Economic impact of the floods in the Valencia province

The devastation caused by the floods could subtract between 10 and 20 basis points from Spain’s GDP in Q4 2024. This estimate is subject to a high degree of uncertainty and assumes a significant impact on Valencia’s primary sector, a moderate impact on its industry and a milder impact on trade. The estimate for 2025 will depend largely on the scale of the investments allocated to reconstruction and the replenishment of the capital destroyed in the floods, as well as on the support measures that are implemented.

The economic consequences of the floods on 29 October 2024 in Valencia are difficult to estimate, but the available information allows us to make a first approximation of their impact on economic activity. As we will see in more detail below, we predict that the impact on GDP growth will be negative in Q4 this year, but we do not believe it will jeopardise our forecast of 2.8% growth for Spain as a whole in 2024. Looking ahead to 2025, the restoration and reconstruction work and purchases of durable goods (furniture, appliances, vehicles, etc.) should make a positive net contribution to GDP growth in the Spanish economy as a whole.1

- 1Note that when a natural disaster occurs, the destruction of productive capital does not count directly as part of GDP, as it represents a loss of wealth.

Area affected by the floods and impact by sector in Valencia

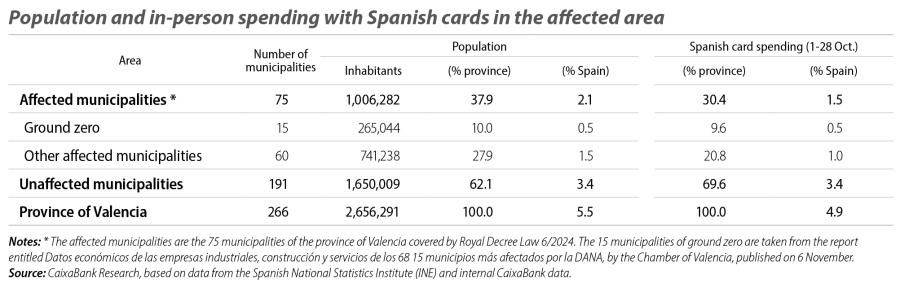

The province of Valencia contributes 5% of Spain’s GDP and 53% of that of the Community of Valencia region. In terms of population, the province is home to some 2.66 million people, 1 million of whom live in the 75 municipalities affected by the floods.2 Of these, there are 15 municipalities that have been severely affected (ground zero), with a population of 265,000 inhabitants, representing 10% of the total of the province and 0.5% of the population of Spain.3

The sectors hardest hit by the floods are agriculture, which accounts for 2.2% of the GVA of the province of Valencia; manufacturing, accounting for 15.3% of the region’s productive structure; and trade, transport and hospitality and leisure, which represent 24% of the GVA.

The sector that suffered the greatest direct impact is the agrifood sector: around half of the useful agricultural land area is affected and the production losses – in the middle of the harvesting campaign – reached 100% in some cases. The products most affected have included persimmon, citrus fruits, rice and vineyards. A provisional assessment by the Ministry of Agriculture, Fisheries and Food estimates that 49,000 producers and 70,000 hectares were affected by the storm.4

- 2Royal Decree Law 6/2024, of 5 November, adopting urgent measures in response to the damage caused by the extreme weather event (referred to locally as a DANA, an acronym for high-altitude isolated depression), covers 74 municipalities in the province of Valencia plus the southern districts of the city of Valencia. It also includes three municipalities outside the province of Valencia (Alahurín de la Torre, in Malaga; Letur, in Albacete; and Mira, in Cuenca). The regional government of Valencia (Generalitat Valenciana) subsequently extended the list to include 15 more municipalities (resolution of 19 November).

- 3The municipalities of ground zero are taken from the report entitled Datos económicos de las empresas industriales, construcción y servicios de los 68 municipios más afectados por la DANA, by the Chamber of Valencia, published on 6 November. The 15 municipalities of ground zero and their number of inhabitants (in brackets) are: Alaquàs (29,825), Albal (17,024), Aldaia (33,376), Alfafar (21,879), Algemesí (27,438), Benetússer (15,879), Beniparrell (2,074), Catarroja (29,316), Chiva (16,750), Llocnou de la Corona (124), Massanassa (10,146), Paiporta (27,184), Picanya (11,760), Sedaví (10,637) and Utiel (11,632).

