An overview of Spain’s manufacturing industry

The Spanish economy has a diverse, export-oriented and highly productive manufacturing sector. However, the business fabric is still highly fragmented compared to German industry, a European benchmark. Increasing company size and the productivity of companies, through investment in R&D and adopting new digital technologies, and moving towards Industry 4.0 are key in the increasing competitiveness of a fundamental sector for the economy and for the Spanish foreign sector. The sector must also evolve towards a more sustainable industrial model: only companies that successfully undertake the energy transition will be able to compete in a new environment in which sustainability will be a prerequisite for continuing to operate in the market.

The importance of the manufacturing industry for Spain’s economy as a whole

Going back two decades, we can see that the manufacturing industry occupied an important position in the Spanish economy as a whole. However, from 2000 onwards, as was already happening in most advanced countries, it went through a very sharp decline that worsened during the Great Recession (2008-2013).1 Specifically, between 2000 and 2014, 41% of manufacturing jobs were lost in Spain (1.16 million fewer employees) and, in relative terms, employment in the sector went from representing 17.8% of the total in 2000 to 10.4% in 2014. The decline in terms of gross value added (GVA) was also considerable (–11% in real terms between 2000 and 2014) but notably less than that of employment,2 reflecting the significant gains in productivity achieved during this period (+3% per year per employee over the 14 years). Industry is precisely the sector that is most likely to reap the benefits of technological change: the automation and digitalisation of production processes boost labour productivity and make it possible to produce much more with the same number of workers.

- 1The deindustrialisation occurring in advanced countries can be explained by several factors, including productivity gains derived from technological advances as well as the offshoring of part of production with globalisation and the expansion of global value chains, the tertiarisation of advanced economies and also the subcontracting (or outsourcing) of certain services that were previously performed by manufacturing companies themselves but are now included in the service sector. For more details, see the «Industry 4.0» Dossier published in the Monthly Report of November 2016.

- 2The relative weight of manufacturing GVA fell from 16.2% in 2000 to 11.3% in 2014.

The relative weight of manufacturing in the Spanish economy has remained fairly stable since 2014,

after going through a sharp decline in the 2000s.

During the period of economic recovery after the global financial crisis, namely between 2014 and 2019, manufacturing grew at an average rate of 2.6% per year in real terms, very similar to the growth of Spain’s economy as a whole, so that its relative weight in the economy as a whole remained stable, contributing around 11.2% of GVA and 10.4% of total employment.3

- 3Average between 2014 and Q1 2021.

Share of the manufacturing sector

Out of total (%)

The contribution made by manufacturing goes beyond its own production volumes. On the one hand, the sector has a significant knock-on effect on the rest of the sectors in the economy: Estimates based on input-output tables suggest that an increase of 1 euro in manufacturing output generates an increase in the economy’s total output of an additional 1.1 euros (indirect effect). Manufacturing also has a positive impact on the trade balance: 39% of the sector’s sales go abroad (27.5% to the EU and 11.3% outside).4 However, in addition to its economic impact, the industrial sector also plays a fundamental role in technological progress due to its high innovation intensity5 and the fact that it promotes the spread of technology to other business sectors and, in general, to society as a whole. These positive synergies generated by industry strengthen the case for a new industrial policy in advanced countries that promotes the development of a competitive and sustainable industrial sector.

- 4Data from the National Statistics Institute (Industrial Structural Survey, 2018).

- 5Innovation intensity (measured as expenditure on innovative activities as a percentage of turnover) in manufacturing is 1.6% compared to 1.1% for all companies. Data from the National Statistics Institute (Business Innovation Survey, 2019).

The manufacturing sector generates many positive synergies for the economy:

it creates stable, good quality jobs, a reflection of its high productivity, and helps to spread technology throughout society.

Industry also generates stable, good quality jobs: 73% of those employed in the sector have been working in their current job for three years or more (compared to 69% in the economy as a whole), 17% of those employed in manufacturing have temporary contracts (compared to 24% in the economy as a whole) and workers in the sector earn wages that are 16.4% higher on average than in the economy as a whole.6 These better working conditions are not detrimental to company competitiveness; in fact they are associated with high levels of labour productivity. In fact, labour productivity in manufacturing is 42% higher than in the economy as a whole.7

