The slowdown in rental prices in Spain: what big data reveal

Based on CaixaBank’s internal data regarding rent payments, we have constructed indicators for the recent trend in residential rental prices at a provincial level and for the largest municipalities. The results obtained show that there was already a generalised slowdown in rent growth before the pandemic arrived, and that the outbreak of the health crisis extended corrections to most provinces and municipalities, with decreases being especially pronounced among the lowest rents and in the most tourist-oriented municipalities.

The downward trend in rental prices has been accentuated in the wake of the pandemic

The trend towards rental price moderation in Spain began before the onset of COVID-19 and the pandemic merely accelerated it. This has been confirmed by the results of the analysis we have carried out using CaixaBank’s internal data on rent payments (duly anonymised and processed in aggregate using big data techniques). Specifically, we select payer-issuer operations that are six months old or less in order to capture the changes in trend occurring in the market, and construct rental price indicators for each province and for the major municipalities in Spain.

Equipped with these indicators, the first chart shows that the year-on-year change in the average for the provinces reached a peak in May 2019 and then began to decelerate markedly in the second half of the year. Specifically, 42% of the provinces and 40% of the municipalities analysed reached their maximum value for new rents before December 2019. Consequently, in many locations we found that rental prices had peaked before the pandemic, after five years of much higher growth than the increase in household income.25

With the arrival of the pandemic, more locations joined the downward trend, which became more pronounced, causing the year-on-year change in the provincial average rental price to reach negative figures from April to July. Several factors probably contributed to this decline, most notably falling household income, which has particularly affected low-income households who tend to live in rented accommodation. For its part, the significant increase in the supply of rented apartments, resulting from the transfer of dwellings intended for tourist rental to the traditional residential market, would also have had an impact on the drop in rental prices in tourist areas, as will be seen below.

- 25For an analysis of the factors that drove rental prices between 2014 and 2019, see «Rent is on the rise Spain», published in the Real Estate Sector Report for the second semester of 2019.

Rents were already experiencing a downward trend before the pandemic.

The fall in household income and the transfer of properties for tourist rental contributed to this drop in prices

In 2021, growth in rental prices has been in negative figures throughout much of Spain: 65% of the provinces and 55% of the municipalities analysed have lower prices in 2021 (with data up to September) compared to the 2020 average. The latest available data, corresponding to September 2021, show that 46% of the provinces and 42% of the municipalities analysed are still posting a lower average rental price than in December 2019, before the pandemic, so the recovery in the rental market is lagging far behind the sale market.

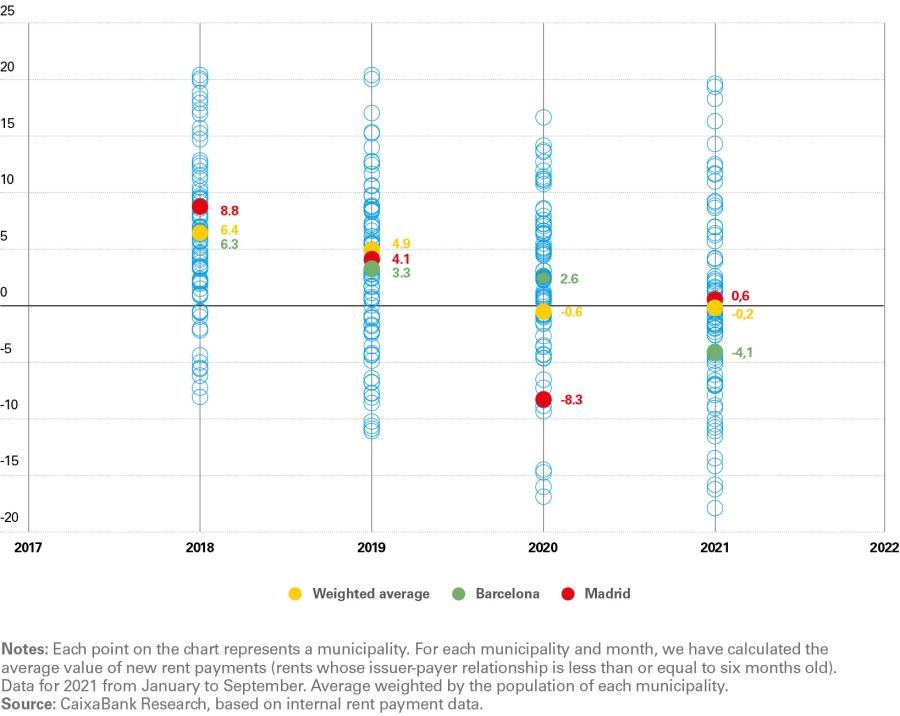

The trend in rental prices in Madrid and Barcelona

Special mention should be made of the municipalities in Madrid and Barcelona, marked with red and green circles, respectively, in the following chart. In the first case, rents fell sharply in 2020 (–8.3%) although it is true that this decline started from higher growth rates in previous years, and they began to recover in 2021 (+0.6%). In contrast, Barcelona rents experienced a slowdown in 2020 but rental prices resisted adjustment until October 2020, when the law limiting rents in Catalonia’s stressed markets came into force.26

- 26Law 11/2020, of 18 September, of the Catalan government, on urgent measures regarding rent containment in rental lease agreements. Since 1 October 2020, this law has limited rental prices in those Catalan municipalities declared a highprice zone.

