Yield curve control: a new tool for the Fed?

The Fed is considering including yield curve control in its toolkit to respond to the COVID-19 crisis. How effective is YYC and what risks does it pose?

- The Fed is considering the possibility of incorporating new instruments into the central bank’s toolbox. Yield curve control (YCC) is one option being considered.

- Despite entailing significant risks, the Bank of Japan has shown that a credible central bank can use YCC as an efficient tool. Thus, it will be a relevant option if the US Federal Reserve decides to take further measures.

The US Federal Reserve’s response to the COVID-19 crisis has been quick and decisive, slashing the reference rate (–150 bps) and introducing a battery of measures aimed at boosting liquidity, supporting lending and anchoring a low-interest-rate environment (swap lines with other central banks, purchases of sovereign and corporate debt, and lending programmes to small and medium-sized enterprises, among others). Even so, the environment is still very demanding. If the Fed needs to boost the stimulus, it may choose to ramp up the current measures, but the option of adopting new tools has also been put on the table. In particular, the possibility of controlling the yield curve directly, especially in the medium/short-term section, has been raised. This is known as yield curve control, or YCC.1 Is this a plausible option? How effective is it and what risks does it entail?

- 1. An alternative option would be to implement negative rates, but the Fed has been very clear in expressing its doubts about this tool.

Direct yield curve control consists of setting a target interest rate for a particular maturity of the sovereign yield curve (e.g. for 3, 5 or 10-year bonds) and communicating the intention to acquire the necessary amount of that type of asset in order to maintain the interest rate at the desired level. While unconventional, this tool has already been used on some occasions. In 1942, during the Second World War, the Federal Reserve agreed with the US Treasury to temporarily set interest rates for the entire yield curve (for as long as the cost of sovereign debt was sky-high due to financing the war effort). For instance, the long-term Treasury rate was initially set at 2.5%, while the rate from seven to nine years was set at 2% and the one-year rate at 0.875%. More recently, the central banks of Japan and Australia have also implemented a sovereign yield curve control scheme. In particular, since September 2016 the Bank of Japan has kept the 10-year sovereign interest rate at 0%, while its Australian counterpart set the 3-year interest rate at 0.25% following the outbreak of the COVID-19 pandemic.

On the one hand, with YCC the Fed could communicate its monetary policy more clearly and transparently and convey greater certainty to the financial markets. For example, while the current asset purchases are helping to anchor a low-interest-rate environment, there is uncertainty about «how low» the Fed wants these rates to be – or how long it considers it necessary to keep them low.

