Financial markets set their sights on summer

The postponement of interest rate cut expectations that had begun in February extended to March, with investors consolidating the idea that the central banks are not in such a hurry to relax financial conditions so soon.

Continuity in financial markets’ narrative

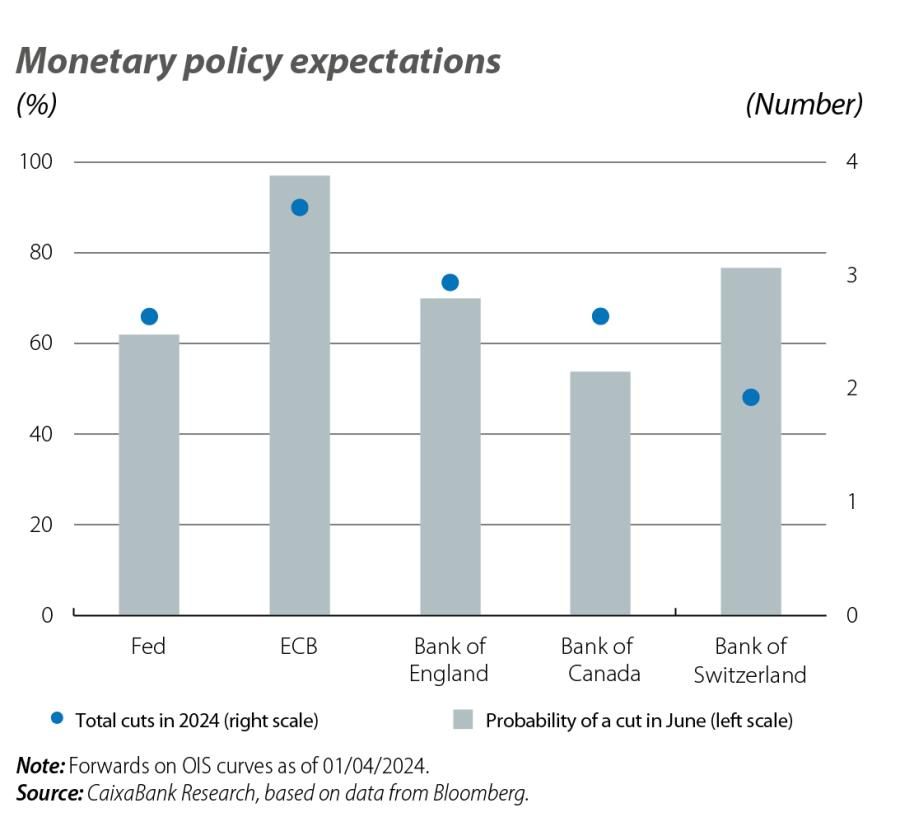

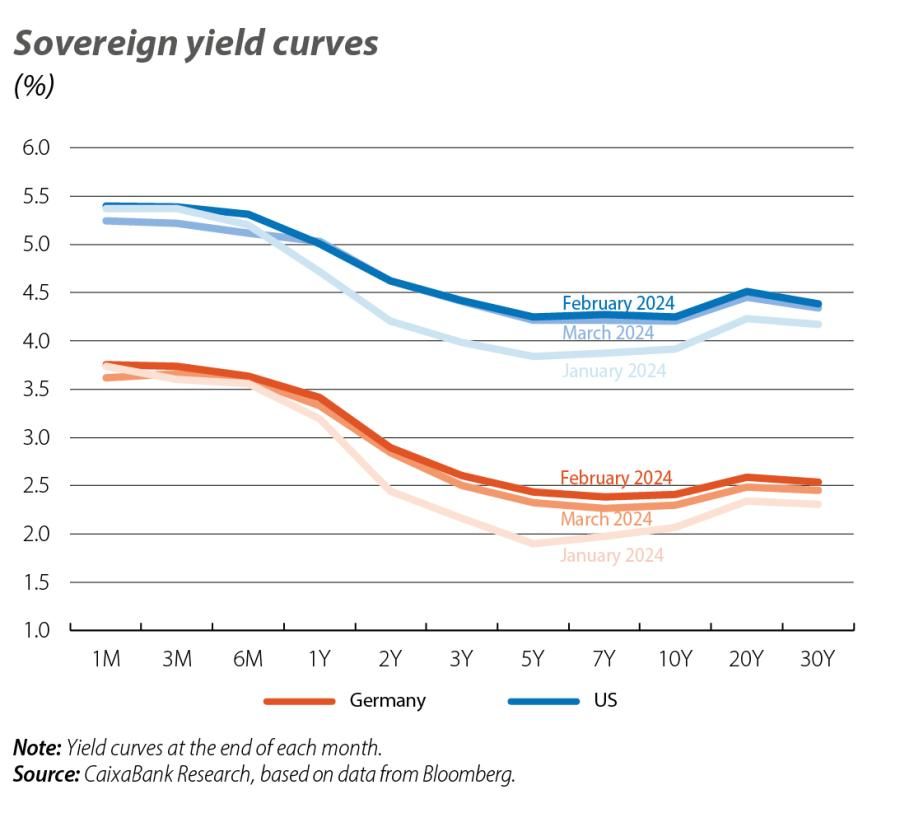

The postponement of interest rate cut expectations that had begun in February extended to March, with investors consolidating the idea that the central banks are not in such a hurry to relax financial conditions so soon. The big difference this month was that, in March, markets showed a greater capacity to discriminate between regions based on the differing pace of the slowdown in disinflation, as well as the divergence in economic strength between the major developed economies. For the euro area, where the progress on inflation has been more promising and economic activity remains more sluggish, investors increased their confidence in the expectation that the first cut of 25 bps will come in June and that the ECB will cut rates a total of three or four times this year. For the US, in contrast, where inflation is showing more persistence and economic activity greater dynamism, the markets were more sceptical and gradually shifted expectations for the first rate cut from June to July, at the same time as they reduced the expectation of four cuts in 2024 down to only three. This continuity in the narrative led to little changes in US sovereign yields in March, which had already rebounded significantly in the previous month, and with modest falls in the German yield curve as expectations of a rate cut in June took hold. Meanwhile, risk assets remained unaffected by the high rates and consolidated another month of gains.

