The role played by rural branches in financial inclusion

Financial inclusion guarantees people access to an appropriate level of financial services. The considerable decline in the number of bank branches in Spain in recent years has increased the risk of financial exclusion for some customers in rural areas. These customers tend to prefer a physical bank branch and specialised offers, especially in the business segment. Within this context, the role played by rural bank branches is twofold: they allow the banking sector to specialised offers in economic sectors critical to large parts of the region, such as agriculture, whilst also maintaining a commitment to financial inclusion.

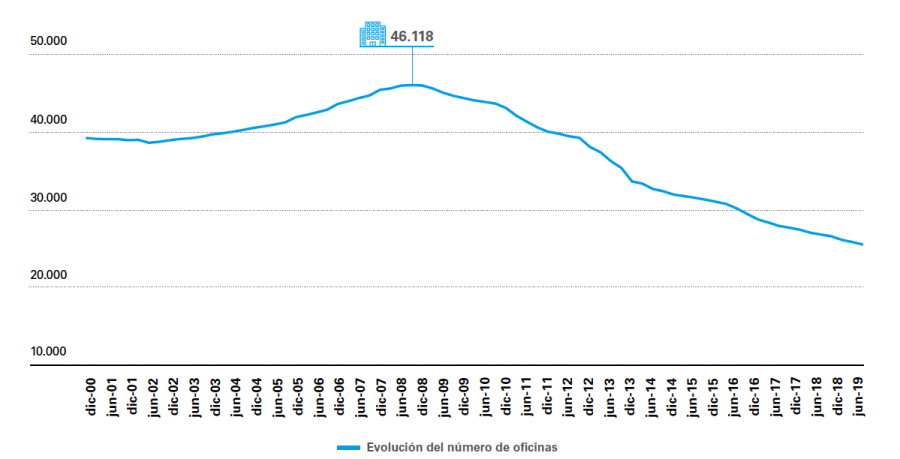

Since the end of 2008, the number of bank branches in Spain has fallen by 45% to 25,565 by mid-2019, an average annual decrease of 6%. This trend has been most pronounced in the most urbanised autonomous communities (ACs) with an initially denser network of branches, such as Catalonia, Madrid and the Valencian Community.

The autonomous communities where the reduction has been the smallest are generally those with the highest proportion of their population in rural areas and small municipalities, such as Extremadura and Castile-La Mancha. The trend in the number of branches in municipalities with fewer than 10,000 inhabitants confirms this pattern, with a 26% decrease between 2008 and the end of 2017, clearly smaller than the 43% decrease in the rest of the municipalities.

The number of branches in Spain has fallen considerably over the past decade

The trend observed of disappearing bank branches is due both to reasons external to the financial sector and to changes related to it, with different effects for rural and urban areas.

Demographics is a key external factor, specifically the progressive decline in the rural population. In the last 10 years, the number of inhabitants of small municipalities has fallen by 4%. This reduction has been much larger (over 10%) in some predominantly rural provinces in Galicia, Castile & Leon, Castile-La Mancha and Aragon. The phenomenon of depopulation that has been occurring in these areas for decades has been aggravated by two other phenomena: the ageing of the rural population (the average age of people living in small municipalities is around 48 compared with the Spanish average of 43) and increased urbanisation (more and more people are living in large towns and cities). This decline in population means that some branches no longer achieve the critical mass of clients required to guarantee minimum profitability.

The decrease in the rural population, newer generations more accustomed to digital banking and the consolidation of the banking sector itself are some of the factors behind the reduction in the number of branches

The increase in the relative weight of generations accustomed to digital banking is another factor affecting the number of branches. As certain financial services (transfers, payments, etc.) can be carried out online, the need to go to a branch decreases. This is especially true in urban areas, where people tend to use digital services more readily. The use of digital banking increased from 19% in 2008 to almost 50% in 2018, a significant change that reveals the rapid progress made by digital channels in just a few years; a trend that is likely to accelerate.

Among the factors linked to the financial sector itself, the main reason for closing branches in the past ten years has been the consolidation of the banking industry. As a result of the financial crisis, the sector has shrunk from 42 banks in 2008 to 11 at present1 . This has led to a significant adjustment in the sector’s installed capacity, in terms of the number of branches and employees, to eliminate duplication in the case of bank mergers. Such duplication has been more frequent in urban areas, where the number of rivals is greater.

- 1. Banks with assets exceeding EUR 20 billion in 2018.

Moreover, in today’s highly complex environment, with negative interest rates, weak growth in the loan portfolio, greater demands regarding capital levels and a necessary but costly digital transformation, the sector has also needed to focus on improving its efficiency and profitability.

However, despite this situation, Spain is still the country with the most branches per capita in the euro area, with nearly six branches per 10,000 inhabitants, almost two more than the euro area average.

Demographics and changes in the financial sector itself have led to a progressive increase in the number of towns in Spain without a bank branch, all of them small, with fewer than 10,000 inhabitants

Currently, as the following table shows, 50% of Spanish municipalities have no bank branch, an increase of 4 pp since 2009. The vast majority are very small municipalities with fewer than 500 inhabitants.

Municipalities without a bank branch: most are very small

Municipalities without a branch affect 2.7% of the population (around 1.3 million people), a figure that demonstrates the still high level of physical financial inclusion in Spain. This can be seen in the following maps, which show the strong presence and spread of rural branches (blue dots). These are naturally particularly dominant in the more rural provinces (highlighted in black and dark grey).

The maps also show that the geographical distribution of branches is relatively complementary among banks originating from savings banks (first map) and those that have always been banks since they were founded (second map). In general, the first group of banks tends to have a stronger presence in less urban and more rural provinces, unlike banks that have never been savings banks, which tend to focus more on large urban areas.