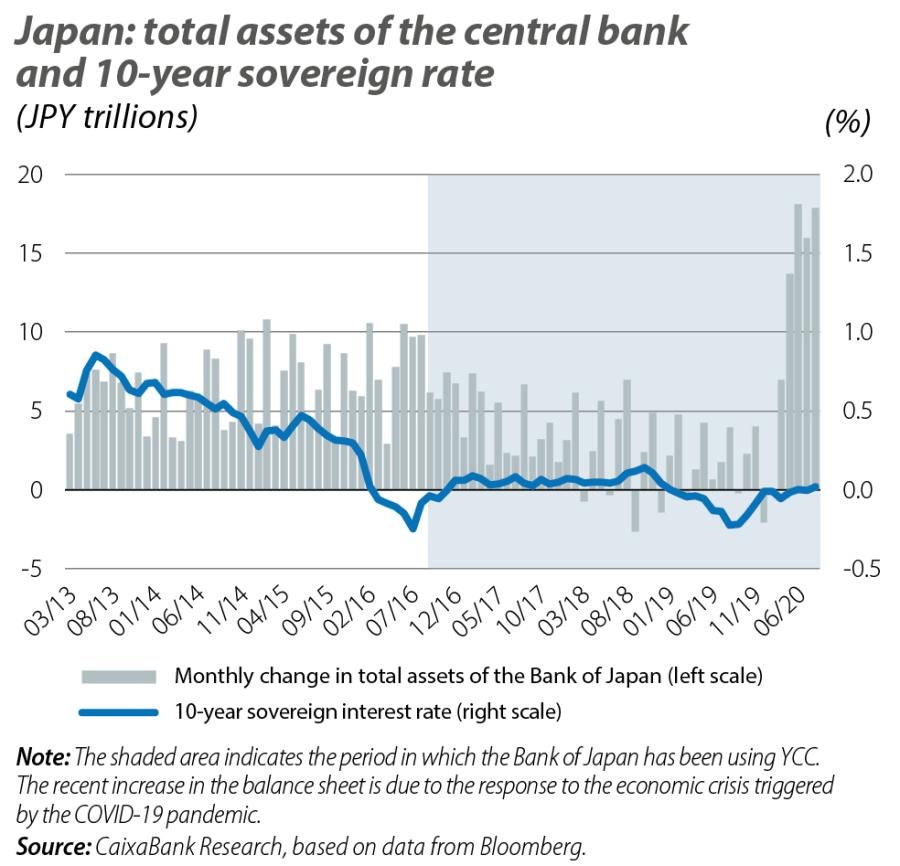

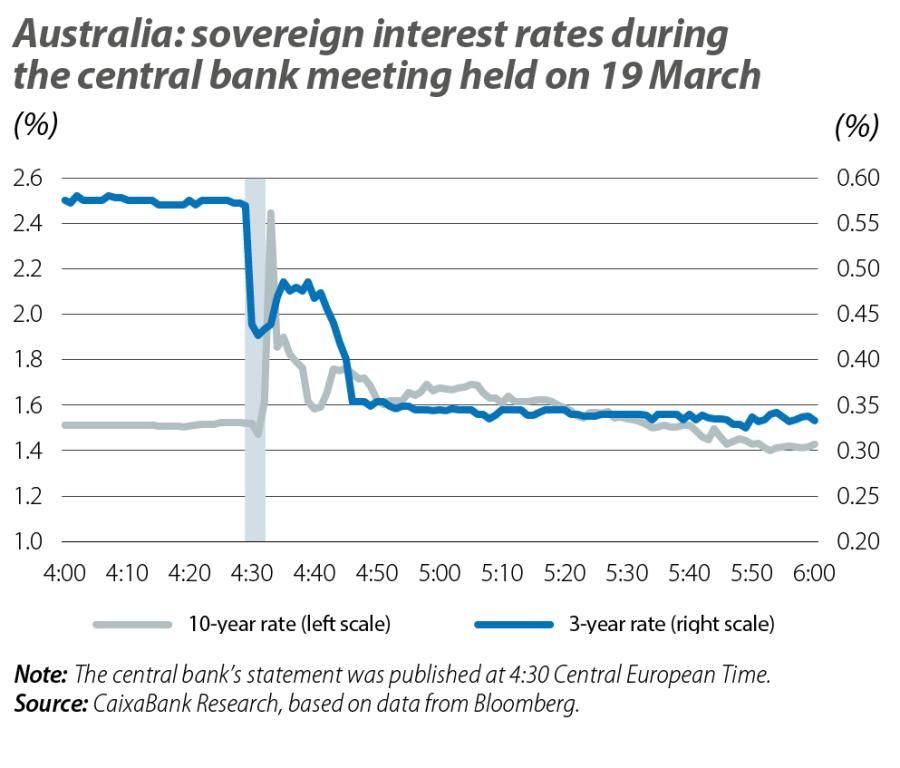

On the other hand, YCC has the potential to be a more efficient tool than the Fed’s current asset purchases.2 In particular, if investors were convinced of the Fed’s intention and ability to set an interest rate at a given level, then the central bank could achieve its target with a less active participation in the treasuries market than at present. Take the Bank of Japan as an example. Since it announced its use of YCC, the Bank of Japan has been reasonably successful in achieving its goal of maintaining the 10-year sovereign interest rate at 0%, while the size of its balance has increased much more gradually than it did prior to the use of YCC (see first chart). Moreover, in Australia (see second chart), since the central bank announced this tool sovereign debt purchases have no longer been necessary. This apparent paradox is due to the effect of the central bank’s credibility on the markets: if investors believe that it will act decisively to meet the target that has been set, then their transactions will already be highly driven by the expectation that the price pursued by the central bank will dominate in the market, hence it will not be necessary for it to act so forcefully. However, this is a double-edged reflection. In order to dispel any doubts over the credibility of YCC, the Fed would need to be both willing and able to acquire assets without limit.3 Therefore, in times of low confidence, it could be forced to make a much greater volume of purchases than initially desired.

- 2. At present, the Fed announces the monthly rate at which it intends to make asset purchases (approximately 80 billion dollars).

- 3. The need for there to be no pre-defined limits on purchases suggests that the ECB is unlikely to be able to opt for YCC in Europe. Indeed, in May, Germany’s Constitutional Court highlighted the existence of pre-defined limits on the ECB’s purchase programmes as one of the guarantees for preventing them from entailing a monetisation of sovereign debt (which is prohibited in the treaties).

