Can metals gain more «shine»?

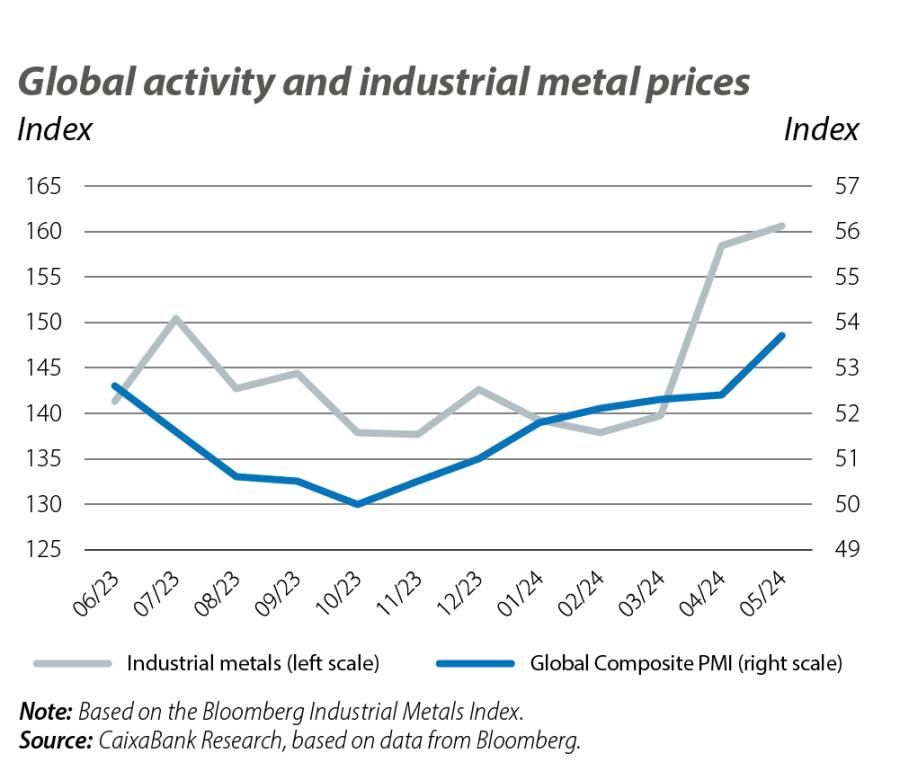

The price of industrial metals has rebounded this year with the revival of global economic activity and the persistence of constraints on some supplies. Will this upward trend continue?