Company size and productivity

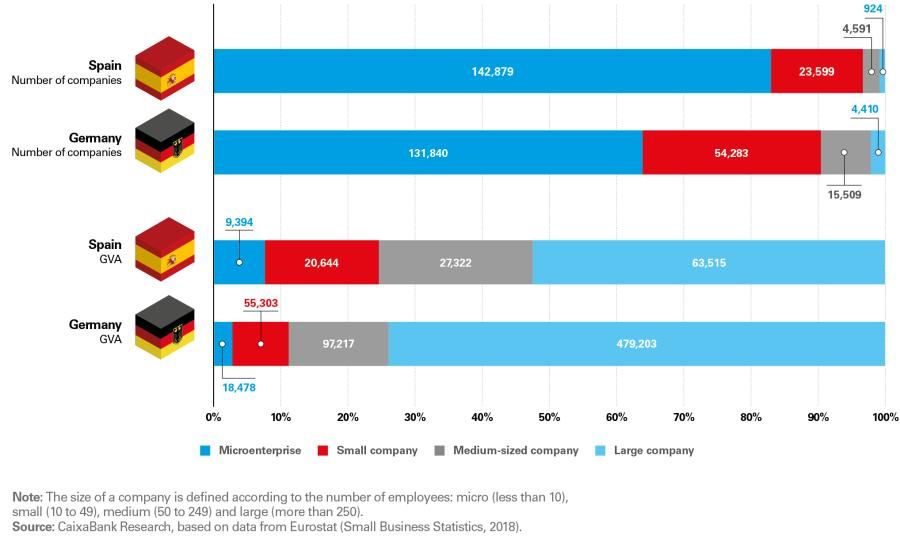

Manufacturing companies have a larger average size than in other sectors. In particular, 0.5% of companies in the sector are large (250 employees or more) compared to 0.1% of the total economy.8 However, an international comparison shows that the average size of Spanish companies is smaller than in Germany, an industrial benchmark for Europe, which has a 2.1% share of large manufacturing firms. These differences in the share of larger companies may seem small but they become amplified when the comparison is made in terms of value added: In Germany, large companies account for 74% of manufacturing GVA compared to 53% in Spain.

- 8Data from Eurostat (Structural Business Statistics, 2018).

Small firms dominate the manufacturing sector but large firms add more value

Large companies are more productive

making them strong enough to compete in a globalised environment.

Company size matters because it is directly related to productivity: manufacturing companies with 250 or more workers are 48% more productive than small and medium-sized enterprises (SMEs) and, coincidentally, also 48% more productive than large companies in the economy as a whole. Consequently, one of the main challenges facing Spanish industrial companies is to increase their size, as this helps them to make the most of economies of scale, to access various sources of financing, invest in R&D and enter international markets. Spanish industry, therefore, would benefit from a process of consolidation that would increase the size of its companies. Other alternative formulas that make it possible to take advantage of synergies between companies are also positive, such as the concentration of the activity in a certain sector within the same geographical area, thereby generating industrial ecosystems and technological clusters.

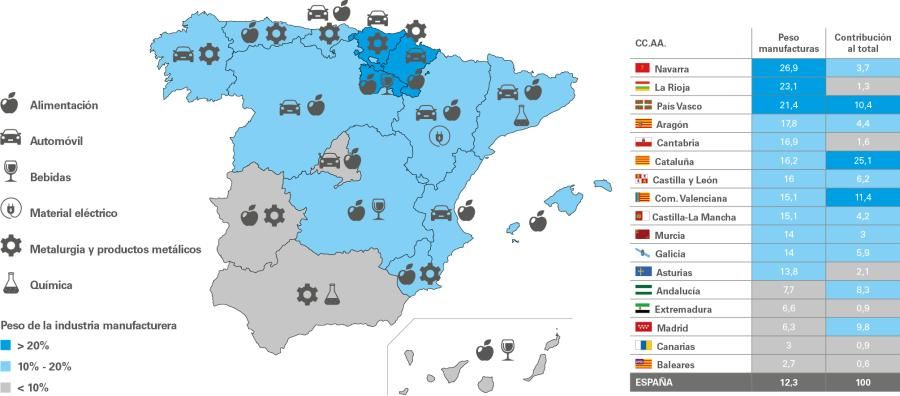

Going into more detail: the different branches of manufacturing

The manufacturing sector encompasses a wide range of activities,9 most significantly the agrifood industry (18.8% of manufacturing GVA), the car and other transport industry (12.7%) and the chemical-pharmaceutical industry (12.1%). At a geographical level, different production specialisation can be seen in different autonomous regions, although a common factor is the agrifood industry, which is in the top 3 manufacturing branches in all regions. Navarra, La Rioja and the Basque Country are the most industrial regions, as in all manufacturing’s share of the region’s GDP is over 20%, compared to 12.3% for Spain on average. On the other hand, Catalonia was the Autonomous Community that contributed the most to the national total (25.1%), followed by the Community of Valencia (11.4%).

