Inflation base effects in 2023: are they important?

We go over what is meant by the so-called «base effect» and analyse how it could impact the course of inflation in Spain during 2023.

Inflation can be measured in many ways, but the most commonly used method is by calculating the year-on-year change in the Consumer Price Index (CPI).1 By definition, inflation depends on the value of the CPI in the month in question, but also on the value of the CPI 12 months earlier, which is the starting point or «base» value. This reference to past CPI values is what gives rise to the so-called «base effect». In this article, we go over this concept and analyse how it could impact the course of inflation in 2023.

- 1The year-on-year change is the percentage change in the value of a variable in a given month compared to 12 months earlier.

An example is worth a thousand words

The first chart provides a visual example of the base effect. We show the evolution of the level of the CPI between January 2021 and December 2023, a series which includes our forecasts for the months of March to December this year. Here, we focus on the comparison between inflation in January and that which is expected in June 2023. As can be seen, inflation (remember, the year-on-year rate of change in the CPI) in January 2023 stood at 5.9%. We also expect inflation to fall to 3.0% in June, even though the level of the CPI is expected to climb by 3.5% between January and June 2023. If the index climbs between January and June, how can inflation fall? This fall in inflation (from 5.9% to 3.0%) is explained by the fact that, between January and June of the previous year (the base), the CPI grew at an even higher rate of 6.5%. Put more precisely, the difference in inflation between January and June 2023, of –2.9 pps (3.0%-5.9%), is due to the sum of the positive contribution of the CPI figures between January and June 2023 (of 3.5 pps) and the negative contribution of the CPI between January and June 2022 (of –6.5 pps).2

- 2Figures rounded to one decimal place.

The base effect in 2023

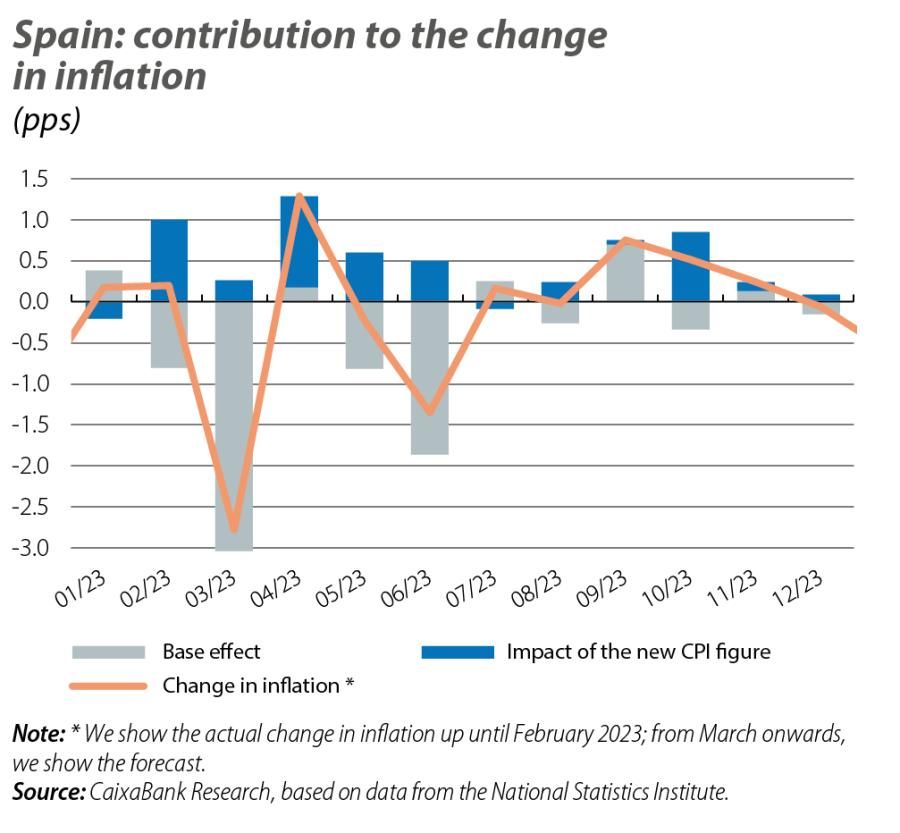

The second chart shows the month-by-month change in inflation throughout 2023, according to our forecast scenario, and the breakdown of this change between the contribution of the impact of the CPI figure for each month and the base effect.

We can extract several messages from this chart. Firstly, it is apparent that the base effect will apply significant downward pressure on inflation throughout the first half of 2023. For instance, we expect inflation to fall by 2.8 pps in March 2023 compared to the previous month. This fall is explained by a monthly increase of 0.3% in the CPI, on the one hand, and a negative base effect of 3 pps, on the other, because the CPI recorded a much higher monthly growth in March 2022 (specifically, 3.0%).

Secondly, we can see that the base effects will subside during the second half of 2023, even changing sign in several months. This is because, as can be seen in the first chart of the article, the significant growth in the CPI was concentrated in the first half of 2022, while during the second half of 2022 the CPI remained rather stable.

To sum up, over the coming months we are likely to see inflation levels moderate. This moderation will be driven by the base effects of the previous year, rather than a substantial moderation in the CPI’s monthly growth rate during 2023.