Oil in the «era» of decarbonisation

Will oil remain an essential source of energy in the coming decades? What supply and demand scenarios are anticipated given the targets to decarbonise the economy?

Over the past four years, energy markets have been under heavy stress, which has led to one of the most volatile episodes in recent decades.1 Part of the legacy of the events of this period has been an acceleration of the political and social commitments to decarbonising the energy system. Since the first major pact between developed and emerging countries was signed in Paris in 2015,2 several global meetings have been held and agreements reached setting targets for reducing the use of fossil fuels, and cutting the resulting CO₂ emissions, while adding impetus to the transition to cleaner and more environmentally friendly energy sources. Several deadlines have been set for these targets, mainly 2030 and 2050, but the challenge ahead is not without its difficulties given the complexity of the current energy scenario. After all, despite the efforts made to date, in 2022 oil and gas still accounted for around 60% of the world’s total primary energy consumption.

- 1This stress has been triggered by events such as the pandemic of 2020, which significantly affected global energy demand, the sanctions on Russia’s energy exports since 2022 and, since last autumn, the armed conflict in Gaza and the crisis in the Red Sea, which for now have not posed an obstacle for the oil supply in the Middle East but have increased the risks of possible contagion among neighbouring countries.

- 2Paris Agreement (December 2015).

Is there a future for oil?

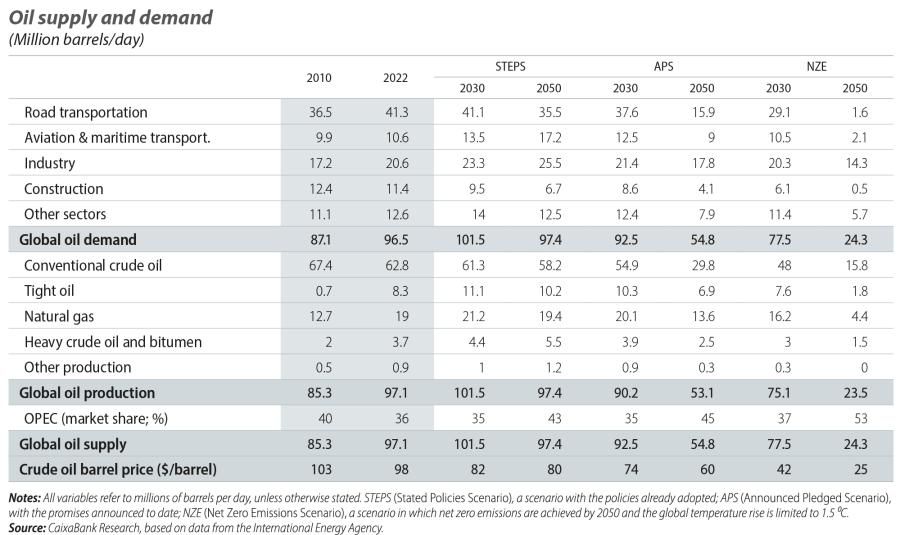

Focusing on oil, establishing a long-term price range for the Brent barrel is no easy task, particularly given the uncertainty dominating the current energy scenario. The International Energy Agency (IEA) conducted an analysis of the outlook through to 2050 in its latest World Energy Outlook.3 Using three scenarios,4 it evaluates the possible future paths of the energy transition and reaches several conclusions. On the one hand, it estimates that the demand for oil will continue to rise over the next few years, driven by continued increases in petrochemical production and air travel, but that it will peak before 2030 (it estimates a global demand of 105.7 million barrels per day in 2028). Factors such as the increase in sales of electric vehicles (in 2023 they had a market share of around 20%) and, even more relevant, the slowdown in the growth rate of China,5 are expected to act as counterweights for this demand for crude oil over the period analysed. It should be noted that in the most demanding decarbonisation scenarios (APS and NZE), the reduction in demand would be noticeably accentuated in the long term, in contrast to the stability that would be observed in the less demanding scenario.

- 3IEA, World Energy Outlook 2023 (October 2023).

- 4The three scenarios are: the Stated Policies Scenario (STEPS), with the policies already adopted; the Announced Pledged Scenario (APS), with the promises that have been announced, and the Net Zero Emissions Scenario (NZE), with a pathway to achieve net zero emissions by 2050 and limiting the global temperature rise to 1.5 ⁰C.

- 5According to the IEA, in the last decade China was responsible for 50% of the growth in global energy demand and 85% of the increase in CO₂ emissions.