Turning point towards the easing of monetary policy

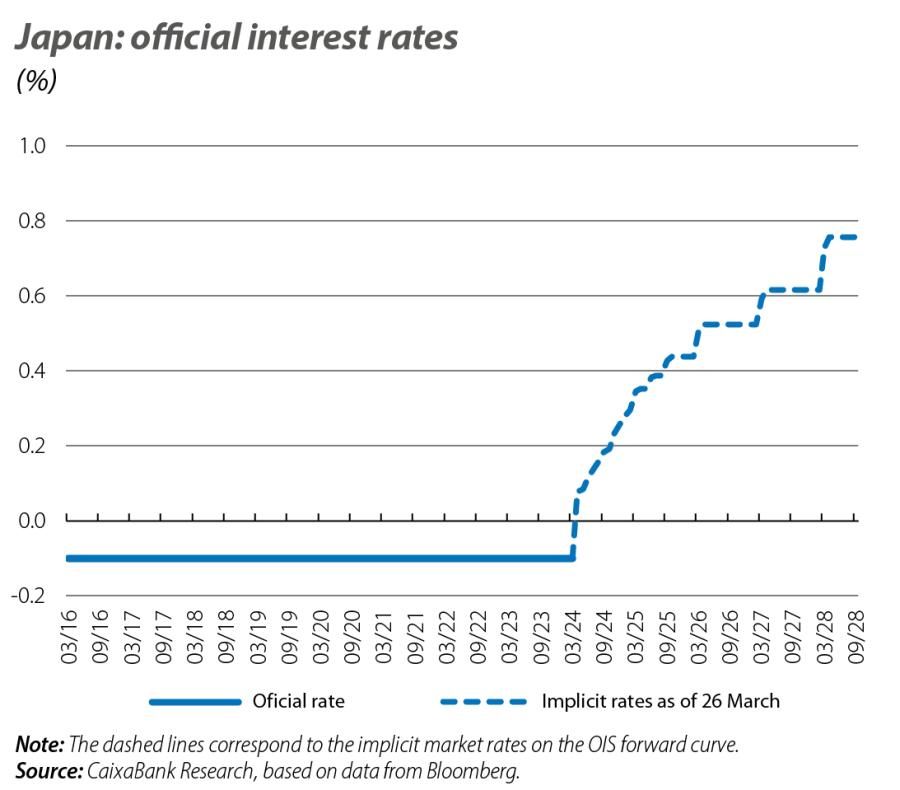

Following the major central banks' meetings, the expectation that the global monetary cycle will move in a new direction in 2024 was reinforced. The Bank of Switzerland clearly demonstrated this by being the first of the G10 economies to cut interest rates, in this case by 25 bps from 1.75% to 1.50%. More indirectly did so the other central banks of the major developed economies, as although they did not announce any changes to their reference rates, there was a noticeably more dovish tone to their messages. In the case of the Bank of England, which held rates at 5.25%, the fact that this was the first meeting in which none of the nine members voted in favour of an additional rate hike was taken as a sign of a shift towards a more accommodative stance. On the other hand, in the case of the ECB (which left the depo rate at 4.00% and the refi rate at 4.50%), despite reinforcing the need for caution and for any decisions to be taken based on the data, the message was articulated around June being a key month for considering the first rate cut. On the other side of the Atlantic, meanwhile, the Fed, which also maintained rates in the 5.25%-5.50% range, appeared confident about the good progress of inflation and its dot plot was explicit in anticipating three rate cuts in 2024, beginning in June. Another turning point was that of the Bank of Japan (BoJ), which ended its regime of negative interest rates by announcing an increase in its short-term benchmark rate from –0.1% up to the 0.0%-0.1% range. Moreover, it announced the end of unconventional monetary policy programmes, including the purchase of Japanese ETFs and REITs, as well as the yield curve control. While there is still a long way for it to go before it will approach the position of other central banks, and while the BoJ gave indications of wanting to move very cautiously in order to mitigate the risks associated with a withdrawal of the stimulus, the measures taken marked a turning point towards a return to more conventional monetary policy.

