The acquisition of housing in Lisbon by foreigners

The Greater Lisbon region accounted for 18% of all home sales in Portugal in 2023. Of these, 23% involved buyers with tax residence outside Portugal and the EU.

In 2023, the Greater Lisbon region accounted for 18% of all home sales in the country. If we focus on buyers whose tax residence is outside Portugal and the EU, they account for 23% of all the sales completed in Greater Lisbon. The increase in demand and prices in Greater Lisbon has a contagion effect on other regions, such as the Setubal Peninsula, Western Portugal and the Tagus Valley.1 We therefore consider it appropriate to analyse in detail the main characteristics of foreign demand in Lisbon.2

- 1See chapter 2 («Exuberance and contagion in the Portuguese housing market: a perspective on disaggregate local residential prices») of the study sponsored by the Francisco Manuel dos Santos Foundation «The real estate market in Portugal: prices, rents, tourism and accessibility» (April 2022).

- 2

The data consider home purchases made by private buyers within the perimeter of the Lisbon Urban Regeneration Area, which covers 21 of the municipality’s 24 districts (excluding Santa Clara, Lumiar and Parque das Nações). The analysis is based on data from Confidencial Imobiliário (SIR), which uses right of first refusal communications as its own data source and makes it possible to perform a more granular analysis by nationality and location.

Origin of the buyers

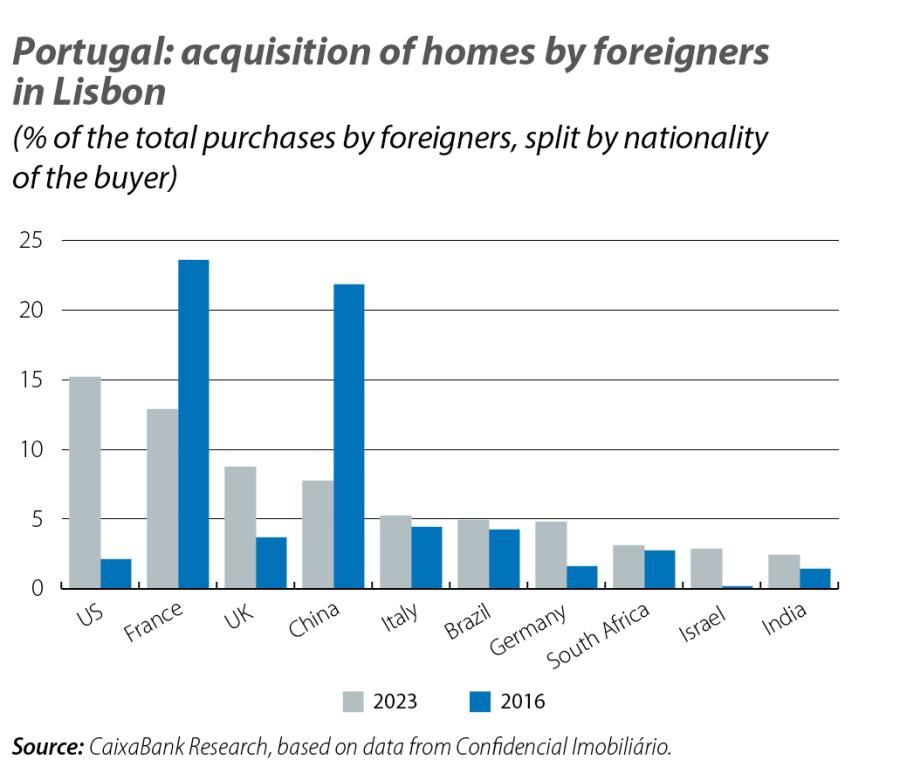

When we analyse the origin of home buyers, we see an increase in the representation of foreigners from the American continent. In fact, buyers from the Americas accounted for 23% of all purchases by non-residents in 2023 (see first chart), compared with 8% in 2016. This increase contrasts with the decrease in the representation of Asian buyers, particularly in recent years following the pandemic. This trend is not unrelated to the strict health restrictions imposed in several countries of this region, especially China: the Chinese account for 33% of all purchases made by Asian buyers in 2023, but their relevance has declined significantly in recent years (only 106 purchases in 2023, 62% less than the average in the period 2016-2020). European buyers continue to hold the top spot in terms of home purchases by foreigners, with 47% of all acquisitions.

Some 40 nationalities are represented in the home purchases made by foreigners in Lisbon, although the top 10 represent around 70% of the total (see second chart). In 2023, US citizens led the ranking, with 15.2% of the total, followed by the French (12.9%) and the British (8.7%). This second chart also reveals the reconfiguration of the nationality mix, with a significant increase in the role of US buyers compared to 2016 (from 2% to 15%), ousting the French from the top spot in the process. There is also a marked reduction in the relative weight of buyers from China (from 22% to 7%). Whereas in 2016, French and Chinese nationals accounted for almost half of all purchases, in 2023 they accounted for just 21%.