On the other hand, while it is true that these scenarios focus on analysing what will happen to oil demand, on the supply side they consider that the production of non-OPEC countries will grow more than that of OPEC and its allies up until 2030, although in 2050 the distribution between the two blocs will be around 50/50. In addition, in the first two scenarios, under the assumption that production will adjust to demand, it suggests that new investments in the sector would be necessary, focused on reducing the environmental impact in production processes in order to avoid a decline in the effectiveness of energy transition programmes.

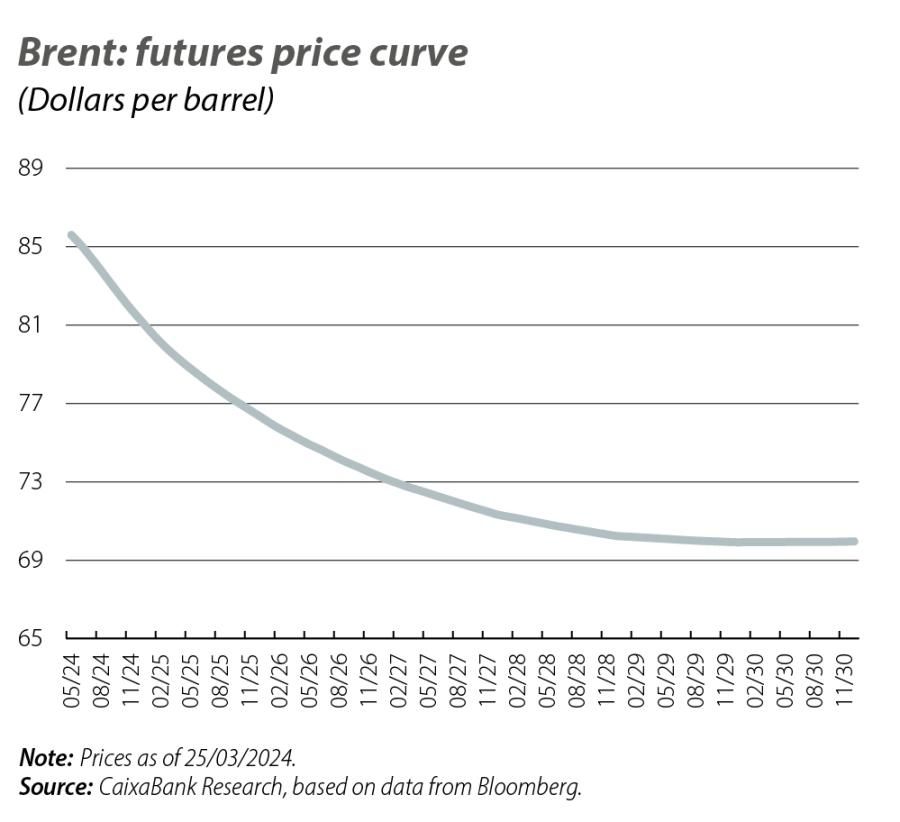

Taking into account the fact that, as anticipated by the IEA, the policies adopted by governments to date will not be sufficient to achieve the decarbonisation targets set for 2030, and given that around 90% of global emissions are subject to zero emissions commitments, it is highly probable that further progress will be made in environmental policies in order to steer the reality closer towards the first two scenarios. In this case, the IEA estimates that the price range for the Brent barrel would be between 74 and 82 dollars in 2030, a higher range than that indicated by the Brent futures curve at the time of writing (70 dollars per barrel in 2030).

Other implications

Oil will remain an important energy source for the next two decades, although countries’ commitments to phase out fossil fuels will reduce oil consumption. In this process, the oil market will become more coherent with the climate objectives. Nevertheless, in turn, this transformation introduces the threat of a disorderly adjustment for those economies most dependent on oil production, as they will face the challenge of continuing to generate profits from oil activity while they seek alternative growth strategies outside the sector. In this regard, according to the IMF6 there are two components to this risk. On the one hand, these countries could see a slump in the value of their oil reserves and the investment they attract, which in turn could lead to serious economic problems, including bankruptcies and crises in the regions currently most dependent on the oil sector. On the other hand, those countries with lower extraction costs could slow down the pace at which they adopt more competitive strategies until they have made material progress in reforming their economies. This would exacerbate the weakness of countries with high fiscal deficits and would negatively affect those items that rely on oil revenues for funding, such as health or public employment.

- 6IMF, The Future of Oil – IMF F&D (2021).