- 4This estimate includes 34 municipalities in the province of Almeria included in Royal Decree Law 7/2024.

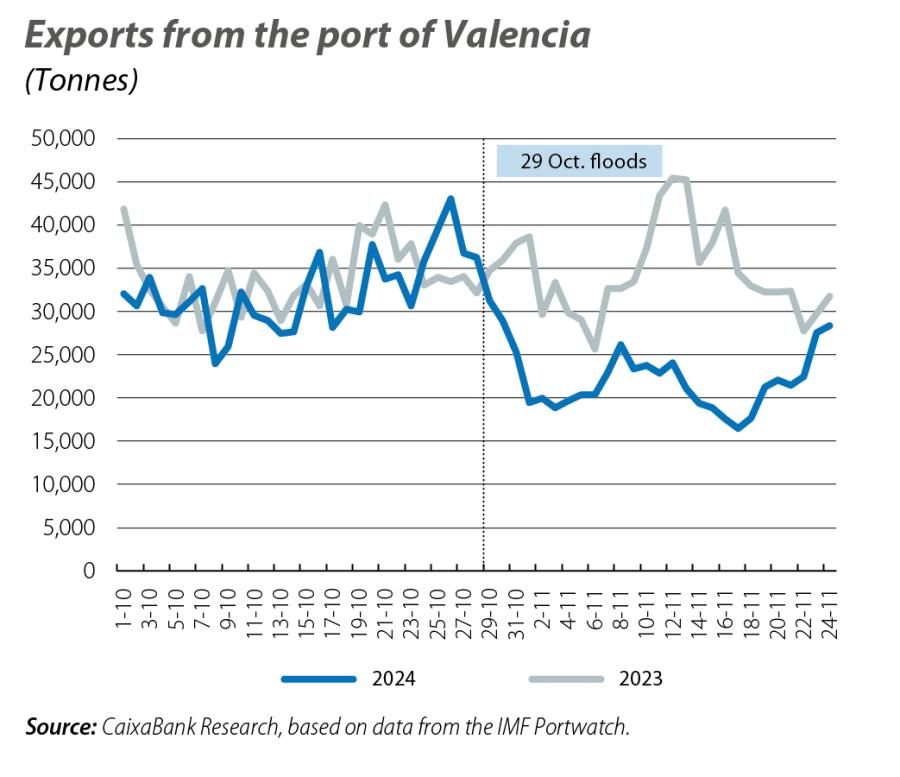

Industry also plays an important role in the area affected by the floods. Specifically, the area is home to 2.7% of Spain’s industrial companies and 3.6% of the country’s industrial employment, compared with 2% in the case of all companies and 1.9% for total employment. The floods inundated industrial estates and logistics centres, many of them linked to export activities by sea: the daily data on port activity show a sharp drop in exports from the port of Valencia following the storm (–30% year-on-year in the first week and –47% in the second week), although the latest data show a normalisation of trade flows (–5% year-on-year in the seven days to 24 November).

Retail trade has also been severely affected. According to the Chamber of Valencia,5 it is estimated that over 5,000 shops could have suffered direct damage, 67% of which are likely to have suffered serious damage. In addition, in the affected areas there are also some 21,000 service establishments (hotels and restaurants, hairdressers, academies, clinics, workshops, etc.), of which 42% are estimated to have suffered serious damage.