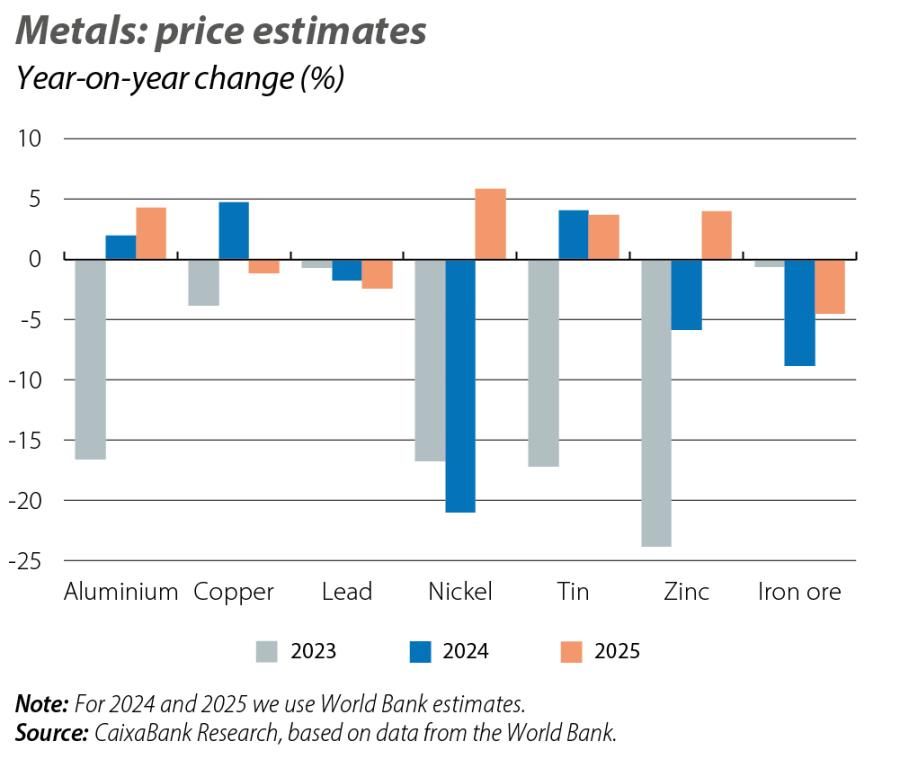

In 2023, the price of industrial metals1 fell by 11% as a result of weak economic growth. However, since the beginning of this year and particularly since the end of March, we are witnessing a rise in demand for most of these metals, focused in the automotive and renewable energy sectors, as industrial activity has picked up around the world, especially in emerging countries. This aspect, coupled with the persistence of constraints in the supply of some key metals, has been reflected in the rise in prices of most of these commodities. For instance, within the non-ferrous group of metals, so far this year the price of copper has risen by 15%, aluminium by 6% and nickel by 5%. The sector has also improved its profitability thanks to cheaper energy and transportation, which has led to an improvement in investor sentiment in relation to these assets.

- 1The World Bank base metals price index includes aluminium, copper, lead, nickel, tin and zinc.

A future on the up

If we try to elucidate where industrial metal prices will go from here, a priori it appears likely that price volatility will remain the dominant dynamic over the coming months, given the bullish forces which we will discuss below. However, there are also risks in the short term, such as the persistence of tight monetary policy at the global level and uncertainty regarding China. On the supply side, the pressure of trade restrictions linked to the recent Western ban on Russian metals will continue,2 and this could reduce the supply of aluminium and copper globally. In the case of tin, the pressure will come from the limits imposed on exports from Myanmar and Indonesia, which are responsible for 40% of the world’s production. Similarly, the World Bank points out that the global supply of copper will be diminished due to production cuts and interruptions in South America, as well as that of zinc due to producers’ response to weak prices during 2022 and 2023. Meanwhile, it is estimated that China’s significant investment in the industrial and infrastructure sector should help offset its lower demand for some metals, such as iron ore, linked to the weakness of its real estate sector. In the rest of the world, the start of interest rate cuts on the monetary policy side could act as an incentive not only for economic activity, but also for the demand for base metals.

- 2In April, the US and the UK banned the import of aluminium, copper and nickel from Russia, produced from 13 April 2024 onwards. This is one of the most direct sanctions on Russian metals since the start of the war in Ukraine, since the delivery of these metals is effectively prohibited in the warehouses of the Chicago Mercantile Exchange (CME) and the London Metal Exchange (LME), which are the main trading exchanges and serve as the benchmarks in the setting of global metal prices.

If we extend the horizon of the outlook for industrial metals to the longer term, more and more analysts are envisaging a future in which these commodities will play a leading role and in which tensions between supply and demand will become increasingly frequent and a determining factor for prices. On of the key arguments shaping this scenario is the low level of investment in the mining and extractive sector in the past two decades. The unattractive return that many investments in long-term projects have offered to date, coupled with the instability of the governments of many of the producing nations, has led to a decline in productive capacity and in inventory levels.

