energy crisis, and the problems in global supply chains have tainted the outlook. Even so, we expect GDP to grow by 4.9% this year, supported by tourism, European funds and the pent-up savings amassed during the months of strict lockdown being channelled into consumption. The pandemic, the risk of a prolongation of the energy crisis, and the problems in global supply chains remain a source of uncertainty, but these factors should be resolved in the second half of the year. Furthermore, the possibility of adapting the existing vaccines to tackle new variants suggests that we will only see occasional episodes of greater uncertainty, without a persistent effect on economic activity.

The latest indicators point to a moderation of growth in Q4 2021

The latest indicators point to a moderation of growth in Q4 2021, although consumption remains the main driver of the recovery. In November, card payments increased by 10.7% compared to the same period in 2019 and retail sales by 5.4%, despite the fall in fuel consumption. The export sector is also contributing to the rally, with exports of goods in November exceeding those of 2019 by 18%. Other indicators – such as industrial production and flights at Portuguese airports – show that the gap compared to 2019 levels remains negative, but is narrowing. In November, industrial production was just 2.8% below the level of November 2019, while the number of flights was 13.6% below.

The labour market is recovering quicker than economic activity

In October, the preliminary data indicated that employment was clearly above pre-pandemic levels (1.1% or 52,100 more jobs), while the unemployment rate remained unchanged at 6.4%. Also, in November, unemployment registered in job centres fell for the eighth consecutive month, by 1.6% (–13.2% year-on-year), although it is still above the pre-COVID level (+13%, +39,900 people). The year-on-year decline in unemployment has been particularly pronounced in construction, retail, real estate services, administrative and support services, and hospitality and catering, which account for around 60% of the total year-on-year decline in unemployment. However, in the latter sector there was a considerable increase in the month of October, which can be justified by the fact it was the second best month of the year in terms of tourism (unlike in previous years). Another sign of the buoyancy of the labour market comes from the number of unfilled job vacancies, which have reached very high levels and far in excess of pre-pandemic figures in some sectors. Thus, our outlook remains positive and we anticipate an unemployment rate of 6.4% in 2022.

The real estate sector remains asymptomatic

The pandemic appears to be having no impact on the residential real estate market. In Q3, the rise in housing prices accelerated to 9.9% year-on-year (+3.6% quarter-on-quarter), up 3.3 pps from the previous quarter. In addition, the number of sale transactions rose by 25.1% year-on-year (+9.3% quarter-on-quarter), while the average sale price increased by around 11% year-on-year, reaching nearly 166,000 euros. Both measures – the number of homes sold and the average sale price – have reached peaks in the series. The latest data continue to show the strength of the sector in Q4: data from Confidencial Imobiliário indicate an 11.7% year-on-year price increase

in November (10.6% in October). For 2022, we expect more moderate growth.

Inflation took time to reach 2%, but it will remain high

Although initially dormant, inflation gradually awoke during the course of 2021, with rates in excess of 2% registered in the euro area since July (4.9% in November). In Portugal, the phenomenon has occurred later and has also been more moderate. The National Statistics Institute’s preliminary estimate for December is 2.8% (2.6% in November), being

only the second consecutive month with inflation above 2%. The transportation component is the only one that has been showing inflation rates above 5% for several months, driven by the rise in fuel prices. In December, however, the surprise came from the sharp rise in unprocessed food prices: +3.2% (0.8% in November), due to their increased costs. We expect the inflation rate of these goods to remain above 2% during the first few months of 2022.

The public deficit is reduced, but the pandemic’s footprint is still evident in the public accounts

The general government deficit stood at 3.4% from January to November, a decrease of 1.4 points compared to the same period in 2020. The improvement in the public accounts is largely due to the marked growth in revenues (8.6% year-on-year), thanks to the increase in tax revenues and collections (as a result of the improvement in economic activity and the reduced impact of the COVID-related measures offering exemptions and extensions in the payment of certain taxes), the receipt of European funds (+1,299 million euros), revenues from the auction of 5G mobile networks and the receipt of CGD dividends. On the other hand, expenditure increased by 5.0% year-on-year, with a substantial rise in current transfers, staff costs, the acquisition of goods and services, and investment. The pandemic continues to have a significant impact: overall, COVID-related measures amount to the equivalent of 2.7% of GDP in 2021 up to November (2.3% in the same period of 2020). Also up to November, the deficit stands in stark contrast to the surplus registered in the same period in 2019, mainly due to the sharp rise in current transfers, which are largely explained by these measures.