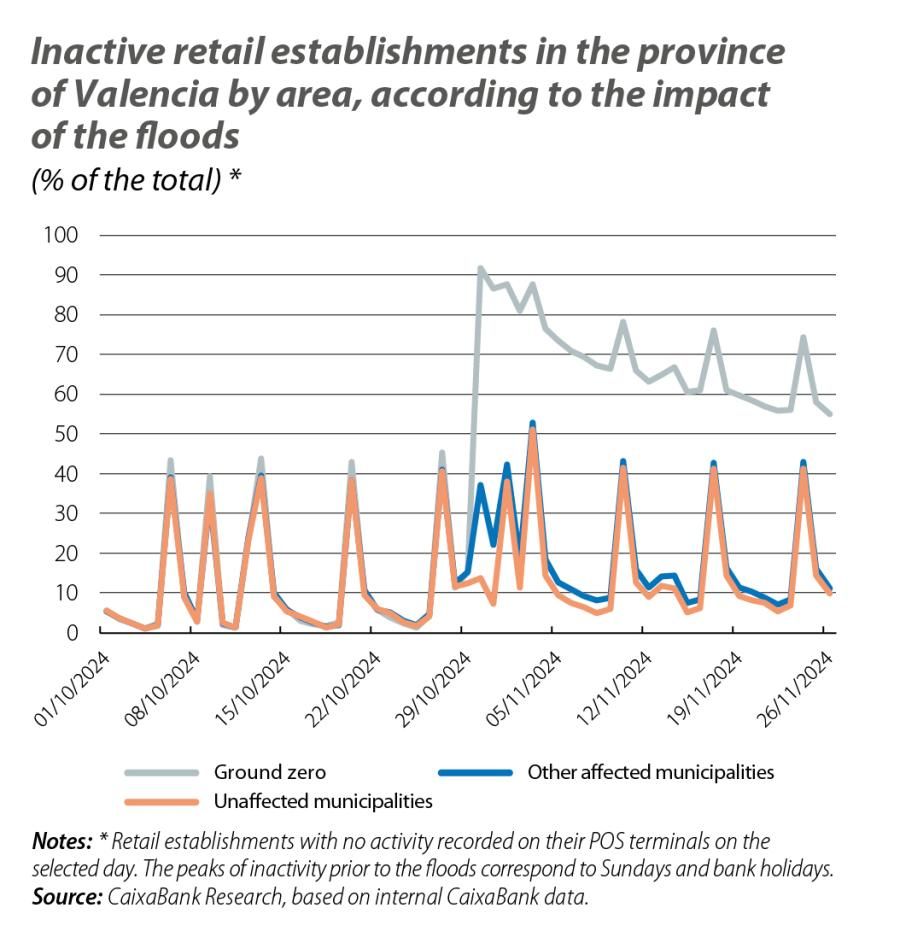

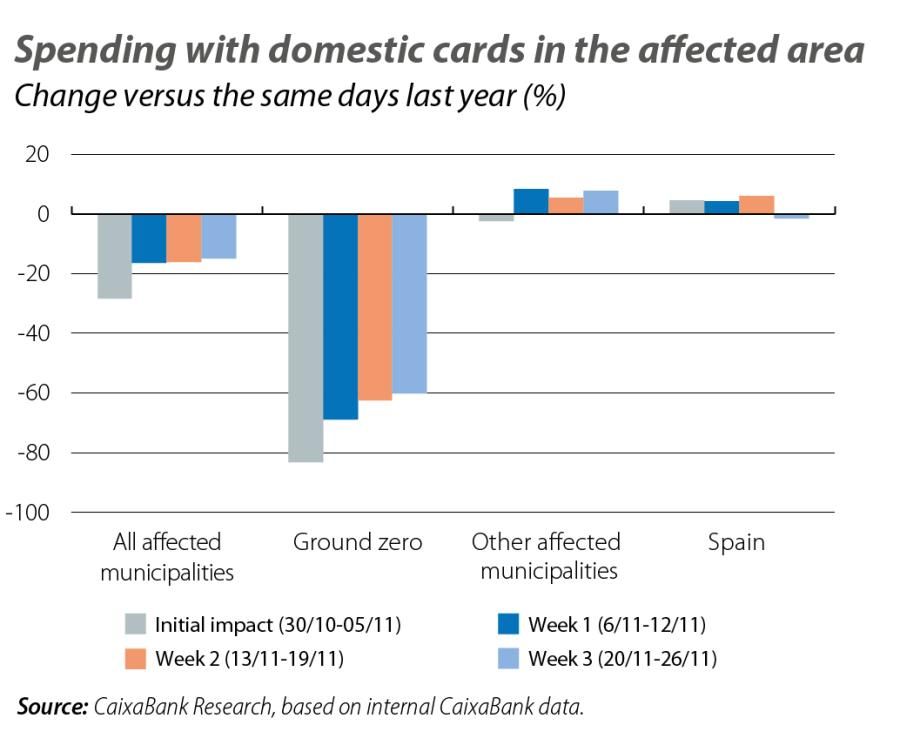

Our internal data on payments made with CaixaBank cards on POS terminals in the affected area allow us to assess the extent and intensity of the initial impact on trade, as well as to track the progress of the recovery in real time in the different areas according to the degree to which they were affected. In the first week after the floods, over 90% of establishments in the ground-zero area were unable to open their doors, with the consequent slump in turnover (–83% year-on-year).6 In the rest of the municipalities affected, but outside ground zero, the impact was significant, but less intense: 30% of establishments registered no activity during the first week, but they quickly followed a very similar pattern to the unaffected municipalities, and their turnover barely decreased (–2% year-on-year in the first week), possibly due to a substitution effect of the establishments in the areas that were affected.

- 5 See the report entitled Informe sobre la evaluación provisional sobre los daños en la actividad comercial minorista en los municipios afectados por la DANA, by the Chamber of Commerce of Valencia, of 12 November.

- 6We make an approximation of the number of establishments that were closed based on those that registered no activity on their POS terminals.

On the other hand, the recovery of trade in ground zero is occurring very slowly: in the week of 20 to 26 November,1 the in-person spending carried out with Spanish cards was still 60% below the same week last year. By expenditure category, retail trade (textiles, furniture, household appliances, etc.) has barely recovered (–85% year-on-year and with 76% of establishments showing no activity). The leisure, hotels and restaurants category shows a slight improvement compared to the first week after the floods, but the impact remains very significant (–51% year-on-year in turnover and 61% of establishments inactive). On the other hand, shops selling essential goods (food shops and pharmacies) show a better trajectory: –42% year-on-year in turnover and 45% of establishments inactive in the week of 20 to 26 November, compared to –71% in turnover and 80% inactive in the first week. The complete destruction of many ground-floor premises suggests that a percentage of these establishments (the exact figure is difficult to quantify) will be forced to close their doors permanently.