Sovereign yields remain high

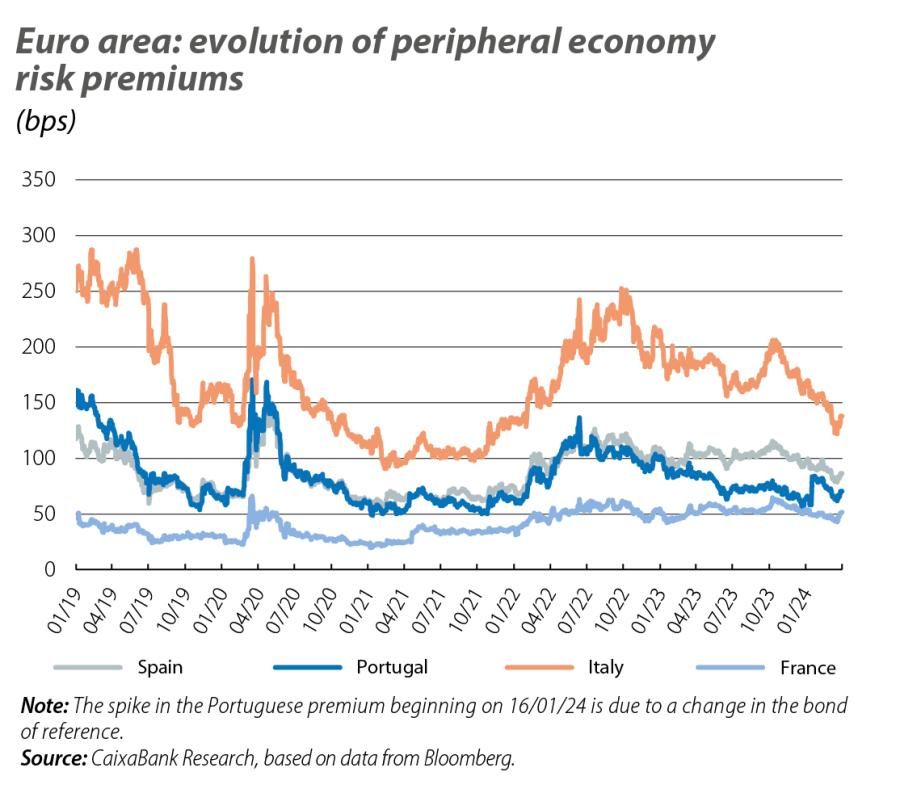

In March, debt markets faced a similar juncture to last month, with no major changes in the ECB’s data-dependency messages or in the Fed’s dot plot, and with greater confidence that the summer is when we will see the first rate cuts. Thus, after spending the month seeking a clear direction, sovereign interest rates ended up almost at the same levels as where they had stood at the end of February. On the other hand, the sovereign curves of the peripheral economies were once again affected by investors’ risk appetite and moderately narrowed their risk premiums, with Spain benefiting from the revision of the country's outlook from «stable» to «positive» assigned by the rating agency Moody's. This was not the case with the French and Italian risk premiums, which rose slightly (+11 bps in Italy and +6 bps in France) from mid-March after it was known that their deficits in 2023 exceeded their respective governments’ targets.