- 9The manufacturing sector includes 24 industrial branches (NACE codes 10 to 33).

Spain’s manufacturing sector is characterised by concentration in certain branches of activity,

in which the agrifood industry stands out with a presence throughout the country, followed by the automotive industry and the chemical-pharmaceutical industry.

Production specialisation by autonomous region

This diversity in manufacturing activities is also reflected in productivity, with very different levels across the different manufacturing branches. It is not surprising that pharmaceuticals, with 77% of the firms carrying out innovative activities, is by far the industry with the highest labour productivity (110,550 euros per worker per year). This is followed by chemicals (with a productivity of 94,400 euros) and beverage production (94,100 euros). In the latter case, however, the proportion of firms carrying out innovative activities is more or less in the lower range (28%).

Export capacity, measured by the share of production destined for export, varies significantly from one industrial branch to another. The most open sector internationally is automobiles: 70% of the sector’s sales are via exports (58% to EU countries plus 10% outside the EU), indicating this sector’s high degree of integration in global value chains. This is followed by pharmaceuticals (53% export sales), electrical products (52%) and metallurgy (49%). In total, exports of manufactured goods peaked at €260 billion in 2019 (accounting for 20.9% of GDP).

The chart below shows a positive relationship between the share of export sales by the manufacturing branches and their productivity, which is largely linked to the degree of innovation of the companies in the sector (represented in the chart by the size of the bubbles). It is important to note, however, that not all differences in export performance across industries necessarily reflect differences in productivity. Some sectors, such as the food and beverage industry, allocate 80% of their production to the domestic market but they also sell their products very competitively in international markets (Spain is the seventh largest exporter of agrifood products in the world).10 That said, the sector must also satisfy domestic demand and, in addition, some products have low added value or transport costs are particularly high, making it a sector that is more dependent on domestic sales.

- 10See the «Agrifood Sector Report» (2020).

Innovation, productivity and internationalisation: a winning combination

Sales abroad (%)

The future of manufacturing lies in the green and digital transition

Spain’s industrial fabric is powerful enough for manufacturing to take off again, but the future is not set in stone. The sector is going through a new industrial revolution, Industry 4.0, which involves a far-reaching transformation of production processes, from adopting new digital technologies (the internet of things, big data or cloud computing, to name but a few) to a new wave of factory automation, with digitally connected robots equipped with artificial intelligence (smart factories).

So how is Spain’s manufacturing industry performing in these areas? In terms of digitalisation, Spanish manufacturing companies have a similar degree of adoption to the European average but the gap with respect to the leading countries widened between 2015 and 2020. This is particularly true among SMEs, so there is plenty of scope for smaller companies to take greater advantage of the huge potential offered by new digital technologies.11

With regard to automation, Spain has similar levels of automation to those of its main rivals (a density of 191 robots installed per 10,000 workers in the manufacturing sector, above the European average of 114),12 but the speed of growth in this area in recent years is not enough for the country to catch up with the leading economies in our immediate vicinity, as is the case of Germany.13

New digital technologies and robotisation

promote the reindustrialisation of advanced countries.

The advances made in these two areas, digitalisation and automation, will be key to bringing back to advanced countries part of the manufacturing production that had been offshored to emerging countries. While some of the forces that have led to the deindustrialisation of advanced economies in recent decades will continue to have an effect (such as the tertiarisation of economies), it is possible the offshoring trend will give way to one of reshoring. A trend that could accelerate in the wake of the current health crisis, as it has highlighted the limitations and fragility of relying on overly dispersed global value chains.14 The pandemic is also making a large number of firms rethink the need to locate factories closer to the end consumer. This would also make production more flexible, shorten time-to-market, enhance customisation and adaptation to the tastes and preferences of different consumers and lower transport costs and pollutant emissions.

- 14See the article «Digitalisation and automation: what will we produce tomorrow?» published in the Dossier of the Monthly Report of March 2021, and the article «How COVID-19 will change the way we produce» published in the Dossier of the Monthly Report of May 2020.

Only companies that successfully undertake the energy transition will be able to survive in a new environment

in which the sustainability of the business model will be a prerequisite to continue operating in the market.

In this respect, it is essential the manufacturing sector undertake this digital transformation at the same time as evolving towards a more sustainable production model; i.e. the green transition and digital transition must go hand in hand. In fact, some experts are already talking about the green neo-industrialisation of advanced countries to underline the need to promote more energy-efficient production models that include circular economy criteria.15 The European Next Generation EU funds are emerging as a major lever to support the green and digital transformation of industry.

- 15The manufacturing sector was responsible for 31.7% of the total greenhouse gases emitted by Spanish industry in 2019.