Characteristics of the homes purchased by foreigners

But where are foreigners buying homes? At what price? Do they buy more expensive properties than the Portuguese?

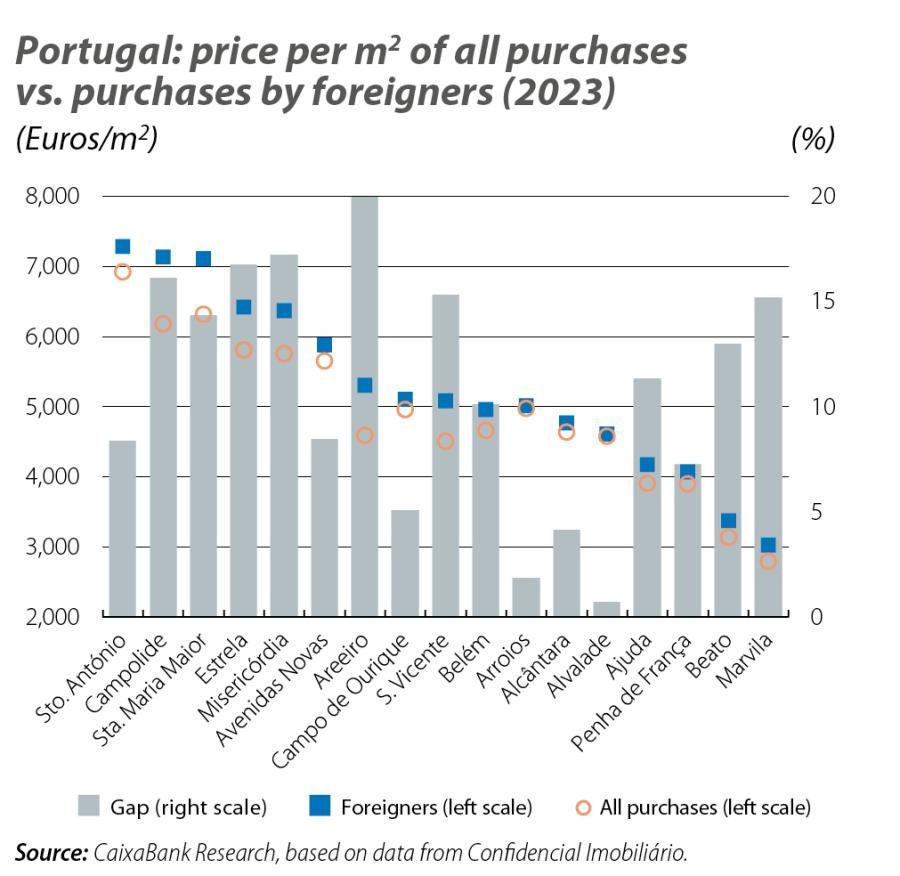

Last year the area which saw the most home purchases by foreigners was the district of Sto. Antonio. At the same time, it is the area where the price per square metre is the highest: 7,393 euros, which can be considered a premium segment. It is a very central location, with very well known streets, particularly the Avenida da Liberdade, which is closely associated with luxury retail. This area is followed by the Arroios neighbourhood, where around 13% of purchases were made, but at prices below the average of all acquisitions made by foreigners. The districts where the lowest prices were paid are found in the eastern part of the city: Beato and Marvila. It is also worth mentioning the district of Campolide, which has the second highest price per square metre. This could be related to a specific, high-end and well-known property development in the area, which is also one of the largest housing projects in the city in recent years.

Among the most representative nationalities, Americans accounted for 35% of purchases in two of the most expensive districts (Sto. Antonio and Estrela), followed by the French – 27% of all purchases were made in these two districts. British demand was more eclectic in terms of prices: 19% of purchases were made in Estrela, but another 15% were made in a district with below-average prices (Arroios). The Chinese concentrated 32% of their purchases in the third most expensive district, Santa Maria Maior, which covers the historical areas of Baixa, Chiado and Sé.

In terms of prices, foreigners have greater financial capacity and their demand is directed towards higher-priced homes. In the last chart, we compare the difference in the average price per square metre of all sales and that of homes purchased by foreigners. This analysis reveals that homes purchased by foreigners have an above-average price in all districts (positive gap), although this gap presents significant differences between different areas. For instance, in Areeiro this gap is wider (+20%), while in Arroios and Alvalade the difference is very residual.