Equities continue to reach record highs

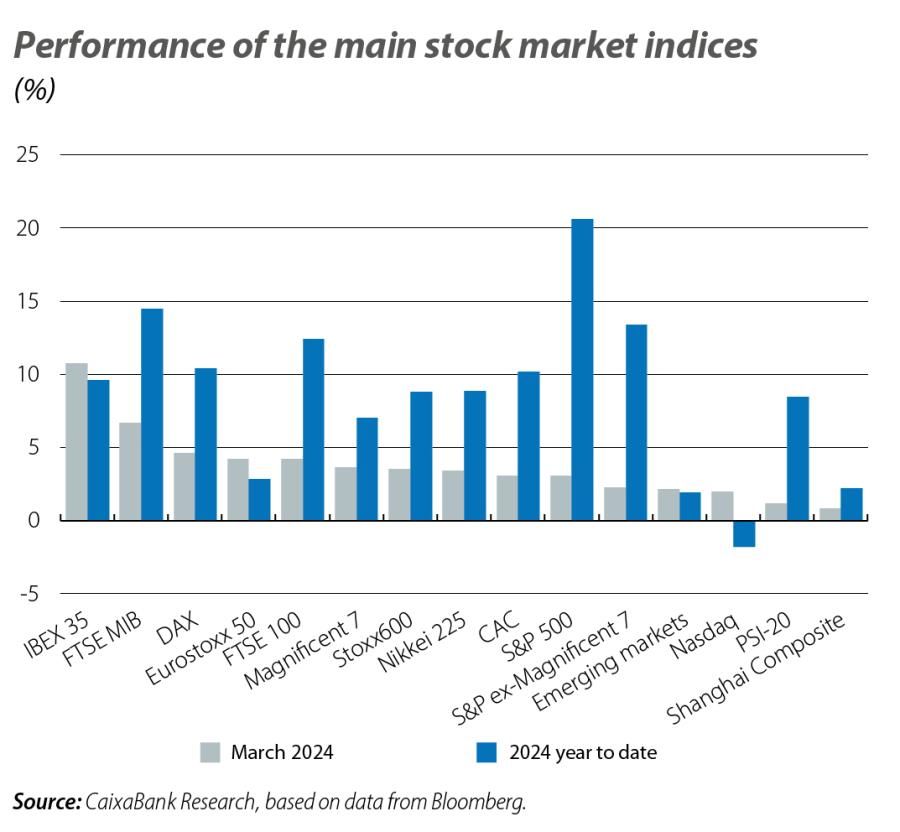

The major stock markets capitalised on the central banks’ dovish tone and remained seemingly oblivious to the high interest rates, the geopolitical risks and even the vulnerabilities in the commercial real estate sector, extending their gains for yet another month. Even the S&P 500 in the US and the Eurostoxx 600 in Europe closed the month of March at new all-time highs. The Spanish stock market stood out in the euro area, with the IBEX 35 rallying almost +11%, spurred by the financial sector after Moody’s positive revision of the rating of 15 national banks after having improved its outlook for Spain. In Asia, Japan’s stock market also hit a record despite the central bank’s rate hike, capitalising on the BoJ’s message of caution on exiting ultra-accommodative conditions, while China’s stock market posted modest gains as flows begin to return to the country amid a government effort to support local markets.