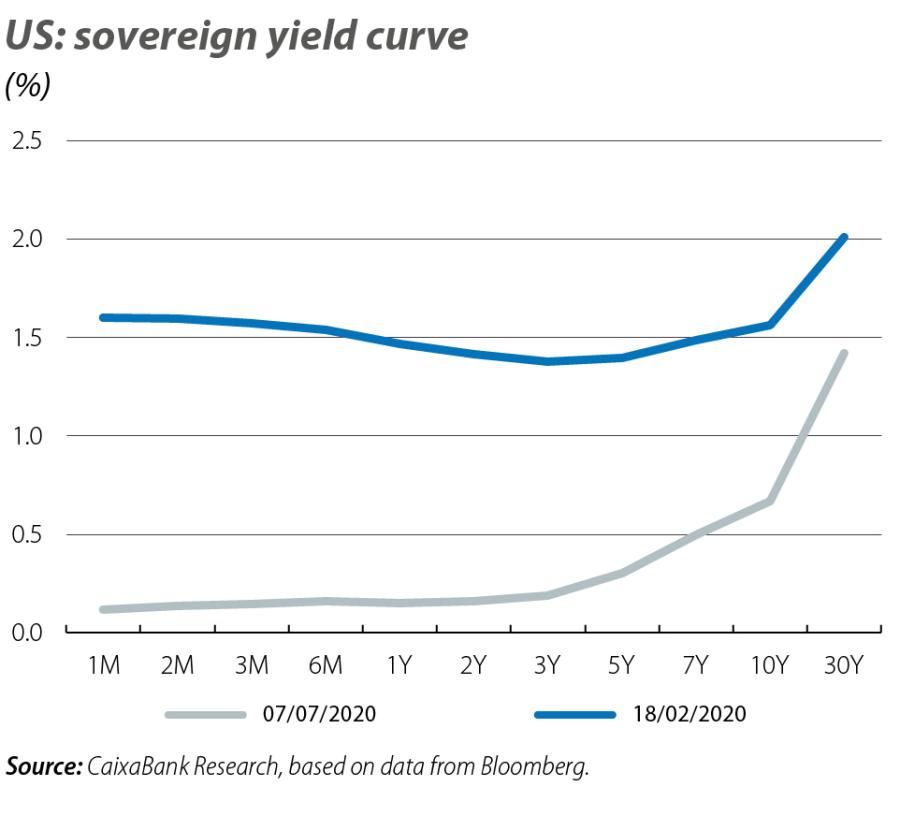

YCC raises some doubts,4 firstly over the independence of the central bank. In the 1940s, the Fed used it to deliberately lower the cost of treasury financing, which today could raise doubts about the central bank’s independence. Secondly, the size of the Fed’s balance sheet could become more volatile and the Fed could lose a certain degree of control over it. In particular, any element that raised doubts about the Fed’s willingness or ability to implement YCC would force it to acquire large volumes of sovereign debt in order to keep the interest rate on target. Thirdly, the process of withdrawing this tool also raises questions. In the early 1950s, when the Fed ended the deal with the US Treasury, the withdrawal from the programme proved more difficult than initially anticipated and the US Treasury (or taxpayers, at the end of the day) absorbed much of the associated losses.5 Finally, in an environment in which sovereign yields are already at historically low levels (see third chart), this tool would not provide a significant additional stimulus (although it would serve as a communication tool and provide greater certainty).

- 4. Expressed among others in the minutes of the Fed’s meeting held on 9 and 10 June 2020.

- 5. With the Federal Reserve’s withdrawal from its role as a holder of sovereign bonds, their price fell and left the balance sheets of other holders (mainly financial institutions) compromised, forcing the treasury to act to support these institutions.

All in all, this tool has its benefits and drawbacks. Its use in the US in the 1940s was somewhat turbulent, but to date the experience in Japan has been reasonably positive thanks to the central bank’s credibility. Given that the Fed has no shortage of this, it could benefit from the advantages offered by YCC if implemented in the medium/short-term section of the yield curve.6

- 6. Several studies indicate that YCC is more effective when it focuses on short- or medium-term interest rates. The reason for this is that, in order to be credible, the interest rate set through YCC must be consistent with expectations for future reference rates. As an example, if a target of X% is set for the 3-year US sovereign interest rate, then the target X must be consistent with the expectation for the Fed funds rate over the next three years. This consistency is easier to ensure with short- and medium-term rates.