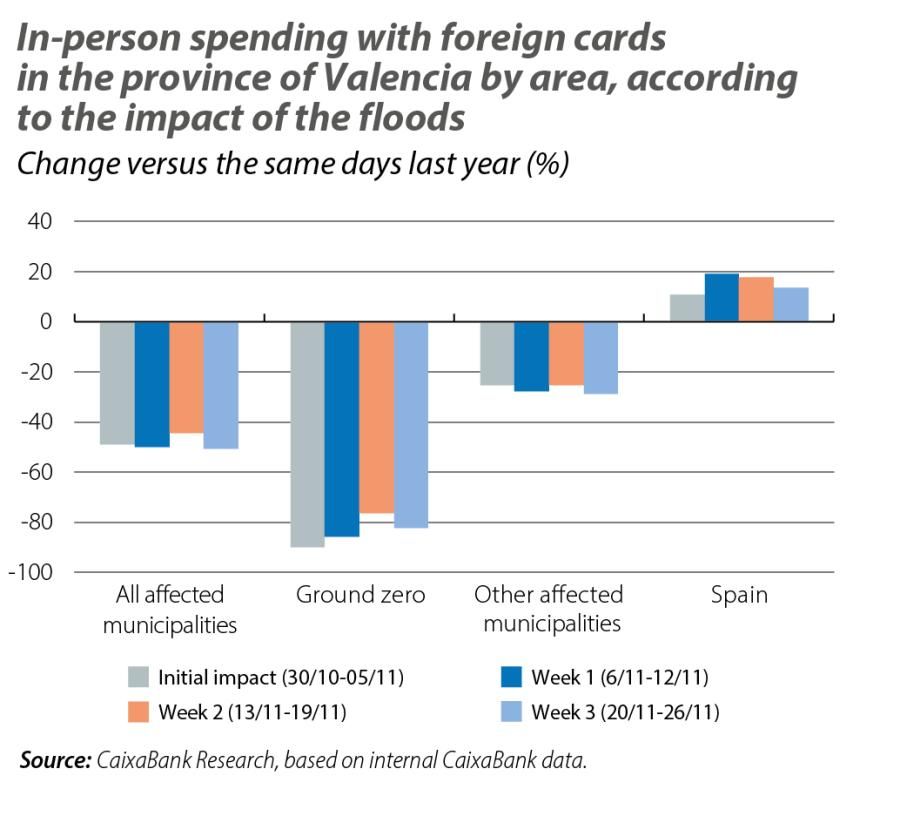

Spending with foreign cards, on the other hand, allows us to approximate the degree to which the tourism sector has been affected.8 In the first week following the floods, spending by foreigners plummeted in ground zero (–90% year-on-year) and the recovery to date has been limited (–82% year-on-year in the week of 20 to November). International spending in the rest of the municipalities affected registered a lower decline in the first week (–25% year-on-year), but shows no signs of improvement (–29% in the week of 20 to 26 November), which contrasts with the increase in international tourism expenditure across Spain as a whole (14% year-on-year). This may be attributable to the impact that the floods had on the infrastructure necessary for transporting tourists and which the news of the disaster has had for attracting potential visitors. In any event, the impact on tourism infrastructure and hotel facilities has been limited, so the tourism sector should be able to recover

in the coming weeks.

- 1Latest week with available data at the time of writing this article. The CaixaBank Research Consumption Tracker contains weekly updates of this data that can be viewed on our website.

- 8According to internal CaixaBank data, spending by international tourists in the municipalities hardest hit by the floods (ground zero) represents 7.3% of the total international tourism expenditure in the province (the city of Valencia is where 33% of the province’s total is recorded). Spending by international and national tourists is distributed practically equally in the province as a whole.

Macroeconomic impact of the floods

We estimate that the devastation caused by the floods could subtract between 10 and 20 basis points from Spain’s GDP in Q4 2024 – an estimate that is is subject to a high degree of uncertainty. This assumes a significant impact on the primary sector, a moderate impact on industry and a milder impact on trade (due to a substitution effect) in the final months of the year. The initial clean-up and reconstruction work will moderate the impact on economic activity.

As for the estimate for 2025, the empirical evidence on the impact of natural disasters on GDP generally finds that it is limited and transient, although the negative impact still dominates a year on.9 In any event, these estimates are subject to a high degree of uncertainty and will depend largely on the scale of the investments allocated to reconstruction and the replenishment of the capital destroyed in the floods, as well as on the support measures that are implemented. In this regard, the government has approved measures amounting to 16.6 billion euros between aid, guarantees and investments (1.1% of GDP). The impact of this package on the 2024 general government deficit should be limited, since the bulk of the allocated budget will materialise in 2025 and, moreover, 5 billion is in the form of guarantees managed by the Official Credit Institute (ICO). We estimate that the deployment of these support measures, as well as the investments for reconstruction, could contribute to a positive impact on Spanish GDP in 2025 of between 10 and 30 basis points (already net of the disruptive effects that could persist in the coming quarters).

Over the coming weeks we will continue to monitor card spending in the province of Valencia, to track the evolution of consumption in real time and to follow the reopening of trade in the affected area. These updates can be found on our website, in the CaixaBank Research Consumption Tracker.

Global warming is likely to lead to extreme weather events becoming more frequent and more severe. The devastation caused by the floods in Valencia should cause us to reflect on the need to invest in mitigating the consequences of climate change and adapting to it in particularly vulnerable regions.

- 9The Bank of Spain estimates, using two different econometric exercises based on historical data from natural disasters and from Hurricane Katrina, a negative impact of 0.2 pps on GDP, which does not show any increase one year later.