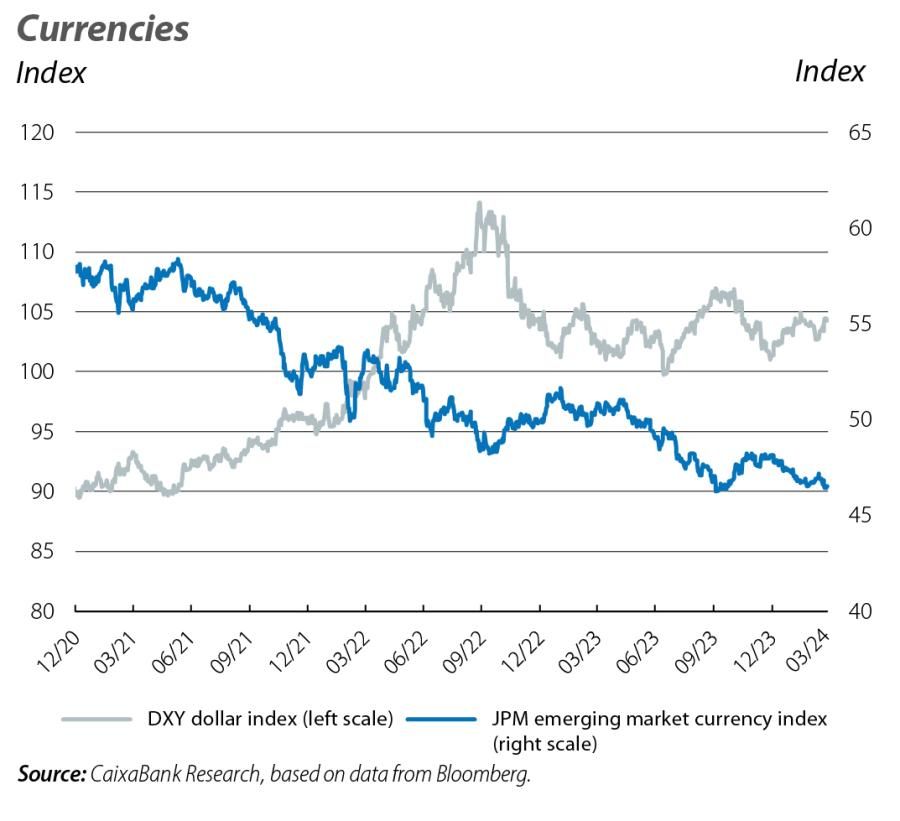

The yen’s weakness stands out among the major currencies

Following the BoJ’s announcement, the already weakened yen depreciated as much as an additional 1% against the euro and the dollar, as investors interpreted the BoJ’s messages as still highly dovish. Japan’s monetary authorities responded that they are prepared to take the necessary measures, as they do not consider the movements to be due to fundamentals. Meanwhile, the dollar remained strong against the major currencies, supported by the expectation that the Fed could take longer to cut rates. Especially notable was the strength of the dollar against other emerging economy currencies, which have depreciated by up to 3% against the dollar so far this year.

Geopolitical risk pushes up commodity prices

The geopolitical tensions, both in the Middle East with renewed attacks in Gaza and on some embassies, and in Ukraine and Russia with new bombings of crude oil refineries, caused oil prices to soar (the Brent barrel came to trade at around 90 dollars/barrel). So too did the price of gold, due to its role as a safe-haven asset, reaching new highs of around 2,200 dollars/ounce.