The moderation in rental prices has accentuated in the aftermath of the pandemic

Annual change in the average rent by municipality (%)

If we compare the trend in rents in the affected Catalan municipalities (where the rental price of new leases cannot exceed the previous price or the benchmark index) before and after this law’s entry into force and also compare it with the rest of the municipalities, we can see that, since October 2020, the year-on-year change in rental price would have been marginally lower in the affected Catalan municipalities (around 1 pp).27 However, the chart below shows that the rental price in the affected Catalan municipalities was somewhat resistant to falling in 2020, before the law came into effect, which could point to a possible reluctance to adjust rental leases to the market situation, anticipating that it will not be possible to raise rents once the new law is in force. However, it is difficult to carry out a rigorous empirical analysis to gauge the impact of this rental law in Catalonia, since it came into force at a time when the market was already adjusting and, in addition, the pandemic has had a different impact on the rental market in each municipality due to a multitude of factors, such as its degree of dependence on tourism, which will be examined below.28

- 27Methodologically, we carried out a difference-in-differences analysis.

- 28Similarly, other analyses show that the Catalan law would have had little impact on rental prices but a negative impact on supply. See «Efectos de la pandemia en el mercado del alquiler: ¿es conveniente una norma de regulación de precios?» EsadeEcPol Insight #27, February 2021, and «La regulación del alquiler en Cataluña apenas incide en los precios, pero destruye la oferta», Idealista, March 2021.

What the average hides... and what microdata reveal

One great advantage of internal rent payment data that they enable us to analyse the distribution of rents within one location. Generally, available rent indicators report the average rental price in a given area. But the truth is that, within the same location, the range of rental prices is relatively wide.29 Consequently, in order to analyse the trend in rents at different points of the distribution, we has calculated two additional indicators (apart from the average): the 75th percentile indicator (high rents) and the 25th percentile indicator (low rents).30

- 29Generally, the rental price depends on the property’s state of repair, its size and other specific factors apart from the area in which the property is located.

- 30The 25th percentile indicator (for a given month and location) is the value such that 25% of the rents in that location are below this value (and 75% of the rents are above). The 75th percentile indicator is defined in a similar way and measures the trend in high rents in an area.

On average, low rents have fallen

more than high rents in the provinces

In doing so, we have found that rents at the lower end of the distribution (25th percentile) grew more moderately before the pandemic (up by 5.1% in 2018 versus 5.8% on average) and that their decline in 2021 is more pronounced (–6.1% versus –4.2% on average).31 In contrast, rents at the upper end of the distribution (75th percentile) grew more vigorously in 2019 (6.5%) and their decline in terms of the provincial average has been more limited in 2021 (–4.1%).32 This can be seen in the chart below, which shows the average annual change at a provincial level (the results at a municipal level are similar). These results suggest that much of the adjustment in rental prices has occurred among the lowest rents, generally in dwellings occupied by low-income households which have been the most affected by the crisis in terms of job losses and reduced income.

- 31Moreover, in those provinces where prices have fallen in 2021, low rents have posted a considerable average annual decrease (–14%).

- 32Moreover, in those provinces where prices have risen in 2021, the prices seeing the highest growth are high rents (the 75th percentile has posted an average increase of 5.9% in these provinces).

The impact of tourism on rental prices

The pandemic hit international tourism hard, in turn having a direct impact on rental prices in the most tourist-oriented locations: properties that had been destined for tourist rental were shifted to the traditional residential market, increasing the supply and therefore pushing down prices. After classifying the municipalities into tourist and non-tourist (depending on whether spending via foreign cards at CaixaBank POS terminals was more or less than 10% of the total in 2019), we can see that the average rental price fell more sharply in 2020 in tourist-oriented municipalities and that this decline was more pronounced for high rents (75th percentile). We can also see that rental prices in non-tourist municipalities have been slower to adjust (no annual average declines are observed until 2021) and the decline was less sharp than in tourist municipalities and concentrated in the lower part of the distribution (25th percentile).33

- 33For an analysis of the impact of international tourism on demand for foreign housing and sale prices in tourist municipalities, see «How has the slump in foreign tourism affected the residential property market?».

Rental prices have fallen more sharply in tourist-oriented municipalities, especially in the upper part of the distribution

Average annual change in new rents (%)

Final points

The COVID-19 crisis has accentuated and extended the price adjustment which the rental market was already experiencing before the pandemic arrived. In this context, the draft bill for the right to housing presented by the Spanish government in October 2021 introduces a new regulatory instrument so that regional governments and municipal councils can declare highrent zones in order to limit rental prices in these areas. International experience stresses the importance of carefully assessing the effectiveness and impact of such measures since, in certain cases, they can be counterproductive.34

- 34See «Public intervention in the rental housing market: a review of international experience» Documentos Ocasionales no. 2002, Bank of Spain, 2020.