Despite the notable presence of rural branches and the complementary nature of different bank branches, the gradual reduction in the number of branches observed in recent years underlines, to a certain extent, the risk of physical exclusion facing a part of the more rural population. 1.3 million inhabitants live in a municipality where there is only one bank (more than 1,000 municipalities).

Rural and urban branches of banks originating from a savings bank

Rural and urban branches of banks originating from a bank

To answer these questions, it is necessary to understand both the nature of the customers living in such areas and the reasons why banks opt to maintain a rural presence, both of which are closely linked.

From the customers’ point of view, rural bank branches are fundamental for two reasons: the preference for a physical branch and the need for specialised supply.

Regarding the first reason, private customers (both rural and urban) value «branch proximity» as a key factor when choosing their main bank (approx. 40%). Physical proximity has lost importance in recent years but still clearly outranks all other factors, such as quality of service and economic conditions. Although we do not have data according to the type of municipality, it is likely that this preference for the physical channel is even greater in rural areas, partly because, as the chart below indicates, this is a less digitised group and therefore uses a branch more to meet their needs, such as having cash.

People living in rural areas use online banking less

% of individuals who used online banking in 2018

The second reason is that business sectors operating in rural areas, such as agriculture, typically require specialised financial services that can often best be provided from a branch, which tends to have greater know-how and information concerning the local business model and environment in which such businesses operate. A physical presence in the area is essential to offer a value proposition focusing on specialisation in sectors such as agriculture, livestock or fishing, and on the commercial responsiveness such businesses require to meet their specific needs. For this group (SMEs and large firms), efficiency and a good knowledge of their business take precedence when choosing a bank, so having a physical presence in the area can represent a competitive advantage.

Understanding the financial nature of rural areas (the strong preference for a physical channel between individuals and a specialised demand on the part of businesses) helps to realise the economic impact that a sharp reduction in financial inclusion could have on these areas.

A large number of empirical studies have highlighted the benefits of financial inclusion on inclusive growth and economic development2 . This is because the presence of financial institutions with a wide range of services encourages household saving and investment and the development of business projects (for example, insurance facilitates investment by covering part of the risk), which in turn contributes to the economic development of an entire region. Financial inclusion also tends to benefit especially poor families, promoting inclusive growth and social cohesion.

- 2. See, for example, the Policy Research Working Paper by the World Bank: «Financial inclusion and inclusive growth. A review of recent empirical evidence». 2017.

From the point of view of the banking sector itself, there are two main reasons for maintaining a physical presence in rural areas: boosting business and a commitment to inclusion.

On the one hand, the predominant economic sectors in these regions, such as agriculture, are critical to the regional economy and represent an attractive market segment for business. The various financial requirements of these businesses, such as investment, payments or insurance, mean that financial institutions can develop a very close relationship with them. Such customers also traditionally show great loyalty and are increasingly adopting new technologies, which should boost their competitiveness.

An example of the appeal of this market segment is the rural savings bank. Due to tradition and proximity, rural savings banks base a large part of their business on the agricultural sector. For instance, on average, rural banks concentrate more than 40% of their branches in municipalities with fewer than 5,000 inhabitants, and their joint market penetration as the preferred bank for the business segment is only behind that of the big five banks. Although their total market share in credit is limited (approx. 4%)3 , in provinces such as Almeria and Valencia, and in communities such as Murcia, Navarre, the Basque Country and even Madrid, their share is significant (between 5% and 8%).

- 3. Share of rural savings banks associated with the UNACC (National Union of Credit Cooperatives).

Business with a very attractive segment and a commitment to inclusion are the two main reasons for maintaining a physical presence in rural areas

Despite their greater concentration in rural areas, on average their profitability (measured in terms of return on assets or ROA) is similar to that of the banks (0.41%), although this varies considerably depending on the area in which they operate (see the chart below). This suggests that their approach of specialising more in the agricultural sector is generally profitable. Their efficiency, on the other hand, is lower, especially compared with larger banks. They have smaller economies of scale (size) and less diversification (geographic, credit, etc.) than banks and, as they are not listed, are also less subject to market pressure, which could partly explain their lower efficiency. Rural savings banks also stand out financially for their prudence, as their solvency is high and they have low NPL rates, possibly because they benefit from their local know-how.

Unlike rural savings banks, banks that cover the whole country benefit from greater economies of scale, geographic diversity and better access to technology, making it easier to profit from this market segment. Having employees with specific, ruraloriented training in financial advice and equipped with mobility devices that allow any financial product to be procured is an efficient way to increase the geographical coverage of rural branches. This ensures the degree of interaction and expert advice required by the sector whilst containing the costs of the branch network.

Main financial indicators of rural savings banks and banks

In %, data from 2018

On the other hand, maintaining a commitment to financial inclusion is an end in itself: the aim is to maintain a presence in small municipalities to support all economic sectors and contribute to the progress of society.

However, this commitment should not prevent banks’ model of financial inclusion from continuing to evolve, especially given the gradual increase in digital penetration in rural areas. Examples of such innovations are the introduction of ATMs, mobile branches and cash management agents in these municipalities.

Beyond having a branch network, a bank’s commitment to rural areas is also maintained by promoting financing for social purposes, an increasingly widespread practice among banks. One example of this is the issuance of social bonds and the granting of microcredits, which serve to finance the projects of companies and individuals in areas with a higher risk of financial exclusion.

This social commitment is fundamental for a financial institution to establish itself firmly in a region, something which also helps a relationship of trust to be built up between the banks and its customers; after all, banking is fundamentally based on trust.