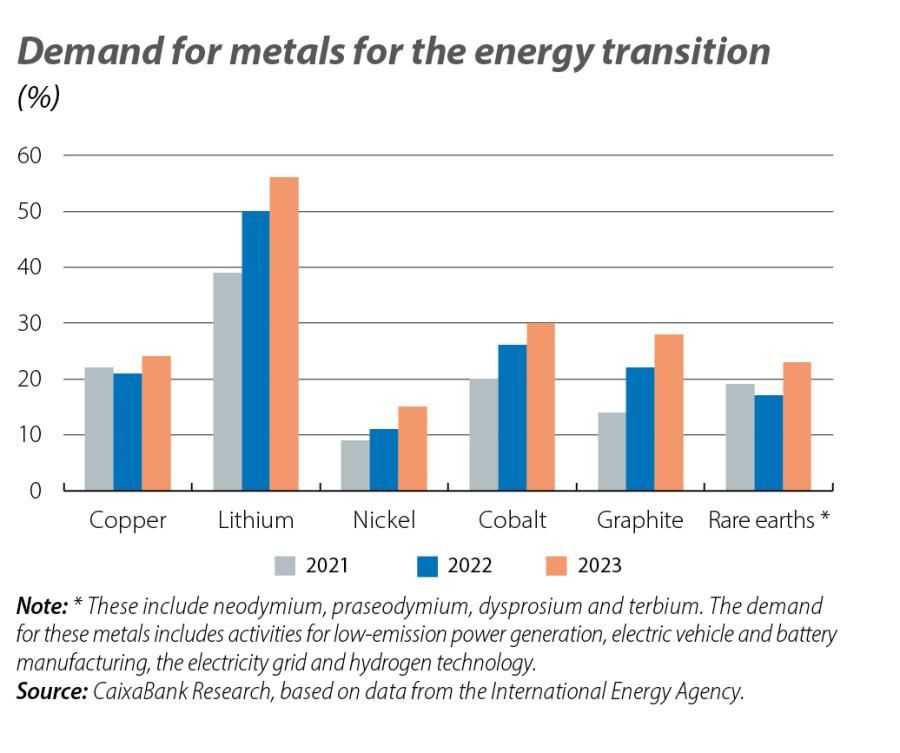

A second argument behind this outlook scenario is the progress being made in decarbonisation and environmental sustainability policies. The energy transition is a process that is intensive in the use of metals, both in implementing new renewable energy sources and in adapting industry to them. It is estimated that demand for metals for «green» purposes will grow by 7% per year through to 2050 (the year when the COP28 countries have committed to achieving net zero carbon dioxide emissions). This is twice as much as the combined demand for aluminium and copper has grown in the last 13 years.3 In this context, copper will play an even greater role, because in addition to being the best conductor of electrical energy (only behind the silver), the development of solar and wind farms and the manufacture of electric vehicles require almost twice as much copper as fossil-fuel-based power plants and internal combustion vehicles,4 and it is increasingly difficult and expensive to extract the same quantity and quality of metal from new mines. A third argument is the development of artificial intelligence (AI) and data centres. Training AI models and their subsequent use leads to a significant increase in electricity demand.5 This requires a sufficiently extensive and up-to-date electricity grid in order to guarantee the supply, so as the use of AI and data centres grows, this will also lead to an increase in the demand for metals.

- 3The International Energy Agency (IEA) estimates that manufacturing an electric vehicle requires up to six times more weight in metal than manufacturing an internal combustion vehicle.

- 4See Thermal Management for EV Power Electronics 2024-2034: Forecasts, Technologies, Markets, and Trends, ID TechEx, March 2024.

- 5The IEA points out that a Google search based on ChatGPT consumes almost 10 times more electricity than a traditional search.

However, this future scenario is not without risks that could alter the path of the rise in the demand for metals – and their prices. On the one hand, the pace of execution of the energy transition will be a determining factor, and this depends on multiple constraints and will vary from country to country. The final product could be altered by aspects such as the degree of commitment from governments in emerging and/or low-income countries, the lack of investment (both public and private) in long-term projects, and the emergence of geopolitical risks. These aspects would also adversely affect the expansion of the electricity grid worldwide. Another risk lies in the pace of technological development. Usually, technological advances have led to a lower use of metals or have led to a change in the use (demand) of one metal for another, favouring an easing of prices.